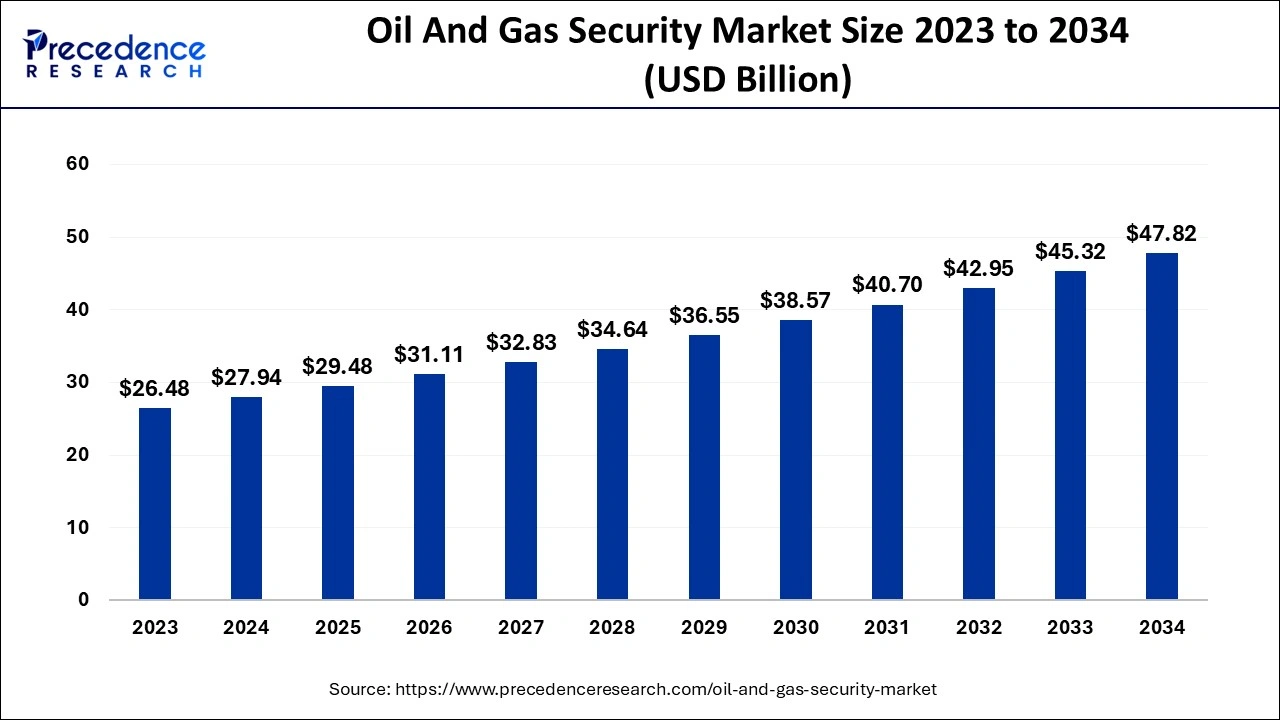

The global oil and gas security market size reached USD 27.94 billion in 2024 and is predicted to be Surpass around USD 47.82 billion by 2034, growing at a CAGR of 5.52% from 2024 to 2034

Key Points

- North America dominated the oil and gas security market with the largest market share of 34% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the studied period.

- By component, the hardware segment contributed the biggest market share of 52% in 2023.

- By component, the services segment will show significant growth in the market over the forecast period.

- By end use, the oil and gas companies segment generated the highest market share of 36% in 2023.

- By end use, the pipeline operators segment is expected to grow at the fastest rate in the market over the projected period.

The oil and gas security market plays a crucial role in ensuring the safety and continuity of operations across the industry. It covers a range of physical and digital security measures, including surveillance systems, access control, and cybersecurity, all aimed at protecting infrastructure, assets, and personnel from various threats.

Sample:https://www.precedenceresearch.com/sample/5220

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.82 Billion |

| Market Size in 2024 | USD 27.94 Billion |

| Market Size in 2025 | USD 29.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers:

The oil and gas security market is driven by multiple factors, with rising geopolitical tensions in oil-producing regions, an increased reliance on digital technologies, and growing threats to critical infrastructure being key contributors. Additionally, as oil and gas companies expand operations, especially in remote and politically unstable areas, there is a heightened demand for robust security solutions. The industry’s ongoing shift towards digitalization further drives the need for sophisticated cybersecurity measures to safeguard against cyberattacks.

Opportunities:

There are significant opportunities in the market, especially with the growing adoption of advanced technologies like artificial intelligence, machine learning, and the Internet of Things (IoT). These technologies enhance threat detection, improve response times, and offer predictive capabilities. Moreover, the integration of cloud-based solutions presents an opportunity for more scalable and flexible security deployments.

Challenges:

Despite these growth drivers, the market faces challenges such as the high costs associated with advanced security solutions, which can be a barrier for smaller companies. Furthermore, the complexity of new security systems, concerns over operational disruptions, and a lack of standardization across different regions can slow down the adoption of necessary security measures. Privacy issues related to the digitalization of security systems also add another layer of complexity.

Regional Insights:

North America currently holds a significant market share, particularly due to the advanced technological infrastructure and substantial investments in cybersecurity. The Middle East, with its geopolitical tensions, also represents a key region for security solutions in oil and gas. In Asia-Pacific, the market is growing rapidly due to increasing energy demand and the expansion of oil and gas exploration.

Read Also: Stationery Products Market Size to Attain USD 180.65 Bn By 2034

Oil And Gas Security Market Companies

- ABB Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- Waterfall Security Solutions Ltd.

- Parsons Corporation

- P2 Energy Solutions

- KBR, Inc.

- DuPont de Nemours, Inc.

- Huawei Technologies Co., Ltd.

- Shell Catalysts & Technology

- Baker Hughes Company

- Halliburton Company

- Symantec Corporation

Recent Developments

- In August 2024, SLB and Palo Alto Networks declared an expansion of their partnership aimed at improving cybersecurity within the energy sector. The partnership seeks to boost SLB’s security infrastructure and develop innovative solutions to address emerging cyber threats.

- In July 2024, Accenture acquired True North Solutions, a U.S.-based provider of industrial engineering solutions, to improve its capabilities in helping clients in the oil, gas, and mining sectors produce and transport energy more safely and efficiently.

Latest Announcements by Market Leaders

- In November 2023, Honeywell International Inc. announced that it would increase its dividend from last year’s comparable payment on the 6th of December to USD 1.13. The payment will take the dividend yield to 2.2%, which is in line with the average for the industry.

- In September 2024, China’s Huawei Showed the World its USD 2,800 ‘Trifold’ phone. The latest announcement from Apple’s China rival came just hours after the unveiling of the iPhone 16.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By End user

- Oil and Gas Companies

- Pipeline Operators

- Drilling Contractors

- Energy Infrastructure Providers

- Third-party Security Providers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa