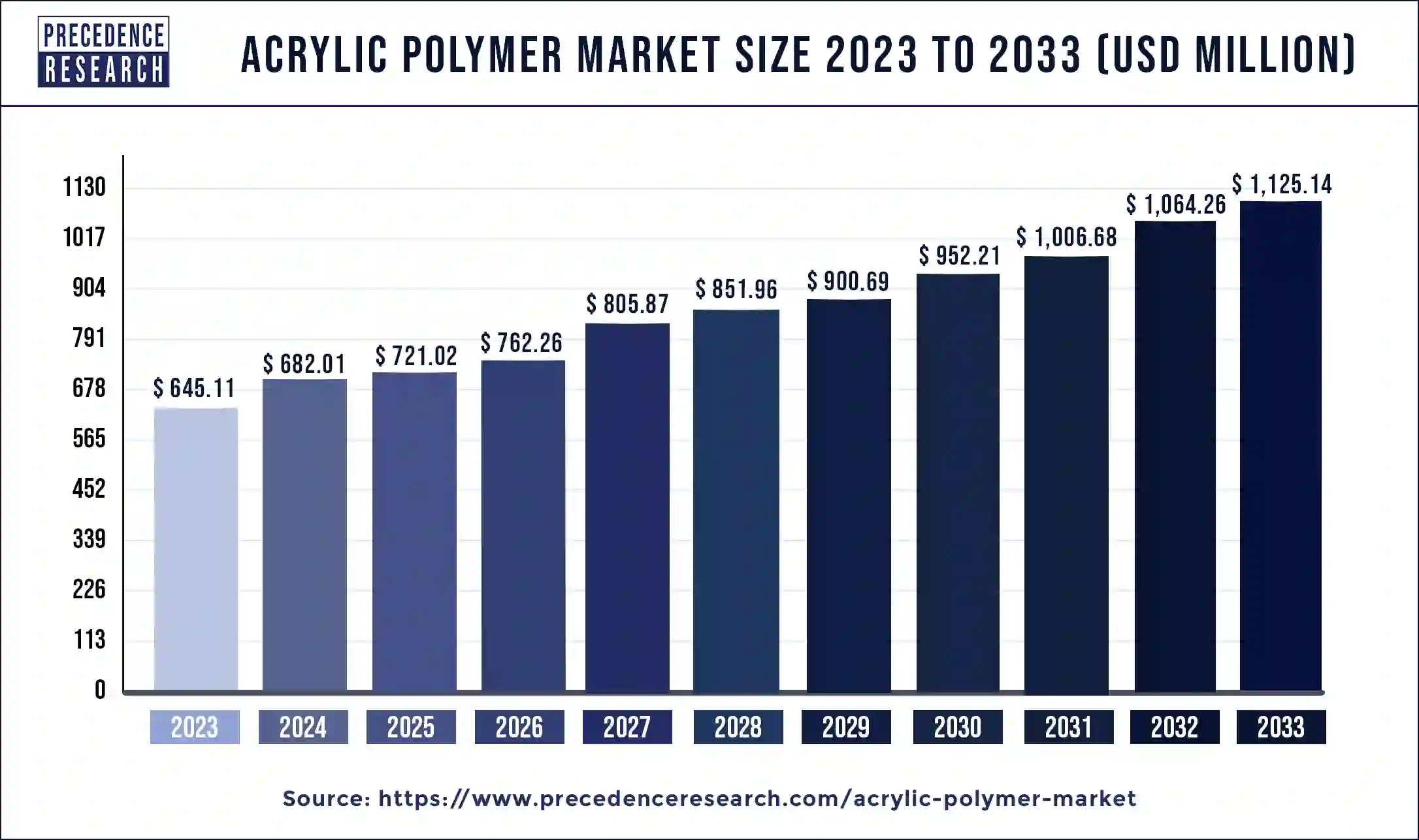

The global acrylic polymer market size reached USD 645.11 million in 2023 and is predicted to hit around USD 1,125.14 million by 2033, growing at a CAGR of 5.72% from 2024 to 2033.

Key Points

- North America dominated the market share in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2024 and 2033.

- By type, the polymethyl methacrylate segment held the largest market share 22% in 2023.

