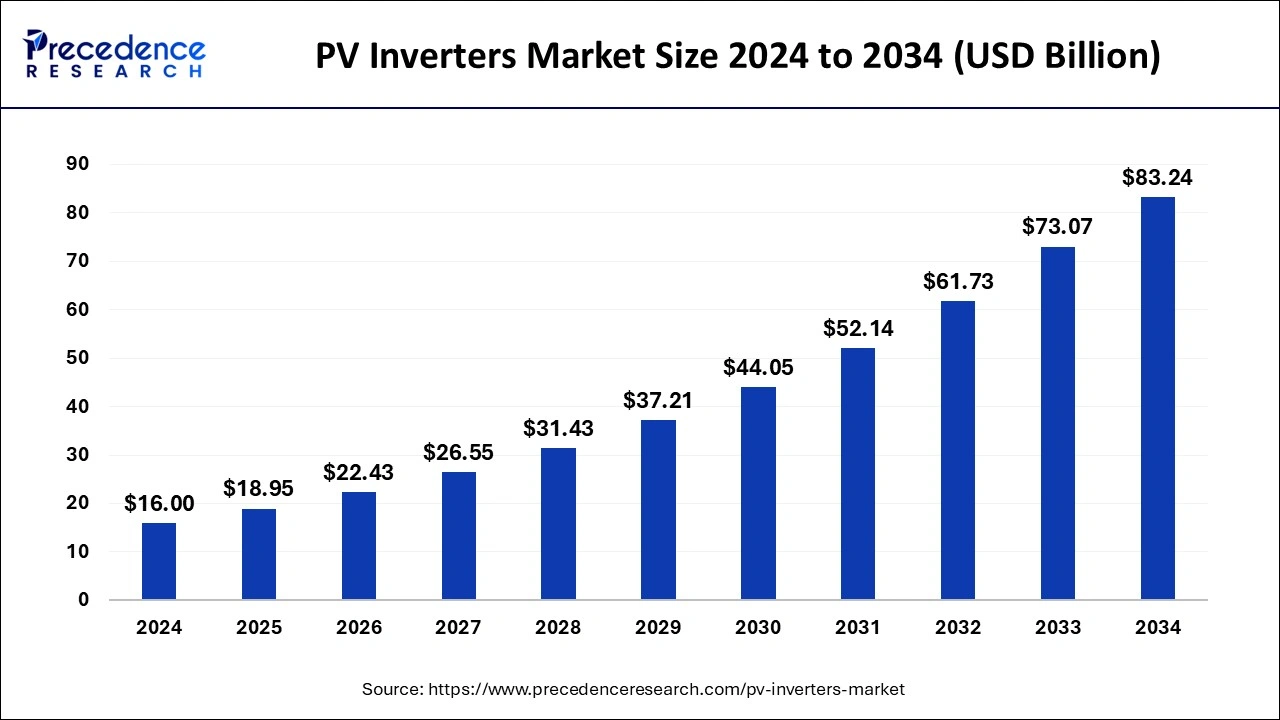

The global PV inverters market size reached USD 13.52 billion in 2023 and is projected to hit around USD 73.07 billion by 2033, expanding at a CAGR of 18.38% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the biggest market share of 45% in 2023.

- By product, the string PV inverter segment has generated more than 48% of the market share in 2023.

- By product, the micro-PV inverters segment is anticipated to grow at a significant CAGR over the forecast period.

- By end use, in 2023, the utility segment has held the major market share of 45% in 2023.

- By end use, the residential segment is expected to grow significantly during the forecast period.

The PV inverters market refers to the segment of the solar energy industry responsible for converting the direct current (DC) generated by photovoltaic (PV) solar panels into alternating current (AC) suitable for use in commercial electrical grids. PV inverters play a crucial role in solar energy systems by ensuring efficient power conversion and grid compatibility. The market for PV inverters has witnessed significant growth in recent years due to the increasing adoption of solar energy solutions globally. As renewable energy sources gain traction as viable alternatives to traditional fossil fuels, the demand for PV inverters is expected to continue rising, driving market expansion.

Get a Sample: https://www.precedenceresearch.com/sample/4003

Growth Factors:

Several factors contribute to the growth of the PV inverters market. Firstly, the growing awareness and concerns regarding climate change and environmental sustainability have led to an increased emphasis on renewable energy sources like solar power. Governments worldwide are implementing supportive policies and incentives to promote the adoption of solar energy systems, thereby driving the demand for PV inverters. Additionally, technological advancements in PV inverter designs, such as the development of microinverters and string inverters with higher efficiency and reliability, have further fueled market growth. Furthermore, declining costs of solar PV modules and associated components have made solar energy more economically viable, stimulating market expansion.

