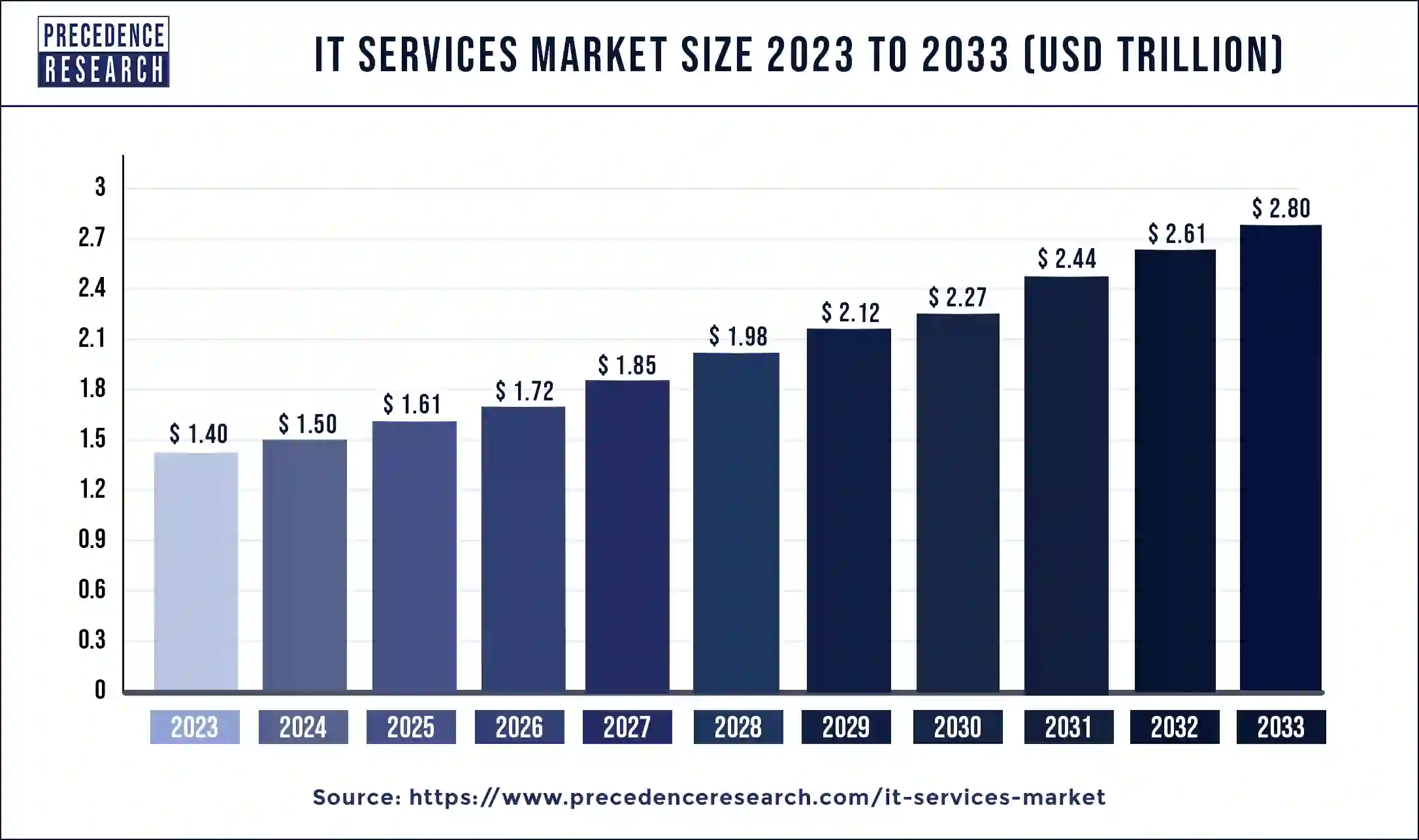

The global IT services market size reached USD 1.40 trillion in 2023 and is anticipated to attain around USD 2.80 trillion by 2033, growing at a CAGR of 7.17% from 2024 to 2033.

Key Points

- North America dominated the IT services market in 2023 with a revenue share of 37%.

- By approach, the reactive IT services segment dominated the market with a revenue share of 57% in 2023.

- By type, the operations & maintenance segment dominated the IT services market in 2023 with a revenue share of 64%.

- By application, the application management segment holds the largest share of around 31.7% in 2023.

- By technology, the AI & machine learning segment dominated the market in 2023 with a revenue share of 32%.

- By deployment, the cloud segment has captured a revenue share of around 55% in 2023.

- By enterprise size, the large enterprise segment holds the largest share of 60.4% in 2023.

- By end-use, the IT & telecom segment has held the largest share of around 17.6% in 2023.

The IT services market plays a crucial role in the modern economy, providing a wide range of services that enable businesses and organizations to leverage technology for efficiency, innovation, and competitiveness. From software development and maintenance to cybersecurity and cloud computing, IT services encompass a diverse array of offerings tailored to meet the evolving needs of clients across various industries. Understanding the dynamics driving growth, regional variations, key drivers, opportunities, and challenges within the IT services market is essential for stakeholders to navigate this dynamic and rapidly evolving sector.

