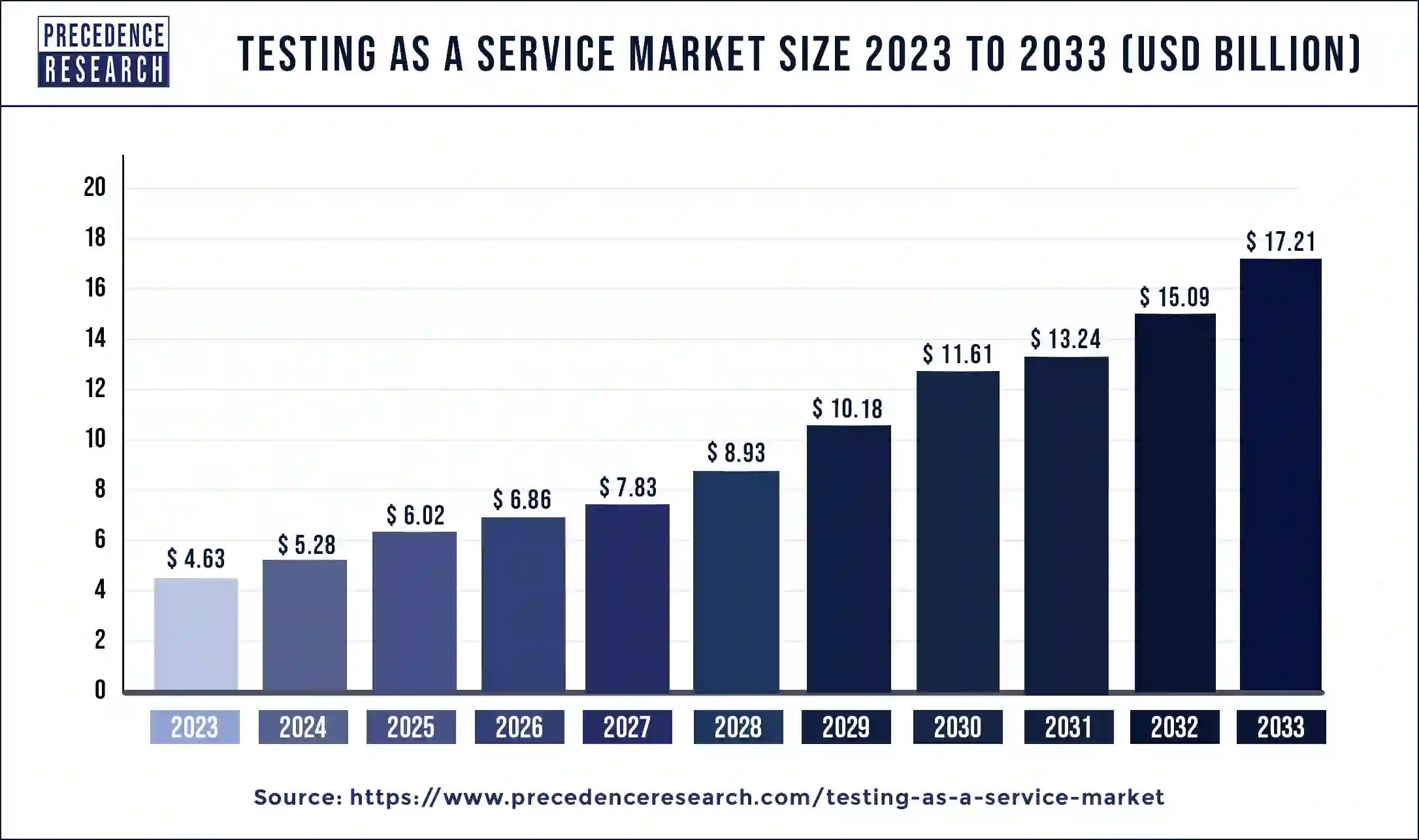

The global testing as a service market size reached USD 4.63 billion in 2023 and is projected to attain around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

Key Points

- North America led the market with holding a 40% of market share in 2023.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By test type, the functionality segment has generated more than 28% of market share in 2023.

- By test type, the security segment is expected to grow the fastest during the forecast period.

- By deployment type, the public segment held a significant share of the market in 2023.

- By deployment type, the private segment is poised to grow at a significant rate during the forecast period.

- By end use, in 2023, the IT & telecommunication segment led the market.

- By end use, the healthcare segment is expected to grow the fastest during the forecast period.

The Testing as a Service (TaaS) market has witnessed significant growth in recent years, driven by the increasing demand for efficient and cost-effective testing solutions across various industries. TaaS refers to the outsourcing of software testing activities to third-party service providers who offer testing services on a pay-per-use or subscription basis. This model enables organizations to streamline their testing processes, reduce testing costs, and improve the quality of their software products. The TaaS market encompasses a wide range of testing services, including functional testing, performance testing, security testing, and usability testing, among others. With the rapid adoption of agile and DevOps methodologies, the need for continuous testing throughout the software development lifecycle has become paramount, further fueling the growth of the TaaS market.

