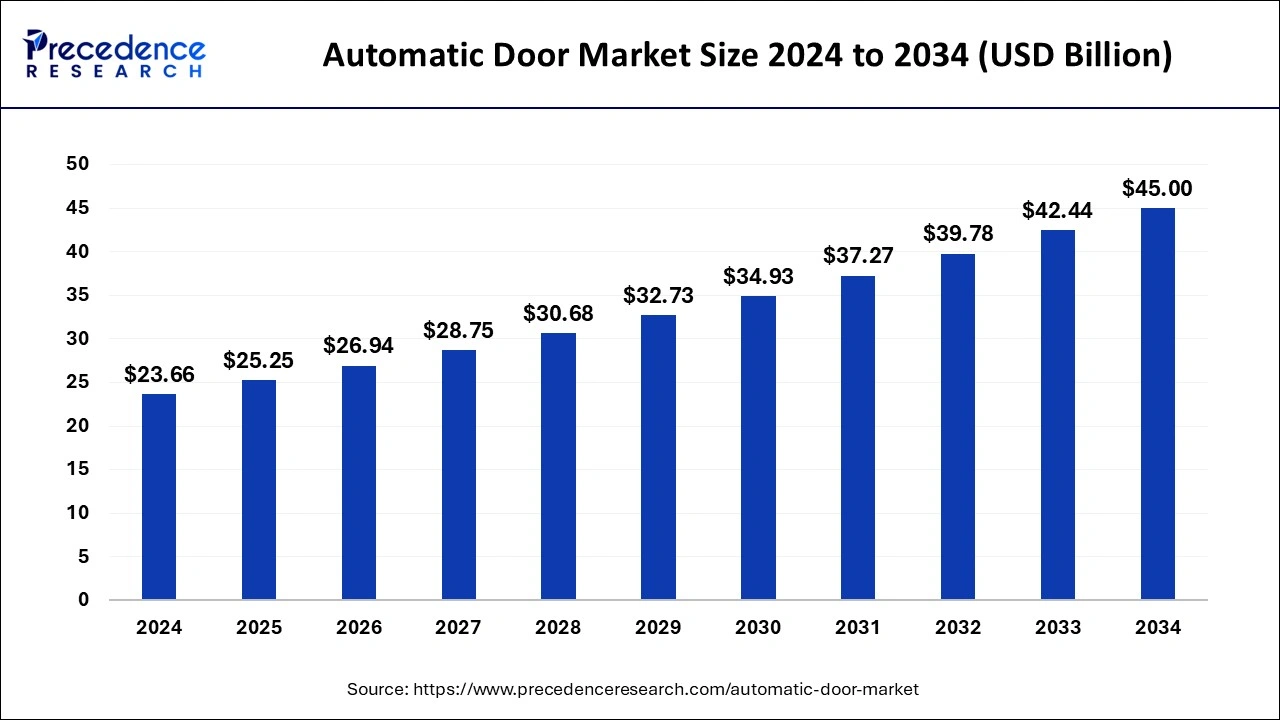

The global automatic door market size reached USD 22.17 billion in 2023 and is predicted to be worth around USD 42.44 billion by 2033, growing at a CAGR of 6.71% from 2024 to 2033.

Automatic Door Market Key Takeaways

- The North America automatic door market size accounted for USD 8.20 billion in 2023 and is expected to attain around USD 15.92 billion by 2033, poised to grow at a CAGR of 6.85% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 37% in 2023.

- Asia Pacific is estimated to be the fastest growing during the forecast period of 2024-2033.

- By door type, the sliding door segment has held the major revenue share of 42% in 2023.

- By door type, the swinging door segment is expected to be the fastest growing during the forecast period.

- By function type, the sensor-based segment has contributed more than 46% of revenue share in 2023.

- By function type, the motion-based segment is the fastest-growing during the forecast period.

- By end-use type, the commercial segment dominated the market in 2023.

- By end-use type, the industrial segment is estimated to be the fastest growing during the forecast period.

The automatic door market has been experiencing significant growth, driven by the increasing demand for advanced and convenient access solutions in various sectors. Automatic doors, which include sliding, swinging, folding, and revolving doors, are equipped with sensors and control systems that enable them to operate without manual intervention. These doors are widely used in commercial, industrial, and residential buildings to enhance security, accessibility, and energy efficiency. Technological advancements, such as the integration of Internet of Things (IoT) and artificial intelligence (AI), are further propelling the adoption of automatic doors across the globe.

