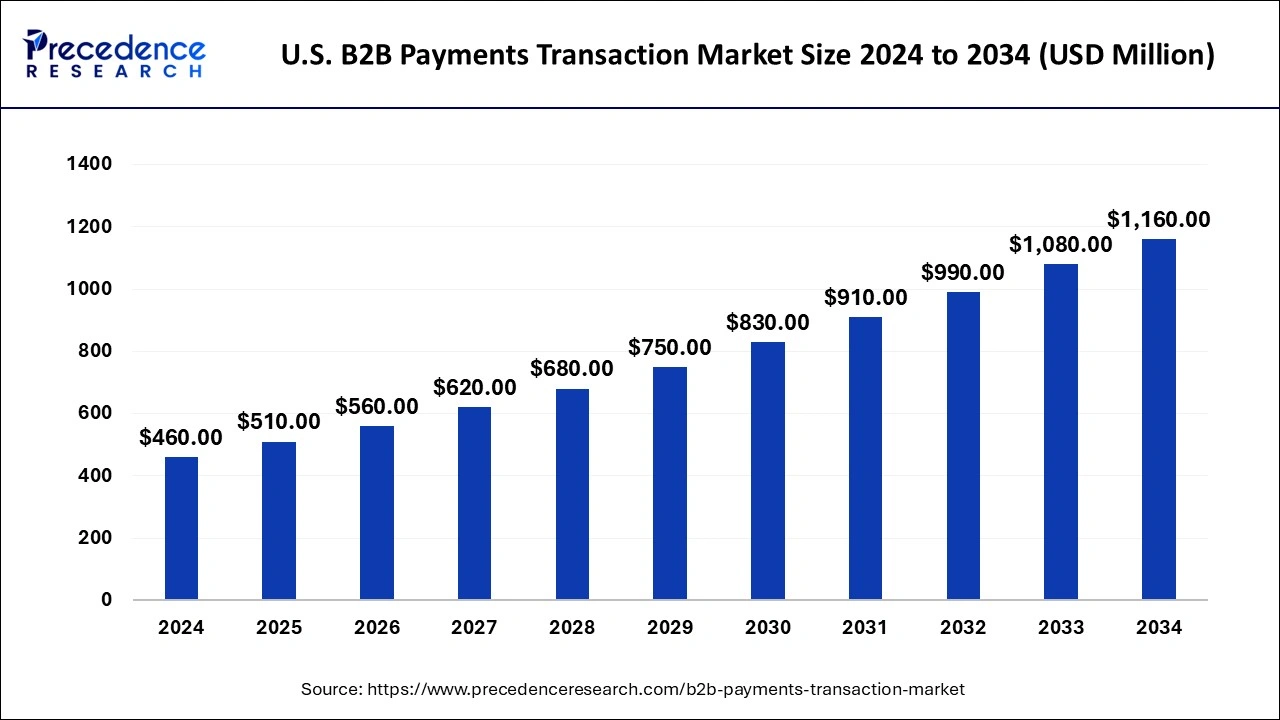

The U.S. B2B payments transaction market size was estimated at USD 410 billion in 2023 and is projected to reach around USD 1,080 billion by 2033, growing at a CAGR of 9.95% from 2024 to 2033.

Key Points

- By payment type, the domestic payment dominated the market with the largest share in 2023.

- By payment mode, the ACH segment dominated the U.S. B2B payments transaction market with the largest share in 2023.

- By enterprise size, the large enterprise segment dominated the market in 2023.

- By industry, manufacturing segment dominated the market with the highest market share in 2023.

- By industry, the BFSI was the second largest segment while it held a considerable share of the market in 2023.

The U.S. B2B payments transaction market is a dynamic and rapidly evolving sector that encompasses the exchange of payments between businesses for goods and services. This market involves a wide range of payment methods and technologies tailored specifically to meet the needs of business-to-business (B2B) transactions. B2B payments are crucial for the functioning of the economy, facilitating trade and enabling businesses to efficiently manage their cash flow and financial operations.

