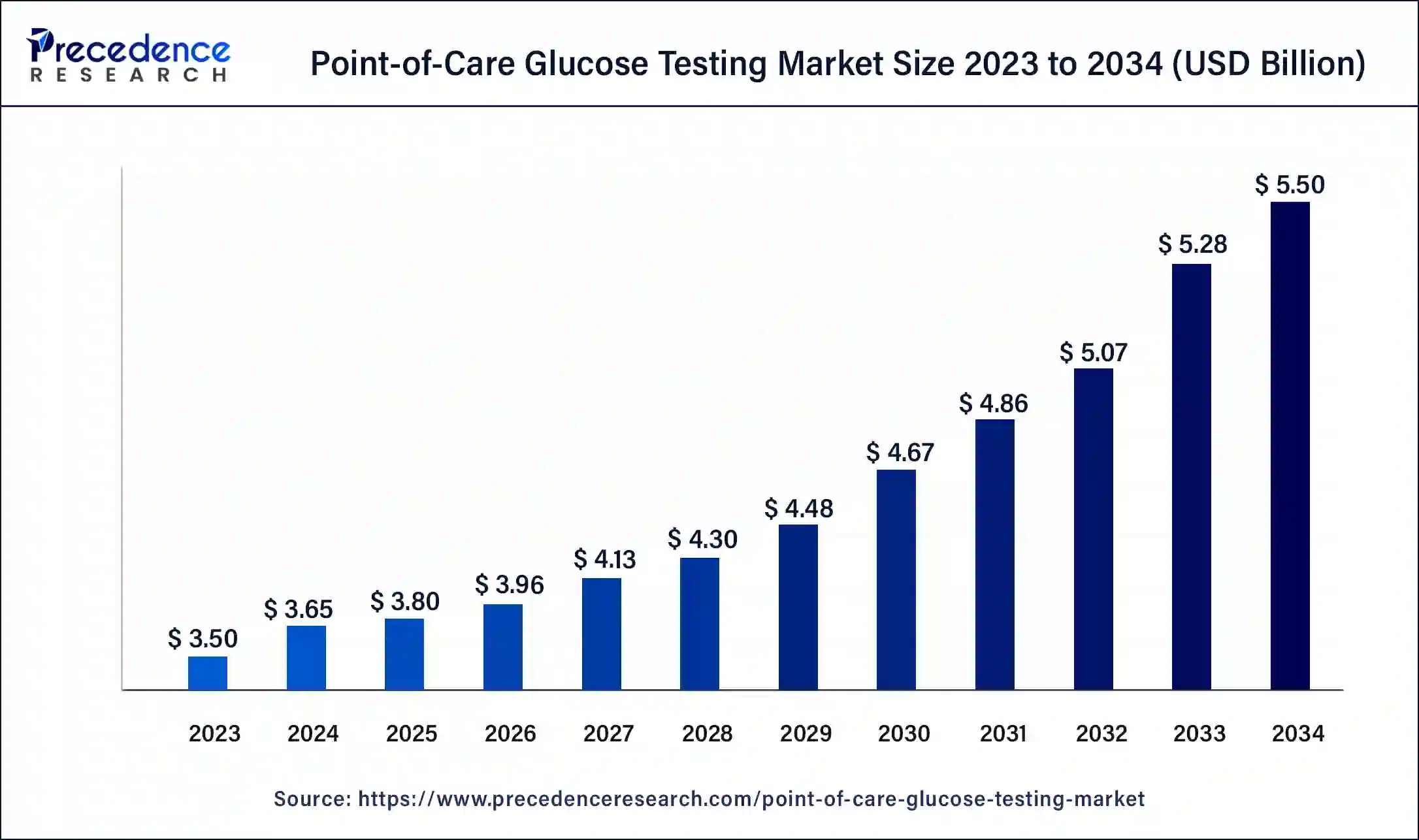

The global point-of-care glucose testing market size reached USD 3.50 billion in 2023 and is projected to attain around USD 5.20 billion by 2033, growing at a CAGR of 4.03% from 2024 to 2033.

Key Points

- The North America point-of-care glucose testing market size surpassed USD 1.44 billion in 2023 and is expected to be worth around USD 2.13 billion by 2033.

- North America dominated the global point-of-care glucose testing market in 2023 with a revenue share of 41%.

- Asia Pacific is witnessing significant growth in the point-of-care glucose testing market.

- By product, in 2023, the lancing devices and strips segment held the largest share of 63%.

- By application, the type 2 diabetes segment dominated the market in 2023 with a revenue share of 81%.

- By end use, the home care setting segment has accounted revenue share of 62% in 2023.

The Point-of-Care Glucose Testing Market refers to the market for devices and technologies used to measure blood glucose levels outside of traditional laboratory settings, typically at the point of care, such as in clinics, hospitals, and home settings. This market encompasses a wide range of devices, including glucometers, continuous glucose monitoring (CGM) systems, and other handheld or portable devices designed to provide rapid and accurate glucose measurements. With the rising prevalence of diabetes worldwide, the demand for point-of-care glucose testing solutions is expected to continue growing significantly in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/4087

Growth Factors:

Several factors contribute to the growth of the point-of-care glucose testing market. Firstly, the increasing incidence of diabetes globally is a major driver, as diabetes patients require frequent monitoring of their blood glucose levels to manage their condition effectively. Additionally, technological advancements have led to the development of more accurate and user-friendly glucose testing devices, driving adoption rates among both healthcare professionals and patients. The growing preference for self-monitoring and home-based healthcare further fuels market growth, as patients seek convenient and accessible ways to manage their diabetes.

