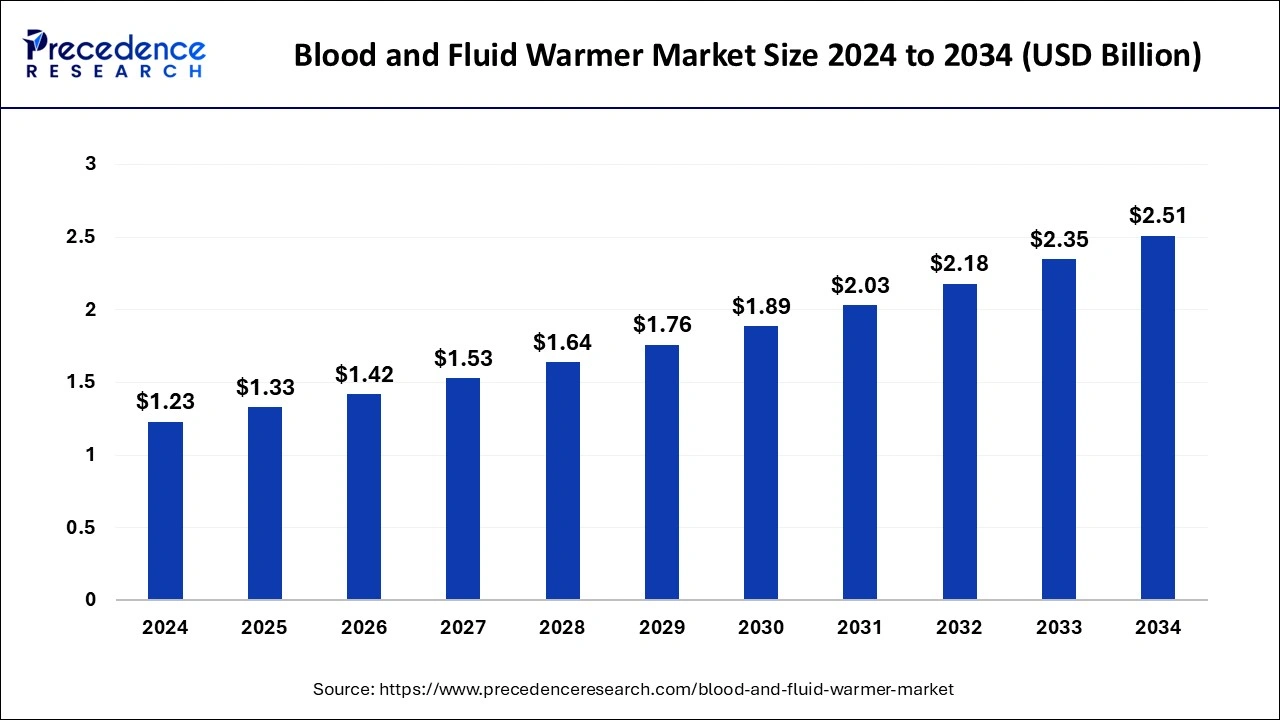

The global blood and fluid warmer market size reached USD 1.15 billion in 2023 and is predicted to be worth around USD 2.35 billion by 2033, growing at a CAGR of 7.40% from 2024 to 2033.

Key Points

- North America dominated the blood and fluid warmer market in 2023.

- Asia Pacific is expected to host the fastest-growing market throughout the forecast period.

- By application, in 2023, the acute care segment dominated the market.

- By application, the homecare segment is expected to show the fastest growth in the market over the forecast period.

- By end-user, the hospitals segment dominated the market in 2023.

- By end-user, the specialty centers segment is projected to show the fastest growth during the forecast period.

The Blood and Fluid Warmer Market refers to the industry involved in the manufacturing and distribution of devices used to warm blood and intravenous fluids to body temperature before transfusion or infusion. These devices play a crucial role in medical settings, including operating rooms, emergency departments, and intensive care units, where maintaining the temperature of fluids is essential for patient safety and comfort. The market encompasses various types of blood and fluid warmers, including portable and stationary models, catering to diverse healthcare needs.