Get a Sample: https://www.precedenceresearch.com/sample/4061

Growth Factors

Several factors contribute to the growth of the IT services market. Technological advancement and digital transformation are primary drivers, as businesses increasingly rely on technology to streamline operations, enhance customer experiences, and gain a competitive edge. The proliferation of digital platforms, mobile devices, and Internet of Things (IoT) technologies has created a robust demand for IT services to support and optimize these digital ecosystems.

Moreover, globalization has led to the outsourcing of IT services to countries with lower labor costs, driving market expansion. Outsourcing enables businesses to access specialized skills, scale operations efficiently, and reduce operational costs, contributing to the growth of the global IT services market.

Region Insights:

The IT services market exhibits significant regional variations influenced by factors such as technological infrastructure, regulatory environments, and economic conditions.

In North America, the United States dominates the IT services market, driven by its advanced technological infrastructure, thriving startup ecosystem, and strong demand for digital solutions across industries. Canada also plays a significant role, particularly in areas such as software development, cybersecurity, and IT consulting.

In Europe, countries like the United Kingdom, Germany, and France are key players in the IT services market, leveraging their advanced economies and skilled workforce to offer a wide range of IT solutions and services. Eastern European countries, such as Poland, Ukraine, and Romania, have emerged as outsourcing destinations for IT services, capitalizing on their cost-effective labor pools and proximity to Western European markets.

In Asia-Pacific, India has established itself as a global hub for IT services, particularly in areas such as software development, business process outsourcing (BPO), and IT consulting. China, Japan, and South Korea also boast vibrant IT services industries, fueled by domestic demand and government initiatives to promote digitalization and innovation.

IT Services Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.17% |

| Global Market Size in 2023 | USD 1.40 Trillion |

| Global Market Size in 2024 | USD 1.50 Trillion |

| Global Market Size by 2033 | USD 2.80 Trillion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Approach, By Type, By Application, By Technology, By Deployment, By Enterprise Size and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

IT Services Market Dynamics

Drivers:

Several drivers propel the growth of the IT services market. Digital transformation initiatives undertaken by businesses across industries drive demand for IT services, including software development, cloud migration, and digital marketing. Companies seek to modernize their IT infrastructure, optimize business processes, and harness data analytics to gain insights and drive informed decision-making.

Furthermore, the increasing complexity and sophistication of cyber threats have heightened the demand for cybersecurity services. With cyberattacks becoming more frequent and sophisticated, organizations require robust cybersecurity solutions to protect their data, networks, and systems from cyber threats and vulnerabilities.

Additionally, the adoption of cloud computing technologies continues to accelerate, driving demand for cloud-based IT services such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Cloud computing offers scalability, flexibility, and cost-efficiency, enabling businesses to innovate and scale operations rapidly.

Opportunities:

The IT services market presents numerous opportunities for growth and innovation. One such opportunity lies in the adoption of emerging technologies such as artificial intelligence (AI), machine learning, and blockchain. These technologies have the potential to transform industries and create new opportunities for IT service providers to develop innovative solutions and services.

Moreover, the increasing focus on data analytics presents significant opportunities for IT service providers to help businesses harness the power of data to drive business insights, optimize operations, and enhance customer experiences. As organizations seek to derive actionable insights from vast amounts of data, the demand for data analytics services is expected to surge.

Furthermore, the rise of remote work and digital collaboration in the wake of the COVID-19 pandemic has accelerated the adoption of remote IT services such as remote monitoring and management, virtual desktop infrastructure (VDI), and collaboration tools. IT service providers can capitalize on this trend by offering tailored solutions to support remote work environments and ensure business continuity.

Challenges:

Despite the opportunities presented by technological advancement and digital transformation, the IT services market faces several challenges. One such challenge is the shortage of skilled IT professionals, particularly in areas such as cybersecurity, cloud computing, and data analytics. The rapid pace of technological change requires continuous upskilling and reskilling of the workforce to meet the evolving demands of the market.

Moreover, data privacy and security concerns pose significant challenges for IT service providers, particularly in light of increasingly stringent regulatory requirements such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Ensuring compliance with data protection regulations while maintaining data integrity and confidentiality requires robust cybersecurity measures and proactive risk management strategies.

Furthermore, geopolitical tensions and trade disputes can disrupt global supply chains and impact the operations of IT service providers that rely on outsourced labor and offshore delivery centers. Uncertainty surrounding trade policies and immigration regulations can hinder market growth and investment in the IT services sector.

Read Also: Aircraft Health Monitoring System Market Size, Report by 2033

Recent Developments

- In November 2023, a strategic relationship between NVIDIA and Amazon Web Services, Inc. has expanded to offer customers cutting-edge services, software, and infrastructure to power their generative artificial intelligence (AI) advancements.

- In September 2022, to support businesses in fostering innovation and achieving their goals for digital growth, IBM revealed plans to purchase Dialexa, a top provider of digital product engineering services in the United States. The acquisition is anticipated to expand IBM’s knowledge in product engineering and enable the company to provide clients with full-service digital transformation solutions.

IT Services Market Companies

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Broadcom (Symantec Corporation)

- Oracle

- Huawei Technologies Co., Ltd.

- IBM Corp.

- Juniper Networks, Inc.

- Microsoft

Segments Covered in the Report

By Approach

- Reactive IT Services

- Proactive IT Services

By Type

- Design & Implementation

- Operations & Maintenance

By Application

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Technology

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By End-use

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- IT & Telecom

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/