Region Insights:

The point-of-care glucose testing market exhibits regional variations driven by factors such as healthcare infrastructure, prevalence of diabetes, and regulatory environment. North America and Europe currently dominate the market, owing to well-established healthcare systems, high diabetes prevalence rates, and early adoption of advanced glucose testing technologies. In contrast, the Asia-Pacific region is experiencing rapid growth due to increasing awareness about diabetes management, rising disposable incomes, and expanding healthcare access in emerging economies such as China and India.

Point-of-Care Glucose Testing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.03% |

| Global Market Size in 2023 | USD 3.50 Billion |

| Global Market Size in 2024 | USD 3.64 Billion |

| Global Market Size by 2033 | USD 5.20 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Point-of-Care Glucose Testing Market Dynamics

Drivers:

Several key drivers are propelling the growth of the point-of-care glucose testing market. Firstly, the increasing global prevalence of diabetes, driven by factors such as sedentary lifestyles, unhealthy dietary habits, and aging populations, creates a growing demand for glucose monitoring solutions. Additionally, the shift towards personalized medicine and patient-centric healthcare models emphasizes the importance of regular glucose monitoring for individualized treatment plans. Technological advancements, such as the integration of wireless connectivity and smartphone apps into glucose monitoring devices, further drive market growth by enhancing user convenience and data accessibility.

Challenges:

Despite the significant growth opportunities, the point-of-care glucose testing market faces several challenges. One major challenge is the stringent regulatory requirements for medical devices, which can delay product approvals and market entry. Moreover, reimbursement issues and pricing pressures in healthcare systems worldwide pose challenges for manufacturers, particularly in emerging markets where affordability is a concern. Additionally, the accuracy and reliability of point-of-care glucose testing devices remain a key focus area, as inaccuracies can lead to incorrect treatment decisions and compromised patient outcomes.

Opportunities:

The point-of-care glucose testing market presents numerous opportunities for innovation and growth. Continued research and development efforts aimed at improving the accuracy, speed, and usability of glucose testing devices can drive market expansion. Furthermore, expanding market penetration in emerging economies offers significant growth prospects, as these regions witness increasing healthcare spending and rising awareness about diabetes management. Integration with digital health platforms and telemedicine services also presents opportunities for expanding the reach of point-of-care glucose testing and improving patient engagement and outcomes.

Read Also: CNC Milling Machines Market Size to Reach USD 113 Bn by 2033

Recent Developments

- In February 2024, Trinity Biotech (TRIB) finalized a conclusive agreement to purchase the biosensor and Continuous Glucose Monitoring (CGM) assets from Waveform Technologies. This strategic acquisition, valued at $12.5 million in cash and 9 million American Depositary Shares (ADSs) of the company, alongside additional considerations, positions Trinity Biotech to innovate diabetes care and upgrade its presence in the biosensor market.

- In July 2023, Avricore Health and Ascensia Diabetes Care revealed a partnership to incorporate blood glucose monitoring into point-of-care testing. The collaboration seeks to integrate the Contour Next-Gen and Contour Next One BGM systems into Avricore’s HealthTab PCOT platform.

- In June 2023, the initial locally produced continuous glucose monitoring device was approved by the South Korean Ministry of Food and Drug Safety. I-SENS, the manufacturer of blood glucose devices, introduced CareSens Air, which claimed to be the most compact and lightweight CGM device accessible in South Korea. It can be utilized continuously for 15 days and incorporates a calibration mechanism to enhance the accuracy of readings.

- In January 2022, Roche introduced the Cobas Pulse, a point-of-care blood glucose monitor meant for hospital personnel, along with a companion gadget structured like a touchscreen smartphone that will run its apps. The Cobas pulse will begin shipping to certain European countries with a CE mark.

Point-of-Care Glucose Testing Market Companies

- Abbott (U.S.)

- Dexcom (U.S.)

- Roche (Switzerland)

- Ascensia Diabetes Care (Switzerland)

- LifeScan (U.S.)

- Medtronic (U.S.)

- Ypsomed (Switzerland)

- Animas (U.S.)

- Insulet (U.S.)

- Bayer (Germany)

- Nipro (Japan)

- Terumo (Japan)

- Arkray (Japan)

- Acon Laboratories (U.S.)

- Freestyle (U.S.)

- One Touch (U.S.)

- Accu-Chek (Germany)

- Dario (U.S.)

- iHealth (China)

- FreeStyle Libre (UK)

Segments Covered in the Report

By Product

- Lancing Devices and Strips

- Blood-Glucose Meter

- Type

- Lifescan OneTouch Ultra and Lifescan OneTouch Verio

- Accu-Chek Aviva Plus and Accuchek

- Freestyle Lite and Freestyle Precission Neo

- Contour Next

- Others

- Type

By Application

- Type-1 Diabetes

- Type-2 Diabetes

By End User

- Hospitals and Clinics

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/