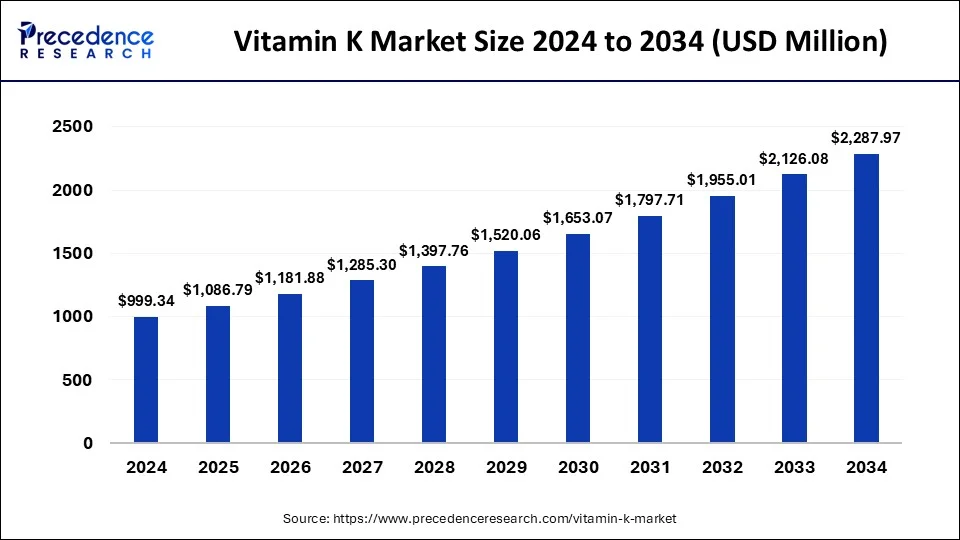

The global vitamin K market size reached USD 918.94 million in 2023 and is estimated to hit around USD 2,126.08 million by 2033, growing at a CAGR of 8.75% from 2024 to 2033.

Key Points

- North America held the largest market share of 39% in 2023.

- Asia Pacific is anticipated to witness the fastest rate of growth in the Vitamin K market during the forecast period.

- By product type, the Vitamin K2 segment accounted for a considerable share and is observed to contribute a significant share in the upcoming period.

- By application, the osteoporosis segment held a significant share of the market in 2023.

- By application, the Vitamin K Deficiency Bleeding (VKDB) segment is expected to grow significantly during the forecast period.

- By route of administration, the oral segment led the market with the largest share in 2023.

The global Vitamin K market has experienced steady growth in recent years, driven by increasing awareness about the health benefits of Vitamin K, rising incidences of chronic diseases, and growing demand for dietary supplements and fortified food products. Vitamin K, a fat-soluble vitamin, plays a crucial role in blood clotting, bone metabolism, and cardiovascular health. As consumers become more health-conscious and seek preventive measures against various health conditions, the demand for Vitamin K supplements and fortified foods continues to rise, fueling market expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3971

Growth Factors:

Several factors contribute to the growth of the global Vitamin K market. Firstly, the growing prevalence of osteoporosis, cardiovascular diseases, and other chronic conditions has heightened awareness about the importance of Vitamin K in maintaining bone health, cardiovascular function, and overall well-being. As healthcare professionals emphasize the role of nutrition in disease prevention and management, consumers are increasingly turning to Vitamin K supplements and fortified foods to meet their dietary needs.

Moreover, demographic trends such as aging populations and increasing life expectancy drive demand for products that support healthy aging and mitigate age-related health concerns. Vitamin K, particularly Vitamin K2, has gained attention for its potential benefits in promoting bone density, reducing the risk of fractures, and improving cardiovascular health, thereby driving market growth among aging consumers.

Additionally, the rising popularity of vegetarian and vegan diets, which may lack sufficient Vitamin K intake from animal-derived sources, has spurred demand for plant-based alternatives and fortified products. Manufacturers are introducing Vitamin K-fortified plant-based foods and supplements to cater to the dietary preferences of consumers seeking plant-centric nutrition without compromising on essential nutrients.

