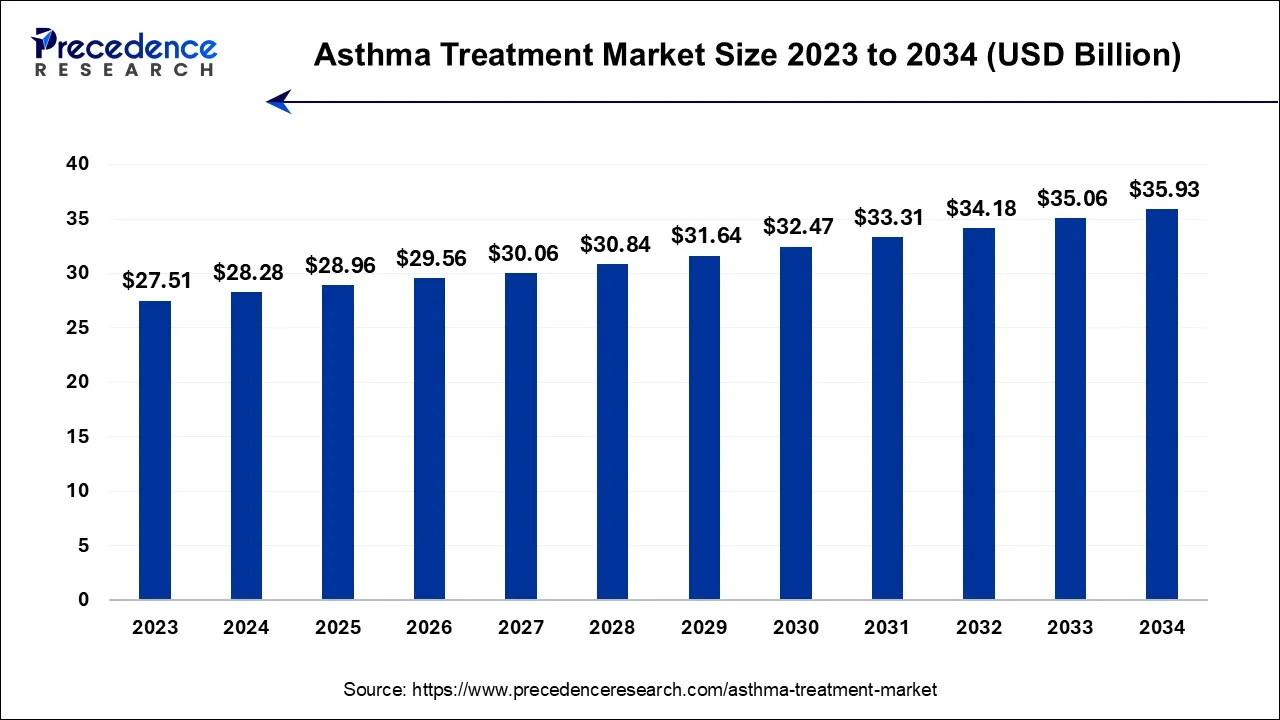

The global asthma treatment market size was valued at USD 27.51 billion in 2023 and is expected to attain around USD 35.93 billion by 2034. It is growing at a CAGR of 2.42% from 2024 and 2034.

Long-term control medicines, most often including inhaled corticosteroids and leukotriene modifiers, combination inhalers, and Theophylline, reduce inflammation within the walls of the airways and decrease the chances of asthma attack. B-agonists, anticholinergic agents, and oral and IV corticosteroids are useful for asthmatic patients in acute attacks and are called quick-relief medications. These medications can be used through portable inhalers or by nebulizers. Ipratropium and Tiotropium are two anticholinergic agents that ease breathing by relaxing the air passages.

Key Insights

- North America has accounted highest market share of 41.66% in 2023.

- Based on medication, the long-term control medication segment has generated market share of 59.86% in 2023.

- Based on route of administration, the inhalers segment has held revenue share of 66.56% in 2023.

- Based on adjunct therapy, the LABA (long-acting beta antagonists) segment has accounted market share of 23.52% in 2023.

- Based on distribution channel, the retail pharmacies & drug stores segment has generated market share of 42.31% in 2023.

