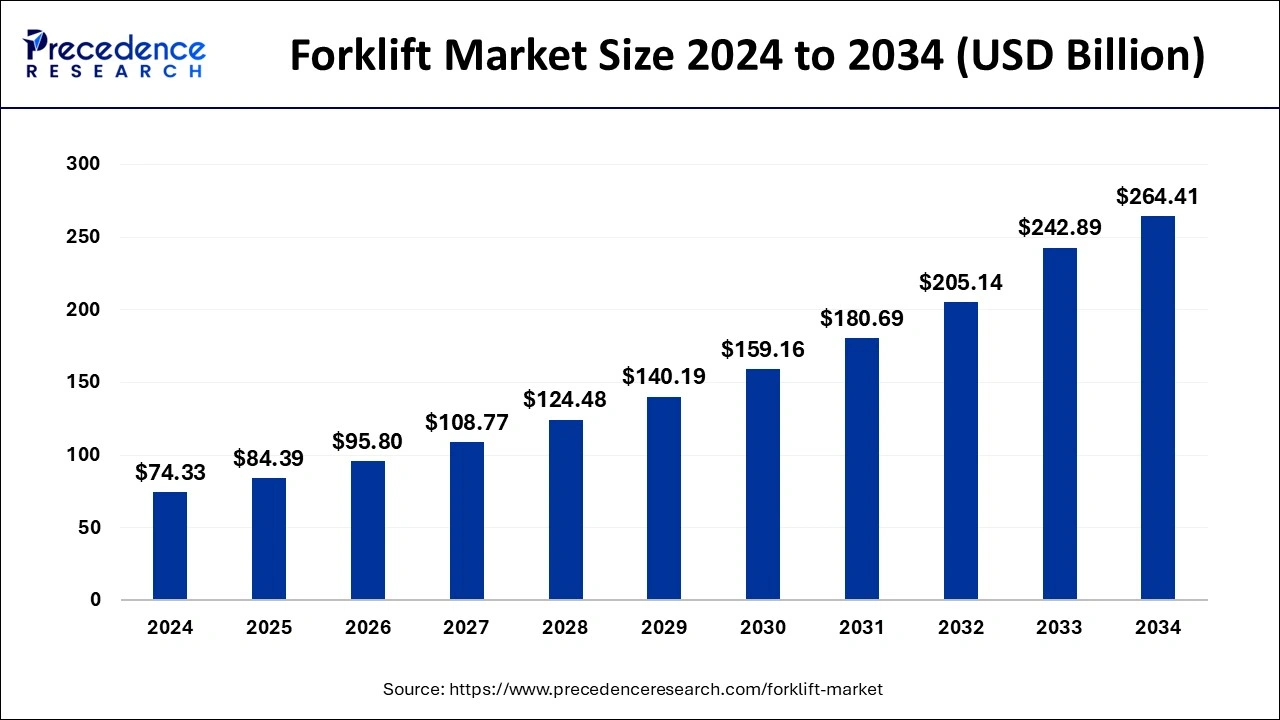

The global forklift market size was estimated at USD 74.33 billion in 2024 and is projected to cross around USD 264.41 billion by 2034 with a CAGR of 13.53%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1032

Key Takeaways

- Asia-Pacific commanded the largest share of the global market at 48% in 2024.

- The class 3 segment emerged as the leading category with a 44% market share in 2024.

- The electric segment was the most dominant power source in 2024.

- The 5-15 ton load capacity range generated the highest market share in 2024.

- The lead-acid battery type accounted for 67% of the electric battery market in 2024.

- The industrial end-use sector secured more than 25% of the total market share in 2024.

The Role of AI in Advancing the Forklift Industry

Artificial intelligence is significantly impacting the forklift market by enabling automation and enhancing operational efficiency. AI-powered forklifts equipped with advanced sensors and computer vision can navigate warehouses autonomously, reducing reliance on human operators and improving safety. These intelligent systems can analyze warehouse layouts and optimize material handling processes.

AI-driven analytics also help businesses track forklift usage, predict maintenance needs, and reduce unexpected breakdowns. By leveraging machine learning, forklifts can adapt to different environments and optimize their routes for maximum efficiency. Integration with AI-based fleet management systems further improves productivity and cost savings.

With continuous advancements in AI and robotics, the forklift industry is moving toward a future where smart and autonomous forklifts will dominate warehouses, ensuring safer, faster, and more precise material handling.

Market Drivers

The increasing need for material handling equipment in logistics, retail, and industrial sectors is propelling forklift demand. Growth in global trade and the rising adoption of automated warehouse solutions further contribute to market expansion.

Opportunities

The development of hydrogen fuel cell-powered forklifts and AI-driven fleet management systems provides significant opportunities for manufacturers. Emerging markets in Latin America and Africa also offer growth potential due to expanding infrastructure projects.

Challenges

Regulatory compliance and environmental concerns regarding fuel-based forklifts pose challenges for manufacturers. Additionally, supply chain disruptions and fluctuating raw material prices impact production costs.

Regional Insights

Asia Pacific leads the forklift market due to large-scale industrialization and warehouse expansion. North America sees steady growth with the rising adoption of electric forklifts, while Europe benefits from strict environmental policies driving the demand for sustainable solutions.

Forklift Market Companies

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha

- Forklift Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

- Hyster-Yale Materials Handling, Inc. (Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnex

Recent Developments

- In February 2024, ArcBest announced the introduction of remote-operated autonomous reach vehicles and forklifts. Vaux Smart Autonomy is an expansion of the business’s existing warehouse freight management technology.

- In November 2023, the leading innovator in material handling technology, Toyota Material Handling (TMH), is introducing a new range of electric pneumatic forklifts, including 48V and 80V variants. This sturdy line is perfect for retail applications, including landscaping, home centers, lumberyards, and shop support applications, because it is made to resist outside terrain and operate in various weather conditions.

Segments covered in the report

By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source

- ICE

- Electric

By Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Electric Battery Type

- Li-ion

- Lead Acid

By End Use

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others

By Regional Outlook

- North America

- U.S.

- Rest of North America

- Europe

- U.K.

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America- Middle East & Africa

- Brazil

- Mexico

- Argentina

- Colombia

- South Africa

- Saudi Arabia

- UAE

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/