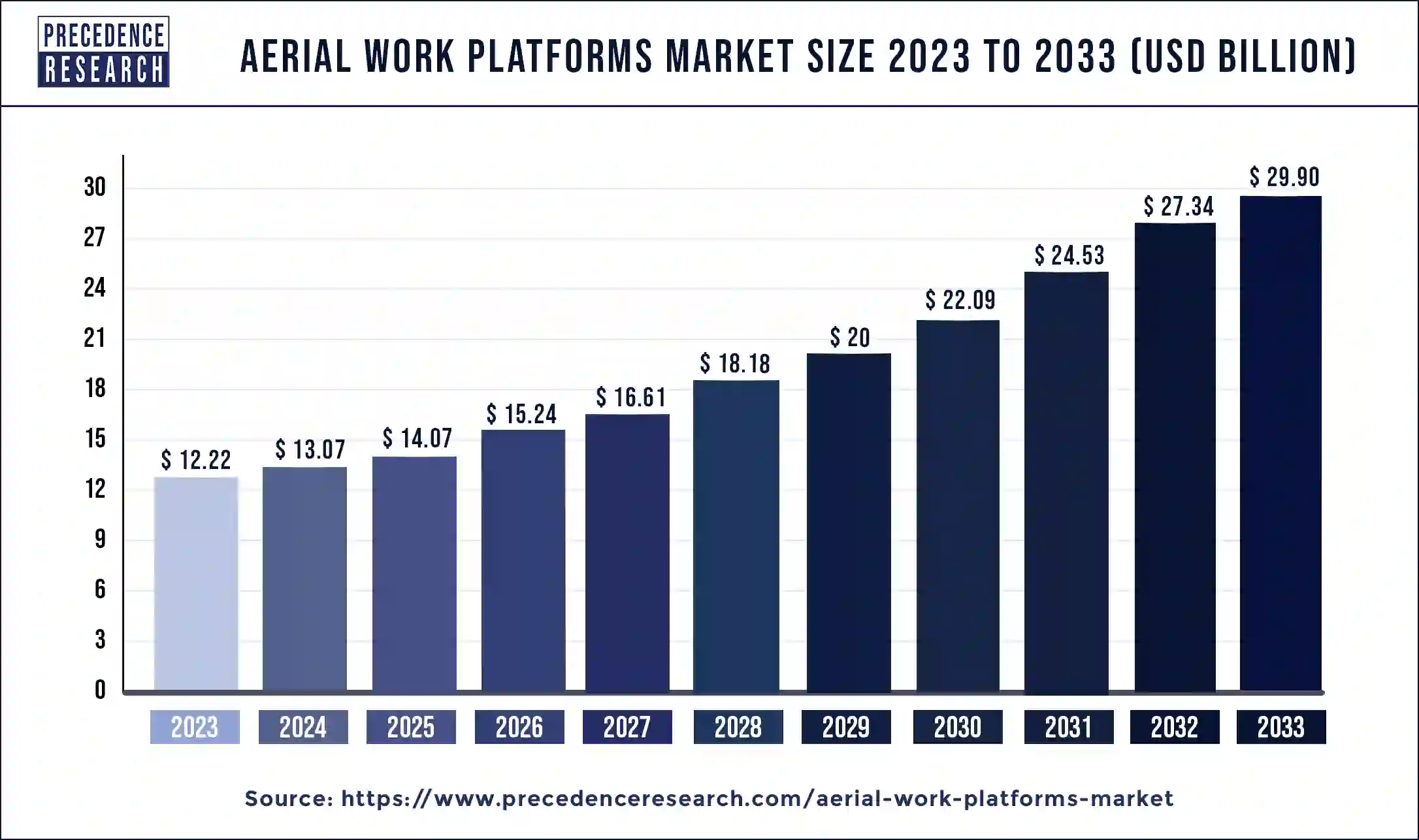

The aerial work platforms market size was valued at USD 12.22 billion in 2023 and is projected to be cross around USD 29.90 billion by 2033, at a CAGR of 9.3%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1083

Key Takeaway

- North America dominated the market in 2023, securing a 38.13% share of total revenue.

- Asia Pacific is anticipated to experience the highest growth rate over the forecast period.

