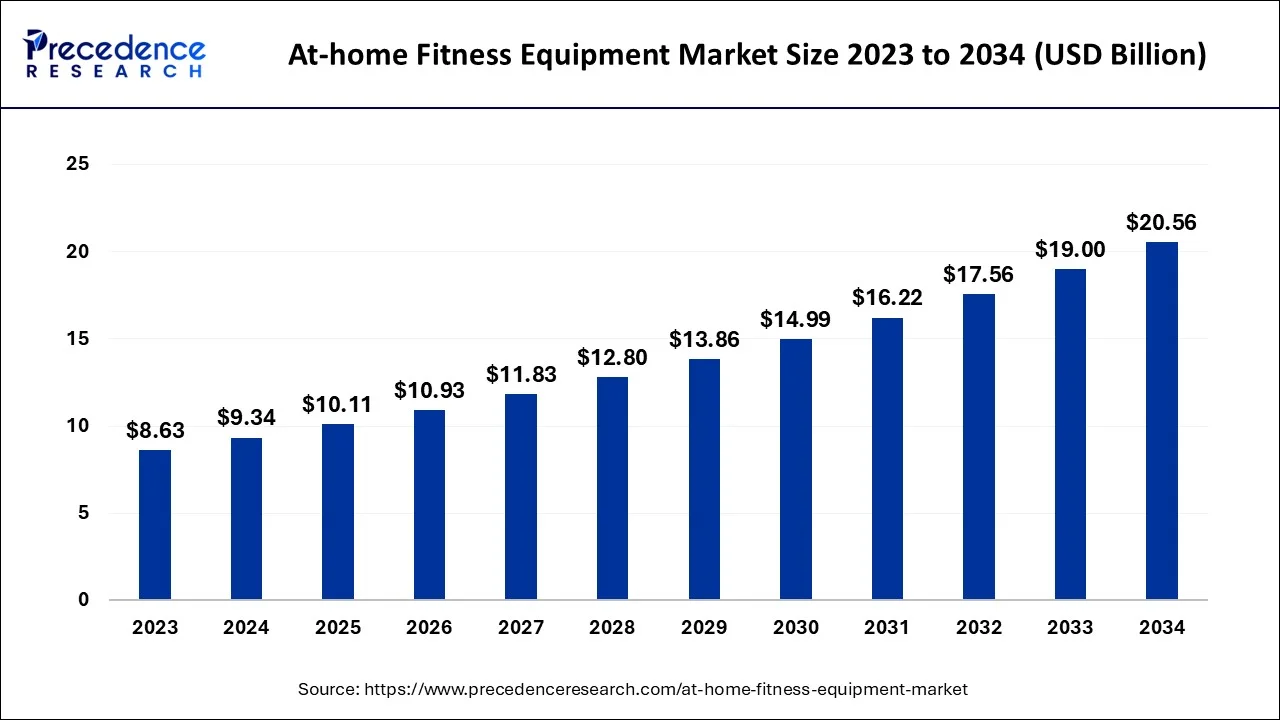

The global at-home fitness equipment market size reached USD 9.34 billion by 2024 and is anticipated to cross around USD 20.56 billion by 2034 with a CAGR of 8.21% from 2024 and 2034.

Key Takeaways

- North America is leading the market in terms of market share.

- Europe is anticipated to expand at a significant CAGR in the at-home fitness equipment market during the forecast period.

- By product, the cardiovascular training equipment segment is expected to expand at a significant growth rate in the near future.

- By product, the free weight segment is projected to grow rapidly in the coming years.

- By distribution channel, the dealers segment accounted for the largest market share in 2023.

- By distribution channel, the online segment is expected to grow at the fastest rate in the market during the forecast period.

- By end-user, the apartments segment led the market in 2023.

- By end-user, the households segment is anticipated to grow at the rapid pace over the studied period.

- By price point, the mid-price point segment dominated the at-home fitness equipment market in 2023.

- By price point, the low-price point segment is projected to witness significant growth in the market throughout the forecast period.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5112

Market Overview

The At-home Fitness Equipment Market has experienced significant growth in recent years, fueled by rising consumer interest in health and wellness, convenience, and technological advancements. This market includes a wide variety of equipment such as treadmills, stationary bikes, rowing machines, resistance bands, free weights, and high-tech, connected devices like smart mirrors and virtual reality systems. The demand for at-home fitness equipment surged, particularly during the COVID-19 pandemic, as people sought alternatives to gym memberships. As a result, manufacturers have increasingly focused on offering innovative, compact, and versatile equipment that meets the needs of diverse fitness levels and preferences.