Region Insights:

The demand for PV inverters varies across different regions based on factors such as solar irradiance levels, government policies, electricity prices, and market maturity. Regions with abundant sunlight and supportive regulatory frameworks, such as Europe, North America, and parts of Asia-Pacific, have witnessed substantial growth in the adoption of solar energy systems and, consequently, PV inverters. In particular, countries like China, the United States, Germany, and Japan have emerged as key markets for PV inverters due to their significant investments in solar power infrastructure and favorable renewable energy policies. Developing regions in Latin America, Africa, and the Middle East are also experiencing increasing interest in solar energy, presenting opportunities for market expansion in the coming years.

PV Inverters Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.38% |

| Global Market Size in 2023 | USD 13.52 Billion |

| Global Market Size by 2033 | USD 73.07 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

PV Inverters Market Dynamics

Drivers:

Several drivers propel the growth of the PV inverters market. Firstly, the declining costs of solar PV systems, including PV modules and inverters, make solar energy more competitive with conventional sources of electricity. Additionally, concerns over energy security, coupled with the desire to reduce reliance on fossil fuels and mitigate greenhouse gas emissions, drive the adoption of solar power solutions. Government incentives, such as feed-in tariffs, tax credits, and renewable energy targets, further incentivize investments in solar energy infrastructure and contribute to market growth. Moreover, advancements in grid integration technologies and the emergence of smart grid solutions enhance the flexibility and reliability of solar PV systems, bolstering the demand for PV inverters.

Opportunities:

The PV inverters market presents several opportunities for stakeholders across the value chain. The ongoing transition towards renewable energy sources and the increasing integration of solar power into electricity grids create a conducive environment for market expansion. Innovations in PV inverter technologies, such as the integration of energy storage capabilities and advanced monitoring and control features, open up new avenues for product differentiation and value creation. Furthermore, the rapid urbanization and electrification of rural areas in emerging economies create a substantial market potential for off-grid and decentralized solar energy solutions, driving the demand for PV inverters in diverse applications.

Challenges:

Despite the promising growth prospects, the PV inverters market faces certain challenges that may hinder its expansion. One challenge is the intermittent nature of solar power generation, which can lead to grid instability and require sophisticated grid management solutions for smooth integration. Additionally, the variability in regulatory frameworks and policy support across different regions poses a challenge for market players seeking to navigate diverse market environments. Technical issues such as inverter efficiency, reliability, and compatibility with emerging PV technologies also present ongoing challenges for manufacturers and system integrators. Moreover, the competitive landscape of the PV inverters market, characterized by a multitude of players offering similar products, intensifies pricing pressures and emphasizes the importance of innovation and differentiation strategies.

Read Also: Monitoring Tools Market Size to Hit USD 163.34 Bn by 2033

Recent Developments

- In February 2024, SMA Solar Technology AG established a strategic partnership with ENGIE, a major energy corporation, to speed up the development and deployment of distributed solar and storage systems throughout Europe.

- In February 2024, Sungrow Power Supply Co. Ltd. announced its latest string inverter series, the “SG iNext,” claiming considerable efficiency gains and improved grid support features.

- In January 2023, Schneider Electric SE announced the acquisition of IGE+X AO, a Russian energy storage solutions provider, to strengthen its position in the distributed energy market.

- In September 2022, the diversity, equity, and inclusion (DE&I) commitments of SunPower, a leading residential solar technology and energy services provider, have made progress toward their goals of giving historically marginalized families, job seekers, and businesses greater access to the many advantages of solar and energy storage.

- In December 2022, the tender offer time for Siemens Gamesa minority stockholders was successfully concluded by Siemens Energy.

- In April 2022, SMA Solar Technology AG, a German inverter manufacturer, launched a new line of four inverters with power ratings of 12kW, 15kW, 20kW, and 25kW for use in rooftop PV systems up to 135kW in size.

PV Inverters Market Companies

- Delta Electronics, Inc

- Eaton

- Emerson Electric Co.

- Fimer Group

- Hitachi Hi-Rel Power Electronics Private Limited

- Omron Corporation

- Power Electronics S.L.

- Siemens Energy

- SMA Solar Technology AG

- SunPower Corporation

Segments Covered in the Report

By Product

- String PV Inverter

- Central PV Inverter

- Micro PV Inverter

- Other PV Inverter

By End-use

- Commercial & Industrial

- Utilities

- Residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/