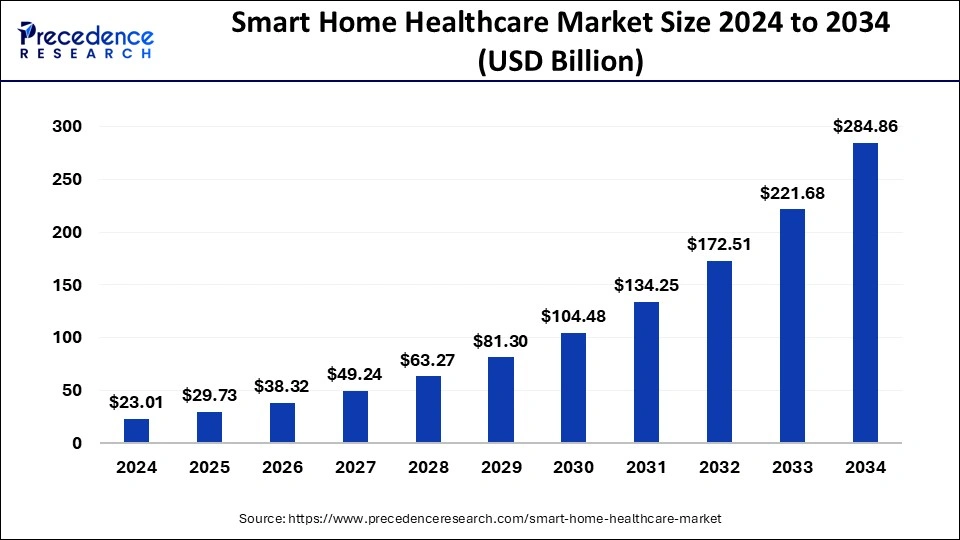

The global smart home healthcare market size reached USD 16.76 billion in 2023 and is projected to hit around USD 212.55 billion by 2033 with a CAGR of 28.92% from 2024 to 2033.

Key Points

- North America dominated the market with the largest share in 2023.

- Asia Pacific is observed to grow at the fastest rate during the forecast period.

- By product, the smart glucose monitoring system segment held the dominating share of the market in 2023.

- By technology, the wireless segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the health status monitoring segment dominated the market with the largest share in 2023.

The smart home healthcare market is a rapidly expanding sector that leverages technology to provide innovative healthcare solutions within the comfort of one’s home. It encompasses a range of devices and services designed to monitor, diagnose, and manage health conditions remotely, thus reducing the need for frequent hospital visits. This market segment has witnessed significant growth in recent years, driven by advancements in wearable technology, IoT (Internet of Things) devices, telemedicine, and the increasing prevalence of chronic diseases worldwide. Smart home healthcare offers convenience, cost-effectiveness, and personalized care, catering to the needs of patients, caregivers, and healthcare providers alike.

Get a Sample: https://www.precedenceresearch.com/sample/3928

Growth Factors

Several factors contribute to the growth of the smart home healthcare market. Firstly, the aging population and the rising incidence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory ailments drive the demand for remote monitoring solutions. Smart home devices enable continuous health monitoring, early detection of health issues, and timely intervention, thereby improving health outcomes and reducing healthcare costs. Moreover, the proliferation of smartphones and high-speed internet connectivity has facilitated the adoption of telehealth services, enabling patients to consult with healthcare professionals remotely and access medical advice and treatment from the comfort of their homes.

Furthermore, the COVID-19 pandemic has accelerated the adoption of smart home healthcare solutions, as lockdowns and social distancing measures necessitated remote healthcare delivery. Telemedicine platforms, remote patient monitoring systems, and virtual care solutions experienced unprecedented demand during the pandemic, highlighting the importance of digital health technologies in ensuring continuity of care. Additionally, advancements in artificial intelligence (AI) and machine learning have enhanced the capabilities of smart home healthcare devices, enabling predictive analytics, personalized health recommendations, and proactive disease management.

Region Insights

The smart home healthcare market exhibits regional variations in terms of adoption rates, regulatory frameworks, and healthcare infrastructure. North America leads the market, driven by the presence of established players, technological advancements, and favorable reimbursement policies. The region boasts a robust ecosystem of healthcare startups, tech giants, and research institutions collaborating to develop innovative smart home healthcare solutions. Europe follows closely, with countries like Germany, the UK, and France witnessing significant growth in telehealth and remote monitoring initiatives.