- The construction segment was the top end-user, holding a 45.53% market share in 2023.

- The internal combustion engine segment led in propulsion type, with an 83.20% market share in 2023.

- The scissor lift segment accounted for more than 49.28% of market revenue in 2023.

Key Types of Aerial Work Platforms

-

Scissor Lifts: Scissor lifts are the most common type of AWP, known for their vertical movement and wide platform area. They are ideal for tasks that require a steady, stable platform, such as electrical work, maintenance, and warehousing.

-

Boom Lifts: Boom lifts feature extendable arms, which can move vertically and horizontally, allowing operators to access hard-to-reach areas. These lifts are available in two main types: articulating boom lifts, which have joints for flexibility, and telescoping boom lifts, which extend in a straight line.

-

Vertical Mast Lifts: These lifts are compact, lightweight, and easy to maneuver, making them perfect for indoor applications. They offer vertical movement and are often used in warehouses, retail spaces, and for maintenance work.

-

Push-Around Lifts: Push-around lifts are a cost-effective and compact solution for accessing elevated areas in tight spaces. While they do not have an onboard power source and require manual pushing, they are still widely used in indoor environments.

Key Market Drivers

Several factors contribute to the growing demand for AWPs across industries. Some of the most significant drivers include:

1. Safety Regulations and Standards

Safety has always been a priority in industries where workers are required to operate at height. Governments and regulatory bodies worldwide have implemented stringent safety standards to reduce workplace injuries and fatalities. AWPs are seen as a safer alternative to traditional methods like scaffolding and ladders, as they offer stability and secure platforms. As safety regulations become stricter, the demand for AWPs is expected to rise.

2. Technological Advancements

The development of more advanced and efficient AWP models has significantly enhanced the functionality of these platforms. Features such as enhanced battery technology, remote operation, and improved lifting capacities have made AWPs more versatile and user-friendly. These technological advancements allow companies to use AWPs in a broader range of applications, from simple tasks to highly specialized operations.

3. Construction and Infrastructure Development

The growth of the construction industry is a major driver of AWP demand. As infrastructure projects expand, particularly in developing regions, there is an increased need for equipment that allows workers to perform tasks at elevated heights with safety and efficiency. AWPs are essential for various construction processes, such as building facades, installing HVAC systems, and working on electrical lines.

4. Aging Infrastructure and Renovation Projects

With the aging infrastructure in many parts of the world, renovation and maintenance projects are on the rise. AWPs play a key role in repairing and refurbishing high-rise buildings, bridges, and other infrastructure, driving the demand for these platforms in the maintenance sector.

5. Urbanization and Industrialization

As urbanization continues to expand globally, the need for AWPs in sectors such as telecommunications, utility maintenance, and urban development grows. In densely populated urban areas, AWPs provide a more efficient and safer alternative to traditional methods for reaching elevated workspaces.

Market Restraints

While AWPs offer a range of benefits, there are also challenges and restraints that can hinder their widespread adoption:

1. High Initial Investment

One of the primary barriers to the widespread use of AWPs, particularly in small and medium-sized enterprises (SMEs), is the high initial cost. Purchasing an AWP requires a significant investment, which may not be feasible for smaller businesses. Furthermore, the cost of maintenance, insurance, and training adds to the overall expenses, making it an expensive option for many companies.

2. Lack of Skilled Operators

Despite the fact that AWPs are relatively easy to operate, the need for qualified and skilled operators remains a critical factor. In many regions, there is a shortage of trained professionals who can operate AWPs safely and effectively. This lack of skilled labor can limit the adoption and usage of AWPs in some industries.

3. Regulatory Challenges

The stringent safety regulations surrounding the use of AWPs can be both a benefit and a hindrance. While these regulations are intended to protect workers, they can also result in additional compliance costs and delays for companies. For example, regular inspections, maintenance checks, and certification requirements can add to the operational costs of AWPs.

4. Limited Terrain Capabilities

While many AWPs are designed to handle a range of terrain conditions, there are limitations. Scissor lifts and boom lifts, for instance, may struggle on uneven surfaces or in outdoor environments with rough terrain. This can restrict their use in certain applications, particularly in industries like agriculture and mining where terrain variability is common.

