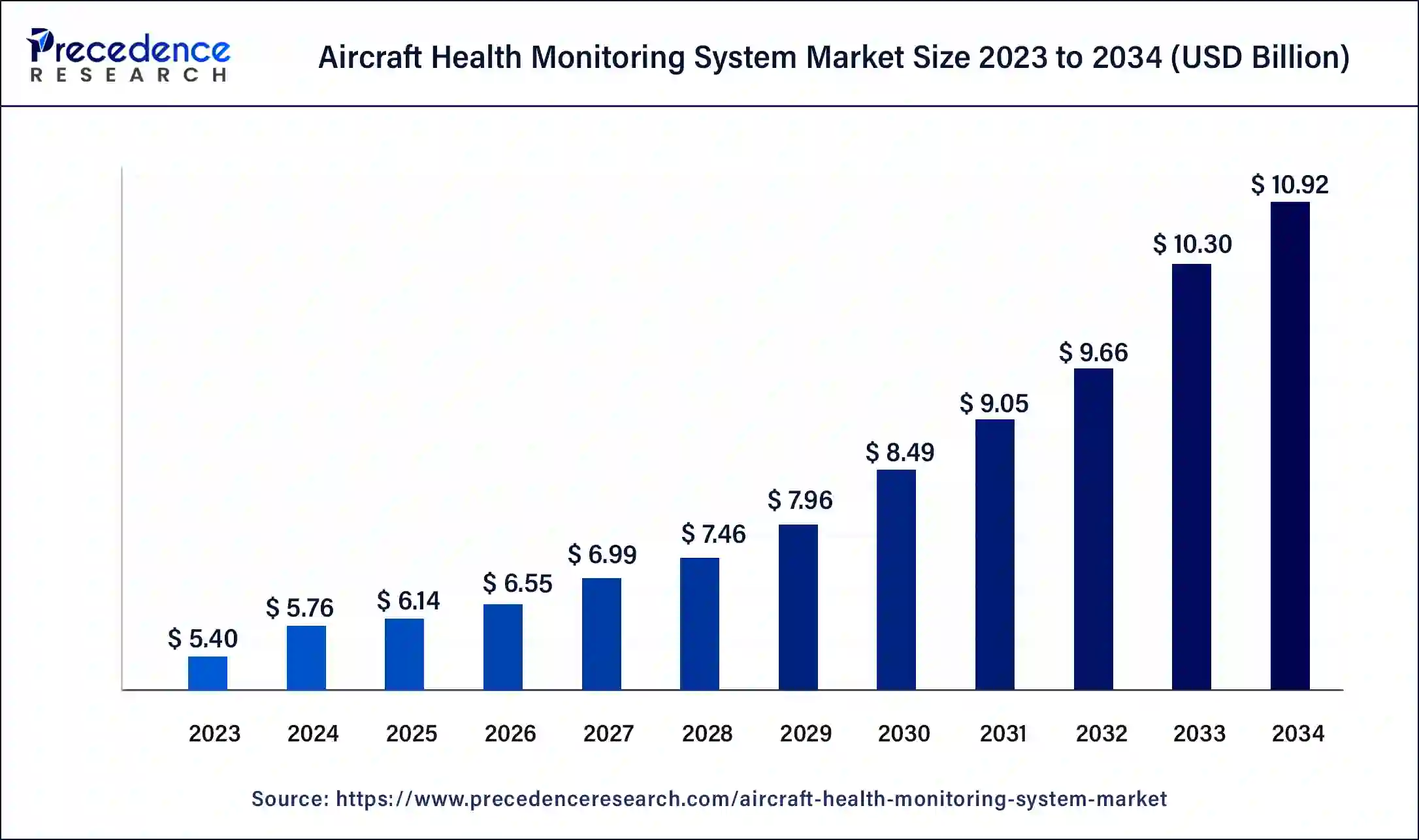

The global aircraft health monitoring system market size reached USD 5.40 billion in 2023 and is anticipated to hit around USD 10.30 billion by 2033, growing at a CAGR of 6.67% from 2024 to 2033.

Key Points

- North America is expected to lead the global aircraft health monitoring system market in 2023 with revenue share of 34%.

- Asia Pacific is witnessing notable growth during the forecast period 2024 to 2033.

- By Fit, the line fit segment has captured highest revenue share of around 85% in 2023.

- By system, the software segment has dominated the market in 2023 with revenue share of 51% in 2023.

- By platform, the narrow body aircraft segment has dominated the market in 2023 with revenue share of 33.8%.

The Aircraft Health Monitoring System (AHMS) market is witnessing substantial growth propelled by the increasing emphasis on aircraft safety, operational efficiency, and maintenance cost reduction. AHMS comprises a set of technologies and solutions designed to monitor and analyze the health and performance of aircraft systems in real-time. These systems enable proactive maintenance, early fault detection, and predictive analytics, thereby enhancing flight safety, reducing downtime, and optimizing operational efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/4060

Growth Factors:

Several factors are driving the growth of the Aircraft Health Monitoring System market. Firstly, the rise in air travel demand, particularly in emerging economies, has led to an expansion of airline fleets, necessitating advanced maintenance solutions to ensure the safety and reliability of aircraft operations. Additionally, regulatory mandates and safety standards imposed by aviation authorities worldwide are encouraging the adoption of AHMS to comply with stringent requirements and enhance aviation safety.

Moreover, technological advancements in sensors, data analytics, and connectivity solutions have facilitated the development of more sophisticated AHMS capable of monitoring various aircraft systems, including engines, avionics, structures, and components. The integration of artificial intelligence (AI) and machine learning algorithms enables predictive maintenance capabilities, allowing operators to anticipate potential failures and schedule maintenance activities proactively, thereby minimizing disruptions and optimizing aircraft availability.