Get a Sample: https://www.precedenceresearch.com/sample/4043

Growth Factors:

Several factors are driving the growth of the Testing as a Service market. Firstly, the increasing complexity of software applications and the need for comprehensive testing across multiple platforms and devices have led organizations to seek specialized testing expertise. TaaS providers offer access to a wide range of testing tools and technologies, as well as skilled testing professionals, enabling organizations to conduct thorough and efficient testing processes. Additionally, the growing adoption of cloud computing and virtualization technologies has made it easier for organizations to access testing infrastructure and resources on-demand, further driving the demand for TaaS solutions. Moreover, the rise of digital transformation initiatives across industries has increased the importance of quality assurance and testing in ensuring the success of software projects, driving the adoption of TaaS solutions.

Region Insights:

The Testing as a Service market is witnessing significant growth across various regions, with North America leading the market due to the presence of a large number of technology companies and the early adoption of TaaS solutions in the region. The Asia Pacific region is also experiencing rapid growth in the TaaS market, driven by the increasing digitization of businesses and the growing demand for software testing services in emerging economies such as China and India. Europe is another key region for the TaaS market, with organizations in sectors such as banking, finance, and healthcare increasingly outsourcing their testing activities to third-party service providers.

Testing as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.03% |

| Global Market Size in 2023 | USD 4.63 Billion |

| Global Market Size by 2024 | USD 5.28 Billion |

| Global Market Size by 2033 | USD 17.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By End-use, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Testing as a Service Market Dynamics

Drivers:

Several key drivers are contributing to the growth of the Testing as a Service market. Firstly, the increasing complexity and diversity of software applications, combined with the need for faster time-to-market, are driving organizations to adopt TaaS solutions to streamline their testing processes and improve the quality of their software products. Additionally, the rise of agile and DevOps methodologies, which emphasize continuous integration and delivery, has increased the demand for automated testing solutions, further fueling the growth of the TaaS market. Moreover, the growing importance of quality assurance and testing in ensuring the security and reliability of software applications, especially in industries such as healthcare, banking, and e-commerce, is driving organizations to invest in TaaS solutions.

Opportunities:

The Testing as a Service market presents several opportunities for service providers and organizations alike. Firstly, the growing adoption of cloud computing and virtualization technologies is creating new opportunities for TaaS providers to offer innovative testing solutions that leverage the scalability and flexibility of the cloud. Additionally, the increasing demand for specialized testing services, such as security testing and performance testing, presents an opportunity for TaaS providers to differentiate themselves in the market by offering niche expertise and tailored solutions. Moreover, the rise of new technologies such as artificial intelligence and machine learning is opening up new possibilities for advanced testing techniques, such as predictive analytics and automated testing, which can help organizations improve the efficiency and effectiveness of their testing processes.

Challenges:

Despite the promising growth prospects, the Testing as a Service market also faces several challenges that could impact its growth trajectory. One of the key challenges is the lack of awareness and understanding among organizations about the benefits of TaaS solutions, particularly among small and medium-sized enterprises (SMEs). Many organizations still rely on traditional in-house testing methods and are hesitant to outsource their testing activities to third-party service providers due to concerns about data security and quality control. Additionally, the commoditization of testing services and the presence of a large number of vendors in the market have led to pricing pressures and intense competition, which could impact the profitability of TaaS providers. Moreover, the rapid pace of technological change and the emergence of new testing tools and methodologies present a challenge for TaaS providers to stay ahead of the curve and continuously innovate their offerings to meet evolving customer needs.

Read Also: Nutraceutical Packaging Market Size to Reach USD 5.86 Bn by 2033

Recent Developments

- In January 2024, Capgemini SE introduced the “CLOUD DE CONFIANCE” platform. This platform provides the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services.

- In December 2023, IBM Corporation took over Software AG, a German multinational software corporation. Through this acquisition, IBM would enhance its business portfolio by creating hybrid cloud and cutting-edge AI solutions for enterprises with a distinct and compelling appeal.

- In November 2023, Accenture PLC came into partnership with Vodafone Group Plc, a British multinational telecommunications company. Through this partnership, Accenture PLC would enhance its technology and transformation services business.

- In November 2023, DXC Technology Company entered into a partnership with Amazon Web Services, Inc., an IT Services and IT Consulting company. Through this partnership, DXC Technology Company would expedite the transfer of its fundamental enterprise systems to cloud infrastructure.

Testing as a Service Market Companies

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Segments Covered in the Report

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By End-use

- IT & telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Deployment Type

- Public

- Private

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/