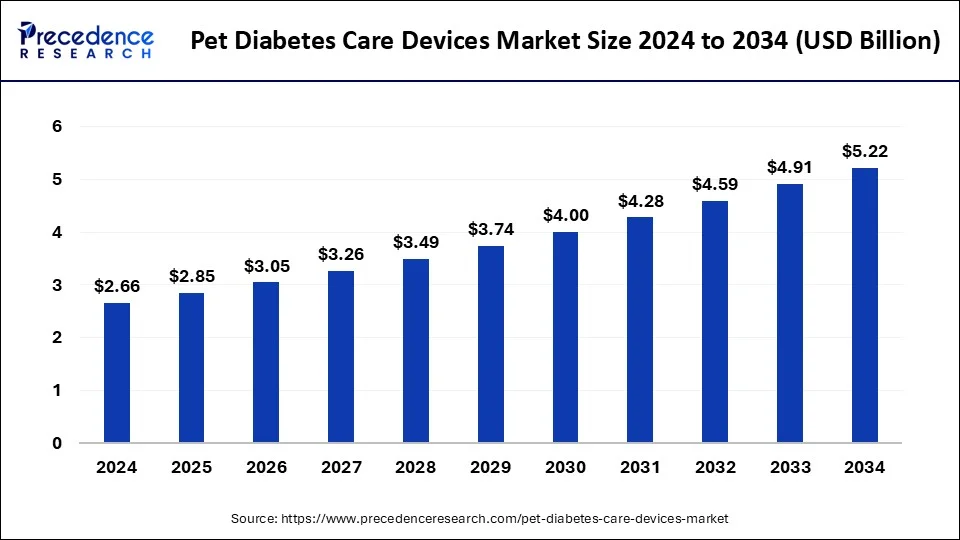

The global pet diabetes care devices market size reached USD 2.48 billion in 2023 and is anticipated to hit around USD 4.91 billion by 2033, growing at a CAGR of 7.05% from 2024 to 2033.

Key Points

- North America held the largest market share of 37% in 2023.

- The Asia-Pacific region is observed to witness the fastest rate of expansion during the forecast period.

- By device, the insulin delivery devices segment has contributed more than 93% of the market share in 2023.

- By animal, the dogs segment led the market with the major market share of 55% in 2023.

- By end-users, the veterinary hospitals segment has recorded more than 42% of the market share in 2023.

The Pet Diabetes Care Devices Market is witnessing steady growth due to the increasing prevalence of diabetes in pets, rising pet healthcare expenditure, and advancements in veterinary diagnostics and treatment options. Diabetes mellitus, a chronic endocrine disorder, affects a significant number of companion animals, including dogs and cats. Similar to humans, pets with diabetes require regular monitoring of blood glucose levels, insulin therapy, and dietary management to maintain optimal health. As awareness about pet diabetes continues to grow among pet owners and veterinarians, the demand for pet diabetes care devices, including glucose monitoring systems, insulin pens, and syringes, is expected to rise.

Get a Sample: https://www.precedenceresearch.com/sample/3970

Growth Factors:

Several factors contribute to the growth of the Pet Diabetes Care Devices Market. Firstly, the increasing prevalence of pet obesity and sedentary lifestyles has led to a rise in the incidence of diabetes among pets. Factors such as poor diet, lack of exercise, genetic predisposition, and aging contribute to the development of diabetes in pets, driving the demand for diabetes management solutions.

Moreover, the growing pet humanization trend, wherein pets are increasingly viewed as members of the family, has led to greater awareness and concern for their health and well-being. Pet owners are more willing to invest in advanced healthcare technologies and treatments to ensure the optimal care of their diabetic pets, thereby fueling the demand for pet diabetes care devices.

Additionally, advancements in veterinary medicine, including improved diagnostics, insulin formulations, and glucose monitoring technologies, have enhanced the management of diabetes in pets. Continuous glucose monitoring (CGM) systems, for example, offer real-time monitoring of blood glucose levels, allowing for better glycemic control and early detection of hypoglycemic or hyperglycemic episodes.