Get a Sample: https://www.precedenceresearch.com/sample/4381

Growth Factors:

The Blood and Fluid Warmer Market is witnessing steady growth due to several factors. One key driver is the increasing prevalence of conditions requiring blood transfusions and intravenous fluid administration, such as trauma, surgery, and critical illnesses. Additionally, advancements in technology have led to the development of more efficient and user-friendly warmers, driving market expansion. Moreover, rising healthcare expenditure, particularly in emerging economies, is contributing to market growth as healthcare facilities upgrade their infrastructure.

Region Insights:

The market for blood and fluid warmers is globally distributed, with significant activity observed across various regions. North America dominates the market, driven by the presence of well-established healthcare infrastructure and high adoption rates of advanced medical devices. Europe follows closely, characterized by a strong emphasis on patient safety and technological innovation. Asia-Pacific is emerging as a lucrative market, propelled by increasing healthcare investments, growing awareness about patient care standards, and rising surgical volumes.

Blood and Fluid Warmer Market Scope

| Report Coverage | Details |

| Blood and Fluid Warmer Market Size in 2023 | USD 1.15 Billion |

| Blood and Fluid Warmer Market Size in 2024 | USD 1.23 Billion |

| Blood and Fluid Warmer Market Size by 2033 | USD 2.35 Billion |

| Blood and Fluid Warmer Market Growth Rate | CAGR of 7.40% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application, Product, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood and Fluid Warmer Market Dynamics

Drivers:

Several drivers are shaping the growth trajectory of the Blood and Fluid Warmer Market. One prominent driver is the growing emphasis on patient safety and comfort, leading healthcare facilities to invest in technologies that enhance transfusion and infusion processes. Additionally, the rising incidence of hypothermia-related complications during medical procedures is driving the demand for blood and fluid warmers. Furthermore, the expanding geriatric population, coupled with the increasing prevalence of chronic diseases, is fueling the need for blood transfusions and intravenous therapies, thereby stimulating market growth.

Opportunities:

The Blood and Fluid Warmer Market presents several opportunities for market players to capitalize on. One notable opportunity lies in expanding product portfolios to cater to specific clinical needs and preferences. Manufacturers can also explore untapped markets in developing regions by offering cost-effective and portable warming solutions. Moreover, strategic collaborations with healthcare facilities and research institutions can facilitate product development and market penetration. Furthermore, technological advancements, such as the integration of smart features and wireless connectivity, can open new avenues for innovation and differentiation.

Challenges:

Despite the promising prospects, the Blood and Fluid Warmer Market faces certain challenges that warrant attention. Regulatory compliance and quality assurance remain significant hurdles for manufacturers, particularly in ensuring the safety and efficacy of warming devices. Moreover, pricing pressures and reimbursement limitations in healthcare systems can impede market growth and profitability. Additionally, competition from alternative warming methods and devices, such as forced-air warmers and warm water baths, poses a challenge to market expansion. Furthermore, concerns regarding the environmental impact of disposable warming consumables underscore the need for sustainable practices and product development strategies.

Read Also: Mastic Gum Market Size to Reach USD 1,008.91 Mn by 2033

Blood and Fluid Warmer Market Recent Developments

- In May 2022, Medtronic derived Food and Drug Administration consent for the Nellcor OxySoft neonatal-adult SpO2 sensor. The latter is the initial pulse oximetry sensor that uses a silicone adhesive to shield delicate skin by suppressing fewer skin cells while upgrading sensing element repositionability and signal acquisition.

- In January 2022, ICU Medical Inc. proclaimed acquiring Smiths Medical, Inc., adding products like syringes and ambulatory infusion apparatus, vascular access, and vital care equipment to the ICU Medical portfolio.

Blood and Fluid Warmer Market Companies

- The 37 Company (37°C)

- Smiths Medical

- Enthermics Medical Systems

- Becton

- Dickinson and Company (BD)

- The 41st Parameter

- 3M Healthcare

- Gambro

- Stihler Electronic GmbH

- di Barkey GmbH & Co. KG

- Meri an Medical Systems

- Stryker Corporation

- Inditherm Medical

- Belmont Medical Technologies

- Sintetica S.A.

- EMIT Corporation

Segments Covered in the Report

By Application

- Homecare

- Acute Care

- Newborn Care

- Preoperative Care

- Others

By Product

- Patient Warming Accessories

- Intravenous Warming System

- Surface Warming System

By End-user

- Clinics

- Hospitals

- Specialty Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/