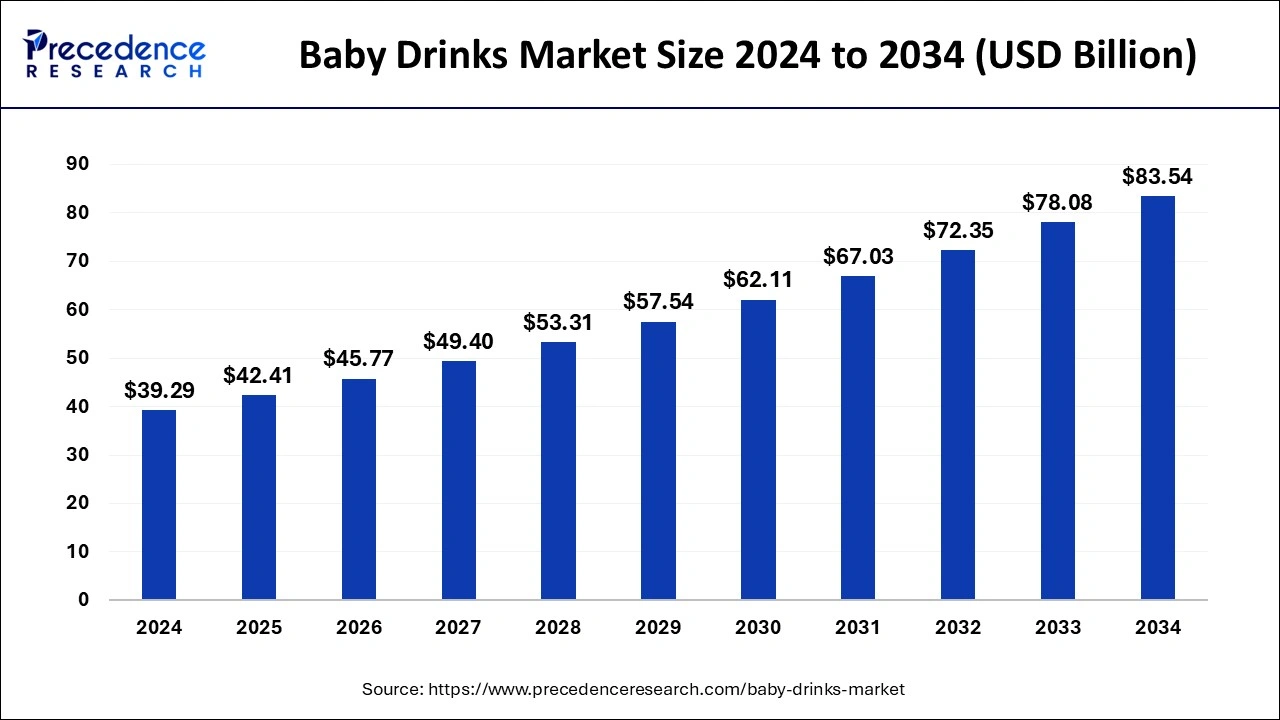

The global baby drinks market size was estimated at USD 36.40 billion in 2023 and is projected to reach around USD 78.08 billion by 2033, growing at a CAGR of 7.93% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 36% in 2023.

- North America is expected to grow rapidly in the market by region during the forecast period.

- The baby formula segment dominated the market by product in 2023.

- The juice segment is expected to grow at a substantial CAGR in the market by product during the forecast period.

- The pharmacy segment dominated the market by product in 2023.

- The supermarket & hypermarket segment is expected to grow at the highest CAGR in the market by product during the forecast period.

The baby drinks market encompasses a range of beverages specifically formulated for infants and toddlers, typically between the ages of 0 to 3 years. These drinks often include infant formula, toddler milk, fruit juices, and functional drinks designed to meet the nutritional needs of young children. The market for baby drinks has witnessed steady growth due to changing lifestyles, increasing awareness about infant nutrition, and rising disposable incomes in emerging economies. Manufacturers are continuously innovating to offer safe, nutritious, and convenient options for parents seeking healthy alternatives for their children.

