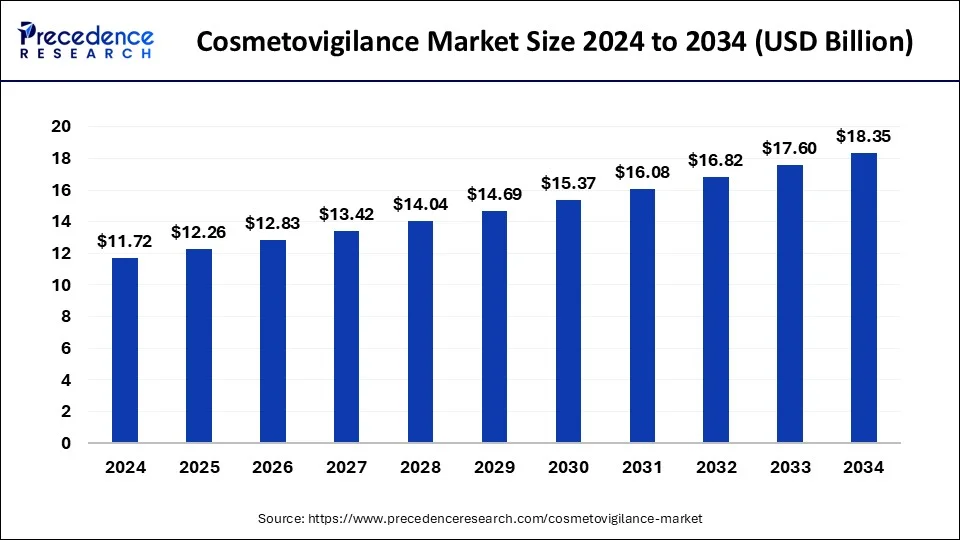

The global cosmetovigilance market size reached USD 11.20 billion in 2023 and is anticipated to attain around USD 17.60 billion by 2033, growing at a CAGR of 4.62% from 2024 to 2033.

Key Points

- Europe has captured highest revenue share in cosmetovigilance market in 2023 with 37.8%.

- By service type, the post-marketing services market segment accounted for the dominant share of the market in 2023 with 64%.

- By service type, the pre-marketing services segment is expected to witness considerable growth in the global market over the forecast period.

- By categories, the skincare segment held the largest share of around 33% in 2023.

- By service provider, the contract outsourcing segment has accounted largest revenue share of 60% in 2023.

- By phase type, the Phase IV segment has held revenue share of 76% in 2023.

Moreover, regulatory agencies worldwide are implementing stricter regulations and guidelines concerning the safety and labeling of cosmetic products. Compliance with regulatory requirements necessitates robust cosmetovigilance practices by cosmetic manufacturers and distributors, thereby driving the demand for cosmetovigilance services and solutions.

Additionally, advancements in technology, such as digital platforms, artificial intelligence, and data analytics, are transforming the cosmetovigilance landscape. These technological innovations enable more efficient data collection, signal detection, and risk assessment, enhancing the capabilities of cosmetovigilance systems to identify and respond to safety concerns in real-time.

Get a Sample: https://www.precedenceresearch.com/sample/4062

Region Insights:

The cosmetovigilance market exhibits regional variations influenced by factors such as regulatory frameworks, consumer behavior, and market dynamics.

In North America, stringent regulations enforced by agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada drive the demand for cosmetovigilance services. The region’s highly developed cosmetic industry, characterized by a diverse range of products and active consumer engagement, necessitates robust monitoring of product safety and adverse reactions.

In Europe, the European Union’s regulatory framework, including the Cosmetics Regulation (EC) No 1223/2009, mandates stringent safety assessment and post-market surveillance of cosmetic products. The presence of established cosmetovigilance systems and collaboration among regulatory authorities and industry stakeholders contribute to the growth of the cosmetovigilance market in Europe.

In the Asia-Pacific region, rapid urbanization, rising disposable income, and changing beauty trends fuel the demand for cosmetics, driving the need for effective cosmetovigilance practices. Emerging economies such as China, India, and South Korea are witnessing significant growth in their cosmetic industries, presenting opportunities for cosmetovigilance service providers to support regulatory compliance and consumer safety initiatives.

