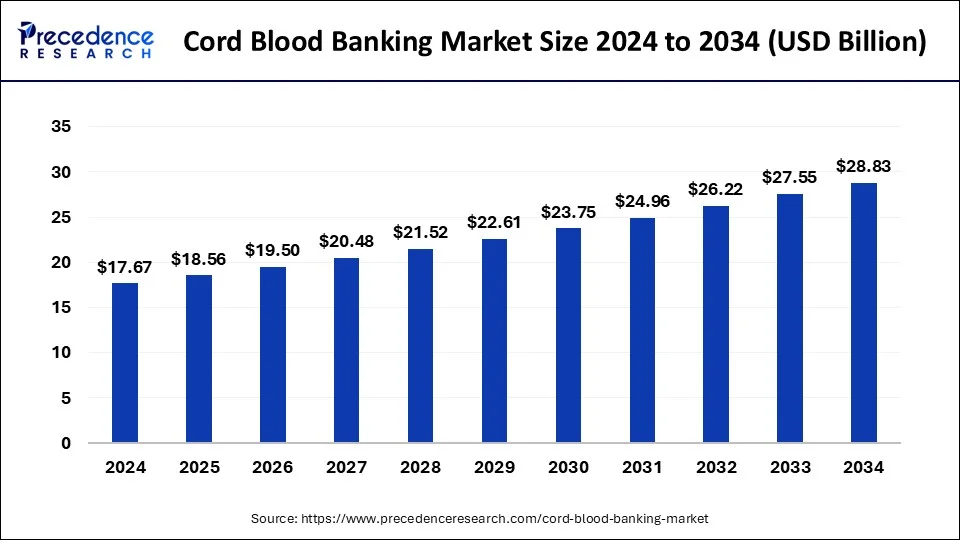

The global cord blood banking market size reached USD 16.81 billion in 2023 and is projected to hit around USD 27.55 billion by 2033, growing at a CAGR of 5.06% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 38% in 2023

- By type of bank, the cord blood banking market’s private bank segment is expected to grow significantly during the forecast period.

- By services, the processing segment dominated the market in 2023.

- By application. The cancer segment significantly contributes to the market and is anticipated to grow at a notable CAGR during the forecast period.

- By end-use, the hospital segment dominated the market in 2023.

The cord blood banking market refers to the practice of collecting, processing, and storing umbilical cord blood for future medical use. Cord blood is rich in stem cells, which have the potential to treat various diseases and disorders. The process involves the extraction of blood from the umbilical cord immediately after childbirth. This blood is then processed to isolate and preserve the stem cells, which can later be used in transplantation procedures to treat conditions such as leukemia, lymphoma, and certain genetic disorders. The cord blood banking industry has witnessed significant growth in recent years due to increasing awareness about the therapeutic potential of stem cells and advancements in banking technologies.

Get a Sample: https://www.precedenceresearch.com/sample/3995

Growth Factors

Several factors contribute to the growth of the cord blood banking market. One significant factor is the rising prevalence of chronic diseases such as cancer and blood disorders, which has led to an increased demand for stem cell therapies. Additionally, the expanding applications of cord blood stem cells in regenerative medicine and research have fueled market growth. Moreover, government initiatives and support for stem cell research and banking infrastructure development have further stimulated market expansion. Furthermore, technological advancements in cord blood processing and storage techniques have enhanced the efficiency and viability of stored stem cells, driving market growth.

Region Insights:

The cord blood banking market exhibits regional variations in terms of demand, adoption rates, and regulatory frameworks. North America holds a prominent share of the market, driven by the presence of established cord blood banks, favorable reimbursement policies, and high awareness among healthcare professionals and parents. Europe follows closely, with increasing investments in stem cell research and supportive regulatory environments contributing to market growth. In Asia-Pacific, the market is witnessing rapid expansion due to growing healthcare infrastructure, rising disposable incomes, and increasing awareness about the therapeutic potential of cord blood stem cells. Emerging economies in Latin America and the Middle East are also witnessing steady growth in cord blood banking, propelled by improving healthcare infrastructure and rising healthcare expenditure.

