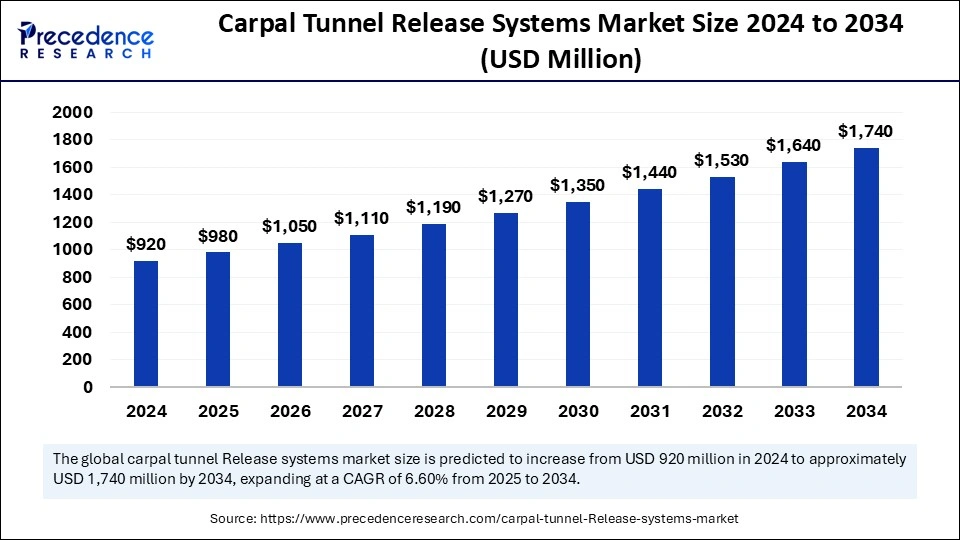

The global carpal tunnel release systems market size was valued at USD 920 million in 2024 and is expected to cross around USD 1,740 million by 2034, CAGR of 6.60%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5763

Carpal Tunnel Release Systems Market Key Highlights

-

In 2024, North America emerged as the dominant regional market, securing a 49% share.

-

Asia Pacific is set to register the fastest growth over the coming years.

-

Open carpal tunnel release systems dominated by product type, holding a 59% market share in 2024.

-

Endoscopic carpal tunnel release systems are anticipated to grow at the highest CAGR between 2025 and 2034.

-

The hospitals segment contributed significantly to the overall market share in 2024.

-

The ambulatory surgical centers segment is projected to expand at the fastest pace during the study period.

Impact of AI on the Carpal Tunnel Release Systems Market

Artificial Intelligence (AI) is revolutionizing the Carpal Tunnel Release (CTR) Systems Market by enhancing surgical precision, improving patient outcomes, and streamlining the overall healthcare workflow. AI-driven innovations are transforming the diagnosis, treatment, and postoperative care associated with carpal tunnel syndrome. Below are key areas where AI is making a significant impact:

1. AI-Enhanced Diagnosis & Early Detection

AI-powered diagnostic tools, such as machine learning-based imaging analysis and predictive analytics, help detect carpal tunnel syndrome (CTS) at an early stage. By analyzing electromyography (EMG) results, nerve conduction studies, and wrist ultrasound scans, AI can identify subtle patterns that indicate nerve compression, allowing for timely intervention before symptoms worsen.

2. AI-Assisted Surgical Planning

AI-driven algorithms assist surgeons in planning carpal tunnel release (CTR) procedures with greater accuracy. By analyzing patient-specific data, such as anatomical variations, nerve positioning, and previous medical history, AI helps tailor surgical approaches to minimize complications and improve patient recovery times.

3. Robotics & AI in Minimally Invasive Surgery

AI-powered robotic-assisted systems are playing a crucial role in enhancing the precision of endoscopic and open CTR surgeries. Robotic platforms integrated with AI allow for improved control, reduced surgical errors, and smaller incisions, leading to faster recovery times and fewer postoperative complications.

4. Predictive Analytics for Patient Outcomes

AI-driven predictive analytics assess various risk factors, including patient demographics, pre-existing conditions, and surgical techniques, to estimate potential outcomes. These insights help healthcare providers make informed decisions regarding the most effective treatment plans, improving overall patient care.

5. AI in Postoperative Monitoring & Rehabilitation

AI-based wearable devices and mobile applications track a patient’s wrist movement, nerve healing progress, and response to rehabilitation exercises after CTR surgery. These technologies provide real-time feedback to physicians, allowing for personalized recovery plans and reducing the risk of recurrence.

6. AI in Workflow Optimization & Cost Reduction

Hospitals and surgical centers are leveraging AI to optimize appointment scheduling, resource allocation, and patient management. AI-driven automation reduces wait times, streamlines insurance processing, and enhances overall operational efficiency, making CTR procedures more accessible and cost-effective.

Growth Factors

The Carpal Tunnel Release (CTR) Systems Market is experiencing significant growth due to the rising prevalence of carpal tunnel syndrome (CTS), particularly among office workers, factory laborers, and individuals performing repetitive hand movements. The aging population and the increasing incidence of conditions like diabetes and arthritis, which contribute to CTS, are also driving the demand for CTR procedures. As more people become aware of the symptoms and risks associated with CTS, early diagnosis rates are improving, further boosting the market.

