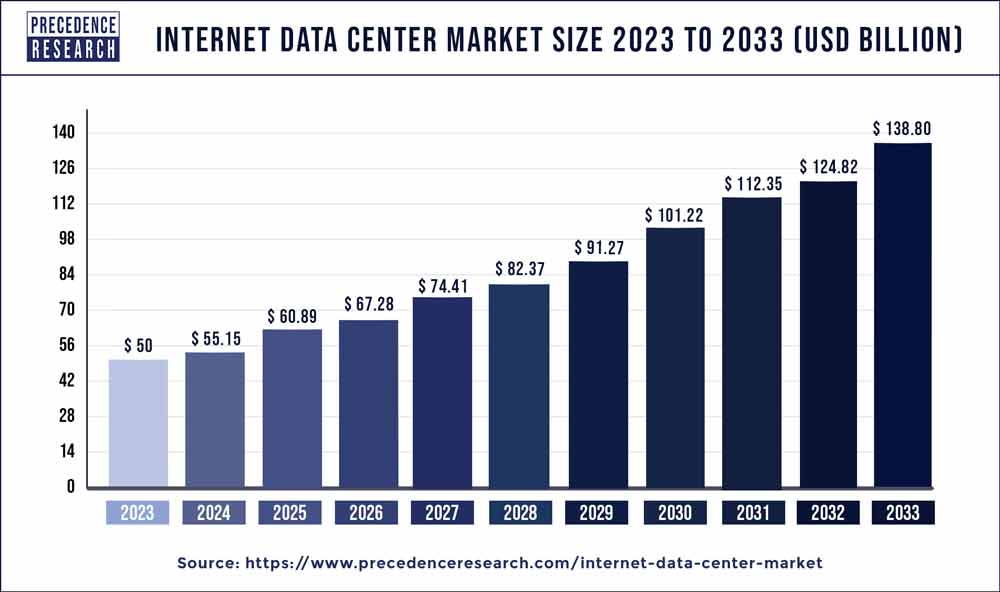

The global internet data center market size reached USD 50 billion in 2023 and is expected to hit around USD 138.80 billion by 2033, notable at a CAGR of 10.80% from 2024 to 2033.

Key Points

- North America dominated the market with a 43% market share in 2023.

- Asia-Pacific is expected to witness the fastest rate with a CAGR of 14.2% during the forecast period of 2024-2033.

- By end-use, the cloud service Provider (CSP) segment held the largest segment of 38% in the internet data center market in 2023.

- On the other hand, the e-commerce & retail segment is expected to grow at a significant rate of 15.2% during the forecast period.

- By service, the colocation segment held the largest share of 43% in 2023.

- By service, the content delivery network (CDN) segment is expected to grow at a notable rate of 10.3% during the forecast period.

- By deployment, the public segment held the largest share of 56% in 2023.

- By deployment, the hybrid segment is expected to grow at a significant CAGR of 16.2% during the forecast period.

- By enterprise size, the large enterprises segment held the dominating share of 86% in 2023.

- Whereas the small and medium-sized enterprises (SME) segment is expected to grow at a notable CAGR of 18.3% during the forecast period.

In today’s digital age, the Internet Data Center (IDC) market plays a crucial role in supporting the ever-expanding demands of businesses and consumers for online services, data storage, and cloud computing. As the world becomes increasingly reliant on digital technologies, the IDC market continues to experience rapid growth and evolution, driven by factors such as the proliferation of data-intensive applications, the rise of cloud computing, and the increasing adoption of IoT (Internet of Things) devices.

Get a Sample: https://www.precedenceresearch.com/sample/3746

Internet Data Center Market Dynamics

The IDC market is characterized by constant innovation and technological advancements, driven by the need for greater efficiency, scalability, and security. Key drivers of growth in this market include:

Increasing Data Traffic: With the growing popularity of online services, social media, streaming platforms, and e-commerce, the volume of data being generated and consumed globally continues to skyrocket. This surge in data traffic necessitates robust data center infrastructure to ensure reliable connectivity and high-speed access.