- By type, the polyvinyl acetate segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By solution type, the water-borne segment generated the biggest market share 28% in 2023.

- By solution type, the solvent-borne segment is expected to expand at the fastest CAGR over the projected period.

- By application, the cosmetics segment has held a major market share of 31% in 2023.

- By application, the paints & coatings segment is expected to expand at the fastest CAGR over the projected period.

The acrylic polymer market is witnessing robust growth driven by its widespread application across various industries, including paints and coatings, adhesives and sealants, construction, textiles, and automotive. Acrylic polymers, derived from acrylic acid or its derivatives, offer versatility, durability, and environmental sustainability, making them a preferred choice for manufacturers seeking high-performance materials. With increasing demand for eco-friendly and cost-effective solutions, the acrylic polymer market is poised for significant expansion in the foreseeable future.

Get a Sample: https://www.precedenceresearch.com/sample/3978

Growth Factors:

Several factors contribute to the growth of the acrylic polymer market. One key driver is the rising demand for water-based acrylic emulsions in the paints and coatings industry. Acrylic polymers offer superior weather resistance, UV stability, and adhesion properties, making them ideal for architectural coatings, automotive finishes, and industrial coatings. Additionally, stringent regulations on volatile organic compound (VOC) emissions drive the transition from solvent-based coatings to water-based formulations, further fueling market growth.

Moreover, the construction industry plays a pivotal role in driving demand for acrylic polymers, particularly in applications such as waterproofing membranes, concrete admixtures, and architectural coatings. Acrylic-based products offer excellent durability, flexibility, and crack resistance, addressing the performance requirements of modern construction materials. The growing infrastructure development projects, urbanization trends, and investments in sustainable building solutions contribute to the increased adoption of acrylic polymers in the construction sector.

Furthermore, the automotive industry presents significant opportunities for acrylic polymer manufacturers, with acrylic-based materials finding applications in automotive coatings, adhesives, and interior components. Acrylic polymers offer advantages such as lightweight, scratch resistance, and color stability, meeting the performance and aesthetic demands of automotive OEMs and aftermarket suppliers. Additionally, the shift towards electric vehicles (EVs) and lightweight vehicle designs further boosts the demand for acrylic-based materials to enhance energy efficiency and reduce vehicle weight.

Region Insights:

The acrylic polymer market exhibits a global presence, with key regions including North America, Europe, Asia-Pacific, and the rest of the world. North America and Europe represent mature markets for acrylic polymers, driven by established manufacturing infrastructure, technological advancements, and stringent environmental regulations. The presence of prominent industry players and extensive R&D activities contribute to market growth in these regions.

In Asia-Pacific, rapid industrialization, urbanization, and infrastructure development drive demand for acrylic polymers across diverse applications. Countries such as China, India, and Southeast Asian nations are witnessing substantial investments in construction, automotive manufacturing, and consumer goods industries, stimulating market growth. Moreover, favorable government policies, increasing disposable income, and growing awareness of sustainable products propel the adoption of acrylic polymers in the region.

The rest of the world, including Latin America, the Middle East, and Africa, presents untapped opportunities for acrylic polymer manufacturers. Economic growth, urban development projects, and expanding industrial sectors contribute to rising demand for acrylic-based materials in these regions. Strategic partnerships, market expansion initiatives, and investments in distribution networks are key strategies adopted by companies to capitalize on growth opportunities in emerging markets.

Acrylic Polymer Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.72% |

| Global Market Size in 2023 | USD 645.11 Million |

| Global Market Size by 2033 | USD 1,125.14 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Solution Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Acrylic Polymer Market Dynamics

Drivers:

Several drivers fuel the demand for acrylic polymers in various industries. One primary driver is the growing emphasis on sustainability and environmental compliance. Acrylic polymers offer eco-friendly alternatives to traditional materials, with water-based formulations reducing VOC emissions and minimizing environmental impact. Regulatory initiatives aimed at reducing carbon footprint and promoting sustainable manufacturing practices further accelerate the adoption of acrylic polymers across industries.

Additionally, the versatility and performance characteristics of acrylic polymers drive their widespread use in diverse applications. Acrylic-based coatings provide excellent weatherability, chemical resistance, and color retention, meeting the stringent performance requirements of architectural, automotive, and industrial coatings. Moreover, acrylic adhesives and sealants offer fast curing, strong bonding, and durability, making them indispensable in construction, electronics, and packaging industries.

