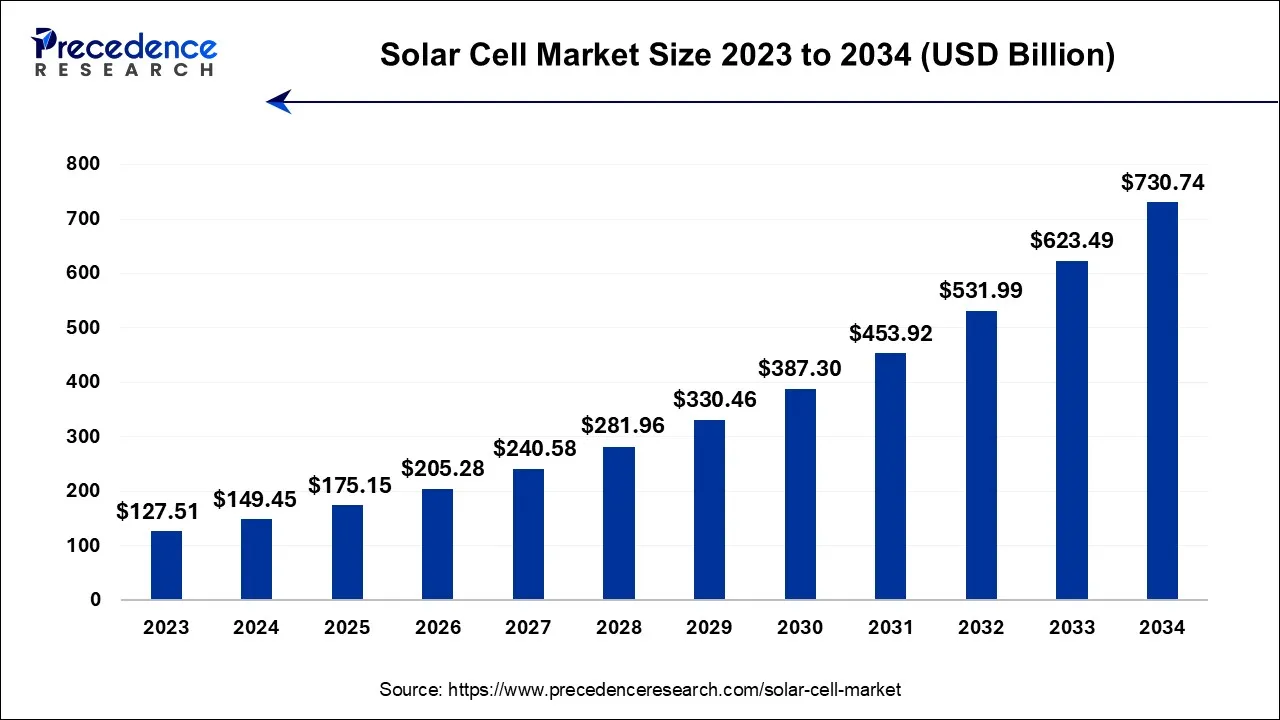

The global solar cell market size was valued USD 127.51 billion in 2023 and is expected to be attain around USD 730.74 billion by 2034. It is growing at a CAGR of 17.2% between 2024 and 2034.

The solar cells market has experienced significant growth over the years due to the significant increase in the installation of solar panels. Solar cells are essential in solar panels, converting sunlight into electricity. The market is expected to expand rapidly in the coming years due to the rising focus on reducing carbon emissions and government policies promoting clean energy. Policies and subsidies by governments, such as tax deductions and assistance programs are boosting the adoption of solar systems. Moreover, the rising demand for electricity worldwide and the growing emphasis on renewable energy propel the market.

| Report Coverage | Details | |

| Market Size in 2023 | USD 127.51 Billion | |

| Market Size by 2033 | USD 623.49 Billion | |

| CAGR | 17.2% | |

| Largest Revenue Holder in 2023 | Asia Pacific (49%) | |

| Top Companies | Panasonic Corporation, JINERGY, Hevel, ReneSola, United Renewable Energy, LLC, SunPower Corporation, Risen Solar, Trina Solar, Jinko Solar | |

Key Insights

- Asia Pacific has accounted highest revenue share of 48% in 2023.

- The Asia Pacific solar cell market size is expected to hit around USD 361.72 billion by 2034 and growing at a CAGR of 17.32% from 2024 to 2034.

- By material, the crystalline segment has accounted revenue share of 87% in 2023.

- By installation type, the utility-scale segment has generated revenue share of 65% in 2023.

- By technology, the monocrystalline segment has accounted highest revenue share in 2023.

- By technology, the polycrystalline segment is anticipated to witness significant growth during the forecast period.

Regional Stance

Asia Pacific dominated the market in 2023. Favorable government policies and incentives have boosted the installation of solar systems, thus boosting the demand for solar cells. The increased demand for solar energy in the utility and commercial sectors bolstered the market in the region. A significant decrease in photovoltaic prices and advancements in renewable energy technology aimed at increasing their operational efficiency further contributed to market growth. India stands 4th across the globe in solar power capacity due to the rising number of solar farms, thus propelling the market in the region. For instance,

- India’s solar installed capacity reached 70,096 MW in 2023, increasing from 21,651 MW in the last five years.