Regional Stance

North America dominated the asthma treatment market in 2023. Several factors, including the high prevalence of asthma, extensive R&D by academic and research entities, a strong healthcare system, and increasing air pollution levels, fueled the market growth in North America. In addition, the wide availability of novel therapeutics and the rising mortality due to asthma, especially in the U.S., boost the market. The U.S. asthma treatment market size is expected to reach around USD 13.10 billion by 2034, growing at a CAGR of 1.73% from 2024 to 2034.

According to the Asthma and Allergy Foundation of America, about 10 people in the U.S. die from asthma each day. In 2021, approximately 3,517 people died from asthma. The prevalence of asthma is rising in the U.S. Over 27 million people have asthma. The rate of asthma is greater among females, as 10.8% of the adult female population is asthmatic compared to 6.5% of males. It is one of the most common chronic diseases among children, with 4.5 million individuals under the age of 18 years diagnosed with the condition.

Asthma Treatment Market Share, By Region, 2023

| Region | Market Share (%) |

| North America | 41.66 |

| Europe | 21.34 |

| Asia Pacific | 20.28 |

| LAMEA | 16.72 |

Medication Insights

The long-term control medication segment dominated the asthma treatment market with the largest share in 2023. To prevent and control the symptoms of asthma, long-term control medications are administered daily. Some effective medicines include long-acting beta2-agonists, inhaled corticosteroids, and anti-leukotriene agents. Antileukotriene modulators, such as zileuton, zafirlukast, and montelukast sodium, effectively relieve symptoms. Corticoids can be used with long-acting beta2-agonists, such as salmeterol, formoterol, and vilanterol. They can be given daily, even without symptoms, to reduce airway inflammation and decrease the severity of asthma attacks.

Asthma Treatment Market, By Medication, 2021-2023 (USD Million)

| By Medication | 2021 | 2022 | 2023 |

| Quick-relief medication | 10,292.20 | 10,681.80 | 11,044.40 |

| Long-term control medication | 15,482.20 | 15,997.30 | 16,467.10 |

Route of Administration Insights

The inhalers segment led the asthma treatment market in 2023. This is because an inhaler is the most preferred way to deliver medications. It is a portable apparatus that administers medications directly into the lungs. This device aids in opening the airways and controlling inflammation in the lungs. They help in controlling the risk of exacerbations of the condition. Inhaled corticosteroids (ICS) are common prescriptions for asthmatic patients, while rescue inhalers are employed to relieve symptoms. Medical professionals frequently recommend these devices to alleviate symptoms.

Asthma Treatment Market, By Route of Administration, 2021-2023 (USD Million)

| By Route of Administration | 2021 | 2022 | 2023 |

| Inhalers | 17,794.00 | 18,088.70 | 18,313.00 |

| Prefilled syringes/vials | 5,436.50 | 6,005.10 | 6,582.10 |

| Others | 2,543.90 | 2,585.20 | 2,616.30 |

Adjunct Insights

The LABA segment led the market in 2023. Long-acting beta-agonists (LABAs) are among the inhaled medication forms that physicians use to treat asthma and COPD patients. They relieve breathlessness and asthma symptoms by relaxing the muscles around the airways. However, in most cases, such LABAs are not recommended as they can be associated with the increased risk of potentially life-threatening asthma exacerbations. Thus, the FDA advised the use of LABAs with inhaled corticosteroids for better effects. LABAs are inhaled through the mouth using inhalers or nebulizer devices directly into the lungs.

Distribution Channel Insights

The retail pharmacies & drug stores segment dominated the asthma treatment market in 2023. Retail pharmacies provide easy access to prescription and over-the-counter (OTC) drugs. These pharmacies sell or distribute drugs to the general public and hospitals. They often have a wide network of small pharmacies. Some retail pharmacies operate 24/7, offering convenience for urgent needs.

