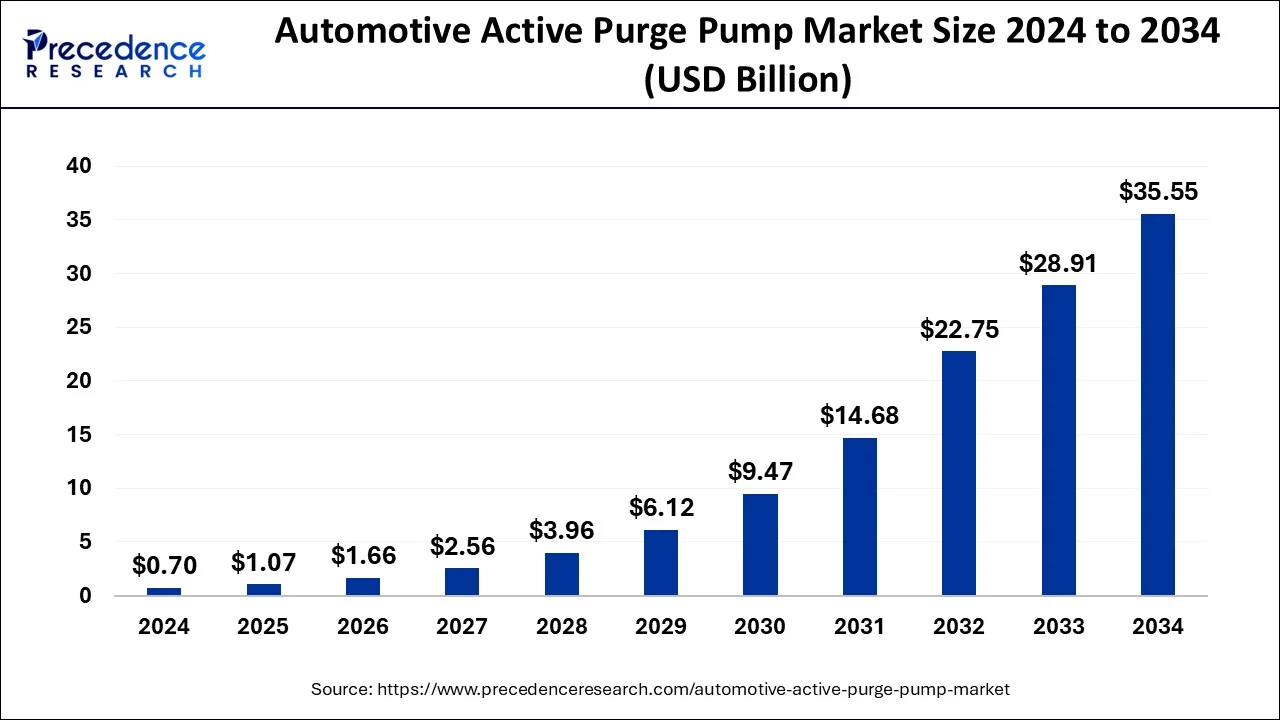

The global automotive active purge pump market size is predicted to gain around USD 35.55 billion by 2034 from USD 0.70 billion in 2024 with a CAGR of 48.10%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1120

Key Insights

- In 2024, North America dominated the automotive active purge pump market, securing a 49% market share.

- The Asia Pacific region is projected to show strong growth potential during the forecast period.

- Among vehicle types, the passenger vehicle category accounted for 66% of total sales in 2024.

- The commercial vehicle segment is poised to grow at the fastest pace in the near future.

- In the components segment, DC motors led the market in 2024 with the highest share.

- The sensors segment is expected to grow at an impressive CAGR in the forecast period.

- OEMs emerged as the leading sales channel in 2024, holding the largest market portion.

- The aftermarket segment is forecasted to experience the fastest growth in the industry.

Market Dynamics

Growth Drivers

The demand for fuel-efficient and low-emission vehicles is a major factor driving the automotive active purge pump market. Governments worldwide are enforcing stringent emission control policies, compelling automakers to integrate efficient fuel vapor management solutions. Additionally, advancements in vehicle automation and onboard diagnostics are further boosting the adoption of active purge pumps, ensuring compliance with environmental regulations while optimizing vehicle performance.

Emerging Opportunities

The market is witnessing promising opportunities with the expansion of electric and hybrid vehicle production. Automakers are increasingly focusing on developing eco-friendly vehicles, which has led to an increased demand for innovative fuel system components. Furthermore, technological advancements, such as the integration of IoT and AI-driven monitoring systems in fuel vapor management, present new growth possibilities. The growing automotive industry in developing economies is also contributing to market expansion.

Key Challenges

One of the major hurdles in the market is the high cost of developing and implementing advanced active purge pump systems. The automotive sector is undergoing a transition toward electrification, reducing the demand for traditional fuel vapor management solutions. Additionally, regulatory uncertainties in certain regions can create challenges for market players. The reliance on semiconductor components and the global chip shortage further add to supply chain complexities.

Regional Landscape

North America continues to be the leading market, backed by a strong regulatory framework and the presence of key automotive manufacturers. Europe is also a significant market due to the region’s commitment to sustainability and clean energy solutions. The Asia Pacific region, particularly China and India, is emerging as a high-growth market, driven by increasing vehicle sales and supportive government policies for emissions reduction. Latin America and the Middle East are gradually witnessing increased automotive production, offering long-term market potential.

Automotive Active Purge Pump Market Companies

- Agilent Technologies

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Akebono Brake Company

- Hitachi Chemical Co. Ltd.

- Allied-Nippon Limited

- Nisshinbo Holdings Inc.

- Vitesco Technologies

- Hyundai Kefico

- Rheinmetall Automotive

- Sauermann

- TSURUMI AMERICA INC

Leader’s Announcements

- In August 2024, U.S. Secretary of Energy Jennifer Granholm talked about novel investments in the building of EVs in North America:

- “This investment will provide good job opportunities alongside offering more transportation options to Americans, no matter their geography or income.”

- In July 2024, Thomas Stierle, member of the executive board and head of the Electrification Solutions division, talked about the launch of new series production of battery management electronics:

- “The company has completed its portfolio for electrification in China along with starting the production series of battery management control electronics in Changchun.”

Recent Developments

- In August 2023, global powertrain tech leader Vitesco Technologies and washer system specialist SEBI Group collaborated for the development of the Advanced Sensor Cleaning System (ASCS).

- In July 2024, Vitesco Technologies, a leading international provider of advanced powertrain technologies and electrification solutions, started its production range of battery management electronics in Changchun, China, which is the first large-scale production planned for a leading Chinese car manufacturer, to equip its novel electric vehicle models with state-of-the-art battery management technology

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors.

Further, this research study calculates market size and its development drift at global, regional, and country from 2016 to 2027. This report contains market breakdown and its revenue estimation by classifying it on the basis of component, material type, manufacturing process, vehicle type, sales channel, and region:

By Components

- Sensors

- DC Motor

- Valves

- Actuators

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Sales Channel

- Aftermarket

- Original Equipment Manufacturers (OEMs)

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/