Cloud Computing: The shift towards cloud-based services has been a significant driver of growth in the IDC market. Cloud computing offers businesses scalability, flexibility, and cost-efficiency, driving demand for data center services to host cloud-based applications and store data.

IoT Expansion: The proliferation of IoT devices, such as smart appliances, wearable gadgets, and industrial sensors, is generating vast amounts of data that require processing and storage. IDCs play a critical role in aggregating, analyzing, and storing IoT-generated data, driving demand for specialized IoT-focused data center solutions.

Edge Computing: The rise of edge computing, which involves processing data closer to the source rather than in centralized data centers, is reshaping the IDC landscape. Edge computing enables faster data processing and reduced latency, making it ideal for applications requiring real-time analytics, such as autonomous vehicles and smart cities.

Digital Transformation: Businesses across various industries are undergoing digital transformation initiatives to stay competitive and meet evolving customer demands. This includes the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics, all of which rely on robust data center infrastructure.

Internet Data Center Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.80% |

| Global Market Size in 2023 | USD 50 Billion |

| Global Market Size by 2033 | USD 138.80 Billion |

| U.S. Market Size in 2023 | USD 15.05 Billion |

| U.S. Market Size by 2033 | USD 42.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Internet Data Center Market Segmentation

The IDC market can be segmented based on various factors, including type, size, tier, and vertical. Common segments within the IDC market include:

- Type: IDCs can be classified into several types based on their function and purpose. This includes enterprise data centers, which are owned and operated by individual organizations to support their internal IT needs, as well as colocation data centers, which provide shared facilities for multiple tenants to host their IT infrastructure. Other types include managed hosting services, cloud data centers, and hyperscale data centers operated by internet giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Size: IDCs vary in size, ranging from small server rooms or closets within an organization’s premises to large-scale facilities spanning hundreds of thousands of square feet. The size of an IDC often correlates with its capacity, power requirements, and cooling infrastructure.

- Tier Classification: IDCs are classified into different tiers based on their design, redundancy, and reliability. The Tier Classification System, developed by the Uptime Institute, categorizes data centers into Tier I, Tier II, Tier III, and Tier IV, with Tier IV being the most resilient and fault-tolerant.

- Vertical: The IDC market serves a wide range of vertical industries, including IT and telecommunications, banking and finance, healthcare, retail, manufacturing, and government. Each vertical has unique requirements and regulatory compliance standards that influence their choice of data center solutions.

Internet Data Center Market Key Players

The IDC market is highly competitive, with numerous global and regional players vying for market share. Some of the key players in the IDC market include:

- Equinix: As one of the world’s largest colocation data center providers, Equinix operates a global platform of interconnected data centers across multiple continents. Equinix’s network-neutral facilities offer direct connections to a wide range of cloud service providers, network carriers, and enterprises.

- Digital Realty: Digital Realty is a leading provider of data center, colocation, and interconnection solutions, with a global portfolio of data centers in major metropolitan areas. The company specializes in providing customizable data center solutions tailored to meet the specific needs of its customers.

- NTT Communications: NTT Communications, a subsidiary of Nippon Telegraph and Telephone Corporation (NTT), is a global provider of information and communications technology (ICT) solutions, including data center services, cloud computing, and network services. NTT Communications operates a network of data centers worldwide, offering scalable and secure infrastructure for enterprises.

- Amazon Web Services (AWS): As a leading cloud computing provider, AWS operates a vast global network of data centers to support its cloud services platform. AWS offers a wide range of services, including compute, storage, databases, networking, AI, and IoT, catering to the needs of businesses of all sizes across various industries.

- Microsoft Azure: Microsoft Azure is another major player in the cloud computing market, with an extensive network of data centers located in regions around the world. Azure provides a comprehensive suite of cloud services, including computing, storage, analytics, AI, and IoT, integrated with Microsoft’s software products and services.

