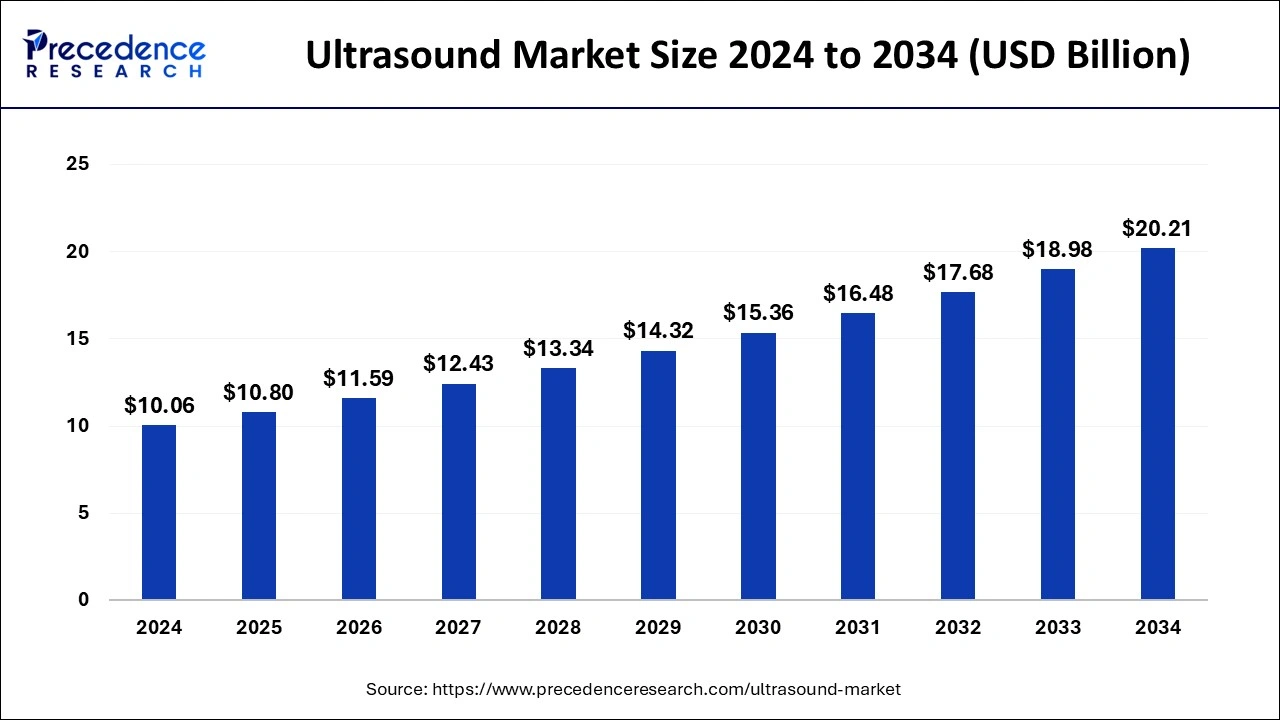

The global ultrasound market size was estimated at USD 9.38 billion in 2023 and is projected to reach around USD 18.98 billion by 2033, growing at a CAGR of 7.30% from 2024 to 2033.

Key Points

- The North America ultrasound market size accounted for USD 3.85 billion in 2023 and is expected to attain around USD 7.88 billion by 2033 with a CAGR of 7.42% from 2024 to 2033.

- North America led the ultrasound market with the largest share in 2023.

- Asia Pacific is observed to experience a notable rate of growth during the forecast period.

- By product, the diagnostic segment held the largest share of the market in 2023.

- By portability, the cart-trolley segment dominated the market in 2023.

- By application, the radiology segment dominated the market in 2023.

- By end-use, the hospitals segment held the dominating share in 2023.

The ultrasound market is a dynamic segment within the medical imaging industry, characterized by the use of high-frequency sound waves to produce images of structures within the human body. These images are utilized for diagnostic purposes across various medical specialties, including obstetrics, cardiology, oncology, and musculoskeletal imaging. Ultrasound technology has evolved significantly over the years, offering improved image quality, portability, and versatility, thereby enhancing its utility in clinical settings.

Get a Sample: https://www.precedenceresearch.com/sample/4311

Growth Factors

The ultrasound market is witnessing steady growth driven by several factors. Technological advancements such as the development of portable and handheld ultrasound devices have expanded the accessibility of ultrasound imaging beyond traditional hospital settings, enabling point-of-care diagnostics in remote or underserved areas. Additionally, the increasing prevalence of chronic diseases, growing geriatric population, and rising healthcare expenditure are fueling the demand for diagnostic imaging modalities, including ultrasound, globally. Moreover, the rising adoption of minimally invasive procedures, where ultrasound guidance plays a crucial role, further contributes to market growth.

