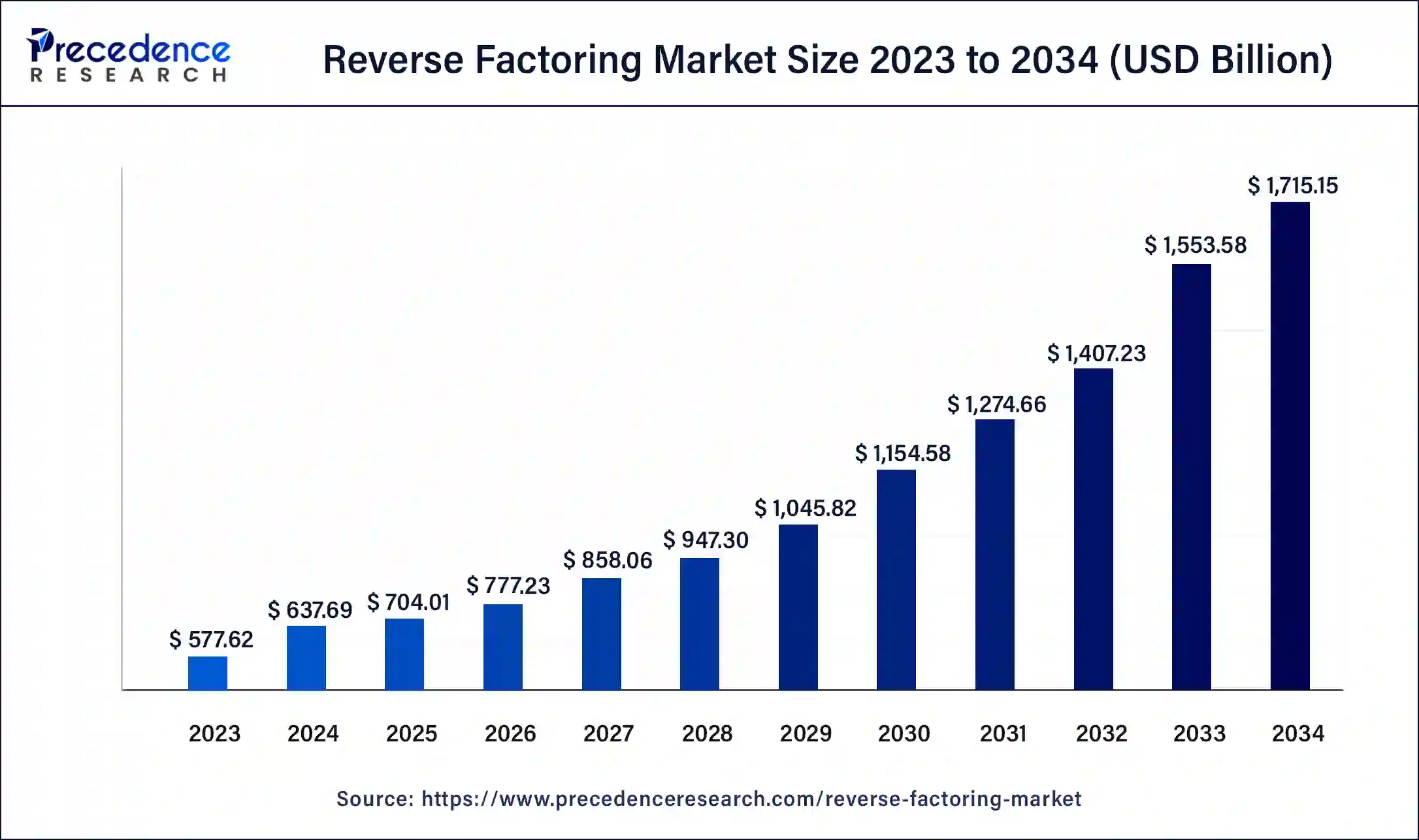

The global reverse factoring market size reached USD 577.62 billion in 2023 and is projected to hit around USD 1,527.05 billion by 2033, expanding at a CAGR of 10.21% from 2024 to 2033.

Key Points

- Europe has contributed more than 50% of market share in 2023.

- By category, the domestic segment held the largest market share in 2023.