Technological advancements in minimally invasive surgery (MIS) are a major growth driver, as procedures like endoscopic carpal tunnel release (ECTR) offer faster recovery times, reduced scarring, lower infection risks, and minimal postoperative pain. Innovations such as AI-assisted robotic systems, ultrasound-guided procedures, and advanced imaging techniques are enhancing surgical precision and improving patient outcomes. These technological improvements have made CTR procedures more efficient and accessible, increasing their adoption in healthcare settings.

Rising healthcare expenditure and favorable insurance policies are also propelling market expansion. Many health insurance providers now cover CTR procedures, making them more affordable for patients. Additionally, the rapid expansion of ambulatory surgical centers (ASCs) is playing a crucial role in market growth, offering cost-effective, outpatient-based CTR procedures that provide convenience and efficiency compared to traditional hospital settings. As a result, ASCs are becoming the preferred choice for CTR surgeries, further accelerating market growth.

The increasing integration of AI and robotics in surgery is transforming the CTR market. AI-driven predictive analytics, robotic-assisted surgical systems, and automated post-surgical monitoring are enhancing efficiency, reducing errors, and improving patient recovery times. Furthermore, government initiatives promoting workplace safety, musculoskeletal health, and occupational therapy programs are contributing to the increased adoption of CTR systems. With continued advancements in minimally invasive techniques, AI-powered solutions, and expanding outpatient care facilities, the CTR systems market is poised for sustained growth in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,74 Million |

| Market Size in 2025 | USD 980 Million |

| Market Size in 2024 | USD 920 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.60% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

An increase in workplace-related injuries and musculoskeletal disorders is a major driver of market growth. The growing awareness of early intervention and the benefits of surgical treatment for CTS is also contributing to the rising demand for CTR systems. Furthermore, technological advancements such as AI-based diagnostics, robotic-assisted surgeries, and ultrasound-guided procedures are helping enhance the efficiency of CTR procedures. Expanding healthcare coverage and favorable reimbursement policies are also encouraging more patients to opt for surgical intervention.

Market Opportunities

The emergence of AI-driven diagnostics and wearable devices for CTS detection presents new opportunities for market expansion. The growing trend of outpatient procedures and the expansion of ambulatory surgical centers allow for cost-effective treatments, creating demand for portable and efficient CTR solutions. Moreover, partnerships between healthcare providers and medical technology firms can lead to the development of cutting-edge CTR systems that improve surgical precision and patient recovery.

Market Challenges

Cost remains a major challenge, as advanced robotic-assisted surgical systems are expensive and not always accessible in lower-income regions. Limited awareness in developing markets about CTS and its long-term impact on productivity further slows market penetration. Additionally, the potential risks of post-operative complications, including nerve damage, make some patients hesitant to undergo surgery. Regulatory challenges and stringent approval processes for new surgical techniques and medical devices also act as barriers to market growth.

Regional Outlook

North America continues to hold the largest market share due to well-established healthcare facilities, a high diagnosis rate, and early adoption of advanced surgical techniques. Asia Pacific is expected to be the fastest-growing region due to rising healthcare awareness and increasing investments in medical technology. Europe is witnessing growth due to favorable government policies promoting musculoskeletal health, while Latin America and the Middle East & Africa are slowly adopting advanced CTR techniques as healthcare infrastructure improves.

Carpal Tunnel Release System Market Companies

- A.M. Surgical Inc.

- Arthrex, Inc.

- CONMED Corporation

- Innomed, Inc.

- Integra LifeSciences

- Medical Designs LLC

- MicroAire Surgical Instruments, LLC

- PAVmed Inc.

- S2S Surgical LLC

- Smith & Nephew plc

- Sonex Health, LLC

- Spirecut

- Stryker

- Trice Medical

Latest Announcements by Industry Leaders

- March 2025 – JUNE Medical

- Founder and Owner of JUNE Medical – Angela Spang

- Announcement – JUNE Medical has announced the upcoming launch of the HandMe Galaxy II Retractor, a device aimed at enhancing access and visibility during hand surgeries. Angela Spang, founder and owner of JUNE Medical, stated, “As an inventor, there is nothing more rewarding than creating devices that make surgery safer and easier. It is an honor to be trusted to assist surgeons in over 40 countries as they perform miracles daily.”

Recent Developments

- In December 2023, Sonex Health celebrated a significant milestone in the treatment of carpal tunnel syndrome (CTS), as they reached over 20,000 patients treated with their UltraGuideCTR device for carpal tunnel release (CTR) using real-time ultrasound guidance. This achievement follows a successful USD 40 million Series B financing round, with funds allocated to enhance access to the company’s commercially available devices designed to safely and effectively treat patients suffering from CTS and trigger finger (TF).

- In June 2022, Sonex Health announced the full U.S. commercial launch of the UltraGuideTFR, an ultrasound-guided device for trigger finger release procedures. This device allows surgeons to visualize anatomy before making an incision, resulting in smaller incisions and more minimally invasive surgery for patients undergoing trigger finger release.

Segments Covered in the Report

By Product Type

- Open Carpal Tunnel Release Systems

- Endoscopic Carpal Tunnel Release Systems

By End User

- Hospitals

- Ambulatory Surgical Centers

- Other

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Site Management Organization Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/