Region Insights:

The Aircraft Health Monitoring System market exhibits regional variations influenced by factors such as fleet size, aviation infrastructure, regulatory environment, and technological adoption. North America dominates the market, driven by the presence of major aerospace companies, extensive airline fleets, and stringent safety regulations. The region’s focus on innovation and technology leadership fosters the development and adoption of advanced AHMS solutions.

Europe is another significant market for AHMS, characterized by a robust aerospace industry, strong regulatory framework, and emphasis on aviation safety. European airlines and aircraft manufacturers are increasingly investing in AHMS to enhance operational efficiency, reduce maintenance costs, and comply with regulatory requirements such as the European Aviation Safety Agency’s (EASA) guidelines on aircraft health monitoring and predictive maintenance.

Asia-Pacific is witnessing rapid growth in the Aircraft Health Monitoring System market, fueled by the expansion of commercial aviation, growing air traffic, and rising investments in aviation infrastructure. Countries like China, India, and Japan are emerging as key markets, driven by their burgeoning airline fleets, increasing aircraft orders, and efforts to modernize aviation maintenance practices. Moreover, the region’s growing focus on aerospace manufacturing and technology development is driving innovation in AHMS solutions.

Aircraft Health Monitoring System Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.67% |

| Global Market Size in 2023 | USD 5.40 Billion |

| Global Market Size in 2024 | USD 5.76 Billion |

| Global Market Size by 2033 | USD 10.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Platform, By Fit, By System, and By Operation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aircraft Health Monitoring System Market Dynamics

Drivers:

Several drivers are propelling the adoption of Aircraft Health Monitoring Systems. Enhanced safety and reliability are primary drivers, as AHMS enable early detection of potential issues, allowing operators to take preventive measures and avoid in-flight incidents or accidents. By continuously monitoring aircraft systems and components, AHMS provide operators with real-time insights into the health and performance of their fleets, enabling proactive maintenance and reducing the risk of unexpected failures.

Furthermore, AHMS contribute to operational efficiency and cost savings by optimizing maintenance schedules, reducing unscheduled downtime, and minimizing the need for costly repairs. By identifying emerging issues before they escalate, AHMS help airlines and maintenance providers streamline their maintenance operations, improve fleet availability, and enhance overall operational performance.

Opportunities:

The Aircraft Health Monitoring System market presents significant opportunities for technology providers, aerospace companies, and service providers. With the increasing digitization of aircraft systems and the growing volume of data generated during flight operations, there is a growing demand for advanced AHMS solutions capable of processing, analyzing, and interpreting large datasets in real-time. Opportunities also exist for integrating AHMS with other aircraft systems, such as flight management systems and onboard diagnostics, to provide comprehensive monitoring and decision support capabilities.

Moreover, the emergence of new technologies such as Internet of Things (IoT), cloud computing, and edge computing opens up new possibilities for AHMS deployment and functionality. By leveraging these technologies, AHMS providers can offer scalable, cost-effective solutions that address the evolving needs of airlines, OEMs, and maintenance providers. Additionally, opportunities exist for AHMS vendors to expand their offerings beyond commercial aviation into other sectors such as military aviation, unmanned aerial vehicles (UAVs), and general aviation.

Challenges:

Despite the opportunities, the Aircraft Health Monitoring System market faces several challenges that could impede growth. One challenge is the complexity of integrating AHMS with existing aircraft systems and infrastructure, which requires coordination among multiple stakeholders, including aircraft manufacturers, avionics suppliers, and regulatory authorities. Standardization of data formats, interfaces, and communication protocols is essential to ensure interoperability and compatibility across different aircraft platforms and systems.

Moreover, data security and privacy concerns pose challenges to the adoption of AHMS, particularly regarding the collection, storage, and transmission of sensitive aircraft data. Ensuring the confidentiality, integrity, and availability of data is crucial to prevent unauthorized access, cyber threats, and data breaches that could compromise flight safety and operational security.

Furthermore, the high upfront costs associated with AHMS implementation, including equipment procurement, installation, and integration, may deter some operators, especially smaller airlines and operators with limited budgets. Convincing stakeholders of the long-term benefits and return on investment (ROI) of AHMS requires robust business cases, cost-benefit analysis, and demonstration of tangible value propositions such as improved safety, reliability, and operational efficiency.

Read Also: Network Analytics Market Size to Reach USD 22.55 Bn by 2033

Recent Developments

- In June 2023, GE Engine Services LLC (General Electric Company) was selected by Korea Aerospace Industries (KAI) to supply health and usage monitoring systems (HUMS).

- In July 2022, Curtiss-Wright Corporation was awarded a contract by Airbus to provide custom actuation technology. This technology offers improved reliability over legacy systems and incorporates health monitoring functions.

- In April 2022, Lufthansa Technik announced that it had recently enhanced its AVIATAR digital platform with various new digital fleet management applications for the Boeing 737 NG (Next Generation), which are now available to 737 operators around the world.

- In March 2022, Indigo announced that it had become the 55th airline to adopt Skywise Health Monitoring (SHM) as its future fleet performance tool.

Aircraft Health Monitoring System Market Companies

- Airbus SE

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd.

- GE Engine Services LLC (General Electric Company)

- Honeywell Aerospace

- Meggitt Plc

- Rolls-Royce Plc

- Safran

- SITA N.V.

- The Boeing Company

Segments Covered in the Report

By Platform

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jet

- Helicopter

- Fighter Jet

By Fit

- Line Fit

- Retrofit

By System

- Hardware

- Software

- Services

By Operation

- Real-time

- Non-real-time

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/