Table of Contents

ToggleCosmetovigilance Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 11.20 Billion |

| Global Market Size in 2024 | USD 11.72 Billion |

| Global Market Size by 2033 | USD 17.60 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.62% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service Type, By Categories, By Phase Type, and By Service Provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cosmetovigilance Market Dynamics

Drivers:

Several drivers propel the growth of the cosmetovigilance market. One of the primary drivers is the increasing awareness among consumers regarding the potential risks associated with cosmetic products. High-profile incidents involving adverse reactions or product recalls have heightened consumer awareness and demand for greater transparency, safety, and accountability from cosmetic brands.

Furthermore, advancements in analytical techniques and methodologies enable more comprehensive safety assessments and risk management strategies in cosmetovigilance. Improved understanding of skin physiology, toxicology, and allergology facilitates the identification and evaluation of potential hazards associated with cosmetic ingredients, formulations, and usage patterns.

Moreover, the globalization of the cosmetic industry and the proliferation of online sales platforms have expanded the reach of cosmetic products, posing challenges for regulatory oversight and consumer protection. Effective cosmetovigilance practices are essential to monitor the safety of cosmetics sold through various channels and ensure compliance with regulatory requirements across jurisdictions.

Opportunities:

The cosmetovigilance market presents several opportunities for stakeholders to enhance safety, compliance, and consumer trust in cosmetic products. One such opportunity lies in leveraging technological innovations such as artificial intelligence, machine learning, and big data analytics to automate and streamline cosmetovigilance processes.

Furthermore, collaboration among regulatory agencies, industry associations, and consumer advocacy groups can facilitate knowledge sharing, best practices dissemination, and capacity building in cosmetovigilance. Multinational companies operating in the cosmetic industry can establish global cosmetovigilance networks to harmonize safety monitoring and reporting practices across their supply chains.

Moreover, the growing trend towards natural and organic cosmetics presents opportunities for cosmetovigilance service providers to develop specialized expertise in assessing the safety and efficacy of botanical extracts, essential oils, and other natural ingredients. By addressing consumer concerns regarding chemical additives and synthetic preservatives, cosmetovigilance can support the sustainable growth of the natural cosmetics market.

Challenges:

Despite the opportunities presented by the cosmetovigilance market, several challenges need to be addressed to ensure its effective implementation and impact. One significant challenge is the lack of standardized methodologies and terminology in cosmetovigilance, which can hinder data comparability, signal detection, and risk assessment across different regions and regulatory authorities.

Read Also: IT Services Market Size to Reach USD 2.80 Trillion By 2033

Recent Developments

- In December 2023, Biofrontera AG, an international biopharmaceutical company, announced that its wholly-owned subsidiary Biofrontera Bioscience GmbH has received a notice of allowance for the application “Photodynamic therapy comprising two light exposures at different wavelengths by the US patent office USPTO. This patent protects several innovations relating to a new illumination method to treat dermatological skin diseases with Photodynamic Therapy (PDT).

- In June 2023, Anju Software and ClinChoice partnered to enhance eClinical solutions for clinical research. ClinChoice’s acquisition of Cromsource led to the collaboration, enabling the delivery of adaptable and cost-efficient eClinical solutions, including TrialMaster, for streamlined clinical trial data management and regulatory compliance.

Cosmetovigilance Market Companies

- Poseidon CRO

- AxeRegel

- PharSafer

- AB Cube

- Aixial Group

- Di Renzo

- Pharmathen

- Skill Pharma

- OC Vigilance

- Preclinical

- safety

- ZEINCRO Group

- FMD K&L

- POSEIDON CRO

- MSL Solution Providers

- Cliantha

- Pure Drug Safety

- KMJ pharma sp. z o.o.

- TheraSkin

- CORONIS Research SA

- PHARMALEX GMBH

- Bioclinica

- Tecnimede Group

- Sciformix

Segments Covered in the Report

By Service Type

- Pre-marketing Services

- Clinical Safety Testing

- Document Writing

- Risk Management

- Post-marketing Services

- Case Intake

- Case Triage

- Data Entry & Acquisition

- Tracking & Reporting

By Categories

- Skincare

- Makeup

- Haircare

- Perfumes and deodorants

- Hair colorants

- Others

By Phase Type

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

By Service Provider

- In-house

- Contract Outsourcing

- Contract Research Organizations (CROs)

- Business Process Outsourcing Organizations (BPOs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/