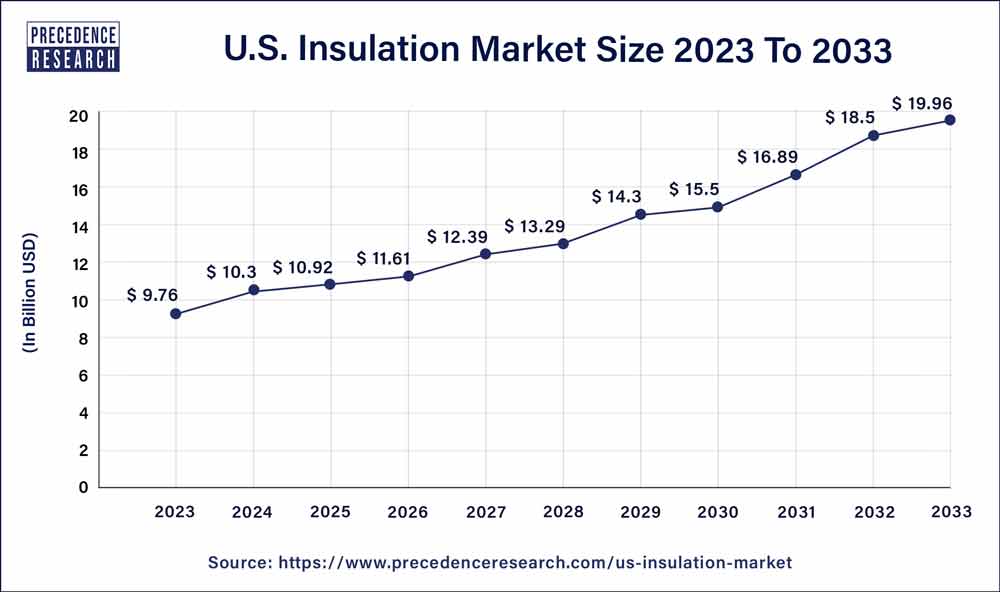

The U.S. insulation market size is poised to grow by USD 19.96 billion by 2033 from USD 9.76 billion in 2023, exhibiting a CAGR of 7.63% during the forecast period 2024 to 2033.

Key Points

- By product, the expanded polystyrene segment held the dominating share of the market in 2023.

- By function, the thermal segment is expected to capture the largest market share during the forecast period.

- By form, the foam segment held the largest share of the market in 2023.

- By end user, the construction segment is expected to continue to dominate the U.S. insulation market during the forecast period.

Overview

The U.S. insulation market is a significant segment within the construction industry, encompassing various materials and technologies aimed at improving energy efficiency and reducing heat transfer in buildings. Insulation plays a crucial role in enhancing thermal comfort, reducing energy consumption, and mitigating environmental impacts by decreasing the reliance on heating and cooling systems. With increasing awareness about sustainability and energy conservation, the demand for insulation solutions continues to rise across residential, commercial, and industrial sectors in the United States.

Get a Sample Report: https://www.precedenceresearch.com/sample/3749

Growth Factors

Several factors contribute to the growth of the U.S. insulation market. Firstly, stringent building codes and regulations mandating energy efficiency standards drive the adoption of high-performance insulation materials. Additionally, government incentives and initiatives aimed at promoting green building practices incentivize builders and homeowners to invest in insulation upgrades. The growing emphasis on sustainability and the rising cost of energy further propel the demand for insulation products that offer long-term energy savings. Technological advancements in insulation materials, such as the development of innovative aerogels and advanced foams, also contribute to market growth by offering superior thermal performance and versatility.

U.S. Insulation Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.63% |

| U.S. Market Size in 2023 | USD 9.76 Billion |

| U.S. Market Size by 2033 | USD 19.96 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Function, By Function, and By End User |

Read More: Organic Peroxide Market Size to Reach USD 1.93 Billion by 2033

Opportunities

The U.S. insulation market presents several opportunities for expansion and innovation. One significant opportunity lies in catering to the growing demand for eco-friendly and sustainable insulation solutions. Manufacturers can capitalize on this trend by investing in research and development to produce insulation materials derived from recycled or renewable resources. Additionally, the retrofitting market offers considerable opportunities, as existing buildings represent a vast potential for energy-saving upgrades. Moreover, the increasing focus on achieving net-zero energy buildings creates a favorable environment for the adoption of high-performance insulation systems that contribute to overall energy efficiency.

Challenges

Despite the favorable growth prospects, the U.S. insulation market faces several challenges. One of the primary challenges is the price sensitivity of consumers and builders, particularly in the residential sector. While energy-efficient insulation offers long-term cost savings, the upfront costs can deter some buyers, especially in a price-sensitive market. Additionally, competition from alternative insulation materials and systems, such as spray foam insulation and reflective barriers, poses a challenge to traditional insulation products. Moreover, the complexity of building codes and regulations across different states and municipalities can create barriers to market entry and expansion for manufacturers and contractors.

U.S. Insulation Market Companies

- Saint Gobain

- GAF

- Kingspan Group

- Knauf Insulation

- Johns Manville

- 3M

- Owens Corning

- Cellofoam North America, Inc.

- BASF

- Huntsman International LLC

Data Sources and Methodology

To gather comprehensive insights on the Global U.S. insulation Market, we relied on a range of data sources and followed a well-defined methodology. Our approach involved interactions with industry experts and key stakeholders across the market’s value chain, including management organizations, processing organizations, and analytics service providers.