Furthermore, advancements in food fortification technologies and formulation techniques have enabled the development of innovative Vitamin K-enriched products with improved bioavailability and stability. Microencapsulation, nanoemulsions, and other encapsulation methods enhance the absorption and efficacy of Vitamin K, expanding the range of fortified food and beverage offerings available to consumers.

Region Insights:

The demand for Vitamin K varies across regions, influenced by factors such as dietary habits, healthcare infrastructure, regulatory environment, and consumer awareness. In North America, the United States and Canada represent significant markets for Vitamin K supplements and fortified foods, driven by a well-established dietary supplement industry, increasing health consciousness, and rising consumer spending on preventive healthcare products.

In Europe, countries such as Germany, the United Kingdom, and France are key markets for Vitamin K, supported by a growing aging population, high prevalence of osteoporosis, and robust regulatory frameworks governing food fortification and nutritional labeling. The European Food Safety Authority (EFSA) has approved health claims related to Vitamin K’s role in bone health and blood clotting, driving product innovation and marketing strategies in the region.

Asia Pacific emerges as a rapidly growing market for Vitamin K, driven by rising disposable incomes, changing dietary patterns, and increasing adoption of Western dietary habits. Countries like Japan, China, and South Korea witness significant demand for Vitamin K supplements and functional foods, particularly among aging populations concerned about bone health and cardiovascular risk factors.

Latin America and the Middle East & Africa regions are also witnessing growing demand for Vitamin K products, fueled by improving healthcare infrastructure, rising consumer awareness about preventive health measures, and expanding distribution channels. Manufacturers are tapping into these emerging markets to capitalize on the growing consumer demand for nutritional supplements and fortified foods.

Vitamin K Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.75% |

| Global Market Size in 2023 | USD 918.94 Million |

| Global Market Size by 2033 | USD 2,126.08 Million |

| U.S. Market Size in 2023 | USD 250.87 Million |

| U.S. Market Size by 2033 | USD 580.42 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Route of Administration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vitamin K Market Dynamics

Drivers:

Several drivers propel the growth of the global Vitamin K market. Firstly, the increasing prevalence of osteoporosis and osteoporotic fractures, particularly among aging populations, drives demand for Vitamin K supplements and fortified foods. Vitamin K plays a crucial role in bone metabolism and calcium utilization, making it essential for maintaining bone density and reducing the risk of fractures, especially in postmenopausal women and elderly individuals.

Moreover, growing concerns about cardiovascular health and the rising incidence of cardiovascular diseases worldwide contribute to the demand for Vitamin K, particularly Vitamin K2. Studies suggest that Vitamin K2 may help prevent arterial calcification, reduce arterial stiffness, and improve endothelial function, thereby lowering the risk of cardiovascular events such as heart attacks and strokes. As consumers seek natural approaches to cardiovascular risk management, the market for Vitamin K supplements targeted at heart health continues to expand.

Furthermore, the rising adoption of preventive healthcare practices and proactive wellness strategies drives consumer interest in dietary supplements and functional foods enriched with essential nutrients like Vitamin K. Health-conscious consumers are increasingly incorporating Vitamin K-rich foods and supplements into their daily routines to support overall health, immune function, and longevity.

Additionally, endorsements from healthcare professionals, nutritionists, and celebrities, as well as positive media coverage and influencer marketing campaigns, play a significant role in shaping consumer perceptions and driving product demand. As awareness about the health benefits of Vitamin K grows, consumers are more likely to seek out Vitamin K products and incorporate them into their lifestyles.

Opportunities:

The global Vitamin K market presents numerous opportunities for manufacturers, retailers, and stakeholders across the value chain. Firstly, there is significant potential for product innovation and diversification to meet the evolving needs and preferences of consumers. Manufacturers can develop novel formulations, delivery formats, and combinations of Vitamin K with other vitamins, minerals, and bioactive compounds to create differentiated products with enhanced efficacy and consumer appeal.

Moreover, there is a growing demand for natural and organic Vitamin K products sourced from sustainable and traceable ingredients. Manufacturers can capitalize on this trend by sourcing high-quality Vitamin K from organic sources such as leafy greens, fermented foods, and algae, and promoting the environmental and ethical credentials of their products to eco-conscious consumers.