The market in North America is expected to grow at the fastest rate during the forecast period, owing to the rising installation of solar systems, government initiatives promoting green energy solutions, feed-in-tariff legislation, and awareness among people about the advantages of using solar power. The rapid transition to clean energy and net metering policy further boosted the adoption of solar systems in the region. The net metering policy enables solar system owners to sell excess energy to the grid, which encourages many businesses and homeowners to invest in solar systems.

Material Insights

The crystalline silicon segment dominated the market in 2023. Solar cells made from crystalline silicon have many benefits, such as high efficiency, long life spans, low costs, and environmentally friendly. Crystalline silicon cells are reliable and easy to manufacture. They can last more than 30 years with a slow degradation rate, typically losing about 0.5% of their efficiency yearly. Additionally, these cells are less harmful to the environment than thin-film PV panels. They have the ability to work in different climates. Moreover, these elements are abundant in the Earth’s crust, so they are a great resource.

- In June 2024, First Solar Inc announced its ownership of patents related to the manufacturing of Tunnel Oxide Passivated Contact (TOPCon) crystalline-silicon (c-Si) photovoltaic solar cells.

Technology Insights

The monocrystalline segment dominated the market in 2023. Monocrystalline solar cells are the most popular type of solar cells, as they are highly efficient and are made from pure silicon, which is the best material for converting sunlight into energy. These solar cells occupy less space than other solar panels because they are space-efficient. While these cells are quite expensive than other solar panels, they can last approximately fifty years. The rising production of monocrystalline solar panels contributes to the segment’s growth.

- In August 2024, IB Solar, a leading manufacturer of solar PV panels, introduced all-weather monocrystalline panels for both residential and commercial use.

The polycrystalline silicon segment is anticipated to grow rapidly during the forecast period. Polycrystalline silicon, also known as multicrystalline silicon, has numerous advantages compared to monocrystalline silicon. Some of these include low cost, long life span, durability, and space efficiency. Additionally, polycrystalline cells can resist extreme weather conditions while occupying less area, producing the same amount of power. Furthermore, they provide an equilibrium between effectiveness and pricing. Polycrystalline lasts approximately 25 years but can serve longer with proper servicing. They are manufactured by melting silicon pieces together in square molds.

Market Dynamics

Driver

Socio-economic benefits of solar energy

Energy is one of the major factors in economic development and growth. With the growing population and rising economies, the energy demand is increasing at a rapid pace. However, solar power has been considered as a potential alternative to meet this evolving energy demand. Moreover, solar power generation systems minimize carbon emissions, aligning well with the growing focus on reducing carbon footprints and environmental sustainability. The rising installation capacity of solar energy across the globe further drives the market.

Restraint

Weather dependency and regulatory barriers

The efficiency of solar power systems is dependent on sunlight. However, nighttime and cloudy days may hamper their efficiency by limiting the amount of power that solar cells can produce. Moreover, regulatory barriers, such as changing government policies and permitting processes, can deter potential homeowners from installing solar systems. Additionally, installing a solar system often requires ample space. However, limited rooftop space may create barriers for widespread adoption of solar systems.

Opportunity

Green Hydrogen or renewable hydrogen stands as an effective and smart solution for storing energy. It is produced through electrolysis powered by sustainable energy sources, such as solar power. Green hydrogen can be produced during periods of excess renewable energy production and can be used for various applications, from fuel cells in vehicles to a utility-scale energy storage solution.

- In September 2024, within 18 months, Gensol Engineering and Matrix Gas & Renewables Ltd will be commencing a project that will convert 25 tons of bio-waste into 1 ton of hydrogen daily.

Recent Developments

- In September 2024, Reliance Industries intends to begin production of PV modules by the end of this year. The company is set to develop its integrated solar production facilities, which will include modules, glass, cells, wafers, polysilicon, and ingots with an annual capacity of 10 GW.

- In August 2024, Airbus Defence and Space partnered with Hanwha Systems’ Flexell Space to produce tandem photovoltaics designed specifically for use on satellites.

Key Players Operating in the Solar Cell Market

- Panasonic Corporation

- JINERGY

- Hevel

- ReneSola

- United Renewable Energy, LLC

- SunPower Corporation

- Risen Solar

- Trina Solar

- Jinko Solar

Segments Covered in the Report

By Material

- Crystalline

- N Material

- P Material

- Thin Film

By Product

- BSF

- PERC/PERL/PERT/TOPCON

- HJT

- IBC & MWT

- Others

By Technology

- Monocrystalline

- Polycrystalline

- Cadmium Telluride (CDTE)

- Amorphous Silicon (A-Si)

- Copper Indium Gallium Diselenide

By Installation Type

- Residential

- Commercial

- Utility

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/2339

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344