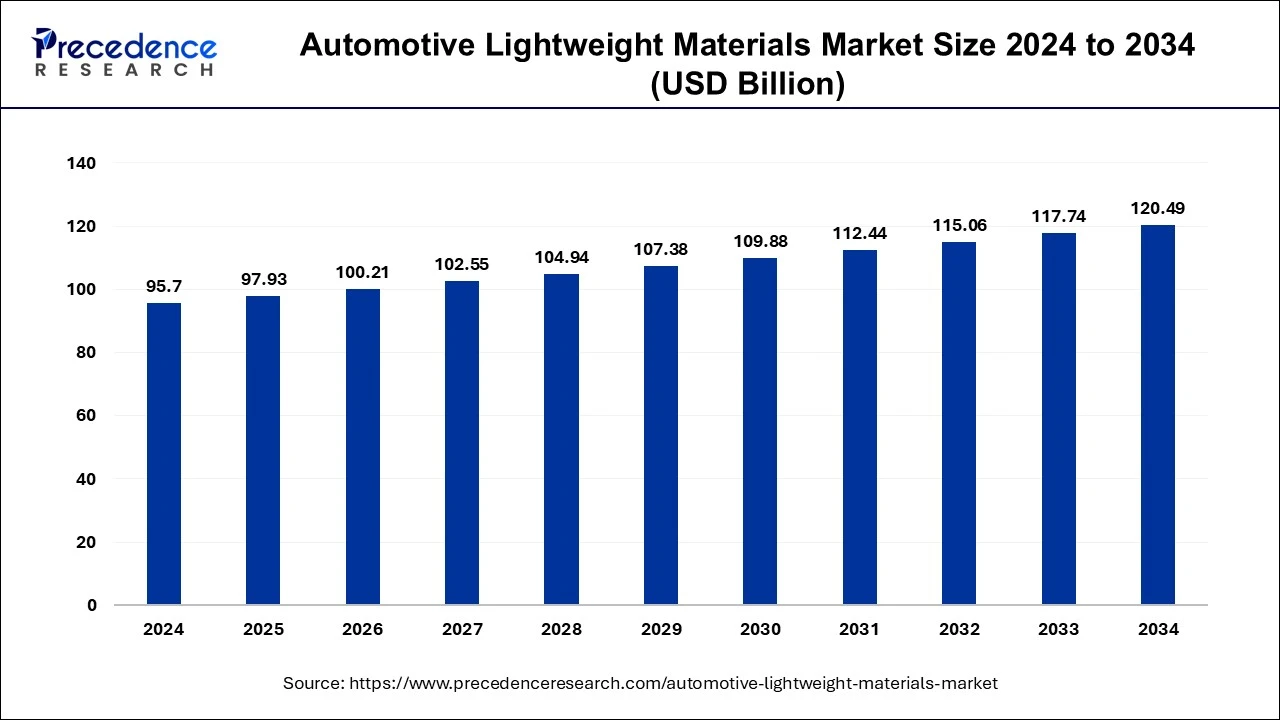

The global automotive lightweight materials market size is predicted to attain around USD 120.49 billion by 2034 from USD 95.7 billion in 2024 with a CAGR of 2.33%.

Key Points

- Europe emerged as the top region in the global automotive lightweight market, securing a 36.52% share in 2024.

- Germany’s automotive lightweight materials market is expanding rapidly with a CAGR of 6.99% over the forecast period.

- North America is forecasted to register a steady growth rate with a CAGR of 4.96% during the forecast period.

- Composites remained the leading material type, contributing 66% of the market share in 2024.

- The plastics segment is poised for growth, expecting a CAGR of 3.83% in the coming years.

- The body in white (BiW) segment led the application category with a 26% market share in 2024.

- The closures segment is set to witness a CAGR of 2.6% over the projected period.

- Passenger cars dominated the end-use category with a commanding 83% share in 2024.

- The light commercial vehicles (LCVs) sector is anticipated to grow at a CAGR of 3.3% during the forecast timeframe.

Market Dynamics

Drivers

The demand for lightweight materials in the automotive industry is increasing due to rising fuel costs and the need for improved vehicle efficiency. Governments across the world are imposing strict emission regulations, pushing automakers to explore lightweight alternatives to conventional materials. Additionally, advancements in composite materials and metal alloys are enhancing vehicle safety and performance while reducing weight.

Opportunities

Technological innovations in material processing and manufacturing techniques, such as additive manufacturing (3D printing) and nanotechnology, are providing significant growth opportunities. The expanding market for electric vehicles, which require lightweight materials to compensate for battery weight, is another major factor driving market expansion. The growing trend of vehicle electrification and connected mobility solutions will further boost the demand for advanced materials.

Challenges

The high initial investment required for developing and producing lightweight materials is a significant challenge for manufacturers. Additionally, the limited availability of raw materials and concerns about the recyclability of certain advanced materials pose environmental and economic challenges. The need for specialized expertise in handling lightweight materials also creates barriers for widespread adoption.

Regional Insights

Europe remains a dominant player in the automotive lightweight materials market, primarily due to its stringent regulatory framework and strong R&D investments. North America is witnessing steady growth due to increasing consumer preference for fuel-efficient and high-performance vehicles. Meanwhile, Asia-Pacific, led by China and India, is emerging as a lucrative market due to rapid urbanization, increasing vehicle production, and growing government initiatives promoting lightweight materials in transportation.

Automotive Lightweight Materials Market Companies

- Henkel AG & Co.

- DuPont

- NovaCentrix

- KGaA

- Intrinsiq Materials, Inc.

- Creative Materials Inc.

- Vorbeck Materials Corporation, Inc

- Johnson Matthey PLC

- Heraeus Holding GmbH

- Applied Ink Solutions

Recent Developments

- In April 2024, Hyundai and Toray, carbon fiber specialist collaborated to develop lightweight and high strength materials. This partnership aims to develops durable materials that are sustainable with joint research and development activities to improve performance of EV batteries and motors.

- In April 2024, LyondellBasell and ASIN signed an agreement for the development of innovative lightweight plastics.

- In May 2024, Covestro and Arecesso’s Arfinio Technology received accolades with innovation award at German Innovation Award 2024. This is a technology that will help produce lightweight, recyclable, and replaceable solid surface materials.

Segments Covered in the Report

By Vehicle

- Passenger Vehicles

- Heavy Commercial Vehicles [HCVs]

- Light Commercial Vehicles [LCVs]

By Material

- High-strength Steel [HSS]

- Metal Alloys

- Polymers

- Composites

By Application

- Exterior

- Interior

- Powertrain

- Structural

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World