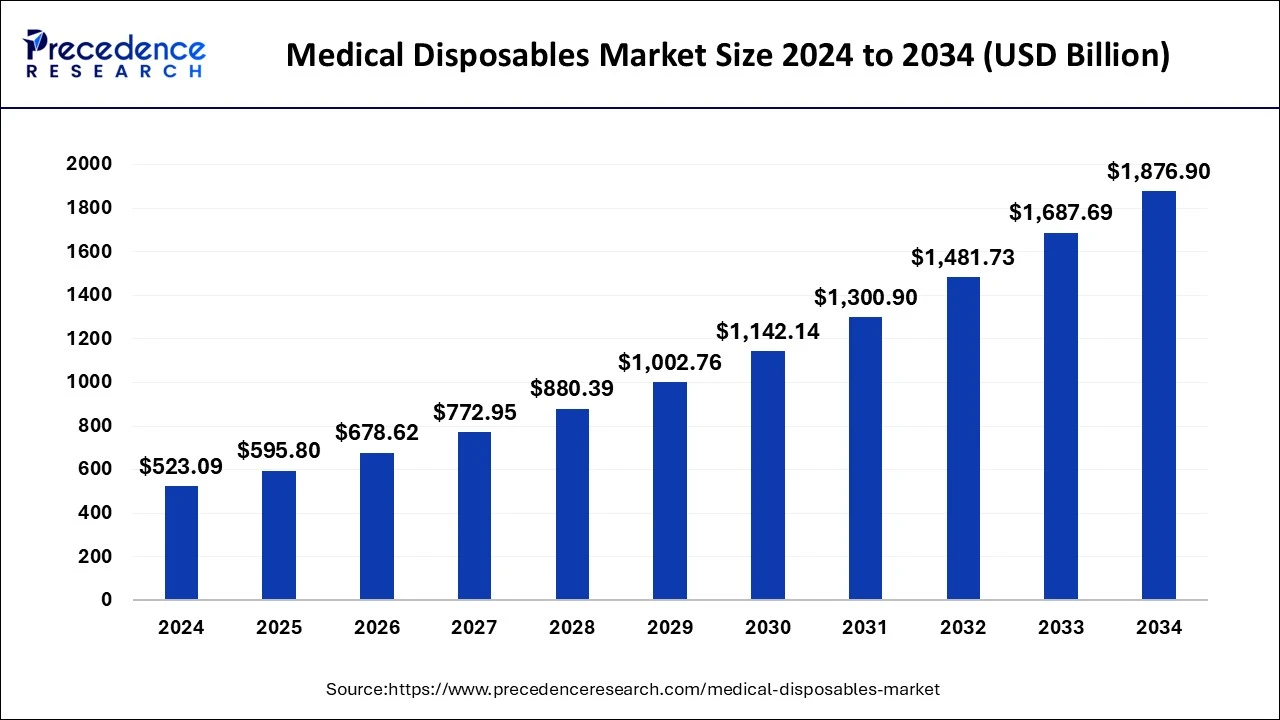

The global medical disposables market size was evaluated at USD 523.09 billion in 2024 and is predicted to cross around USD 1,876.90 billion by 2034, growing at a CAGR of 13.90%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1014

Market Key Takeaways

- In 2024, North America held a revenue share of more than 34.73% in the medical disposables market.

- The sterilization supplies segment captured 15% of the total revenue for the year.

- The plastic resins segment accounted for the highest revenue share at 59% in 2024.

- Hospitals dominated the end-use category, contributing over 56% of the market revenue in 2024.

Market Overview

The medical disposables market is growing rapidly due to increasing demand for hygiene, infection control, and efficient healthcare solutions. These disposable products, including gloves, syringes, catheters, and sterilization supplies, are essential in healthcare settings for preventing cross-contamination and ensuring patient safety. The rise in healthcare spending, combined with a global emphasis on improving medical care, is driving the market forward. The growing focus on maintaining sterility and reducing hospital-acquired infections is also contributing to the demand for medical disposables.

Market Drivers

Key drivers of the medical disposables market include the growing healthcare infrastructure, an increasing number of surgeries, and the rising focus on infection control. The expanding elderly population, along with chronic disease prevalence, is driving the demand for healthcare services and disposable products.

Additionally, regulatory measures and a heightened focus on safety standards are encouraging the adoption of medical disposables in both hospitals and outpatient care settings. Moreover, the COVID-19 pandemic has further accelerated the use of disposable medical products in healthcare settings globally.

Market Opportunities

There are numerous opportunities in the medical disposables market, especially in emerging markets where healthcare systems are evolving and demand for disposable products is increasing. Innovations in biodegradable and environmentally friendly materials present significant growth potential.

Furthermore, advances in the development of next-generation sterilization supplies and packaging solutions offer opportunities for companies to cater to new healthcare trends. Expanding product offerings and focusing on customized medical disposables for specific medical procedures could also open up new revenue streams.

Market Challenges

Despite the market’s growth, there are several challenges, including rising raw material costs, particularly for plastics and resins, which could impact the overall cost structure. Regulatory challenges and the need to comply with stringent health and safety standards can also hinder market growth.

Additionally, environmental concerns regarding the disposal of medical waste and the sustainability of plastic-based disposables are significant challenges for the industry. The market also faces issues related to the availability of raw materials, especially during periods of global supply chain disruptions.

Regional Insights

The North American region leads the medical disposables market, holding a significant revenue share, driven by advanced healthcare systems and high demand for disposable products. Europe is also a major market, driven by the adoption of new healthcare technologies and strict regulations for hygiene and safety.

The Asia-Pacific region is expected to witness rapid growth due to the rising healthcare infrastructure, increased disposable income, and demand for affordable healthcare solutions. Emerging markets in Latin America and the Middle East are gradually adopting medical disposables as healthcare standards improve, providing further growth potential.

Medical Disposables Market Companies

- Bayer AG

- BD

- Smith & Nephew PLC

- Cardinal Health

- Medline Industries, Inc.

- 3M

- MED-CON Inc.

- Medtronic

- Boston Scientific

- Becton, Dickinson and Company

- Pfizer

- Johnson and Johnson

Recent Developments

- In December 2022, the largest and most varied manufacturer of healthcare goods in the world, Johnson & Johnson, stated that the acquisition of Abiomed, Inc. was complete. Abiomed will now function as a stand-alone company within Johnson & Johnson’s MedTech division. Abiomed is now a part of Johnson & Johnson.

- In April 2021, Cardinal Health was given a contract worth $57.8 million, with options that, if exercised by the U.S. Department of Health and Human Services (HHS), could increase it to $91.6 million. This was for the preservation and allocation of around 80,000 pallets of PPE to encourage the Strategic National Stockpile, a division of the department of the Assistant Secretary for Preparedness and Response within HHS.

- In April 2021, for its $450 million injectables production, Pfizer used VR, robotics, and sterile technology. Never stepping foot inside, new production employees were familiar with the tools and processes at Pfizer’s forthcoming sterile injectables facility.

Segments Covered

By Product

- Wound Management Products

- Hand Sanitizers

- Gel Sanitizers

- Foam Sanitizers

- Liquid Sanitizers

- Other Sanitizers

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Drug Delivery Products

- Diagnostics and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Others

By Raw Material

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

By End-use

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- Asia Pacific

- China

- Japan

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/