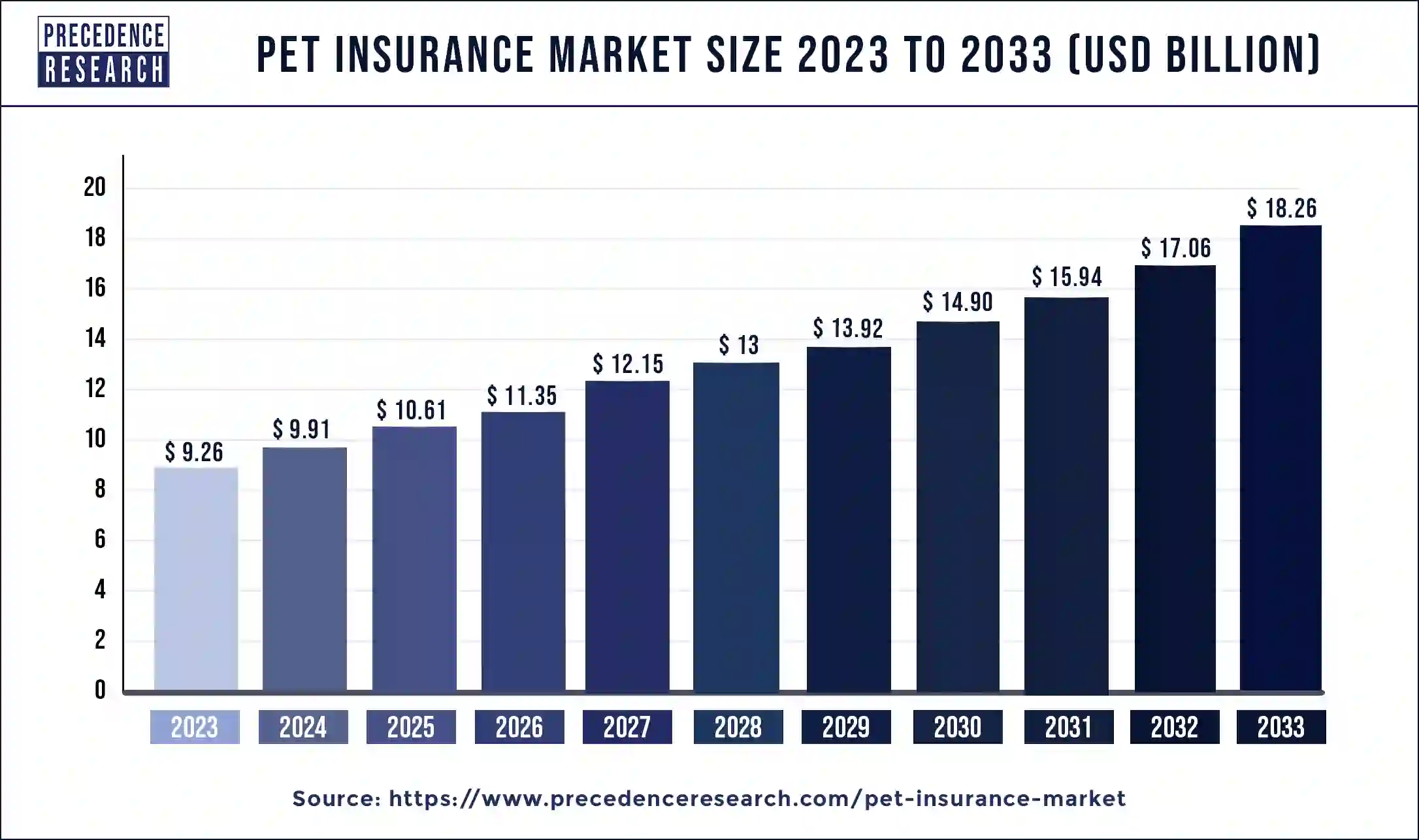

The global pet insurance market size reached USD 9.26 billion in 2023 and is projected to hit around USD 18.26 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033.

Key Points

- Europe dominated the global market with the largest market share of 35% in 2023.

- North America is expected to witness notable growth during the forecast period.

