The Inertial Measurement Unit (IMU) market comprises devices that measure linear and angular motion in three-dimensional space, using a combination of accelerometers and gyroscopes. IMUs play a crucial role in various applications such as aerospace, defense, automotive, consumer electronics, and industrial automation. They provide data for navigation, orientation, and motion sensing, making them essential components in modern technology.

Get a Sample:https://www.precedenceresearch.com/sample/4096

Growth Factors

The IMU market is growing due to increasing demand for precise navigation and motion tracking systems across various industries. In the automotive sector, the rise of autonomous vehicles and advanced driver assistance systems (ADAS) is fueling the demand for IMUs. In aerospace and defense, the need for advanced navigation systems in drones, missiles, and aircraft is driving market growth. Additionally, the proliferation of smart devices and wearables in the consumer electronics market is boosting IMU adoption.

Region Insights

North America leads the IMU market due to its advanced technological infrastructure and strong aerospace and defense industries. Europe follows, driven by the region’s focus on aerospace innovation and automotive manufacturing. The Asia-Pacific region is experiencing rapid growth, fueled by the expanding automotive industry and the rising adoption of smart devices and drones. Countries like China, Japan, and India are key contributors to the market’s growth in this region.

Inertial Measurement Unit Market Scope

| Report Coverage |

Details |

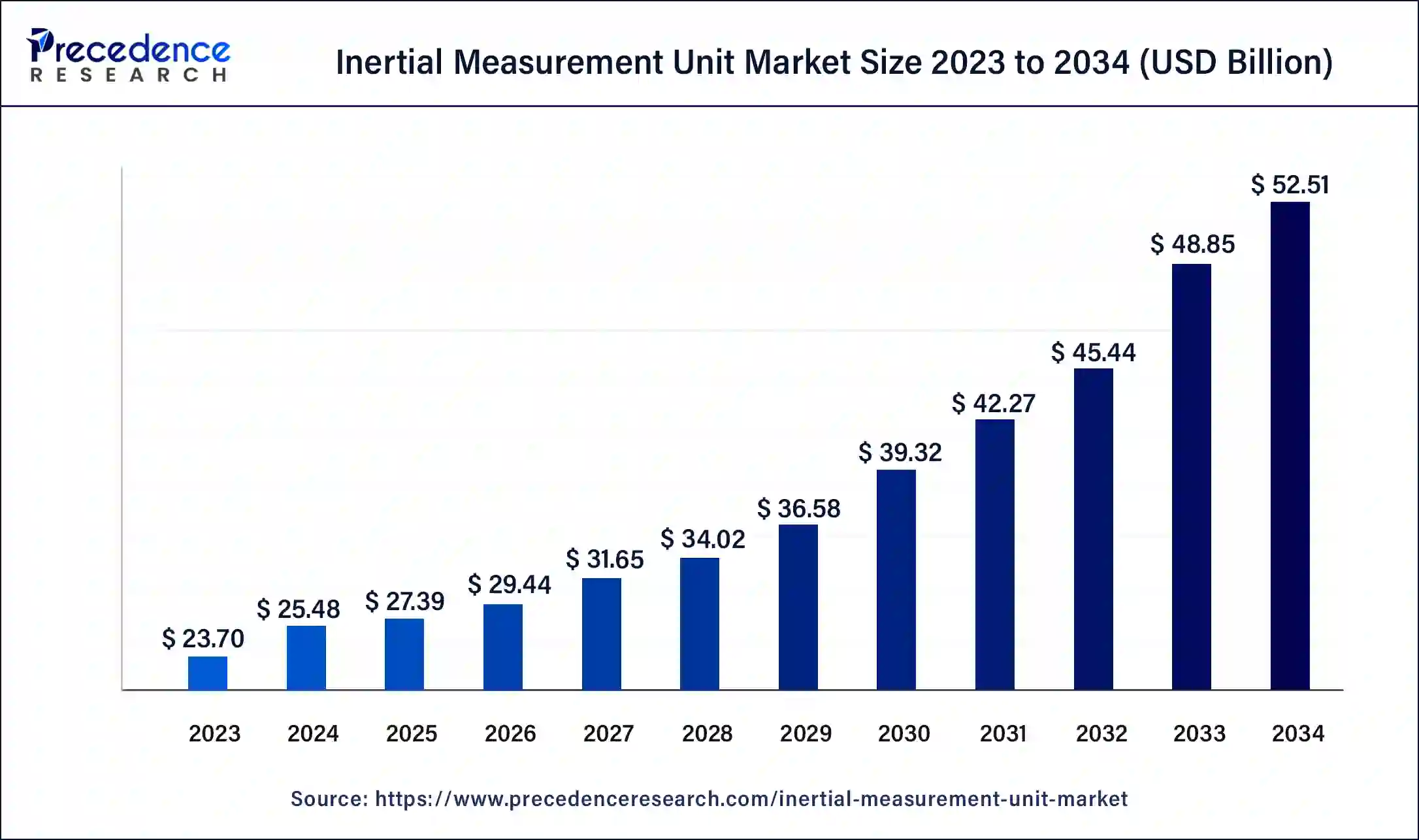

| Growth Rate from 2024 to 2033 |

CAGR of 7.35% |

| Global Market Size in 2023 |

USD 23.70 Billion |

| Global Market Size in 2024 |

USD 25.44 Billion |

| Global Market Size by 2033 |

USD 48.20 Billion |

| Largest Market |

North America |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Component, By Technology, By Platform, and By End-user |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Inertial Measurement Unit Market Dynamics

Drivers

Key drivers of the IMU market include the increasing demand for high-performance navigation and tracking systems in emerging applications such as drones and autonomous vehicles. Technological advancements, including the development of miniaturized and cost-effective IMUs, are enabling broader adoption across various industries. Additionally, government initiatives and investments in defense and aerospace projects are propelling market growth.

Opportunities

The IMU market presents opportunities in several areas, such as the development of advanced sensor fusion technology, which integrates data from multiple sensors for improved accuracy. The rise of the Internet of Things (IoT) also opens up new possibilities for IMUs in connected devices and smart infrastructure. Collaborations between IMU manufacturers and software developers can lead to innovative solutions and new applications.

