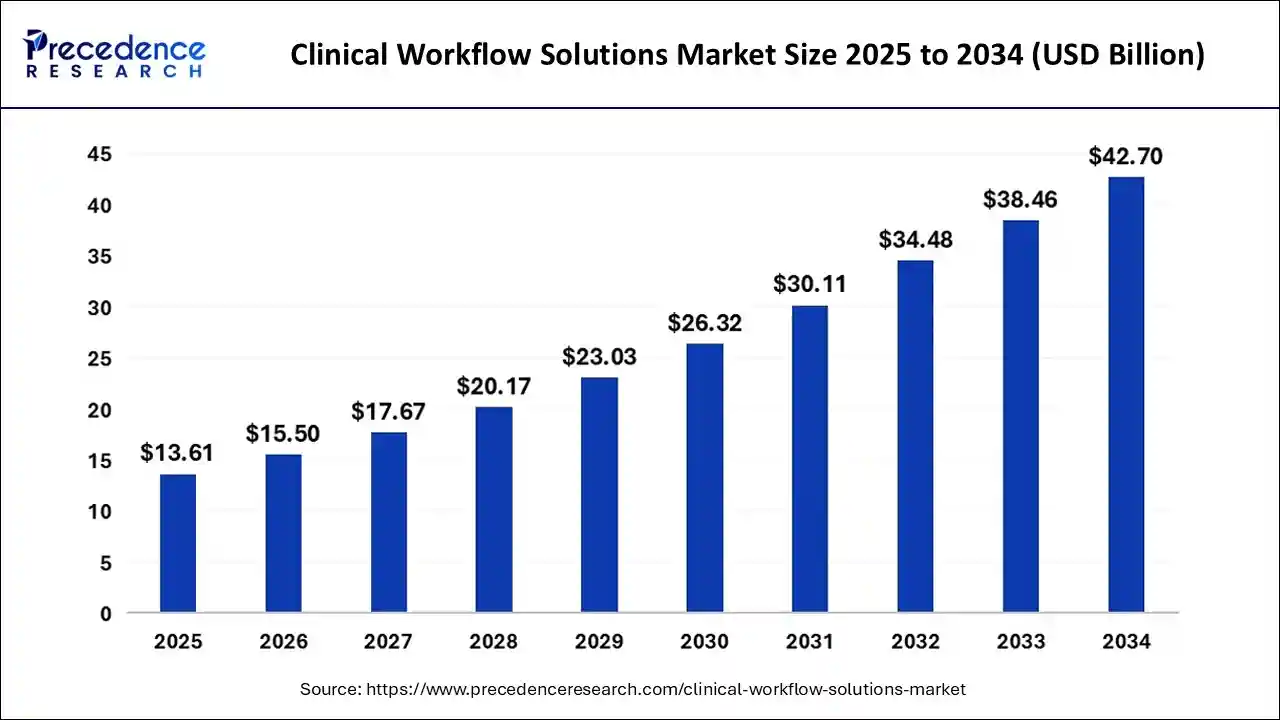

The global clinical workflow solutions market size is expected to attain around USD 42.7 billion by 2034 from USD 11.96 billion in 2024, with a CAGR of 13.57%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1104

Key Points

- North America maintained its market leadership in 2024, contributing over 41.55% of total revenue.

- Data integration solutions remained the top-performing segment by type, securing a 26.4% revenue share.

- Hospitals held the largest market share among end-users, reaching 46% in 2024.

Market Dynamics

Drivers

The growing need for improved clinical efficiency and patient-centered care is driving the adoption of clinical workflow solutions. Healthcare providers are facing increasing pressure to manage large volumes of patient data while ensuring accuracy and compliance with regulations.

The shift toward value-based care models has further fueled demand for workflow automation to optimize healthcare delivery. Additionally, the rise in healthcare consolidation, including mergers and acquisitions of hospitals and clinics, has increased the need for standardized workflow management solutions.

Opportunities

Cloud-based clinical workflow solutions are opening new opportunities for scalability and cost efficiency. Cloud platforms enable real-time data access, remote collaboration, and seamless integration with other healthcare systems.

The rising adoption of mobile health (mHealth) applications and wearable devices also presents opportunities for workflow optimization by enabling continuous patient monitoring and real-time data exchange. Furthermore, the expansion of personalized medicine and precision healthcare is increasing demand for advanced workflow solutions tailored to specific medical needs.

Challenges

One of the key challenges in implementing clinical workflow solutions is the complexity of integrating them with existing healthcare IT infrastructure. Many healthcare organizations use legacy systems that are not easily compatible with modern workflow solutions, leading to implementation delays.

Additionally, concerns over cybersecurity threats and data breaches can discourage healthcare providers from fully adopting digital solutions. The lack of skilled IT professionals in healthcare settings also hinders smooth deployment and management of workflow automation tools.

Regional Analysis

North America continues to lead the clinical workflow solutions market due to strong government support for healthcare digitization and the high prevalence of chronic diseases requiring efficient care management. Europe is also experiencing steady growth, driven by regulatory mandates and increasing investments in digital health initiatives.

The Asia-Pacific region is witnessing rapid expansion, supported by rising healthcare spending, growing patient populations, and advancements in technology. Latin America and the Middle East & Africa are gradually adopting clinical workflow solutions, with a focus on improving healthcare accessibility and efficiency.

Clinical Workflow Solutions Market Companies

- Cerner Corporation

- Allscripts Healthcare Solutions, Inc.

- NXGN Management, LLC

- Koninklijke Philips N.V.

- McKesson Corporation

- Hill-Rom Services Inc.

- General Electric

- Cisco

- Stanly Healthcare

- ASCOM

- Vocera Communications

- athenahealth, Inc.

Latest Announcements

- In March 2024, Royal Philips collaborated with Amazon Web Services (AWS) to address the growing need for secure, scalable digital pathology solutions in the cloud. Tehsin Syed, GM of Health AI at Amazon Web Services, said, “Healthcare organizations benefit when clinical workflow leadership is combined with scalable cloud infrastructure. By building cloud-native enterprise pathology solutions on services like AWS Health Imaging and Amazon Bedrock, Philips is offering their customers the best of both worlds.”

Recent Developments

- In December 2024, the All India Institute of Medical Sciences (AIIMS) signed a MoU (Memorandum of Understanding) with Wipro GE Healthcare. Under this MoU, Wipro GE Healthcare will focus on the development of intelligent systems and workflow solutions tailored to the identified areas in healthcare.

- In October 2024, Emtelligent, a leading company engaged in the development of clinical-grade medical AI software, announced the launch of its emtelligent Clinical Workflow. This AI-driven clinical review tool transforms the way healthcare professionals review medical records.

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2025 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis oftype, end-use, and region:

By Type

- Real-Time Communication Solutions

- Unified Communication

- Nurse Call Alert Systems

- Data Integration Solutions

- Medical Image Integration

- EMR Integration

- Workflow Automation Solutions

- Nursing & Staff Scheduling Solutions

- Patient Flow Management Solutions

- Enterprise Reporting & Analytics Solutions

- Care Collaboration Solutions

- Rounding Solutions

- Perinatal Care Management

- Medication Administration

- Other Care Collaboration Solutions

By End-User

- Ambulatory Care Centers

- Long-term Care Facilities

- Hospitals

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/