Furthermore, partnerships and collaborations between industry players, research institutions, and healthcare organizations can drive innovation, market expansion, and consumer education initiatives. By leveraging scientific research, clinical trials, and health education programs, stakeholders can enhance consumer understanding of Vitamin K’s health benefits and foster trust in Vitamin K products.

Additionally, digital marketing strategies, e-commerce platforms, and social media channels offer opportunities to reach and engage with a wider audience of health-conscious consumers. By leveraging online platforms for product promotion, educational content, and direct-to-consumer sales, manufacturers can enhance brand visibility, customer engagement, and sales conversion rates.

Moreover, expansion into untapped markets and segments, such as sports nutrition, pediatric health, and beauty supplements, can unlock new growth opportunities for Vitamin K products. By targeting specific demographic groups and addressing their unique health needs and preferences, manufacturers can diversify their product portfolios and capture market share in niche segments.

Challenges:

Despite the promising growth prospects, the global Vitamin K market faces several challenges that may impact market dynamics and growth trajectory. Firstly, regulatory complexities and varying standards for food fortification, labeling, and health claims present hurdles for manufacturers seeking to introduce new Vitamin K products or expand into new markets. Compliance with regional regulations and navigating the regulatory landscape requires significant resources and expertise, particularly for multinational companies operating in multiple jurisdictions.

Moreover, consumer skepticism, misinformation, and confusion surrounding dietary supplements and fortified foods may hinder market growth and adoption. Negative publicity, product recalls, and safety concerns related to supplement quality, purity, and efficacy can erode consumer trust and confidence in Vitamin K products, leading to decreased demand and market saturation.

Additionally, pricing pressures, intense competition, and price-sensitive consumer segments pose challenges for manufacturers in terms of maintaining profit margins and sustaining business growth. As the market becomes increasingly crowded with new entrants and private label brands, manufacturers must differentiate their products through unique value propositions, superior quality, and targeted marketing strategies to capture market share and command premium pricing.

Read Also: Pet Diabetes Care Devices Market Size, Growth Report by 2033

Recent Developments

- In October 2023, Smidge Small Batch Supplements announced the launch of grass-fed, Australian Emu Oil for real food vitamin K2. The company unveiled a new small-batch supplement to their premium, clean line product line that offers essential nutrients lacking in even the best whole foods diet.

- In November 2023, Abbott announced the launch of the new PediaSure with Nutri-Pull System. The Nutri-Pull system is a unique combination of ingredients like vitamin K2, vitamin D, vitamin C, and casein phosphopeptides (CPPs), which help support catch-up growth amongst children through the absorption of key nutrients.

- In June 2022, Balchem Corporation announced the acquisition of vitamin K2 player Kappa Bioscience. Balchem Corporation has signed a definitive agreement to acquire Norwegian Vitamin K2 supplier Kappa Bioscience AS for approximately US$340 million.

Vitamin K Market Companies

- BASF SE

- Lonza Group

- Glanbia Plc

- ADM

- Farbest Brands

- SternVitamin GmbH & Co. K.G.

- Adisseo

- Rabar Pty Ltd

- DSM

- Kappa Bioscience

- Livealth Biopharma

- NattoPharma

- Amphastar Pharmaceuticals Inc.

- NOW Foods

- Pfizer Inc

- Solgar Inc

- Nexeo Solutions

- Kyowa Hakko USA

- Stason Pharmaceuticals

- Asiamerica Ingredients

- Amway

- Bluestar Adisseo Co.

- Atlantic Essential Products Inc.

- Bactolac Pharmaceutical Inc.

Segments Covered in the Report

By Product Type

- Vitamin K1

- Vitamin K2

By Route of Administration

- Oral

- Topical

- Parenteral

By Application

- Osteoporosis

- Vitamin K Dependent Clotting Factor Deficiency (VKCFD)

- Prothrombin deficiency

- Vitamin K Deficiency Bleeding (VKDB)

- Dermal Application

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/