Get a Sample: https://www.precedenceresearch.com/sample/4366

Growth Factors

Several factors are contributing to the robust growth of the automatic door market. Firstly, the rapid urbanization and expansion of the construction industry, particularly in developing countries, are driving the demand for automatic doors in commercial buildings, shopping malls, airports, and hospitals. Secondly, the increasing focus on energy conservation and sustainable building practices is boosting the adoption of automatic doors, which help reduce energy consumption by minimizing the loss of conditioned air. Additionally, the growing awareness and implementation of accessibility standards for people with disabilities are leading to the installation of automatic doors in public and private spaces. Lastly, the rising security concerns and the need for efficient crowd management in high-traffic areas are further augmenting market growth.

Automatic Door Market Scope

| Report Coverage | Details |

| Automatic Door Market Size in 2023 | USD 22.17 Billion |

| Automatic Door Market Size in 2024 | USD 23.66 Billion |

| Automatic Door Market Size by 2033 | USD 42.44 Billion |

| Automatic Door Market Growth Rate | CAGR of 6.71% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Door Type, Function Type, End-use Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automatic Door Market Dynamics

Regional Insights

The automatic door market exhibits varying trends across different regions. North America and Europe are leading markets due to the high adoption of advanced technologies and stringent building codes promoting the use of automatic doors for safety and accessibility. In North America, the United States dominates the market owing to substantial investments in infrastructure development and modernization projects. Europe, particularly countries like Germany, France, and the UK, also shows significant market penetration, supported by the region’s focus on energy-efficient and smart building solutions.

Asia-Pacific is expected to witness the highest growth rate during the forecast period. The rapid urbanization, economic growth, and increasing construction activities in countries like China, India, and Japan are major drivers. Furthermore, government initiatives aimed at improving public infrastructure and smart city projects are creating lucrative opportunities for market players. The Middle East and Africa, along with Latin America, are also emerging markets, driven by the expanding commercial sector and infrastructural developments.

Opportunities

The automatic door market presents several opportunities for growth and innovation. The integration of IoT and AI in automatic door systems opens new avenues for enhancing security and operational efficiency. For instance, AI-powered facial recognition and biometric authentication systems can be integrated with automatic doors for advanced security solutions. Additionally, the rising trend of smart homes and buildings creates a demand for intelligent automatic door systems that can be controlled remotely via smartphones or other devices. The increasing emphasis on green building certifications and energy-efficient solutions also offers potential for market expansion, as automatic doors can contribute to achieving these standards.

Challenges

Despite the promising growth prospects, the automatic door market faces several challenges. High installation and maintenance costs can be a deterrent for small and medium-sized enterprises, limiting market penetration. Technical issues, such as sensor malfunctions and the need for regular maintenance, can affect the reliability and lifespan of automatic door systems, leading to increased operational costs. Moreover, the lack of standardized regulations and building codes across different regions can create inconsistencies in product quality and performance. Additionally, the COVID-19 pandemic has impacted the construction industry and delayed several infrastructure projects, posing a temporary challenge to market growth.

Read Also: Europe Logistics Automation Market Size, Share, Report by 2033

Automatic Door Market Recent Developments

- In May 2022, a new bus sliding door 028d slim model, with safety and an eye on lightness, was launched by Spanish Masats. It is useful in the new autonomous vehicles, which give great safety system properties.

- In June 2023, a pure electric MPV Surpasses version model D1 was launched by BYD. In this type of model, there is the use of hidden door handles and electric sliding doors are used.

- In October 2023, non-handed automatic swinging doors were released by the NABCO. They are used as both sides for right-handed and left-handed automatic swing door applications and are capable of 330 lbs door weight in low energy applications.

- In March 2024, in India, Lexus 350h luxury MPV was launched at Rs. 2 crores. It includes various features like a power sliding door switch, audio output systems, infrared sensors for power seat long slide rail, multi-position tip-up seat, and climate control.

Automatic Door Market Companies

- Zhejiang Seacon Door Technology Co., Ltd

- Wilcox Door Service Inc

- Vortex Industries, Inc

- Ultra Safe Security Doors

- TORMAX USA Inc

- Stanley Access Technologies (a part of Dormakaba)

- Royal Boon Edam International B.V.

- Record USA

- Panasonic Corporation

- Nabtesco Corporation

- Horton Automatics

- GEZE GmbH

- Entrematic

- Dormakaba Group

- ASSA ABLOY Entrance System

Segments Covered in the Report

By Door Type

- Sliding Door

- Swinging Door

- Folding Door

- Revolving Door

- Bi-fold Doors

- Others

By Function Type

- Sensor Based

- Motion Based

- Push Button

- Access Control

By End-use Type

- Residential

- Commercial

- HoReCa

- Shopping Malls

- Airports Hospitals

- Others (Retail Stores, etc.)

- Industrial

- Warehouse

- Manufacturing Facilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/