Furthermore, the increasing availability of pet insurance and reimbursement options for veterinary care has made diabetes management more affordable for pet owners, encouraging them to seek timely diagnosis and treatment for their diabetic pets. Insurance coverage for diabetes-related expenses, including insulin, glucose monitoring supplies, and veterinary consultations, alleviates financial burdens and promotes proactive management of the disease.

Region Insights:

The Pet Diabetes Care Devices Market exhibits regional variations in terms of market size, adoption rates, and regulatory landscape. In North America, the United States and Canada dominate the market, driven by a large pet population, high pet healthcare expenditure, and a well-established veterinary healthcare infrastructure. The presence of leading pet healthcare companies, research institutions, and veterinary clinics in the region further contributes to market growth.

In Europe, countries such as the United Kingdom, Germany, and France are significant contributors to the Pet Diabetes Care Devices Market. Increasing pet ownership rates, growing awareness about pet health, and favorable government initiatives to promote animal welfare drive market growth in the region. Moreover, the presence of key players and veterinary associations focused on diabetes management supports the adoption of pet diabetes care devices in Europe.

In Asia Pacific, rapid urbanization, rising disposable incomes, and changing lifestyles have fueled the demand for companion animals, driving market growth for pet diabetes care devices. Countries such as China, Japan, and Australia are witnessing a surge in pet ownership and pet healthcare expenditure, creating lucrative opportunities for market players. Additionally, advancements in veterinary healthcare infrastructure and increasing awareness about diabetes management contribute to market expansion in the region.

Pet Diabetes Care Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.05% |

| Global Market Size in 2023 | USD 2.48 Billion |

| Global Market Size by 2033 | USD 4.91 Billion |

| U.S. Market Size in 2023 | USD 640 Million |

| U.S. Market Size by 2033 | USD 1,270 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Device, By Animal, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Diabetes Care Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the Pet Diabetes Care Devices Market. Firstly, the rising incidence of diabetes in pets, attributed to factors such as obesity, aging, and genetic predisposition, creates a growing need for effective diabetes management solutions. As pet owners become more aware of the signs and symptoms of diabetes in their pets, they seek access to reliable and convenient diabetes care devices to ensure the well-being of their furry companions.

Moreover, the increasing emphasis on preventive healthcare and wellness among pet owners drives demand for pet diabetes care devices. Routine blood glucose monitoring, insulin therapy, and dietary management are essential components of diabetes management in pets, helping to prevent complications and improve quality of life. As pet owners prioritize preventive healthcare measures, the demand for diabetes care devices that facilitate monitoring and treatment adherence is expected to rise.

Additionally, advancements in veterinary diagnostics and treatment options for diabetes contribute to market growth. Innovations in glucose monitoring technologies, insulin delivery systems, and veterinary telemedicine enable more accurate diagnosis, personalized treatment plans, and remote monitoring of diabetic pets. These advancements enhance the effectiveness and convenience of diabetes management, driving adoption rates among pet owners and veterinarians.

Furthermore, the increasing availability of pet insurance coverage for diabetes-related expenses incentivizes pet owners to invest in diabetes care devices and treatments for their pets. Insurance reimbursement for insulin, glucose monitoring supplies, and veterinary consultations alleviates financial barriers to diabetes management, encouraging pet owners to seek timely diagnosis and treatment for their diabetic pets. This, in turn, boosts market demand for pet diabetes care devices and services.

Opportunities:

The Pet Diabetes Care Devices Market presents several opportunities for market players to capitalize on emerging trends and unmet needs in pet diabetes management. Firstly, there is growing demand for user-friendly, technologically advanced diabetes care devices that simplify blood glucose monitoring and insulin administration for pet owners. Devices equipped with features such as wireless connectivity, mobile apps, and cloud-based data storage offer convenience and ease of use, enhancing user experience and treatment adherence.