Asia Pacific represents a lucrative market for smart home healthcare, fueled by rapid urbanization, increasing healthcare expenditure, and government initiatives to promote digital health technologies. Countries such as China, Japan, and South Korea are at the forefront of innovation in healthcare technology, with a growing emphasis on telemedicine, wearable devices, and IoT-enabled healthcare solutions. Moreover, the COVID-19 pandemic has spurred investments in digital health infrastructure across the region, driving the adoption of remote healthcare services and smart home healthcare devices.

Smart Home Healthcare Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 28.92% |

| Global Market Size in 2023 | USD 16.76 Billion |

| Global Market Size by 2033 | USD 212.55 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Smart Home Healthcare Market Dynamics

Drivers:

Several drivers propel the growth of the smart home healthcare market. Firstly, the growing preference for home-based care and the desire for greater independence among aging populations drive the demand for remote monitoring and telehealth solutions. Smart home devices such as wearable fitness trackers, blood pressure monitors, and glucose meters enable individuals to manage their health proactively and stay connected with healthcare providers remotely. Moreover, the integration of artificial intelligence and machine learning algorithms into smart home healthcare platforms enhances their diagnostic capabilities, enabling early detection of health issues and personalized interventions.

Additionally, the shift towards value-based care models and the emphasis on preventive healthcare further incentivize the adoption of smart home healthcare solutions. By empowering patients to monitor their health metrics regularly and adhere to treatment plans, these technologies help prevent disease complications, reduce hospital admissions, and improve overall health outcomes. Furthermore, the increasing penetration of smartphones and internet connectivity, particularly in emerging markets, expands access to telemedicine services and remote patient monitoring solutions, bridging the gap between patients and healthcare providers.

Restraints:

Despite the promising growth prospects, the smart home healthcare market faces several challenges and barriers to adoption. One of the primary concerns is data privacy and security, as remote monitoring devices collect sensitive health information that needs to be protected from unauthorized access and cyber threats. Ensuring compliance with data protection regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) poses a significant challenge for healthcare providers and technology vendors.

Moreover, interoperability issues and the lack of standardization hinder seamless integration and communication between different smart home healthcare devices and platforms. Incompatibility between devices from different manufacturers may limit the effectiveness of remote monitoring solutions and create challenges for data aggregation and analysis. Additionally, the digital divide, particularly in rural and underserved communities, may restrict access to smart home healthcare technologies, exacerbating healthcare disparities and widening the gap in health outcomes.

Opportunities:

Despite these challenges, the smart home healthcare market presents immense opportunities for innovation and growth. The convergence of healthcare and consumer electronics has opened up new avenues for product development and market expansion. Manufacturers are increasingly focusing on designing user-friendly, intuitive devices that cater to the needs of diverse patient populations, including the elderly and individuals with chronic conditions. Moreover, partnerships and collaborations between healthcare providers, technology companies, and telecommunication firms can drive the development of integrated smart home healthcare ecosystems that offer seamless connectivity and interoperability.

Furthermore, the adoption of value-based care models and remote patient monitoring programs by healthcare payers and providers creates opportunities for market expansion and revenue growth. By demonstrating the cost-effectiveness and clinical efficacy of smart home healthcare solutions in reducing hospital readmissions, improving patient outcomes, and enhancing quality of life, stakeholders can secure reimbursement and investment for these technologies. Additionally, ongoing research and development efforts in areas such as remote diagnostics, predictive analytics, and personalized medicine hold the promise of further advancements in smart home healthcare, unlocking new opportunities for market players and improving patient care delivery.

Read Also: Influenza Drug Market Size to Reach USD 1,348.55 Mn by 2033

Recent Developments

- In January 2022, the debut of Carrie was announced by Fresenius Medical Care, a prominent supplier of goods and services for people with renal disorders. The Asia-Pacific region’s clinical teams and Fresenius Kidney Care nurses are connected, informed, and supported by this specially designed mobile application.

- In March 2022, the digital health company Quil, which was formed by Independence Health Group and Comcast, announced the limited commercial launch of Quil Assure, a new smart home platform that enables seniors to age in place and maintain support from friends and family acting as caregivers while granting them more freedom.

Smart Home Healthcare Market Companies

- Sunfox Technologies Pvt Ltd.

- Bayalarm

- Agatsa Software Pvt. Ltd.

- DexCom, Inc

- Qure4u

- Medical Guardian LLC

- Withings

- Tunstall Group

- Connect America

- Mytrex Inc.

Segments Covered in the Report

By Product

- Smart Glucose Monitoring System

- Medical Device Alert Systems

- Smart Cardiac Monitoring System

- Others

By Technology

- Wired

- Wireless

By Application

- Health Status Monitoring

- Fall Prevention and Detection

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/