Get a Sample:https://www.precedenceresearch.com/sample/4268

Growth Factors:

Several factors contribute to the growth of the baby drinks market. One significant driver is the increasing number of working mothers and dual-income households, which has led to higher demand for convenient and ready-to-feed baby drinks. Moreover, growing awareness about the importance of early childhood nutrition and pediatric health has encouraged parents to opt for specialized baby drinks that cater to specific dietary requirements. Additionally, advancements in product formulation and packaging technologies have improved the safety and shelf-life of baby drinks, boosting consumer confidence.

Region Insights:

The baby drinks market exhibits varying trends across different regions. In developed economies such as North America and Europe, there is a strong demand for organic and natural baby drinks due to health-conscious consumer preferences. Asia-Pacific is emerging as a lucrative market driven by rapid urbanization, increasing birth rates, and improving healthcare infrastructure. Countries like China and India are witnessing substantial growth in the baby drinks sector owing to rising disposable incomes and a growing middle-class population.

Baby Drinks Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.93% |

| Baby Drinks Market Size in 2023 | USD 36.40 Billion |

| Baby Drinks Market Size in 2024 | USD 39.29 Billion |

| Baby Drinks Market Size by 2033 | USD 78.08 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Baby Drinks Market Dynamics

Drivers:

Key drivers stimulating the baby drinks market include rising birth rates in certain regions, increasing parental awareness about infant nutrition, and the convenience offered by packaged baby drinks. Moreover, aggressive marketing strategies by manufacturers, emphasizing the benefits of fortified baby drinks, have contributed to market expansion. Regulatory initiatives promoting safety standards and nutritional labeling have also bolstered consumer confidence and market growth.

Opportunities:

The baby drinks market presents several opportunities for manufacturers and investors. There is a growing demand for organic, plant-based, and allergy-friendly baby drinks, catering to niche consumer segments. Expansion into untapped markets in developing regions and strategic collaborations with pediatricians and healthcare professionals can further fuel market growth. Moreover, innovations in product formulations, such as lactose-free and hypoallergenic options, can create new avenues for market penetration.

Challenges:

Despite the promising growth prospects, the baby drinks market faces certain challenges. Concerns over sugar content in flavored drinks and regulatory restrictions on marketing infant formula are key challenges that manufacturers must navigate. Additionally, price sensitivity among consumers in developing economies and competition from homemade alternatives pose challenges to market expansion. Maintaining product quality and safety standards amidst evolving consumer preferences and regulatory landscapes remains a constant challenge for industry players.

Read Also: Citronella Oil Market Size to Reach USD 222.69 Million by 2033

Baby Drinks Market Recent Developments

- In April 2024, Else Nutrition, which specializes in plant-based but soy-free infant and toddler formulas, launched in Asia-Pacific with Australia as its first stop.

- In February 2024, the UK’s Competition and Markets Authority (CMA) announced a market study into the supply of infant formula in the UK, saying it would use its formal legal powers to gather more evidence on the factors affecting the market, such as consumer behavior, the regulatory framework, and barriers to entry and expansion for new entrants. The market study follows a November 2023 CMA report, which found that the average price of infant formula had risen by 25% over the previous two years and that families could save more than GBP 500 over the first year of a baby’s life by switching to cheaper alternatives.

- In January 2024, a partnership between UK-based pre-cut lidding manufacturer, Chadwicks, and New Zealand-based plastic injection molding provider, Tekplas, has resulted in an innovative spoon-in-lid design for infant formula packaging. Two companies have developed and launched this new packaging for the infant formula market in New Zealand, Australia, and East Asia.

Baby Drinks Market Companies

- Nestlé

- The Kraft Heinz Company

- Mead Johnson & Company, LLC.

- Danone S.A.

- Beingmate Group Co., Ltd.

- CAMPBELL SOUP COMPANY.

- Abbott

- Arla Foods amba

- Sign Softech Private Limited

- Hain Celestial

- Dana Dairy

- FrieslandCampina

- HIPP

- ORHEI-VIT

- Freed Foods, Inc.

- Holle Baby Food AG

- Nature’s One

- Organix Brands Limited

- NANNYcare Ltd.

Segment Covered in the Report

By Product

- Baby Formula

- Juice

- RTD

- Concentrate

- Electrolyte

By Distribution Channel

- Supermarket & Hypermarket

- Pharmacies

- Online

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/