- Google Cloud Platform (GCP): Google Cloud Platform, operated by Google, offers a range of cloud computing services hosted on its global network of data centers. GCP’s services include infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), along with advanced capabilities in areas such as machine learning, data analytics, and container orchestration.

Market Trends

Rise of Hyperscale Data Centers: Hyperscale data centers, characterized by their massive scale and efficient design, are becoming increasingly prevalent as internet giants expand their infrastructure to support growing demand for cloud services. Hyperscale data centers leverage economies of scale and innovative technologies to deliver high performance, scalability, and cost-effectiveness.

Sustainability and Green Data Centers: With growing concerns about environmental sustainability, there is a growing emphasis on building energy-efficient and environmentally friendly data centers. Green data center initiatives focus on reducing power consumption, minimizing carbon emissions, and implementing renewable energy sources such as solar and wind power.

Edge Computing Adoption: Edge computing is gaining traction as organizations seek to process data closer to the point of generation to reduce latency and improve application performance. Edge data centers are being deployed in locations such as urban areas, industrial sites, and remote environments to support emerging applications such as IoT, autonomous vehicles, and augmented reality.

Hybrid and Multi-Cloud Strategies: Many organizations are adopting hybrid and multi-cloud strategies to leverage the benefits of both public and private cloud environments. This involves deploying workloads across multiple cloud platforms and on-premises infrastructure, driven by factors such as regulatory compliance, data sovereignty, and workload portability.

Containerization and Kubernetes Adoption: Containerization technologies such as Docker and orchestration platforms like Kubernetes are gaining popularity for deploying and managing applications in distributed environments. IDCs are increasingly supporting containerized workloads, providing the scalability and flexibility needed for modern application development and deployment.

Challenges and Opportunities

Despite the significant growth opportunities in the IDC market, several challenges need to be addressed:

Security Concerns: Data security and privacy are paramount concerns for organizations hosting sensitive data in IDCs. Protecting against cyber threats, data breaches, and unauthorized access requires robust security measures, including encryption, multi-factor authentication, and intrusion detection systems.

Data Sovereignty and Compliance: Regulatory compliance requirements vary across different regions and industries, posing challenges for organizations operating in multiple jurisdictions. Data sovereignty laws dictate where data can be stored and processed, influencing the choice of data center locations and cloud providers.

Scalability and Flexibility: As data volumes continue to grow exponentially, IDCs must be able to scale infrastructure rapidly to meet increasing demand. This requires investments in scalable architectures, modular designs, and automation tools to support dynamic workloads and changing business requirements.

Energy Efficiency and Sustainability: Data centers consume vast amounts of energy, contributing to carbon emissions and environmental impact. Achieving energy efficiency and sustainability goals requires investments in efficient cooling systems, renewable energy sources, and innovative cooling technologies such as liquid cooling and free air cooling.

Skills Shortage: The rapid pace of innovation in the IDC market has created a shortage of skilled professionals with expertise in areas such as data center design, network engineering, cloud computing, and cybersecurity. Addressing this skills gap requires investment in training and education programs to cultivate the next generation of data center professionals.

Read Also: AI in Food Market Size, Share, Growth, Report by 2033

Recent Developments

- In September 2023, Google, Microsoft, Schneider Electric, and Danfoss jointly unveiled a collaborative initiative known as the Net Zero Innovation Hub for Data Center. This groundbreaking project is developed in partnership with the Danish Data Center Industry. The proposed location for this innovative center is Fredericia, Denmark.

- In November 2020, the United States Immigration & Customs Enforcement Agency invested over USD 100 million in cloud services, utilizing the Amazon Web Services and Microsoft Azure cloud environments.

- In January 2020, Vapor IO announced its ambitious plans to establish 36 edge data center sites across the United States by 2021.

Segments Covered in the Report

By Service

- Hosting

- Colocation

- CDN

- Others

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- CSP

- Telecom

- Government/Public Sector

- BFSI

- Media & Entertainment

- E-commerce & Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com