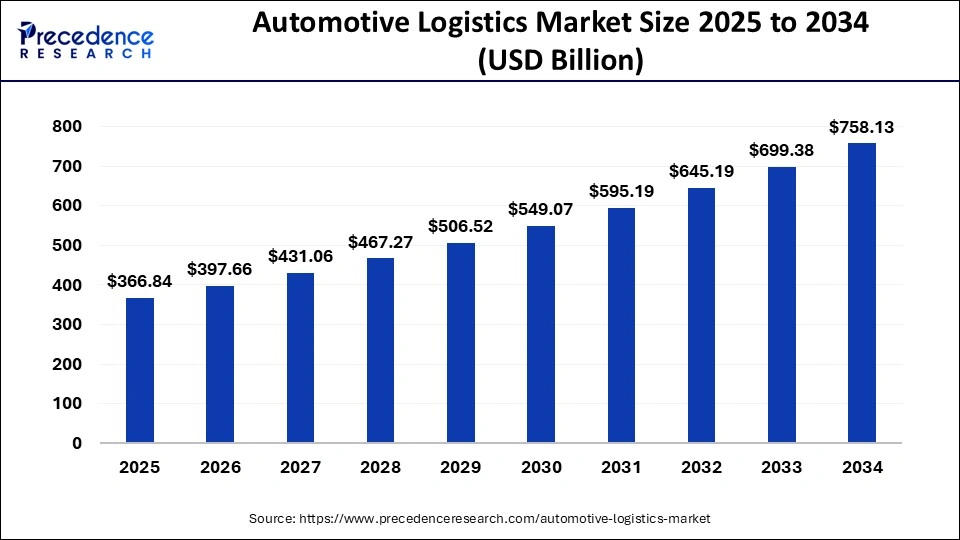

The global automotive logistics market size accounted for USD 338.42 billion in 2024 and is projected to attain USD 758.13 billion by 2034, at a CAGR of 8.4%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1105

Key Insights

- Asia Pacific accounted for more than 47% of the market revenue in 2024, maintaining its dominance.

- The automobile parts segment emerged as the leading category by type in 2024.

- The finished vehicles segment is anticipated to witness substantial growth between 2025 and 2034.

- The transportation segment recorded the highest revenue share among activities in 2024.

- The warehousing segment is projected to grow at the highest CAGR throughout the forecast period.

Drivers

The rapid growth of the automotive industry, especially in emerging economies, is fueling the automotive logistics market. The expansion of manufacturing facilities and the shift toward lean supply chain models have increased the need for efficient logistics solutions.

Moreover, the adoption of Industry 4.0 technologies, such as automation, robotics, and cloud-based logistics management, is enhancing operational efficiency. The rise in vehicle exports and imports is further driving the demand for integrated logistics solutions, ensuring timely delivery and cost-effective transportation.

Opportunities

The increasing focus on sustainability and green logistics is creating new growth opportunities in the market. Many logistics providers are adopting electric and hydrogen-powered vehicles to reduce carbon footprints, in line with global climate commitments.

The development of multimodal transportation networks, combining road, rail, air, and sea freight, is also optimizing supply chain efficiency. Additionally, the push for smart warehouses with AI-powered inventory management is expected to revolutionize automotive logistics in the coming years.

Challenges

The automotive logistics industry faces significant challenges due to rising transportation costs and capacity constraints. The shortage of skilled drivers and logistics professionals is another pressing issue, impacting the efficiency of supply chain operations.

Additionally, the reliance on third-party logistics (3PL) providers can create bottlenecks, as manufacturers may have limited control over delivery timelines. The increasing complexity of customs regulations and trade barriers also poses risks to global logistics operations.

Regional Analysis

North America remains a key player in the automotive logistics market, driven by the strong presence of automakers and logistics providers. Europe is experiencing steady growth, supported by robust regulatory frameworks and technological advancements in supply chain management.

The Asia-Pacific region continues to dominate, with China and India being major manufacturing hubs. Latin America and the Middle East & Africa are gradually expanding their automotive logistics networks, driven by infrastructure improvements and increasing vehicle demand.

Automotive Logistics Market Companies

- CEVA Logistics

- BLG LOGISTICS GROUP AG & Co. KG

- Hellmann Worldwide Logistics

- Ryder System, Inc.

- GEFCO

- CFR Rinkens

- Penske Automotive Group, Inc.

- Imperial Logistics

- Expeditors International of Washington, Inc.

- Nippon Express Co. Ltd.

- Kerry Logistics Network

- Schnellecke group ag& co. Kg

Companies Share Insights

The global automotive logistics market is oligopolistic in nature and dominated by the some of the key players operating in the market. Market players are incorporating advanced technologies for route optimization, real-time tracking of shipments, and also provide technology-driven services to their customers. Collaboration, merger & acquisition of various other automotive logistics companies are the prime strategies adopted by the industry participants to capture maximum revenue share in the market. Furthermore, the market players are also focusing to improve their automation technology to achieve a competitive advantage among different end-users.

Segments Covered in the Report

By Type

- Automobile Parts

- Finished Vehicle

By Activity

- Transportation

- Airways

- Roadways

- Railways

- Maritime

- Warehousing

By Logistics Solution

- Outbound

- Inbound

- Reverse Distribution (International and Domestic)

By Distribution

- International

- Domestic

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/