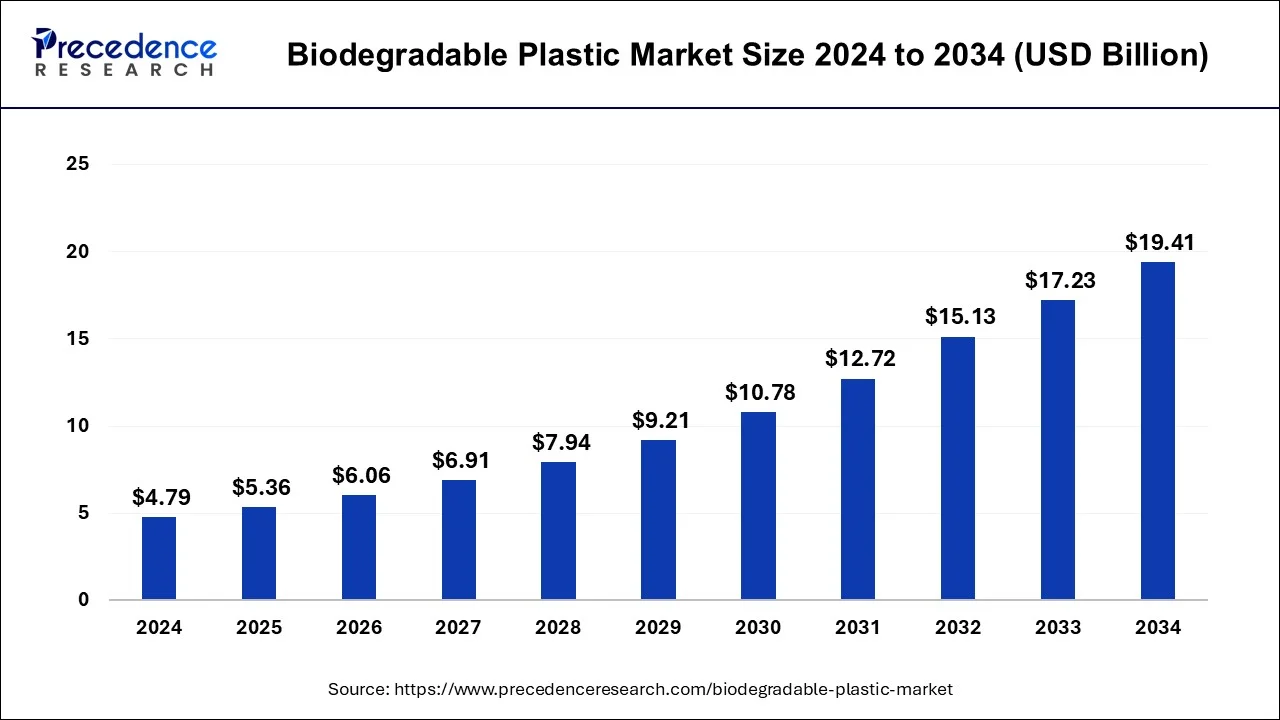

The global biodegradable plastics market size reached USD 4.79 billion in 2024 and is expected to cross around USD 19.41 billion by 2034 with a CAGR of 15.28%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1067

Key Points

- In 2024, Europe emerged as the leading market, securing a 42.14% share.

- The Asia Pacific region is anticipated to grow at the fastest CAGR in the coming years.

- Among types, starch-based bioplastics accounted for the highest market share in 2024.

- The Polyhydroxyalkanoate (PHA) segment is set to expand at the highest CAGR during the forecast period.

- The packaging sector dominated the market in 2024 in terms of revenue contribution.

- The agriculture sector is projected to grow at the most rapid CAGR from 2025 to 2034.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.28% |

| Market Size in 2024 | USD 4.79 Billion |

| Market Size by 2034 | USD 19.41 Billion |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle Class, and By Architecture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The biodegradable plastic market is gaining momentum due to the increasing focus on reducing carbon footprints and minimizing plastic pollution. With industries shifting towards sustainability, the demand for biodegradable alternatives in packaging, agriculture, and consumer goods is accelerating.

Government incentives and subsidies promoting eco-friendly materials have further encouraged manufacturers to invest in biodegradable plastics. Additionally, the food and beverage industry’s growing reliance on sustainable packaging solutions has played a crucial role in driving market expansion.

Market Opportunities

As companies worldwide look to improve their sustainability practices, the demand for biodegradable plastics is expected to rise significantly. Innovations in raw material sourcing, such as the use of agricultural waste and plant-based polymers, present lucrative growth opportunities.

The expanding e-commerce industry is another key driver, as businesses seek eco-friendly packaging solutions to align with sustainability goals. Additionally, partnerships between private companies and research institutions are paving the way for advanced biodegradable plastic formulations with enhanced functionality.

Market Challenges

One of the major challenges in the biodegradable plastic market is the difficulty in achieving large-scale production at a cost-competitive level. Many biodegradable plastics still rely on expensive raw materials, making them less attractive to price-sensitive industries.

Moreover, confusion among consumers regarding disposal methods and proper composting practices can lead to inefficiencies in waste management. The lack of international standardization in biodegradable plastic certifications also poses a hurdle for manufacturers looking to expand their global footprint.

Regional Insights

Europe dominates the market due to robust regulatory frameworks and well-established recycling and composting infrastructure. The Asia Pacific region is experiencing rapid growth, with increasing demand from emerging economies like China and India, where environmental awareness is rising.

North America continues to be a key market player, with advancements in biopolymer technology and growing adoption of biodegradable plastics in industries such as healthcare and agriculture.

Biodegradable Plastic Market Companies

- Biome Technologies plc

- Mitsubishi Chemical Corporation

- BASF SE

- Plantic Technologies Limited

- Yield10 Bioscience, Inc.

- Corbion

- Eastman Chemical Company

- Dow Inc.

- NatureWorks LLC

- Danimer Scientific

- Toray Industries, Inc.

- p.A.

- TianAn Biologic Materials Co., Ltd.

Recent Developments

- In December 2023, with the introduction of a new end-to-end licensed technology called CAPSULTM for the continuous manufacturing of polycaprolactone (PCL), a biodegradable polyester frequently used in the packaging, textile, agricultural, and horticultural industries, Swiss technology company Sulzer is broadening its line of bioplastics.

- In February 2024, leading South Korean chemical manufacturer LG Chem Ltd. and food and biotechnology company CJ CheilJedang Corp. have partnered to establish an environmentally friendly bio-nylon joint venture in an effort to reduce carbon emissions and generate new revenue. The CEOs of the two companies, LG Chem and CJ CheilJedang, announced on Thursday that they had inked a head of agreement (HOA) to construct a joint venture plant that would manufacture environmentally friendly nylon using PMDA, or bio-materials made from fermenting corn, sugarcane, and other crops.

Segments Covered in the Report

By Type

- Starch-based

- PBS

- PLA

- PHA

- PBAT

- Others

By End-User

- Consumer Goods

- Agriculture

- Packaging

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/