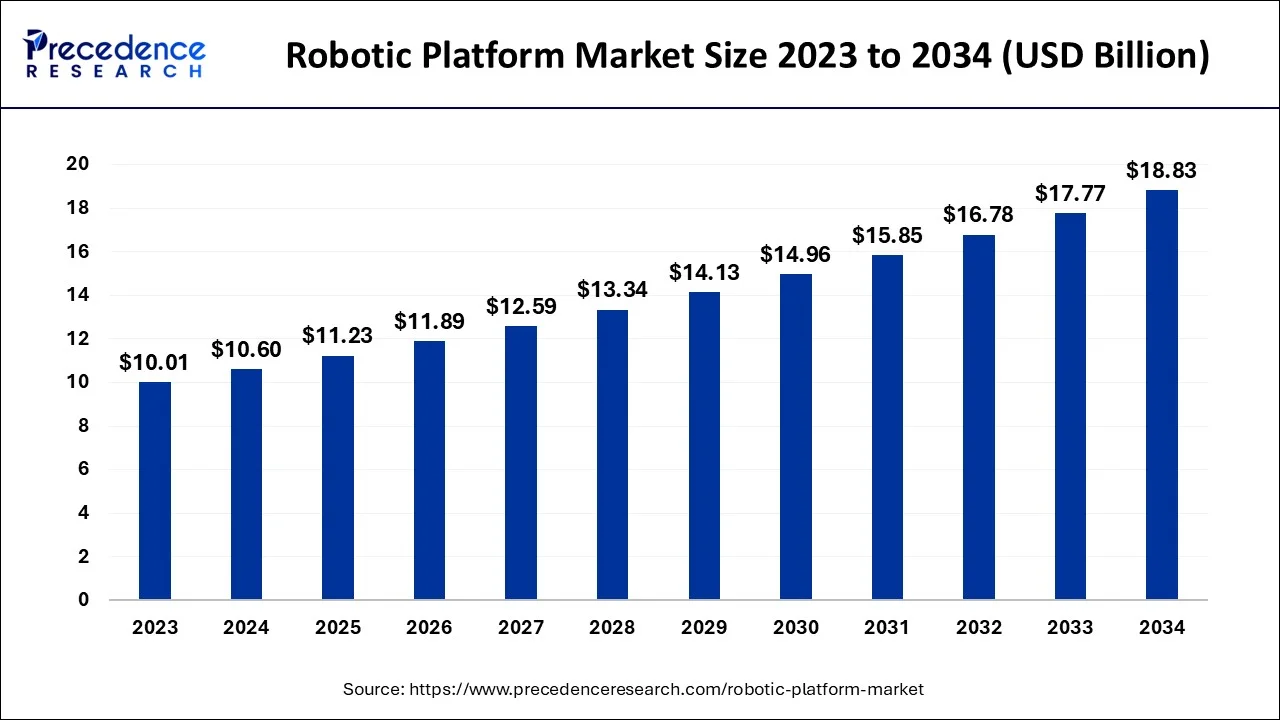

The global robotic platform market size reached USD 10.60 billion by 2024 and is anticipated to cross around USD 11.23 billion by 2034 with a CAGR of 5.91% from 2024 and 2034.

Key Takeaways

- North America dominated the robotic platform market with the largest market share of 36% in 2023.

- Asia Pacific is expected to grow at a solid CAGR of 8.04% during the forecast period.

- By robot type, the industrial robots segment accounted for the largest market share of 67% in 2023.

- By robot type, the service robots segment is expected to expand at the fastest growth rate during the forecast period.

- By deployment, the on-premises segment dominated the robotic platform market in 2023.

- By deployment, the cloud segment is expected to grow significantly in the coming years.

- By type, the stationary segment led the market with the largest share in 2023.

- By type, the mobile segment is projected to register the fastest growth during the foreseeable period.

- By end-user, the manufacturing segment held the largest share of the market in 2023.

- By end-user, the healthcare segment is expected to expand at a significant pace throughout the forecast period.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5111

Market Overview

The Robotic Platform Market is experiencing rapid growth as industries increasingly adopt automation to enhance productivity, accuracy, and operational efficiency. These platforms, which include a variety of robotic systems and frameworks, are extensively used in sectors such as manufacturing, healthcare, logistics, defense, and agriculture. The market covers different types of robotic platforms, including stationary, mobile, and aerial robots. Innovations in AI, machine learning, and IoT are continually driving advancements in robotic platforms, making them smarter and more adaptable to complex tasks. The expanding applications across diverse industries are setting the stage for significant market expansion in the coming years.