Opportunities in the AWP Market

Despite the challenges, there are several emerging opportunities within the AWP market that could drive further growth:

1. Electric and Hybrid Models

As the demand for sustainability grows, electric and hybrid aerial work platforms are gaining popularity. These platforms are more environmentally friendly, producing fewer emissions and less noise compared to their diesel-powered counterparts. The growing push for green construction practices and environmentally responsible equipment is expected to fuel the adoption of electric AWPs.

2. Rental Market Growth

One of the most significant opportunities in the AWP market is the growing trend toward equipment rental. Many construction and maintenance companies prefer to rent AWPs rather than purchase them outright due to the high capital cost and maintenance requirements. This trend is particularly prevalent in regions with fluctuating demand for AWPs. Rental companies provide a cost-effective solution for short-term or project-based needs.

3. Integration with IoT and Smart Technologies

The integration of Internet of Things (IoT) technology and other smart features into AWPs opens up new opportunities for improving efficiency and safety. Smart sensors, GPS tracking, and real-time data analytics can help monitor AWP usage, track maintenance schedules, and enhance operational efficiency. These innovations provide an opportunity for manufacturers to offer more advanced and connected products, enhancing their competitive edge.

4. Growing Demand for AWPs in Emerging Markets

The increasing pace of industrialization in emerging markets, particularly in Asia-Pacific, Latin America, and Africa, presents a significant opportunity for AWP manufacturers. These regions are investing heavily in infrastructure, construction, and urban development projects, which will drive demand for AWPs in the coming years.

5. Automation and Remote Operation

The development of autonomous aerial work platforms and remote operation capabilities could revolutionize the industry. Operators can control AWPs from a distance, reducing the need for on-site personnel and further enhancing safety and productivity.

Challenges in the AWP Market

The AWP market, like any industry, faces its own set of challenges:

1. Technological Barriers

Despite significant advancements, the technology used in AWPs must continue to evolve to meet the growing demands of the market. Features such as increased lifting capacity, enhanced battery life, and advanced safety features are still in the developmental phase and can be expensive to implement.

2. Competition and Market Saturation

With the increasing popularity of AWPs, the market has become highly competitive. Several players are vying for market share, leading to price wars and potentially reduced profit margins for manufacturers. Companies must differentiate themselves through innovation, customer service, and product quality to maintain a competitive edge.

3. Logistics and Supply Chain Issues

The global nature of the AWP market means that logistics and supply chain issues can disrupt the availability of key components and finished products. The COVID-19 pandemic highlighted vulnerabilities in the global supply chain, and the ongoing challenge of ensuring smooth and timely delivery of AWPs remains a significant concern for manufacturers and suppliers.

4. Maintenance and Downtime

While AWPs are designed to be durable and reliable, regular maintenance is essential to ensure safe operation. Unforeseen maintenance issues can lead to extended downtime, impacting productivity and increasing operational costs. The availability of spare parts and the cost of repairs are also crucial factors in minimizing downtime.

Aerial Work Platforms Market Companies

- CTE

- Aichi Corporation

- Haulotte Group

- Dinolift OY

- Hunan Runshare Heavy Industry Company, Ltd.

- Zhejiang Dingli Machinery Co, Ltd.

- Holland Lift International bv

- JLG Industries

- Hunan Sinoboom Heavy Industry Co. Ltd.

- Niftylift Limited

- Manitou Group

- Snorkel

- Skyjack

- Tadano Limited

- SocageSrl

- Teupen

- Genie

Segments Covered in the Report

By End-User

- Construction

- Maintenance and Cleaning

- Logistics and Transportation

- Manufacturing

- Aerospace and Defense

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Powered

By Platform Working Height

- Below 10 meters

- 10-20 Meters

- 20-30 Meters

- Above 30 Meters

By Type

- Boom Lift

- Articulating Boom Lift

- Telescopic Boom Lift

- Cherry Pickers

- Scissor Lift

- Electric Scissor Lifts

- Rough Terrain Scissor Lifts

- Pneumatic Scissor Lifts

- Atrium Lift

- Z-style Atrium Lift

- S-style Atrium Lift

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/