Challenges

Challenges in the IMU market include maintaining accuracy and performance while reducing the size and cost of the devices. Manufacturing complexities and the need for calibration and testing to ensure precise measurements can hinder market growth. Additionally, competition from alternative technologies such as GNSS (Global Navigation Satellite System) can pose a challenge to IMU adoption in certain applications.

Read Also: In-vitro Diagnostics Enzymes Market Size, Report by 2033

Recent Developments

- In January 2022, EMCORE Corporation received a continuing development award from a U.S. contractor for finalizing the design and creating a method for manufacturing high-end inertial measurement units for tactical grade pods.

- In May 2022, Emcore Corporation awarded new contracts for multistage space launch vehicle navigation grade and flight stabilization. The corporation finalized its purchase of L3 Harris Space and Navigation. The contract is part of the space launch vehicle Tri-Axial Inertial Measurement Unit (TAIMU) program.

- In July 2022, Honeywell Technologies Inc. and Civitanavi Systems announced a collaboration to develop a new IMU for aerospace customers. The new HG2800 inertial measurement units are low-cost, low-power precision pointing solutions with device stabilization.

- In November 2022, Collins Aerospace and China’s Hainan Airlines signed a FlightSense contract to deliver Hainan Airlines’ fleet of Boeing 787s with customizable support solutions to lessen repair time and costs. The contract with Hainan Airlines, which builds on a 30-year relationship between the two organizations, includes 185 aircraft on multi-platforms through 2025. Collins will assist in ensuring the availability of Hainan Airlines’ maintenance, repair, and overhaul (MRO) supply chain management.

Inertial Measurement Unit Market Companies

- Honeywell International Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- VectorNav Technologies, LLC

- STMicroelectronics N.V.

- Invensense, Inc.

- Safran Group

- Thales Group

- Trimble Navigation Ltd.

- Analog Devices, Inc.

- KVH Industries, Inc.

- Moog Inc.

- Epson Europe Electronics GmbH

- Gladiator Technologies, Inc.

- Silicon Sensing Systems Ltd.

- MEMSIC Inc.

- Sagem (Safran Electronics & Defense)

Segments Covered in the Report

By Component

- Accelerometers

- Gyroscopes

- Magnetometers

By Technology

- Fiber optics Gyro

- Mechanical Gyro

- Ring laser Gyro

- Mems

- Others (vibrating gyro, hemispherical resonator gyro)

By Platform

- Airborne

- Ground

- Maritime

- Space

By End-user

- Aerospace And Defense

- Consumer Electronics

- Marine

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa