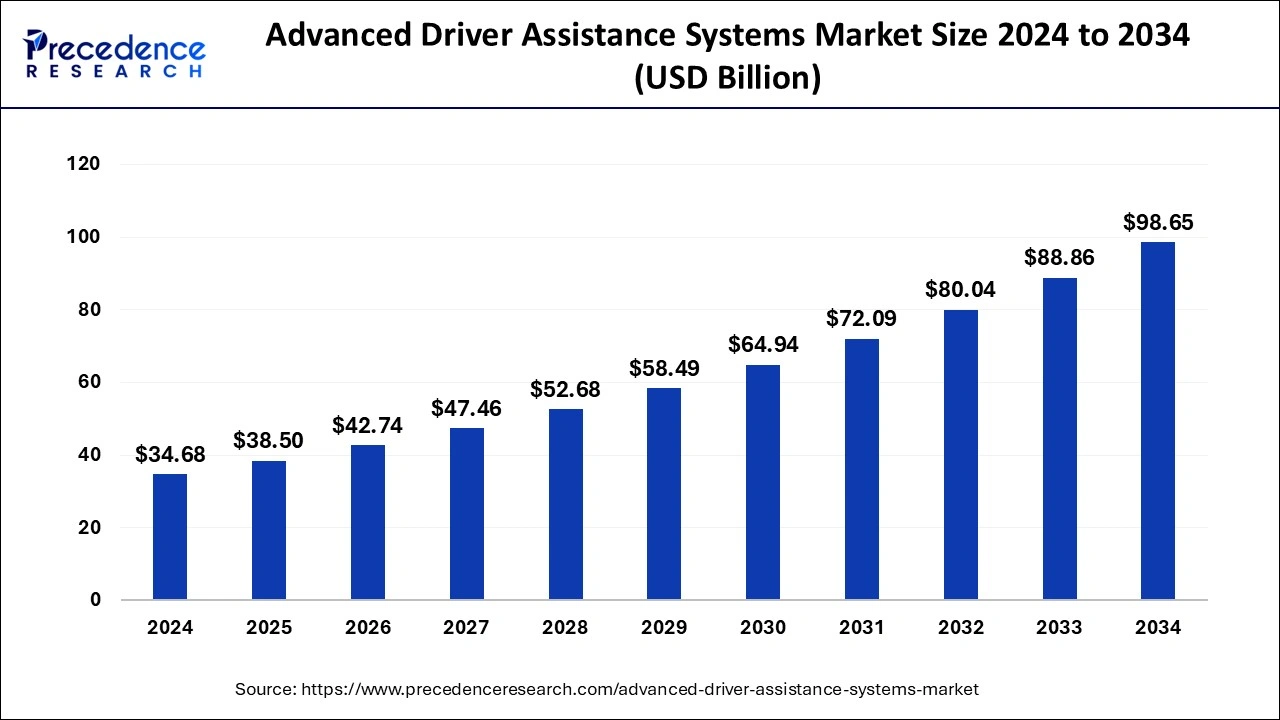

The advanced driver assistance systems (ADAS) market size is predicted to attain USD 98.65 billion by 2034 from USD 34.68 billion by 2034 with a CAGR of 11.02%.

Get Sample Copy of Report @ https://www.precedenceresearch.com/sample/1007

Market Key Takeaways

- LiDAR sensors dominated the ADAS market in 2024 in terms of component type.

- The software segment is projected to grow at a strong CAGR from 2025 to 2034.

- The commercial car segment is expanding at a 17.3% CAGR, driving demand for ADAS solutions.

- Tire pressure monitoring systems secured 20.7% of the market share in 2024.

- Autonomous emergency braking systems are set to grow at a 21.5% CAGR throughout the forecast period.

Market Overview

The Advanced Driver Assistance Systems (ADAS) market is rapidly growing, driven by increasing safety regulations and technological innovations. ADAS features, including lane departure warning, adaptive cruise control, and collision avoidance, enhance driving safety and convenience. Automakers are integrating AI-driven solutions to improve accuracy, reliability, and efficiency, leading to widespread adoption across various vehicle segments.

Market Drivers

Regulatory mandates, rising road accidents, and growing consumer demand for vehicle safety are key market drivers. Technological advancements in sensor fusion, AI, and autonomous driving are further accelerating adoption. Additionally, the growing electric and autonomous vehicle market is increasing reliance on ADAS solutions.

Market Opportunities

- AI-powered V2X communication is transforming connected vehicle safety.

- Expansion of semi-autonomous and fully autonomous vehicles is creating new revenue streams.

- Emerging markets are rapidly adopting ADAS due to rising consumer awareness and safety regulations.

Market Challenges

- High system costs and integration complexities hinder widespread adoption.

- Cybersecurity risks pose challenges to ADAS implementation.

- Regulatory inconsistencies across different regions slow down global market penetration.

Regional Insights

- North America & Europe: Leading due to strict safety mandates and high consumer adoption.

- Asia-Pacific: Fastest-growing market, led by China, Japan, and South Korea.

- Latin America & Middle East: Gradual adoption driven by government road safety initiatives

Advanced Driver Assistance Systems (ADAS) Companies

- Denso

- Aptiv

- Robert Bosch GmbH

- Continental AG

- Magna International

- Veoneer

- Hyundai Mobis

- ZF Friedrichshafen

- Valeo

- NVIDIA

- Intel

- Microsemi Corporation

- Nidec Corporation

- Hella

- Texas Instruments

- Infineon Technologies AG

- Hitachi Automotive

- Renesas Electronics Corporation

Recent developments

- In November 2024, Wipro Limited, a leading technology services and consulting firm, worked with FORVIA (FRVIA), the world’s seventh-largest automotive technology supplier, to optimize FORVIA’s Advanced Driver Assistance Systems (ADAS) application set.

- In June 2023. With the Smart Cockpit HPC, Continental presents a high-performance computer (HPC) that provides ideally adapted system performance for a pre-integrated set of vehicle functions.

Segments Covered in the Report

By System Type

- Intelligent Park Assist (IPA)

- Lane Departure Warning (LDW)

- Road Sign Recognition (RSR)

- Tire Pressure Monitoring System (TPMS)

- Night Vision System (NVS)

- Automatic Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Adaptive Front Light (AFL)

- Blind Spot Detection (BSD)

- Cross Traffic Alert (CTA)

- Driver Monitoring System (DMS)

- Forward Collision Warning (FCW)

- Others

By Sensor Type

- Image Sensors

- Ultrasonic Sensors

- LiDAR

- Radar Sensors

- Infrared (IR) Sensors

- Laser Sensors

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

By Level of Autonomy

- L1

- L2

- L3

- L4

- L5

By Electric Vehicle

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/