Get a Sample: https://www.precedenceresearch.com/sample/4292

Growth Factors

Several key factors are driving the growth of the U.S. B2B payments transaction market. One significant factor is the increasing adoption of electronic payment methods among businesses, which offer speed, efficiency, and cost savings compared to traditional paper-based methods. The shift towards digital transformation in business operations is also contributing to the growth, as companies seek to streamline processes and improve transparency in financial transactions. Moreover, the emergence of innovative fintech solutions and payment platforms is further fueling market expansion by offering advanced payment capabilities and value-added services.

Regional Insights

The U.S. B2B payments transaction market is influenced by regional trends and dynamics. Different industries and geographical areas within the U.S. exhibit varying levels of adoption and preferences for specific payment methods. Urban centers and technology hubs often lead in the adoption of cutting-edge payment technologies, while rural areas and traditional industries may still rely more heavily on traditional payment methods. Regulatory frameworks at the state and federal levels also play a role in shaping the landscape of B2B payments in different regions.

U.S. B2B Payments Transaction Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.95% |

| U.S. B2B Payments Transaction Market Size in 2023 | USD 410 Billion |

| U.S. B2B Payments Transaction Market Size in 2024 | USD 460 Billion |

| U.S. B2B Payments Transaction Market Size by 2033 | USD 1,080 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Payment, By Payment Mode, By Enterprise Size, and By Industry |

U.S. B2B Payments Transaction Market Dynamics

Drivers

Several drivers are propelling the growth of the U.S. B2B payments transaction market. The ongoing shift towards digitalization and automation in business processes is a major driver, as companies seek to modernize their payment infrastructure and improve operational efficiency. Additionally, the growing demand for real-time and secure payment solutions, coupled with the need for enhanced data analytics and reporting capabilities, is encouraging businesses to adopt innovative B2B payment technologies. Moreover, the rise of remote work and global supply chains is driving the need for flexible and scalable payment solutions that can support diverse business needs.

Opportunities

The U.S. B2B payments transaction market presents several opportunities for stakeholders. Fintech companies and payment providers can capitalize on the demand for integrated payment platforms that offer seamless connectivity with ERP systems and other business applications. There is also an opportunity to develop specialized solutions for specific industries or niche markets, such as healthcare or manufacturing, which have unique payment requirements. Moreover, partnerships and collaborations between financial institutions, technology providers, and businesses can unlock new avenues for innovation and market growth.

Challenges

Despite the promising growth prospects, the U.S. B2B payments transaction market faces certain challenges. One significant challenge is the complexity of integrating diverse payment systems and technologies within large enterprises, which often have legacy systems and diverse supplier networks. Additionally, concerns around data security, compliance with regulatory requirements, and the risk of fraud pose ongoing challenges for businesses adopting digital payment solutions. Addressing these challenges requires concerted efforts from industry stakeholders to ensure seamless and secure B2B payment experiences.

Read Also: Smart Display Market Size to Reach USD 51.47 Billion by 2033

U.S. B2B Payments Transaction Market Recent Developments

- In April 2024, Paystand, a blockchain-enabled B2B payments network, acquired Teampay, a management software provider for increasing the B2B payments services. The transaction will work on the B2B payments powerhouse aiming to revolutionalize payement by increasing fastest, largest, and the most cost-efficient B2B payment network.

- In April 2024, Airwallex, a global leader in the financial and payment platform for new-age businesses announced the launch of payment acceptance solutions in US. The launch is offered to the merchant in US to accept the payments from the domestic and international customers.

- In April 2024, FedNow is work as a revolutionary force in real-time payments marking a significant shift from the traditional Automated Clearing House (ACH) system. A shit is the banking revolution provide the instant transaction process that meets the demand of the modern financial transaction.

U.S. B2B Payments Transaction Market Companies

- American Express

- Bank of America Corporation

- MasterCard

- Citigroup Inc

- PayPal Holdings Inc

- Block Inc

- Payoneer Inc

Segments Covered in the Report

By Payment Type

- Domestic Payments

- Cross-border Payments

By Payment Mode

- Cheque And Cash

- Ach

- Card

- Wire And Others

By Enterprise Size

- Large Enterprises

- Smes

- Small Businesses

By Industry

- BFSI

- Manufacturing

- Businesses and Professional Services

- IT and Telecom

- Energy and Utilities

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/