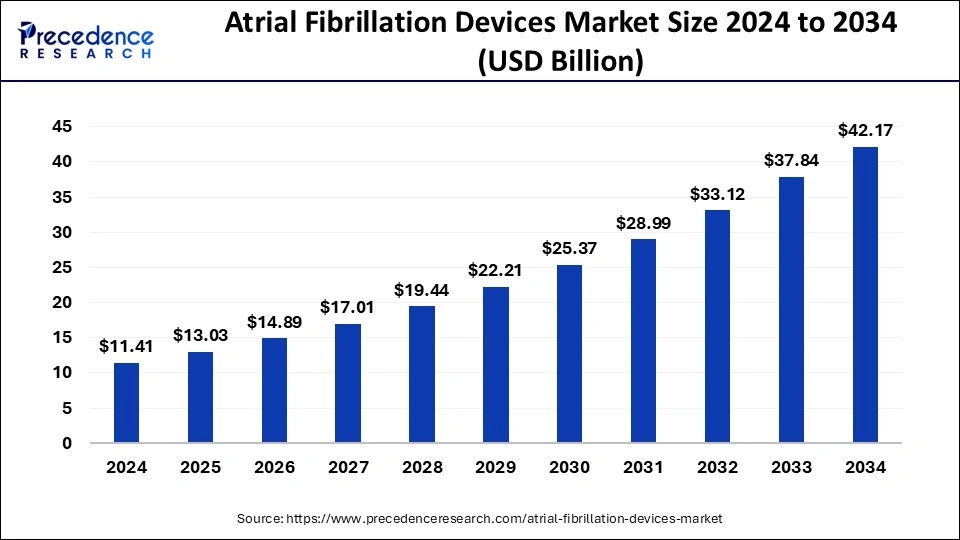

The global atrial fibrillation devices market size reached USD 9.99 billion in 2023 and is projected to surpass around USD 37.84 billion by 2033, growing at a CAGR of 14.25% from 2024 to 2033.

Key Points

- North America dominated the market share of 40% in 2023.

- By product, the EP ablation catheters segment dominated the atrial fibrillation devices market in 2023.

- By end-use, the hospitals segment dominated the market in 2023.

The Atrial Fibrillation (AF) Devices Market is witnessing substantial growth due to the increasing prevalence of atrial fibrillation worldwide. Atrial fibrillation is a common heart rhythm disorder characterized by irregular and often rapid heart rate, which can lead to various complications such as stroke, heart failure, and other cardiovascular diseases. As the aging population continues to grow and lifestyle factors contribute to the rise in cardiovascular diseases, the demand for AF devices is expected to surge. AF devices encompass a range of technologies including catheter ablation systems, cardiac monitors, and implantable devices like pacemakers and defibrillators. These devices aim to diagnose, monitor, and treat atrial fibrillation effectively, thus improving patient outcomes and quality of life.

Get a Sample: https://www.precedenceresearch.com/sample/3950

Growth Factors

Several factors are driving the growth of the atrial fibrillation devices market. Firstly, the increasing prevalence of atrial fibrillation, particularly among the elderly population, is a significant growth factor. With aging populations in many regions, the incidence of atrial fibrillation is expected to rise, leading to higher demand for diagnostic and therapeutic devices. Additionally, advancements in technology have led to the development of more efficient and minimally invasive treatment options such as catheter ablation procedures and implantable devices, driving market growth. Moreover, rising healthcare expenditure, improving healthcare infrastructure, and growing awareness about atrial fibrillation and its treatment options among patients and healthcare professionals contribute to market expansion.

Region Insights:

The atrial fibrillation devices market exhibits regional variations driven by factors such as healthcare infrastructure, prevalence of atrial fibrillation, regulatory policies, and technological advancements. North America holds a significant share of the market, primarily attributed to the high prevalence of atrial fibrillation in the region, coupled with well-established healthcare infrastructure and favorable reimbursement policies. Europe is another prominent market for AF devices, with countries like Germany, the UK, and France leading in terms of market share due to the increasing adoption of advanced technologies and a growing geriatric population. In the Asia-Pacific region, countries like China, Japan, and India are witnessing rapid market growth due to improving healthcare infrastructure, rising healthcare expenditure, and increasing awareness about atrial fibrillation and its treatment options.

Atrial Fibrillation Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.25% |

| Global Market Size in 2023 | USD 9.99 Billion |

| Global Market Size by 2033 | USD 37.84 Billion |

| U.S. Market Size in 2023 | USD 3 Billion |

| U.S. Market Size by 2033 | USD 11.35 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atrial Fibrillation Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the atrial fibrillation devices market. One of the key drivers is the growing aging population globally, as elderly individuals are more prone to atrial fibrillation. Additionally, lifestyle factors such as obesity, sedentary lifestyles, and unhealthy dietary habits contribute to the rising prevalence of atrial fibrillation, thereby increasing the demand for AF devices. Technological advancements in device technology, including the development of novel catheter ablation systems, advanced cardiac monitors, and miniaturized implantable devices, also drive market growth by improving treatment outcomes and patient comfort. Furthermore, increasing healthcare expenditure, expanding healthcare infrastructure, and rising awareness about atrial fibrillation among patients and healthcare providers fuel market expansion.

Opportunities:

The atrial fibrillation devices market presents several opportunities for growth and innovation. One significant opportunity lies in the development of advanced diagnostic technologies for early detection and monitoring of atrial fibrillation. Innovations in wearable devices, smartphone applications, and remote monitoring systems can enable continuous monitoring of heart rhythm, facilitating early intervention and personalized treatment approaches. Moreover, there is a growing trend towards the integration of artificial intelligence (AI) and machine learning algorithms in AF devices for predictive analytics, risk stratification, and treatment optimization, offering new avenues for market players to differentiate their products and services. Furthermore, expanding market penetration in emerging economies presents untapped opportunities for AF device manufacturers to address the unmet needs of patients and healthcare systems in these regions.

Challenges:

Despite the promising growth prospects, the atrial fibrillation devices market faces several challenges. One of the key challenges is the high cost associated with advanced AF devices and procedures, which may limit their accessibility, particularly in developing economies with constrained healthcare budgets. Moreover, regulatory hurdles and reimbursement issues pose challenges to market entry and adoption of new technologies. The complexity of atrial fibrillation management and the variability in patient responses to treatment also present challenges for healthcare providers in achieving optimal outcomes. Additionally, the lack of skilled healthcare professionals proficient in performing complex procedures such as catheter ablation may hinder market growth in certain regions. Addressing these challenges requires collaborative efforts from stakeholders across the healthcare ecosystem to develop cost-effective solutions, streamline regulatory processes, and enhance healthcare infrastructure and workforce capacity.

Read Also: Cardiac Arrhythmia Monitoring Devices Market Size, Report 2033

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/