Furthermore, technological advancements in acrylic polymer chemistry enable the development of tailor-made formulations with enhanced properties and functionalities. Innovations such as self-crosslinking acrylic emulsions, bio-based acrylic polymers, and hybrid acrylic-silicone materials expand the application potential of acrylic polymers, catering to evolving market demands. Moreover, advancements in manufacturing processes, such as emulsion polymerization and reactive extrusion, enhance production efficiency and product quality, driving market growth.

Opportunities:

The acrylic polymer market presents numerous opportunities for innovation and expansion. One significant opportunity lies in the development of bio-based and sustainable acrylic polymers derived from renewable feedstocks such as plant-based sugars or bio-waste. Bio-acrylic polymers offer environmental benefits, reduced dependency on fossil fuels, and potential cost savings, aligning with the growing demand for green materials and circular economy principles.

Moreover, the expansion of acrylic polymer applications in emerging industries such as 3D printing, electronics, and healthcare presents new growth avenues. Acrylic-based materials demonstrate compatibility with additive manufacturing processes, offering high-resolution printing, dimensional stability, and biocompatibility for medical device fabrication and tissue engineering applications. Additionally, acrylic-based conductive polymers find utility in electronic components, flexible displays, and printed electronics, driving market penetration in the electronics sector.

Furthermore, strategic collaborations, partnerships, and mergers and acquisitions offer opportunities for market expansion and portfolio diversification. Collaborations between acrylic polymer manufacturers, technology providers, and end-users facilitate product development, customization, and market access. Moreover, investments in research and development to explore novel formulations, functional additives, and application-specific solutions enhance competitiveness and differentiation in the acrylic polymer market.

Challenges:

Despite the positive growth outlook, the acrylic polymer market faces several challenges that may impact its trajectory. One such challenge is the volatility of raw material prices and supply chain disruptions. Acrylic polymers rely on feedstocks such as acrylic acid, methacrylic acid, and acrylate monomers, which are susceptible to price fluctuations driven by factors such as oil prices, supply-demand dynamics, and geopolitical tensions. Fluctuations in raw material costs can affect manufacturing margins and product pricing strategies, posing challenges for market players.

Additionally, competition from alternative materials and technologies presents challenges for acrylic polymer manufacturers. Substitution threats from bio-based polymers, silicone-based coatings, and advanced composite materials require companies to continually innovate and differentiate their products to maintain market relevance. Moreover, regulatory requirements, quality standards, and compliance with industry certifications impose additional burdens on manufacturers, impacting production costs and time-to-market for acrylic polymer solutions.

Furthermore, the COVID-19 pandemic has disrupted global supply chains, manufacturing operations, and end-user demand, affecting the acrylic polymer market. Lockdown measures, trade restrictions, and economic uncertainties have led to project delays, cancellations, and reduced consumer spending across industries. However, the recovery of key end-user sectors such as construction, automotive, and electronics, coupled with stimulus measures and vaccination efforts, bodes well for market recovery and growth in the post-pandemic era.

Read Also: Bispecific Antibodies Market Size, Share, Report by 2033

Recent Developments

- On February 9, 2023, Roehm, a chemical company based in Germany, unveiled two acrylic-based copolymer compounds, Cyrolite GP-20 and MD zk6, during the 2023 MD&M West trade show. Designed for injection molding and extrusion processes, these compounds demonstrated an outstanding combination of properties ideal for medical device applications.

Acrylic Polymer Market Companies

- BASF SE

- Dow Chemical Company

- Arkema SA

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- LG Chem Ltd.

- Solvay SA

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

- Nippon Shokubai Co., Ltd.

- DIC Corporation

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Saudi Basic Industries Corporation (SABIC)

Segments Covered in the Report

By Type

- Polymethyl Methacrylate

- Sodium Polyacrylate

- Polyvinyl Acetate

- Polyacrylamide

- Others

By Solution Type

- Water-Borne

- Solvent-Borne

By Application

- Dentistry

- Cosmetics

- Paints & Coatings

- Cleaning

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/