Region Insights:

The ultrasound market exhibits regional variations influenced by factors such as healthcare infrastructure, regulatory environment, and economic conditions. Developed regions like North America and Europe dominate the market, driven by high healthcare expenditure, well-established healthcare systems, and early adoption of advanced medical technologies. However, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth in the ultrasound market due to increasing healthcare investments, rising disposable incomes, and expanding patient populations.

Ultrasound Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.30% |

| Ultrasound Market Size in 2023 | USD 9.38 Billion |

| Ultrasound Market Size in 2024 | USD 10.06 Billion |

| Ultrasound Market Size by 2033 | USD 18.98 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Portability, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ultrasound Market Dynamics

Drivers

Several drivers propel the growth of the ultrasound market. One significant driver is the increasing preference for non-invasive diagnostic techniques, where ultrasound imaging offers advantages such as real-time visualization, absence of ionizing radiation, and cost-effectiveness compared to other imaging modalities. Furthermore, the growing emphasis on early disease detection and preventive healthcare practices contributes to the rising demand for ultrasound examinations across diverse medical specialties.

Opportunities

The ultrasound market presents ample opportunities for innovation and market expansion. Continued research and development efforts aimed at enhancing imaging technologies, improving image resolution, and expanding the clinical applications of ultrasound hold promise for future growth. Additionally, the increasing adoption of artificial intelligence (AI) and machine learning algorithms to augment ultrasound image analysis and interpretation opens avenues for advanced diagnostic capabilities and personalized medicine.

Challenges

Despite its growth prospects, the ultrasound market faces certain challenges that warrant attention. One key challenge is the competition from alternative imaging modalities such as magnetic resonance imaging (MRI) and computed tomography (CT), which offer superior image resolution for certain applications. Moreover, reimbursement limitations, particularly in emerging markets, and concerns regarding the accuracy and reliability of ultrasound imaging in certain clinical scenarios pose challenges to market expansion. Additionally, regulatory hurdles and the need for skilled healthcare professionals proficient in ultrasound interpretation present ongoing challenges to market penetration and adoption.

Read Also: Telecommunication Market Size to Reach USD 3.99 Trn by 2033

Ultrasound Market Recent Developments

- In February 2024, Fujifilm launched a new endoscopic ultrasound machine in India, the ‘ALOKA ARIETTA 850’. This machine offers superior features such as enhanced image quality, HD-THI for deeper penetration, and combi-elastography.

- In November 2023, Samsung launched a new ultrasound system named ‘V6’. This ultrasound system enhances image clarity and accuracy. It is also adaptable to various medical settings through its simplified workflows, wide screen, remote access, and powerful design with a battery option.

- In November 2023, Koninklijke Philips N.V. announced the launch of its flagship ultrasound system, the Compact Ultrasound 5000 Series. This system features Contrast-enhanced ultrasound, an ultra-high-frequency transducer, 3D-like vascular flow advanced imaging, quality advanced image acquisition, and expanded tele-ultrasound capability.

- In May 2024, Esaote SPA launched a portable ultrasound system named ‘MyLab Omega eXP VET.’ This system will help veterinarians examine animals with a high level of flexibility and accuracy in diagnostic imaging. It also covers animals of all species and ensures high performance, ranging from general imaging and echocardiography to interventional procedures.

- In April 2024, GE HealthCare (GEHC) launched two ultrasound systems, ‘Voluson Signature 20’ and ‘Voluson Signature 18’. These systems are equipped with AI features and advanced tools to increase the efficiency of diagnostic centers and improve women’s health.

- In September 2023, Mindray Medical International Limited launched the TE Air wireless handheld ultrasound device. This device offers multi-device connectivity and flexible charging options. It also produces high-quality images and ensures accessibility in critical clinical scenarios.

Ultrasound Market Companies

- Zimmer MedizinSysteme GmbH

- General Electric Healthcare

- Fujifilm Corporation

- Hitachi, Ltd.

- Mindray Medical International Limited.

- Samsung Healthcare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Canon Inc.

- ESAOTE SPA

Segments Covered in the Report

By Product

- Diagnostic Ultrasound Devices

- 2D

- 3D/4D

- Doppler

- Therapeutic Ultrasound Devices

- High-intensity Focused Ultrasound

- Extracorporeal Shockwave Lithotripsy

By Portability

- Handheld

- Compact

- Cart/Trolley

- Point-of-Care Cart/Trolley Based Ultrasound

- Higher-end Cart/Trolley Based Ultrasound

By Application

- Cardiology

- Obstetrics/Gynaecology

- Radiology

- Orthopaedic

- Anaesthesia

- Emergency Medicine

- Primary Care

- Critical Care

By End-use

- Hospitals

- Imaging Centres

- Research Centres

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/