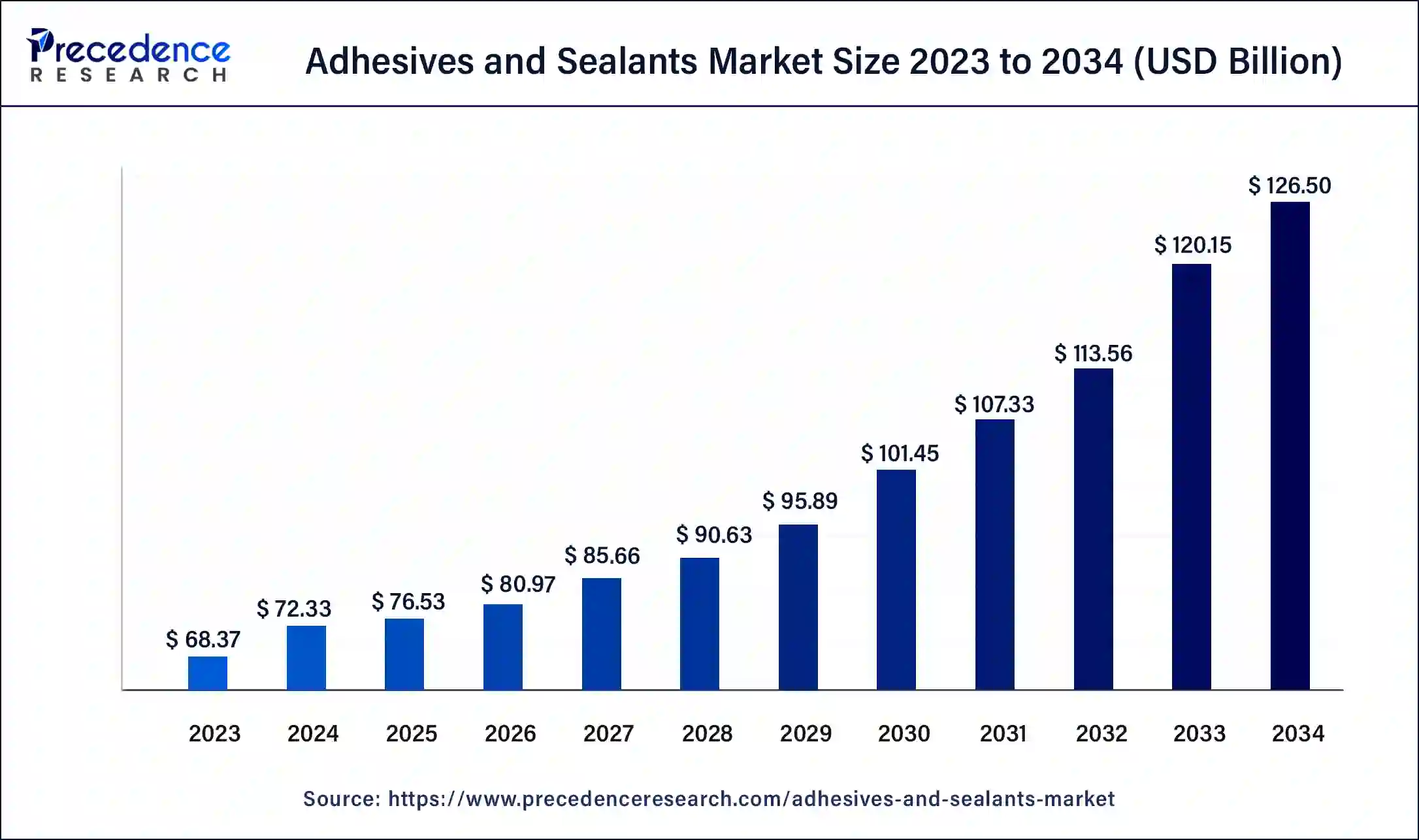

The adhesives and sealants market size accounted for USD 72.33 billion in 2024 and it is projected to cross around USD 126.50 billion by 2034, at a CAGR of 5.7%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1141

Key Points

- Asia Pacific dominated the market in 2023, capturing a 38% revenue share.

- The reactive & others technology segment was the largest, holding 48.4% of the market.

- Among products, the silicones segment led with a 31.5% share.

- The paper & packaging sector generated 30% of the total market revenue.

How AI is Reshaping the Adhesives and Sealants Industry

The integration of AI in the adhesives and sealants market is enabling smarter material development, predictive maintenance, and sustainable production. AI-driven simulations and testing accelerate the creation of next-generation adhesives with improved durability and eco-friendly compositions.