- By category, the international segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By financial institution, the bank segment has generated the biggest market share in 2023.

- By financial institution, the non-banking financial institutions segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the manufacturing segment has led the significant market share in 2023.

- By end-use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

Reverse factoring, also known as supply chain finance, is a financial arrangement that allows businesses to optimize their cash flow by leveraging their relationships with suppliers and financial institutions. In this arrangement, a buyer works with a financial institution to extend payment terms to its suppliers, while the financial institution advances funds to the suppliers against approved invoices at a discounted rate. This enables suppliers to access early payment for their invoices, while buyers benefit from extended payment terms, improved working capital management, and potentially better negotiating power with suppliers.

Get a Sample: https://www.precedenceresearch.com/sample/3985

The reverse factoring market has experienced significant growth in recent years, driven by several factors. One key factor is the increasing pressure on businesses to optimize their working capital and liquidity management in a competitive global marketplace. Reverse factoring offers an attractive solution for both buyers and suppliers to improve their cash flow positions without resorting to costly financing options or compromising their relationships.

Reverse Factoring Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.21% |

| Global Market Size in 2023 | USD 577.62 Billion |

| Global Market Size by 2033 | USD 1,527.05 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Category, By Financial Institution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reverse Factoring Market Dynamics

Another factor driving the growth of the reverse factoring market is the expansion of global supply chains and the increasing complexity of supplier networks. As businesses operate in an interconnected world with suppliers located across different geographies, managing payment terms and cash flow becomes more challenging. Reverse factoring provides a streamlined and efficient mechanism for managing payments and mitigating risks associated with supplier financing.

Additionally, the digital transformation of financial services has played a significant role in the growth of the reverse factoring market. Advancements in technology have enabled the automation of processes, real-time data analytics, and seamless integration with existing financial systems, making reverse factoring more accessible and scalable for businesses of all sizes. Digital platforms and fintech solutions have emerged to facilitate the implementation of reverse factoring programs, further driving adoption and market growth.

From a regional perspective, the reverse factoring market has witnessed strong growth across various regions, including North America, Europe, Asia-Pacific, and Latin America. In developed markets, such as North America and Europe, mature financial ecosystems and regulatory frameworks have supported the adoption of reverse factoring as a strategic tool for working capital optimization. In contrast, emerging markets in Asia-Pacific and Latin America have seen rapid adoption driven by the growth of manufacturing industries, expanding supply chains, and increasing demand for financing solutions.

Despite its growth and popularity, the reverse factoring market also faces several challenges and risks. One challenge is the potential for supplier dependency on reverse factoring as a source of financing, which may result in overreliance on a single buyer or financial institution. This could expose suppliers to liquidity risks if buyers or financial institutions were to change their financing arrangements or terms suddenly.

Moreover, regulatory and compliance requirements vary across jurisdictions, posing challenges for businesses operating in multiple geographies. Ensuring compliance with anti-money laundering (AML), know-your-customer (KYC), and other regulatory requirements adds complexity to the implementation of reverse factoring programs and may require significant resources and expertise.

Read Also: Aviation IoT Market Size to Reach USD 69.51 Billion by 2033

Recent Developments

- In October 2022, HSBC Hong Kong, a wholly-owned subsidiary of the HSBC Group, unveiled Trade Platform, a comprehensive e-platform designed to offer flexibility, safety, and security in managing global trade transactions. It caters to trade loans for sellers and buyers, guarantees, import bills, and import documents for credit.

- In December 2022, Endesa, in collaboration with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander, introduced a circular reverse factoring solution. This innovative initiative includes incentives and rewards for sustainable practices, thereby enhancing their competitiveness within the economy.

Reverse Factoring Market Companies

- Citibank

- HSBC

- Santander

- Banco Bilbao Vizcaya Argentaria (BBVA)

- Caixabank

- JPMorgan Chase

- Bank of America

- BNP Paribas

- Deutsche Bank

- Barclays

- Société Générale

- Credit Suisse

- ING Group

- Wells Fargo

- Standard Chartered

Segments Covered in the Report

By Category

- Domestic

- International

By Financial Institution

- Banks

- Non-banking Financial Institutions

By End-use

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Retail, Food & Beverages, Among Others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/