We followed a rigorous data analysis process to ensure the quality and credibility of our research. The gathered information was carefully evaluated, and relevant quantitative data was subjected to statistical analysis. By employing robust analytical techniques, we were able to derive meaningful insights and present a comprehensive overview of the Global U.S. insulation Market.

The most resonating, simple, genuine, and important causes because of which you must decide to buy the U.S. insulation market report exclusively from precedence research

- The research report has been meticulously crafted to provide comprehensive knowledge on essential marketing strategies and a holistic understanding of crucial marketing plans spanning the forecasted period from 2023 to 2032.

Key Features of the Report:

- Comprehensive Coverage: The report extensively encompasses a detailed explanation of highly effective analytical marketing methods applicable to companies across all industry sectors.

- Decision-Making Enhancement: It outlines a concise overview of the decision-making process while highlighting key techniques to enhance it, ensuring favorable business outcomes in the future.

- Articulated R&D Approach: The report presents a well-defined approach to conducting research and development (R&D) activities, enabling accurate data acquisition on current and future marketing conditions.

Market Segmentation:

By Product

- Expanded polystyrene

- Glass wool

- Mineral wool

- Cellulose

- Calcium silicate

- Others

By Function

- Thermal

- Acoustic

- Electric

- Others

By Form

- Blanket

- Foam

- Board

- Pipe

- Others

By End User

- Industrial use

- Construction

- Residential

- Non-residential & Commercial

- Original equipment manufacturer

- Transportation

- Automotive

- Marine

- Aerospace

- Appliances

- Packaging

- Furniture

- Others

Reasons to Consider Purchasing the Report:

- Enhance your market research capabilities by accessing this comprehensive and precise report on the global U.S. insulation market.

- Gain a thorough understanding of the overall market landscape and be prepared to overcome challenges while ensuring robust growth.

- Benefit from in-depth research and analysis of the latest trends shaping the global U.S. insulation market.

- Obtain detailed insights into evolving market trends, current and future technologies, and strategic approaches employed by key players in the global U.S. insulation market.

- Receive valuable recommendations and guidance for both new entrants and established players seeking further market expansion.

- Discover not only the cutting-edge technological advancements in the global U.S. insulation market but also the strategic plans of industry leaders.

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Insulation Market

5.1. COVID-19 Landscape: U.S. Insulation Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Insulation Market, By Product

8.1. U.S. Insulation Market Revenue and Volume Forecast, by Product, 2024-2033

8.1.1. Expanded polystyrene

8.1.1.1. Market Revenue and Volume Forecast (2021-2033)

8.1.2. Glass wool

8.1.2.1. Market Revenue and Volume Forecast (2021-2033)

8.1.3. Mineral wool

8.1.3.1. Market Revenue and Volume Forecast (2021-2033)

8.1.4. Cellulose

8.1.4.1. Market Revenue and Volume Forecast (2021-2033)

8.1.5. Calcium silicate

8.1.5.1. Market Revenue and Volume Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 9. U.S. Insulation Market, By Function

9.1. U.S. Insulation Market Revenue and Volume Forecast, by Function, 2024-2033

9.1.1. Thermal

9.1.1.1. Market Revenue and Volume Forecast (2021-2033)

9.1.2. Acoustic

9.1.2.1. Market Revenue and Volume Forecast (2021-2033)

9.1.3. Electric

9.1.3.1. Market Revenue and Volume Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 10. U.S. Insulation Market, By Form

10.1. U.S. Insulation Market Revenue and Volume Forecast, by Form, 2024-2033

10.1.1. Blanket

10.1.1.1. Market Revenue and Volume Forecast (2021-2033)

10.1.2. Foam

10.1.2.1. Market Revenue and Volume Forecast (2021-2033)

10.1.3. Board

10.1.3.1. Market Revenue and Volume Forecast (2021-2033)

10.1.4. Pipe

10.1.4.1. Market Revenue and Volume Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 11. U.S. Insulation Market, By End User

11.1. U.S. Insulation Market Revenue and Volume Forecast, by End User, 2024-2033

11.1.1. Industrial use

11.1.1.1. Market Revenue and Volume Forecast (2021-2033)

11.1.2. Construction

11.1.2.1. Market Revenue and Volume Forecast (2021-2033)

11.1.3. Original equipment manufacturer

11.1.3.1. Market Revenue and Volume Forecast (2021-2033)

11.1.4. Transportation

11.1.4.1. Market Revenue and Volume Forecast (2021-2033)

11.1.5. Appliances

11.1.5.1. Market Revenue and Volume Forecast (2021-2033)

11.1.5. Packaging

11.1.5.1. Market Revenue and Volume Forecast (2021-2033)

11.1.5. Furniture

11.1.5.1. Market Revenue and Volume Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 12. U.S. Insulation Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Volume Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Volume Forecast, by Function (2021-2033)

12.1.3. Market Revenue and Volume Forecast, by Form (2021-2033)

12.1.4. Market Revenue and Volume Forecast, by End User (2021-2033)

Chapter 13. Company Profiles

13.1. Saint Gobain

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. GAF

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Kingspan Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Knauf Insulation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Johns Manville

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. 3M

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Owens Corning

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Cellofoam North America, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. BASF

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Huntsman International LLC

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

Precedence Statistics – Empowering Your Data Insights

Contact Us

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com