Predictive maintenance powered by AI helps manufacturers minimize downtime and optimize production lines, leading to cost savings and higher efficiency.

Market Dynamics and Future Insights for the Adhesives and Sealants Market

Market Dynamics

- Growing Demand Across Industries: The adhesives and sealants market is witnessing significant growth due to rising demand from industries such as construction, automotive, packaging, electronics, and healthcare. The increasing use of lightweight and high-performance bonding solutions is driving market expansion.

- Technological Advancements: Innovations in adhesive formulations, such as bio-based and smart adhesives, are enhancing performance, durability, and environmental sustainability. AI and automation are optimizing manufacturing processes and product development.

- Stringent Environmental Regulations: Governments worldwide are imposing regulations to reduce VOC emissions, pushing manufacturers to develop eco-friendly, water-based, and solvent-free adhesives and sealants.

- Supply Chain Challenges: Fluctuations in raw material prices and supply chain disruptions impact market stability. Companies are adopting alternative sourcing strategies and sustainable raw materials to mitigate risks.

Future Insights

- Sustainability and Green Adhesives: The future of the market lies in the development of bio-based and biodegradable adhesives, driven by increasing environmental concerns and regulatory requirements.

- AI and Smart Adhesives: AI-powered research will lead to the creation of self-healing, temperature-responsive, and high-strength adhesives, improving efficiency and durability in industrial applications.

- Expansion in Emerging Markets: Rapid industrialization in Asia-Pacific, Latin America, and the Middle East is expected to fuel demand for adhesives and sealants, creating new growth opportunities.

- 3D Printing Integration: The rise of 3D printing technology will boost the demand for advanced adhesives tailored for additive manufacturing applications.

- Customization and Performance Enhancements: Future innovations will focus on developing high-performance adhesives with improved bonding strength, flexibility, and resistance to extreme conditions, catering to specialized industry needs.

Also Read: https://www.expresswebwire.com/data-center-cooling-market/

Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 68.37 Billion |

| Market Size in 2024 | USD 72.33 Billion |

| Market Size by 2034 | USD 120.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, and By Application |

Adhesives and Sealants Market Companies

- B. Fuller Company

- 3M Company

- Avery Dennison Corporation

- Dow Chemical Company

- Bostik SA

- BASF AG

- Uniseal Inc

- ND Industries Inc.

- Beardow & Adams Adhesives Inc.

- Ashland Inc.

- Momentive Specialty Chemicals Inc.

- Eastman Chemical Company

- Sika AG

Recent Developments in the Adhesives and Sealants Market

-

Evonik’s Strategic Restructuring: In October 2024, Evonik announced plans to streamline its adhesives and healthcare units to focus on core assets. This restructuring involves divesting certain operations, including its polyester business and a production line for keto acids in Hanau, affecting approximately 260 employees. The initiative aims to enhance efficiency and concentrate on high-growth areas within the company’s portfolio.

-

Pidilite Industries’ Financial Performance: India’s Pidilite Industries reported an 18.8% increase in consolidated net profit for the second quarter of 2024, reaching approximately $63.7 million. This growth is attributed to a modest rise in input costs, notably an 11% decrease in the price of vinyl acetate monomer, a key raw material for adhesives. The company’s revenue rose by 5.2%, with significant contributions from both consumer and business segments.

-

Henkel’s Expansion of Adhesive Technologies: In May 2024, Henkel inaugurated a 70,000-square-foot Adhesive Technologies Technology Center in Bridgewater, New Jersey, USA. This facility is dedicated to developing sustainable adhesive solutions, underscoring Henkel’s commitment to innovation and sustainability in the adhesives sector.

-

APPLIED Adhesives’ Acquisition: In 2021, APPLIED Adhesives, a U.S.-based manufacturer and distributor of adhesives, acquired American Chemical, a regional adhesive supplier. This strategic move aims to strengthen APPLIED Adhesives’ market presence and enhance technical support capabilities in the region.

Segments Covered in the Report

By Adhesives Product

- PVA

- Epoxy

- Acrylic

- Styrenic block

- Polyurethanes

- EVA

- Others

By Adhesives Technology

- Solvent based

- Water based

- Hot melt

- Reactive & Other

By Adhesives Application

- Packaging

- Pressure Sensitive Applications

- Furniture

- Construction

- Footwear

- Automotive

- Others

By Sealants Product

- Polyurethane [PU]

- Silicone

- Acrylic

- Polyvinyl Acetate [PVA]

- Others

By Sealants Application

- Automotive

- Construction

- Assembly

- Packaging

- Consumers

- Pressure Sensitive Tapes

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/