Cord Blood Banking Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.06% |

| Global Market Size in 2023 | USD 16.81 Billion |

| Global Market Size by 2033 | USD 27.55 Billion |

| U.S. Market Size in 2023 | USD 4.47 Billion |

| U.S. Market Size by 2033 | USD 7.33 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type of Bank, By Services, By Application, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cord Blood Banking Market Dynamics

Drivers:

Several factors serve as drivers for the cord blood banking market. One of the primary drivers is the increasing prevalence of hematologic disorders and cancers, which require stem cell transplantation for treatment. Additionally, the growing number of clinical trials and research studies exploring the therapeutic potential of cord blood stem cells for various diseases drive market growth. Furthermore, advancements in cord blood processing technologies, such as automated systems and novel cryopreservation methods, enhance the viability and efficacy of stored stem cells, thus driving market demand. Moreover, strategic collaborations between cord blood banks and healthcare institutions to promote awareness and education about cord blood banking contribute to market expansion.

Opportunities:

The cord blood banking market presents several opportunities for growth and innovation. Expanding the applications of cord blood stem cells beyond hematopoietic transplantation to regenerative medicine and cellular therapies opens new avenues for market expansion. Furthermore, the development of personalized medicine approaches utilizing cord blood stem cells tailored to individual patient profiles holds promise for future growth. Moreover, increasing investments in research and development to improve stem cell isolation, expansion, and manipulation techniques offer opportunities for technological innovation and market differentiation. Additionally, the integration of artificial intelligence and data analytics in cord blood banking processes could optimize inventory management and enhance treatment outcomes, thereby creating new growth opportunities for market players.

Restraints:

Despite the promising growth prospects, the cord blood banking market faces certain challenges and restraints. One significant restraint is the high cost associated with cord blood banking and transplantation procedures, which limits accessibility, particularly in low- and middle-income regions. Moreover, ethical concerns surrounding the commercialization of cord blood and the lack of standardized regulations across different jurisdictions pose challenges for market expansion. Additionally, the limited availability of matching donors and the risk of graft-versus-host disease (GVHD) in cord blood transplantation procedures present clinical challenges for healthcare providers and patients. Furthermore, the emergence of alternative sources of stem cells, such as bone marrow and peripheral blood, poses competitive challenges for the cord blood banking industry, requiring continuous innovation and differentiation to maintain market relevance.

Read Also: Antipsychotic Drugs Market Size to Reach USD 31.37 Bn by 2033

Recent Developments

- In April 2022, Aspen Neuroscience, Inc. commenced a groundbreaking patient screening study, the Trial-Ready Cohort Study, in collaboration with multiple clinical screening sites across the United States. This study marks a crucial initial step toward submitting an Investigational New Drug (IND) application to the United States Food & Drug Administration. Aspen Neuroscience’s objective is to explore the potential of ANPD001, an iPSC-derived cell replacement therapy, for treating Parkinson’s disease.

- In April 2022, TreeFrog Therapeutics introduced The Stem Cell SpaceShot Grant, a grant program offering USD 100,000 in research funding exclusively dedicated to advancing the field of stem cell biology and regenerative medicine. This initiative supports innovative research projects, fostering progress and breakthroughs in understanding and applying stem cells.

- In September 2022, ExCellThera aimed to enhance patients’ access to cord blood transplants. Cord blood transplants, characterized by not requiring exact HLA matching, offer a significant advantage over adult sources of stem cells. The company’s efforts contribute to improving the accessibility and efficacy of this medical intervention.

- In March 2022, Cryo-Cell International, Inc. reported its purchase agreement for a newly constructed 56,000 sq ft facility within the Regional Commerce Center in the Research Triangle, NC. This facility is anticipated to expand Cryo-Cell’s cryopreservation and cold storage business, introducing a new service called ExtraVault. The closure is subject to customary conditions.

Cord Blood Banking Market Companies

- Thermo Fisher Scientific (US)

- Merck KGaA (Germany)

- Lonza Group (Switzerland)

- STEMCELL Technologies (Canada)

- Takara Bio (Japan)

- FUJIFILM Cellular Dynamics (US)

- Sartorius AG (Germany)

- GE Healthcare (UK)

- Charles River Laboratories International (US)

- Cynata Therapeutics (Australia)

- Mesoblast (Australia)

- Cellular Dynamics International (US)

- Organogenesis (US)

- Osiris Therapeutics (US)

- Gamida Cell (Israel)

- Pluristem Therapeutics (Israel)

- Athersys (US)

- Brainstorm Cell Therapeutics (Israel)

- Cellectis (France)

- Ncardia AG (Germany)

Segments Covered in the Report

By Type of Bank

- Public

- Private

By Services

- Processing

- Storage

- Others

By Application

- Cancer

- Blood Disorders

- Bone Marrow Failure Syndrome

- Immuno-deficiency Disorders

- Metabolic Disorders

By End Use

- Hospital

- Research Institutes

- Specialty Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/