- By policy type, the accident & illness segment has contributed 97% of market share in 2023.

- By end-user, the dogs segment dominated the market in 2023.

- By end-user, the cats segment is expected to gain a significant share during the upcoming years.

The global economy encompasses a complex web of interconnected markets, industries, and economies across the world. It is influenced by various factors such as technological advancements, geopolitical events, trade policies, and consumer behavior. Understanding the dynamics of the global economy requires an analysis of growth factors, regional insights, drivers, opportunities, and challenges that shape its trajectory.

Get a Sample: https://www.precedenceresearch.com/sample/3982

Growth Factors:

Several key growth factors contribute to the expansion and development of the global economy. One significant factor is technological innovation, which drives productivity gains, facilitates new business models, and fosters economic efficiency. Emerging technologies such as artificial intelligence, blockchain, and advanced robotics are revolutionizing industries, fueling growth, and creating new opportunities for businesses worldwide. Additionally, demographic trends, including population growth, urbanization, and changing consumer preferences, play a crucial role in shaping demand patterns and market dynamics.

Region Insights: Different regions around the world exhibit unique characteristics and contribute differently to the global economy. The Asia-Pacific region, for instance, has emerged as a powerhouse driven by rapid industrialization, urbanization, and a growing middle class. Countries like China and India have become key players in global trade and investment, driving economic growth not only in the region but also globally. In contrast, mature economies in North America and Europe are characterized by technological advancement, innovation, and established financial markets, which contribute to their significant influence on the global economy.

Pet Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Global Market Size in 2023 | USD 9.26 Billion |

| Global Market Size by 2033 | USD 18.26 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Policy Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Insurance Market Dynamics

Drivers:

Various drivers propel the growth and development of the global economy. Trade liberalization and globalization have led to increased interconnectedness among economies, fostering cross-border trade, investment, and specialization. International trade agreements and economic partnerships further facilitate the flow of goods, services, and capital, promoting economic integration and cooperation. Moreover, infrastructure development, including transportation networks, communication systems, and digital infrastructure, enhances connectivity and enables the efficient movement of goods and information across borders.

Opportunities:

The global economy presents numerous opportunities for businesses, investors, and governments to capitalize on emerging trends and market dynamics. The rise of e-commerce and digital platforms has opened up new channels for reaching customers globally, allowing businesses to expand their market reach and tap into previously inaccessible markets. Furthermore, increasing demand for sustainable and environmentally friendly products and services presents opportunities for companies to innovate and differentiate themselves in the market. Additionally, investments in infrastructure, renewable energy, and technology offer long-term growth prospects and contribute to sustainable development.

Challenges:

Despite its vast potential, the global economy also faces several challenges that pose risks to its stability and growth. Geopolitical tensions, trade disputes, and protectionist measures can disrupt global supply chains, hinder trade flows, and dampen investor confidence. Economic inequality and social unrest pose challenges to inclusive growth and sustainable development, requiring policy interventions to address disparities and promote equitable opportunities. Moreover, environmental degradation, climate change, and resource depletion present existential threats that require coordinated efforts and innovative solutions to mitigate their impact on the global economy.

Read Also: Joint Reconstruction Devices Market Size, Share, Report by 2033

Recent Developments

- In 2024, a leading cloud-based company called Five Sigma collaborated with Odie Pet Insurance to make pet insurance accessible and affordable in many regions. These companies aim to accelerate the pet insurance market.

- In 2023, a pet insurance platform named Independent Pet Group (IPG) partnered with Felix for the insurance of cats in the United States.

- In 2023, The global risk partners acquired Petsmedicover, a pet insurance broker in the United Kingdom.

- In 2023, a company called ‘Go Digit General Insurance’ collaborated with Vetina to offer insurance coverage, especially for dogs.

- In 2023, Best Friends Animal Society (BFAS), an animal welfare organization, partnered with Fetch to promote the shelter of dogs and cats in America. This collaboration will aim to provide a shelter for pets.

Pet Insurance Market Companies

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Segments Covered by the Report

By Policy Type

- Accident

- Accident & Illness

- Embedded Wellness

By End-user

- Dogs

- Cats

- Horses

- Exotic Pets

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/