Growth Factors

Several factors are propelling the growth of the Robotic Platform Market. First, the rising demand for automation in manufacturing and logistics to enhance efficiency and reduce human error is a major growth driver. Second, advancements in sensor technology and AI are enabling robots to perform more intricate and sensitive tasks, particularly in healthcare and precision agriculture. Additionally, the shift towards Industry 4.0, which focuses on smart manufacturing processes, is fostering the adoption of robotic platforms across sectors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.83 Billion |

| Market Size in 2024 | USD 10.6 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Robot Type, Deployment, Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The market is driven by increasing labor costs and the need for faster production rates, prompting businesses to invest in robotic solutions that can operate around the clock. In healthcare, the demand for robotic surgery and telemedicine has surged, especially post-pandemic, as hospitals and clinics seek minimally invasive solutions and remote care options. In agriculture, the growing need for efficient crop monitoring and harvesting techniques to address global food demands is pushing the adoption of robotic platforms.

Opportunities

Significant opportunities exist in expanding the scope of robotic platforms into emerging markets where automation adoption is still in its early stages. There is also potential for growth in developing multi-functional robots capable of performing diverse tasks in dynamic environments, such as rescue missions and hazardous material handling. Additionally, the integration of AI and cloud computing with robotics is opening new avenues for remote monitoring, real-time data analysis, and enhanced decision-making, which can further drive demand for these platforms.

Challenges

Despite its growth prospects, the Robotic Platform Market faces several challenges. High initial costs and the complexity of implementing robotic systems can be barriers for small and medium-sized enterprises (SMEs). Moreover, concerns over job displacement due to automation and the requirement for skilled personnel to manage and maintain robotic systems are challenges that need to be addressed. Cybersecurity threats associated with connected robotic platforms are also a growing concern, as these systems become increasingly integrated into critical infrastructure.

Region Insights

Regionally, North America is a leading market for robotic platforms due to the high adoption rate in industries like healthcare, manufacturing, and defense. Europe follows closely, with a strong focus on automotive manufacturing and industrial automation. The Asia-Pacific region, particularly China and Japan, is witnessing substantial growth driven by a booming electronics manufacturing sector and substantial government investments in automation. In contrast, Latin America and the Middle East & Africa regions are still in the nascent stages of robotic adoption but present vast potential for growth as industries there begin to embrace automation technologies.

Read Also: Conductive Polymers Market Size to Cross Around USD 12.74 Billion by 2034

Recent Developments

- In June 2024, ABB unveiled the OmniCore, a next-generation robotics control platform. OmniCore is a progression to a modern and adaptable control system that will open up opportunities for the targeted use of AI, sensor, cloud, and edge technologies to build new, sophisticated, and self-sufficient robotic solutions.

- In May 2023, Robocath launched a new robotic platform, R-One+. This platform allows the interventional cardiologist to perform coronary angioplasties by controlling the devices using an integrated control command unit located in the cath lab or the control room.

- In March 2024, IBM revealed Robotic Process Automation version 23.0.15 with improved functions and solutions. This brings about scheduling and workflow with Time Zone support as well as the use of Federal Information Processing Standards (FIPS) and intelligent User Management Services (UMS) management tools.

- In March 2024, Cognizant and Google Cloud expanded their partnership to enhance software development efficacy by embracing the Gemini platform for Google Cloud.

- In March 2024, Addverb entered into a partnership with DHL Supply Chain in North America. The partnership entails the use of 52 Zippy sorting robots and an Addverb software application in a DHL warehouse in Columbus, Ohio.

Robotic Platform Market Companies

- ABB LTD.

- Amazon.com, Inc.

- Clearpath Robotics

- CloudMinds

- Cyberbotics

- Dassault Systemes

- Google LLC

- IBM Corporation

- KEBA

- KUKA AG

- Microsoft

- NVIDIA Corporation

- Rethink Robotics

- Universal Robots

Segments Covered in the Report

By Robot Type

- Service Robots

- Industrial Robots

By Deployment

- Cloud

- On-premises

By Type

- Stationary

- Mobile

By End-user

- Manufacturing

- Electrical & Electronics

- Automotive

- Pharmaceuticals

- Food & Beverages

- Metals & Machinery

- Plastic, Rubber, and Chemicals

- Others

- Logistics and Transportation

- Healthcare

- Retail and e-commerce

- Residential

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5111

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com