Asthma Treatment Market, By Distribution Channel, 2021-2023 (USD Million)

| By Distribution Channel | 2021 | 2022 | 2023 |

| Online Pharmacies | 6,503.70 | 6,775.00 | 7,030.70 |

| Hospital Pharmacies | 8,430.80 | 8,649.40 | 8,839.40 |

| Retail Pharmacies & Drug Stores | 10,839.90 | 11,254.70 | 11,641.30 |

Asthma Treatment Market Dynamics

Drivers

Availability of a wide range of medications

Treatment for severe asthma involves the use of multiple drugs and constant attention from specialized doctors and nurses. Oral corticosteroids, biologic medications, bronchial thermoplasty, and immunotherapy are among the widely used treatment methods to terat patients with severe asthma. Inhalers are used to ease the symptoms, prevent the appearance of symptoms altogether, or both. Reliever inhalers are effective in relieving symptoms quickly and have minimal side effects. Inhalers can be used daily to lessen swelling and hyper-reactivity of the air passages. Combination inhalers are effective in alleviating the symptoms and offer extended relief. Other forms of treatment, such as injections and surgical operations, are quite uncommon but may be advised if all the above options fail.

Increasing funding in Asthma research and the growing awareness about the disease

The market is expected to expand at a rapid pace in the coming years due to the rising funding from various health agencies, such as the National Institute of Health (NIH) and the Centers for Disease Control and Prevention (CDC), in research for developing novel asthma treatments. Moreover, the demand for early diagnosis is rising with the growing awareness of asthma. This, in turn, boosts the demand for novel therapeutics to manage symptoms. According to the CDC, asthma is one of the leading causes of death. The rate of asthma deaths was higher in 2020 than in 2019.

Restraint

Lack of adherence to treatment

Poor asthma management is frequently associated with a lack of treatment adherence and inadequate inhaler use. Given the low asthma patients adherence rate, the primary care providers must take the matter seriously. Poor inhaler technique is also associated with poor asthma management, increasing hospitalization rates, and the chance of being prescribed oral corticosteroids OCS. A review of the existing literature regarding the performance of patients using pMDIs and DPIs discovered that incorrect use of an inhaler was commonplace (31%) and had not been reduced since 1975. Errors can include failure to coordinate inhalation with device actuation, wrong preparation of the device, and absent breath holding after inhalation.

Opportunity

Emergence of novel technologies

New therapeutics for patients with severe asthma are in the pipeline, the most recent of which is an anti-IL-5 therapy. Studies show that exacerbation rates are significantly lower in the treated arm than in the placebo arm. Anti-IgE treatment, biotherapy directed against “Th2-high” patients, and anti-allergy therapies in the form of tablets are some of the recent additions to treatments. Instead of relying solely on medication, healthcare facilities are performing bronchial thermoplasty. A few health agencies have already approved this minimally invasive and effective treatment for managing severe asthma.

Recent Developments

- In June 2024, Chinese scientists have developed a cell therapy that could offer long-term asthma relief with a single shot, improving treatment and patient outcomes.

- In October 2023, Aiolos Bio, Inc., a clinical-stage biopharmaceutical company, launched with a $245 million Series A investment, focusing on treating patients with respiratory and inflammatory conditions, with its lead drug candidate, AIO-001, undergoing Phase 2 clinical trial, for asthma patients.

- In November 2022, Vanderbilt University Medical Center has begun enrolling patients with asthma in a clinical trial of a novel treatment, semaglutide. It is a medicine approved for Type 2 diabetes and weight management, targeting the metabolic pathway to improve insulin secretion. This trial represents the first prospective study of this class of medications in individuals with asthma.

Companies Operating in the Asthma Treatment Market are:

- AstraZeneca

- Teva Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc

- Boehringer Ingelheim International GmbH

- Roche Holding AG / Novartis AG

- Merck & Co., Inc.

- Koninklijke Philips N.V.

- Sanofi-Aventis SA

- MundiPharma.

Market Segmentation

By Medication

- Quick-relief medication

- Long-term control medication

By Route of Administration

- Inhalers

- Prefilled syringes/vials

- Others

By Adjunct Therapy

- LAMA (long-acting muscarinic antagonists)

- LABA (long-acting beta antagonists)

- Others

By Distribution Channel

- Online pharmacies

- Hospital pharmacies

- Retail pharmacies & drug stores

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/1557

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344