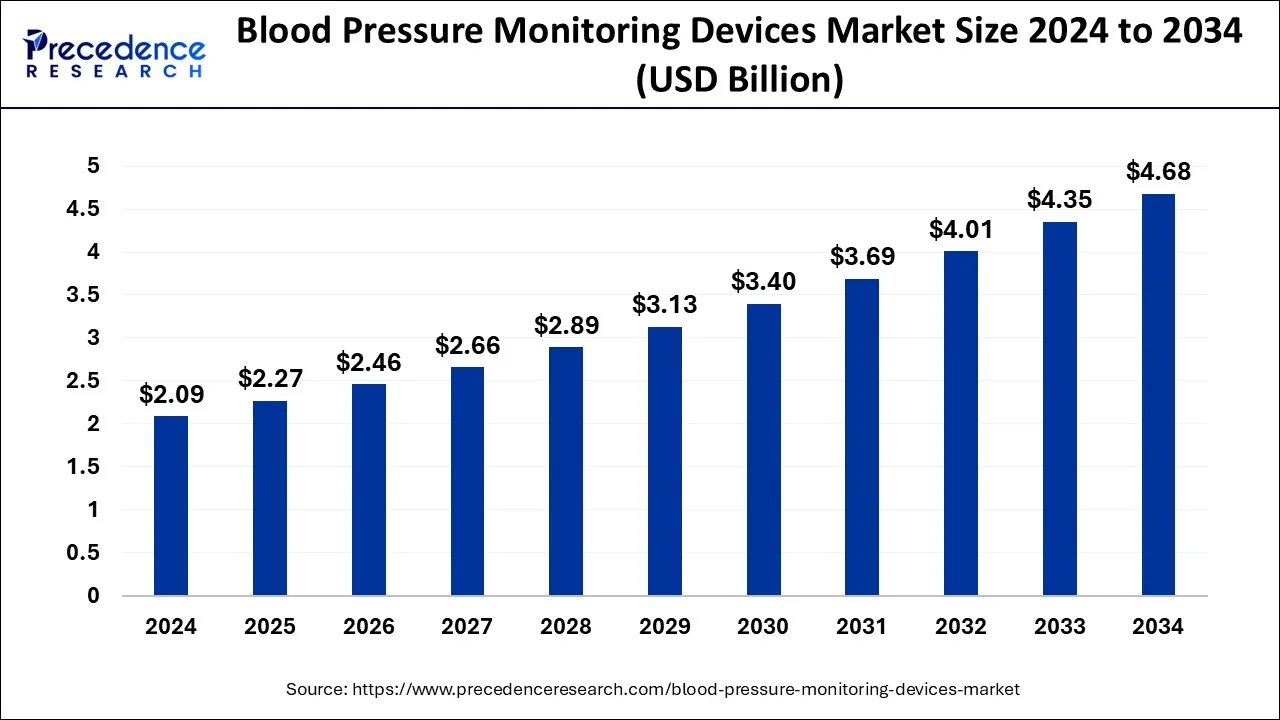

The blood pressure monitoring devices market size is predicted to cross around USD 4.35 billion by 2034 from USD 2.09 billion in 2024 with a notable CAGR of 8.49%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1090

Key Points

- North America emerged as the leading region in the global market, holding a 37.44% share in 2024.

- The digital blood pressure monitor segment recorded the largest market share of 35.80% by product type.

- Among end-users, hospitals held the highest share, contributing 59.34% to total market revenue.

Market Dynamics

Blood Pressure Monitoring Devices Market Drivers

The rising prevalence of hypertension and cardiovascular diseases is a major driver of the blood pressure monitoring devices market. As sedentary lifestyles, poor dietary habits, and stress levels increase, so does the demand for regular blood pressure monitoring.

Additionally, the growing awareness regarding preventive healthcare and the importance of early diagnosis has led to a surge in the adoption of home-based blood pressure monitors. Technological advancements, such as digital and wearable blood pressure monitors with Bluetooth connectivity and smartphone integration, are further fueling market growth.

Blood Pressure Monitoring Devices Market Opportunities

The increasing adoption of telemedicine and remote patient monitoring presents significant opportunities for the market. With the rise in digital health solutions, healthcare providers and patients are increasingly relying on connected blood pressure monitors for real-time data tracking.

Moreover, the expansion of healthcare infrastructure in emerging economies, coupled with government initiatives to promote awareness and access to diagnostic devices, creates growth potential. The demand for portable, wearable, and user-friendly monitoring devices is also on the rise, paving the way for innovation in the sector.

Blood Pressure Monitoring Devices Market Challenges

One of the key challenges in the blood pressure monitoring devices market is the high cost of advanced monitoring equipment, which limits accessibility, particularly in low-income regions. Additionally, accuracy concerns with some home-use and wrist-based monitors pose a reliability issue, leading to hesitancy among healthcare professionals.

Regulatory hurdles and stringent approval processes for new medical devices also add complexity to market entry. Furthermore, the availability of counterfeit and low-quality products remains a challenge, impacting consumer trust.

Blood Pressure Monitoring Devices Market Regional Analysis

North America leads the global blood pressure monitoring devices market due to the high prevalence of hypertension, well-established healthcare infrastructure, and increasing adoption of advanced medical technologies. Europe follows closely, driven by government initiatives and rising awareness about cardiovascular health.

The Asia Pacific region is expected to experience rapid growth, fueled by expanding healthcare facilities, rising disposable incomes, and increasing focus on preventive care. Meanwhile, Latin America and the Middle East & Africa are witnessing steady market expansion due to improving healthcare accessibility and growing awareness of lifestyle diseases.

Blood Pressure Monitoring Devices Market Companies

- Koninklijke Philips N.V.

- General Electric Company

- A & D Company, Limited

- SunTech Medical, Inc.

- Welch Allyn

- American Diagnostic Corporation

- Briggs Healthcare

- Withings

- Spacelabs Healthcare

- GF HEALTH PRODUCTS, INC.

- Kaz, A Helen of Troy Company

- Rossmax International Limited

- Microlife Corporation

Recent Developments

- In December 2024, Withings’ BPM Pro 2, a cellular blood pressure monitor designed to enhance remote patient care for those with heart failure, has received approval from the U.S. Food and Drug Administration (FDA). The gadget was first introduced in October and went on sale in the United States on January 1 2025.

- In November 2024, in a move that marks the company’s first market expansion outside of Europe, Aktiia’s continuous blood pressure monitoring (CBPM) wristband was approved by Health Canada and introduced there

Segments Covered in the Report

By Product

- Digital Blood Pressure Monitor

- Wrist

- Arm

- Finger

- Sphygmomanometer

- Ambulatory Blood Pressure Monitor

- Instruments & Accessories

- Blood pressure cuffs

- Reusable

- Disposable

- Others

- Blood pressure cuffs

- Transducers

- Reusable

- Disposable

By End-User

- Ambulatory Surgical Centers & Clinics

- Hospitals

- Home Healthcare

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/