Growth Factors

The primary growth factors for the at-home fitness equipment market include the growing emphasis on health and fitness, an increase in disposable incomes, and the ongoing trend of fitness personalization. With increasing awareness of the health risks associated with sedentary lifestyles, consumers are motivated to invest in convenient, at-home fitness solutions. Additionally, advancements in fitness technology, such as digital coaching, interactive streaming services, and AI-driven workout personalization, have made at-home workouts more engaging and effective. Social media and celebrity endorsements also play a role in driving the demand for specific types of equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.56 Billion |

| Market Size in 2024 | USD 9.34 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution Channel, End-user, Price Point, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Several factors are driving the at-home fitness equipment market, including the convenience of working out at home, cost savings compared to long-term gym memberships, and the desire for personalized workout experiences. Technological innovations such as AI trainers, virtual classes, and real-time performance tracking have further fueled consumer interest. Moreover, growing urbanization has led to smaller living spaces, creating demand for compact and multi-functional equipment. The ongoing development of subscription-based fitness platforms and hybrid fitness models, which combine physical and digital training, also acts as a significant market driver.

Opportunities

The market presents various opportunities, particularly in the areas of smart and connected fitness equipment, as well as home fitness subscriptions. With the increasing adoption of IoT and wearable devices, companies have the chance to integrate advanced features like biometric monitoring, gamified workout experiences, and AI-driven insights. Additionally, there is potential for growth in emerging markets, where interest in fitness and wellness is on the rise. Collaborations with fitness influencers and strategic partnerships with content creators can also help brands expand their reach and attract new customers.

Challenges

Despite its growth, the at-home fitness equipment market faces challenges such as high initial costs and concerns about the long-term durability of equipment. Consumers may also struggle with maintaining motivation over time, leading to lower usage rates. Another challenge is competition from traditional gyms and outdoor activities, which may regain popularity as restrictions ease. Furthermore, the presence of counterfeit products and a lack of industry standards can impact consumer trust and brand loyalty.

Region Insights

The North American region currently dominates the at-home fitness equipment market, driven by high consumer awareness, disposable incomes, and a strong presence of key market players. Europe follows closely, with increasing investments in wellness and fitness, particularly in countries like Germany and the UK. The Asia-Pacific region is anticipated to witness the highest growth in the coming years, as rising middle-class populations, increasing urbanization, and greater awareness of fitness contribute to market expansion. In particular, countries like China and India offer significant opportunities for market players due to their large population bases and growing demand for home fitness solutions. Meanwhile, the Middle East & Africa and Latin America are gradually emerging as viable markets, with increasing fitness awareness and lifestyle changes.

Read Also: Robotic Platform Market Size to Cross Around USD 18.83 Billion by 2034

Recent Developments

- In September 2024, SOLE Fitness, a leading manufacturer of fitness equipment, announced the launch of its home gym treadmills equipped with the range of pre-set and customized training modes and programs.

- In May 2024, Sunny Health & Fitness, the U.S.-based leading provider of high-quality at-home fitness equipment, launched the new Smart Stepper line, a novel advancements in the connected home fitness.

- In February 2024, four IIT-Delhi graduates designed and build Aroleap X, a smart, wall-mounted home gym equipment, with. It is the smart, wall-mounted home gym equipment.

- In December 2023, IKEA launched DAJLIEN, a limited home training collection with set of 19 versatile products that support movement in everyday life and offering people to create healthy habits at home.

At-home Fitness Equipment Market Companies

Segments Covered in the Report

By Product

- Cardiovascular Training Equipments

- Treadmills

- Stationary Cycles

- Rowing Machines

- Elliptical and Others

- Free Weights

- Power Racks

By Distribution Channel

- Dealers

- Online

- Direct Distribution

- 3rd Party Retailers

- Retail

- Mass Retailers

- Specialty Retailers

- Gym/Clubs

By End-user

- Household

- Apartments

By Price Point

- Low

- Mid

- Luxury

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5112

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/