Moreover, there is a need for personalized diabetes management solutions tailored to the unique needs of individual pets. Customized treatment plans, based on factors such as breed, age, weight, and lifestyle, can optimize glycemic control and minimize the risk of complications in diabetic pets. Market players can leverage data analytics, artificial intelligence, and veterinary telemedicine to develop personalized diabetes management solutions that improve treatment outcomes and enhance pet well-being.

Additionally, there is growing interest in holistic and integrative approaches to pet diabetes management, incorporating dietary modifications, exercise regimens, and complementary therapies alongside conventional medical treatments. Market players can explore opportunities to develop innovative products and services that address the holistic needs of diabetic pets, including specialized diets, supplements, and wellness programs. By offering comprehensive diabetes management solutions, companies can differentiate themselves in the market and meet the evolving needs of pet owners and veterinarians.

Furthermore, there is untapped potential for market expansion in emerging markets with rising pet ownership rates and increasing awareness about pet health and wellness. Market players can target these regions with tailored marketing strategies, partnerships with local distributors, and educational initiatives to raise awareness about diabetes management in pets. By establishing a presence in emerging markets and catering to the unique needs of pet owners and veterinarians, companies can capture market share and drive growth in the Pet Diabetes Care Devices Market.

Challenges:

Despite the growth opportunities, the Pet Diabetes Care Devices Market faces several challenges that could impact market growth and adoption rates. Firstly, there is a lack of standardized diagnostic criteria and treatment protocols for diabetes in pets, leading to variability in diagnosis and management practices among veterinarians. The absence of consensus guidelines and best practices may hinder the adoption of diabetes care devices and create confusion among pet owners regarding the optimal approach to diabetes management.

Moreover, cost considerations pose a challenge to market growth, particularly in regions with limited access to affordable healthcare services and pet insurance coverage. Diabetes care devices, including glucose monitoring systems, insulin pens, and syringes, can entail significant upfront and ongoing expenses for pet owners, especially in cases of long-term diabetes management. Affordability concerns may deter some pet owners from investing in diabetes care devices or seeking timely diagnosis and treatment for their diabetic pets, thereby impacting market demand.

Read Also: Vibration Sensor Market Size to Worth USD 12.44 Bn by 2033

Recent Developments

- In November 2023, Boehringer Ingelheim got approval for SENVELGO® in Europe. This is the first oral liquid medication available for diabetic cats, and it represents a significant advancement in treating feline diabetes in Europe. SENVELGO® can be given to cats once a day, either mixed with a small amount of food or directly administered into their mouth.

- In May 2023, UBI introduced the Petrackr, a diabetes monitoring device for pets. The product consists of a device and single-use test strips for collecting a small drop of blood sample and a hand-held monitor that can supervise multiple profiles of pets. The device accurately tracks, monitors, and displays the blood glucose levels of pets. The product has distribution partnerships in the United States and Canada.

- In Feb 2023, ALRT, a Singapore-based medical device company, launched GluCurve Pet CGM. It is a continuous monitoring device for diabetic cats and dogs produced in collaboration with Covetrus. It is designed to make diabetes management more effortless.

Pet Diabetes Care Devices Market Companies

- Merck animal health

- Becton

- Fitbark

- TaiDoc

- Dickinson

- Allison Medical

- Henry Schein

- Zoetis

- Ulticare

- Boehringer Ingelheim Vetmedica Inc.

- IDEXX Laboratories

- Johnson & Johnson Services, Inc

- Novo Nordisk

- Eli Lilly and Company

- Vetoquinol S.A.

Segments Covered in the Report

By Device

- Glucose Monitoring Devices

- Insulin Delivery Devices

- Insulin Delivery Pen

- Insulin Delivery Syringes

By Animal

- Dogs

- Cats

- Horses

By End-use

- Veterinary Clinics

- Home Care Settings

- Veterinary Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/