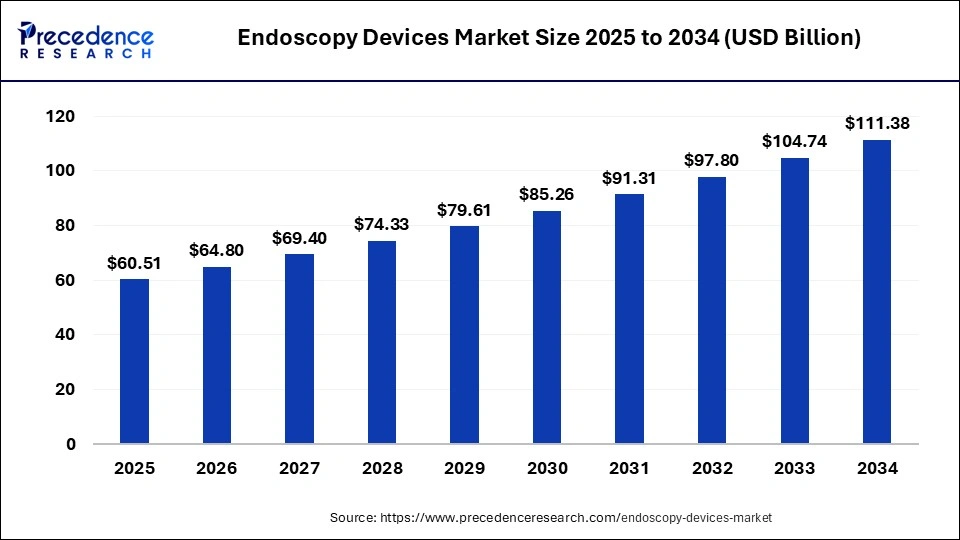

The global endoscopy devices market size was calculated at USD 56.50 billion in 2024 and is projected to attain around USD 111.38 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1095

Key Points

- In 2024, endoscopy visualization systems held a 37% share of total market revenue.

- Hospitals emerged as the dominant end user, capturing a 48% revenue share.

- Gastrointestinal (GI) endoscopy led in application-based revenue, securing 55.2% of the market in 2024.

- The urology endoscopy application segment is witnessing rapid growth.

- North America accounted for approximately 43% of the global market revenue in 2024.

- The Asia Pacific region is projected to grow at a 6.9% CAGR between 2025 and 2034.

Market Dynamics

Drivers

The increasing preference for minimally invasive procedures is a primary driver of the endoscopy devices market. Patients and healthcare providers are opting for endoscopic procedures due to reduced post-operative complications, faster recovery times, and minimal scarring.

The rising burden of cancer, gastrointestinal disorders, and obesity-related diseases has further increased the need for effective diagnostic and therapeutic tools. Advancements in endoscopic imaging, such as narrow-band imaging (NBI) and fluorescence endoscopy, have also enhanced early disease detection and treatment outcomes.

Opportunities

The integration of digital technologies in endoscopy, including AI-powered diagnostics and cloud-based image storage, presents significant growth opportunities. The increasing demand for single-use endoscopes, which reduce the risk of cross-contamination, is another emerging trend in the market.

Additionally, the expansion of ambulatory surgical centers (ASCs) and outpatient clinics, which offer cost-effective alternatives to hospital-based procedures, is expected to drive market growth. Expanding medical tourism in countries like India, Thailand, and Mexico further supports the adoption of advanced endoscopy devices.

Challenges

The shortage of skilled endoscopists and the need for specialized training pose challenges to market expansion. Performing endoscopic procedures requires expertise, and a lack of trained professionals in certain regions may limit adoption.

Additionally, concerns over patient safety and the risk of device-related complications, such as perforations and infections, necessitate stringent regulatory compliance. The high cost of robotic and AI-assisted endoscopic systems remains a barrier, particularly for small and mid-sized healthcare facilities.

Regional Insights

North America dominates the endoscopy devices market due to strong healthcare infrastructure, rapid technological advancements, and high adoption rates of innovative medical devices. Europe follows as a key market, supported by growing awareness of preventive healthcare and government initiatives promoting early disease detection.

Asia Pacific is emerging as a fast-growing region due to increasing investments in healthcare, expanding middle-class populations, and rising disposable income. Latin America and the Middle East are gradually advancing their healthcare systems, leading to increased demand for modern endoscopic procedures.

Endoscopy Devices Market Companies

- Ethicon Endo-Surgery, LLC

- Olympus Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Smith & Nephew Inc.

- Karl Storz GmbH & Co. KG

- Richard Wolf GmbH

- PENTAX Medical

- Medtronic Plc (Covidien)

- Machida Endoscope Co., Ltd.

Segments Covered in the Report

By Product

- Endoscopes

- Flexible Endoscopes

- Colonoscopes

- Upper Gastrointestinal Endoscopes

- Sigmoidoscopes

- Bronchoscopes

- Pharyngoscopes

- Laryngoscopes

- Nasopharyngoscopes

- Duodenoscopes

- Rhinoscopes

- Other Flexible Endoscopes

- Rigid Endoscopes

- Arthroscopes

- Laparoscopes

- Cystoscopes

- Urology Endoscopes

- Neuroendoscopes

- Gynecology Endoscopes

- Other Rigid Endoscopes

- Disposable Endoscopes

- Capsule Endoscopes

- Robot Assisted Endoscope

- Flexible Endoscopes

- Endoscopy Visualization Systems

- High Definition (HD) Visualization Systems

- 3D Systems

- 2D Systems

- Standard Definition (SD) Visualization Systems

- 3D Systems

- 2D Systems

- Ultrasound Devices

- High Definition (HD) Visualization Systems

- Endoscopy Visualization Components

- Insufflators

- Camera Heads

- High-definition Monitors

- Light Sources

- Video Processors

- Suction Pumps

- Operative Devices

- Access Devices

- Energy Systems

- Hand Instruments

- Suction & Irrigation Systems

- Snares

- Wound Retractors

By Application

- Urology Endoscopy

- Gastrointestinal (GI) Endoscopy

- Obstetrics Endoscopy

- Laryngoscopy

- Laparoscopy

- Bronchoscopy

- Arthroscopy

- Otoscopy

- Mediastinoscopy

- Other Applications

By Hygiene

- Single-Use

- Reprocessing

- Sterilization

By End-Use

- Ambulatory Surgical Centers

- Hospitals

- Other End-uses

By Regiona

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/