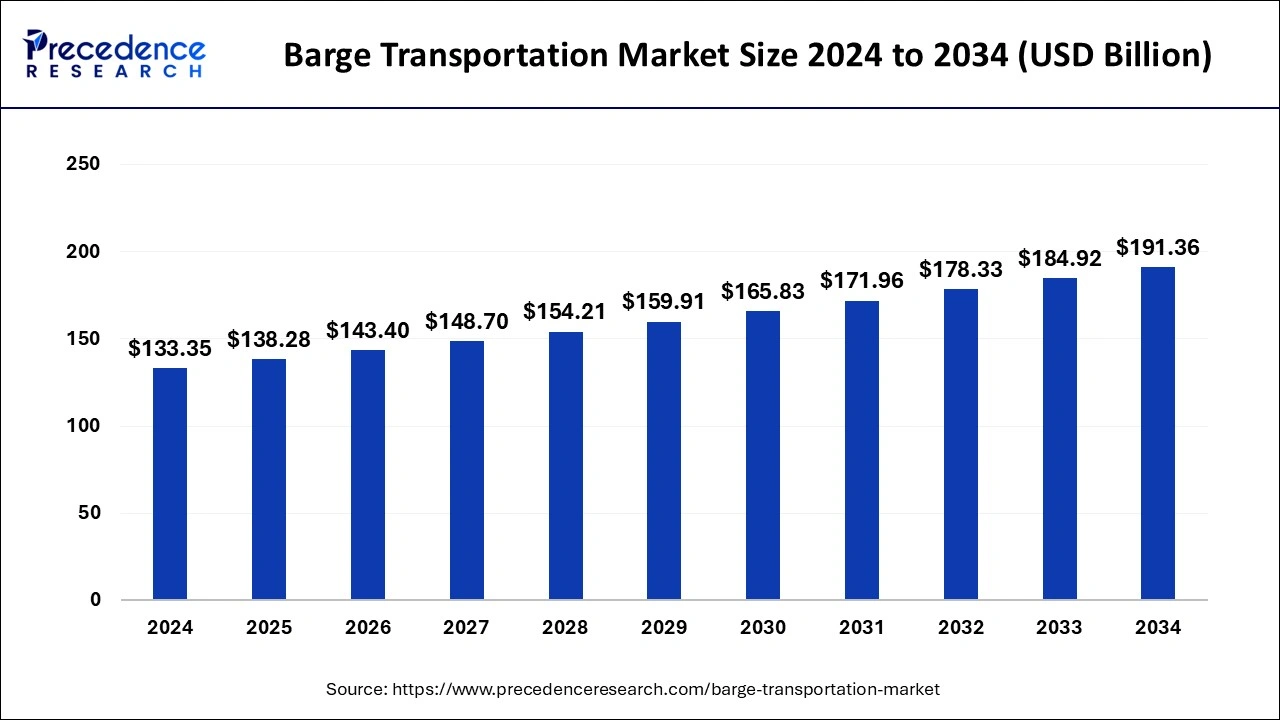

The global barge transportation market size was estimated at USD 133.35 billion in 2024 and is projected to surge around USD 191.36 billion by 2034 with a CAGR of 3.68%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1043

Key Insights

- Europe captured the highest market share of 72% in the global market during 2024.

- The tank segment in the barge fleet category generated more than 25% of the revenue share in 2024.

- Among products, the dry cargo segment led the market with the largest share in 2024.

How AI is Transforming Barge Transportation

Smarter Navigation and Scheduling

- AI optimizes travel routes, reducing congestion and improving time management.

- Automated scheduling ensures better coordination and reduces operational delays.

Advanced Cargo Monitoring and Security

- AI-powered tracking systems provide real-time insights into cargo conditions and location.

- Enhanced security measures reduce the risk of cargo loss and damage.

Improved Safety and Risk Management

- AI-driven risk assessment models help prevent accidents by identifying potential hazards.

- Automated safety protocols reduce maintenance costs and enhance compliance with regulations.

Barge Transportation Market: Trends and Growth Prospects

Overview

The barge transportation market is expanding as industries seek efficient and cost-effective freight solutions. Barges offer high cargo capacity and are instrumental in reducing transportation costs for bulk commodities. The industry is evolving with the adoption of digital technologies and regulatory measures promoting low-emission transport solutions.

Market Drivers

Economic expansion and growing trade volumes have fueled the demand for barge transportation. The market benefits from the cost efficiency of waterway transport and its lower environmental impact compared to trucking and rail freight. The increasing movement of commodities such as coal, petroleum, and agricultural goods further accelerates market growth.

Opportunities

Technological advancements, such as automated fleet monitoring and AI-based predictive maintenance, create new opportunities for market players. Investments in inland waterway infrastructure and port modernization in developing regions enhance growth prospects. The transition to sustainable energy sources, such as LNG-powered barges, presents a long-term opportunity for the industry.

Challenges

One of the major challenges in the market is infrastructure constraints, particularly in emerging economies where waterways require significant upgrades. The industry also faces seasonal disruptions due to extreme weather conditions. Moreover, the availability of skilled labor and compliance with evolving maritime regulations remain concerns for operators.

Regional Insights

Europe remains the dominant region in barge transportation, owing to its well-developed network of rivers and canals. The United States continues to see strong demand due to its extensive inland waterways and energy transportation needs. Meanwhile, Asia-Pacific is emerging as a lucrative market with increasing investments in port and river transport infrastructure, particularly in China, India, and Southeast Asia.

Barge Transportation Market Companies

- SEACOR Holdings

- American Commercial Barge Line (ACBL)

- Ingram Marine Group

- Campbell Transportation Company

- Kirby Corporation

- APL Logistics

- Crowley Maritime Corporation

Industry Leader Announcement

- In October 2024, Tobias Martin Bartz, CEO of the Rhenus Group, a leading transportation company in Europe, announced a plan to ramp up operations in India. The company is set to invest about USD 100 million into the country’s inland waterways in 2025. The German company, operating in India in a joint venture with Mumbai-based Western Arya Group, is expected to operate 10 barges on Indian waters to ship cargo.

Recent Developments

- In January 2025, the Inland Waterways Development Council (IWDC), the apex body for policy deliberation on the inland waterways network in India, announced investments of more than Rs 50,000 crore over the next 5 years. The announcements to boost infrastructure along national waterways (NWs) were made at the second meeting of IWDC, organized by the Inland Waterways Authority of India (IWAI), at Kaziranga. They include a series of new initiatives across 21 Inland Waterways, worth more than Rs 1,400 crore.

- In June 2023, Cargill partnered with KOTUG International to deploy Kotug’s zero emission E-Pusher and E-Barges to Cargill’s cocoa factory in Zaandam, the Netherlands. These fully electrified pusher and barges eliminate both emissions and noise pollution.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying on the basis of barge fleet, product, application, and region:

By Barge Fleet

- Covered

- Open

- Tank

By Product

- Liquid Cargo

- Dry Cargo

- Gaseous Cargo

By Application

- Agricultural Products

- Coal & Crude Petroleum

- Metal Ores

- Coke & Refined Petroleum Products

- Food Products

- Secondary Raw Materials & Wastes

- Beverages & Tobacco

- Rubber & Plastic

- Chemicals

- Nuclear Fuel

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/