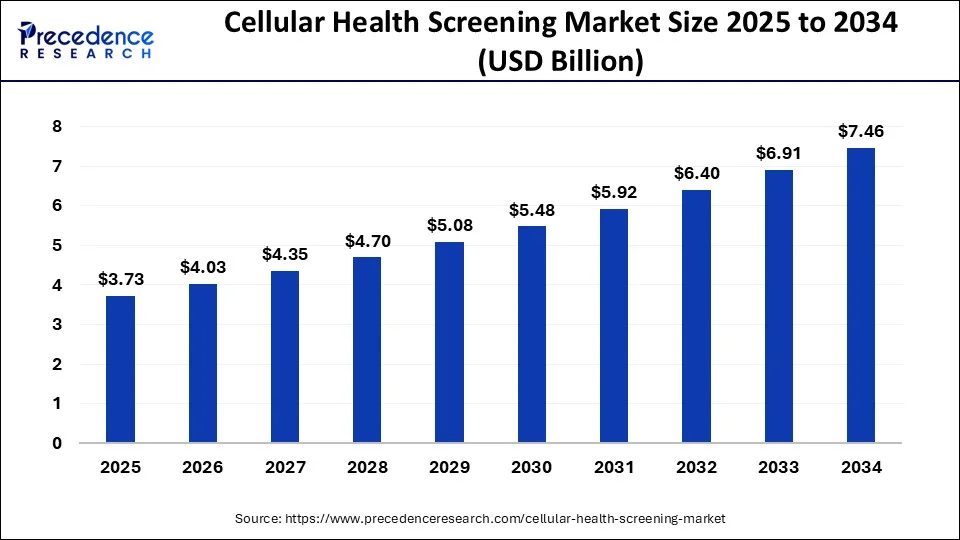

The global cellular health screening market size reached USD 3.20 billion in 2023 and is projected to hit around USD 6.80 billion by 2033, growing at a CAGR of 7.82% from 2024 to 2033.

Key Points

- North America led the global cellular health screening market in 2023 and accounted for a 50% revenue share.

- Asia Pacific is anticipated to be the fastest-growing region in the forecast period.

- By test type, in 2023, the single test panels segment accounted market share of around 79.20%.

- By sample type, in 2023, the blood samples segment held the majority share of over 47.85%.

- By collection site, the hospital segment accounted for the largest share of 39.50% in 2023.

The cellular health screening market involves a range of diagnostic tools and tests designed to evaluate the health and functionality of cells in the human body. These assessments offer insights into cellular aging, oxidative stress, telomere length, mitochondrial function, and other cellular factors that play a critical role in overall health and the progression of diseases. The market is growing rapidly as consumers become more health-conscious and seek preventive health measures, which has led to a demand for personalized medicine and proactive healthcare strategies. Cellular health screening provides crucial data for health maintenance, anti-aging, and disease prevention.

Get a Sample: https://www.precedenceresearch.com/sample/4079

Growth Factors

- Aging Population: As the global population ages, there is a rising interest in monitoring cellular health to prevent age-related diseases and maintain a high quality of life.

- Health and Wellness Trends: Consumers are increasingly seeking personalized and proactive healthcare solutions to improve their overall well-being, leading to a growing demand for cellular health screening services.

- Technological Advancements: Innovations in biotechnology and diagnostics have made it easier and more affordable to conduct cellular health screenings, leading to wider adoption.

- Preventive Healthcare: There is a shift toward preventive healthcare, with individuals wanting to monitor their cellular health to catch potential issues early and take appropriate measures.

- Rising Chronic Diseases: The prevalence of chronic diseases such as diabetes and heart disease has prompted a need for more precise monitoring of cellular health to better manage and treat these conditions.

Region Insights

The cellular health screening market varies across different regions:

- North America: North America leads the market due to the presence of advanced healthcare infrastructure, a high awareness of preventive healthcare, and ongoing research and development activities. The United States is a major contributor to the market, with a significant number of biotechnology and healthcare companies operating in the region.

- Europe: Europe is another prominent region for cellular health screening, driven by increasing healthcare spending, an aging population, and a strong focus on research and development. Countries like Germany and the United Kingdom are at the forefront of this market.

- Asia-Pacific: This region is expected to experience significant growth due to a large population base, rising healthcare awareness, and increasing disposable income. Countries such as China and India are seeing a surge in demand for cellular health screening services.

- Latin America and Middle East & Africa: These regions are also showing growth potential as healthcare infrastructure improves and awareness of preventive healthcare measures increases.

Cellular Health Screening Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.82% |

| Global Market Size in 2023 | USD 3.20 Billion |

| Global Market Size in 2024 | USD 3.45 Billion |

| Global Market Size by 2033 | USD 6.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By Sample Type, and By Collection Site |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cellular Health Screening Market Dynamics

Drivers

Key drivers for the cellular health screening market include:

- Consumer Awareness: Growing awareness of the importance of cellular health and preventive healthcare is driving the demand for screening services.

- Personalized Medicine: Cellular health screenings provide data that can be used to tailor healthcare plans to individual needs, supporting the trend toward personalized medicine.

- Advancements in Diagnostic Technology: Technological progress in diagnostic tools has made cellular health screening more accessible and affordable for a broader audience.

- Government Support: In some regions, governments are encouraging preventive healthcare and supporting research and development in the field of cellular health.

- Corporate Wellness Programs: Many companies are investing in employee health programs, which include cellular health screenings to improve productivity and reduce healthcare costs.

Opportunities

The cellular health screening market offers several opportunities for growth:

- Innovative Products and Services: Companies can capitalize on the demand for new diagnostic tests and services that offer more detailed insights into cellular health.

- Expansion in Emerging Markets: Emerging markets present opportunities for growth as healthcare infrastructure improves and awareness of cellular health increases.

- Partnerships and Collaborations: Collaborations between healthcare providers, research institutions, and biotechnology companies can lead to innovative screening methods and greater market penetration.

- Telehealth and Remote Monitoring: The rise of telehealth services presents an opportunity for remote cellular health monitoring, which can expand access to screening services.

- Preventive Healthcare Integration: Integrating cellular health screening with existing preventive healthcare strategies can enhance the overall approach to health maintenance and disease prevention.

Challenges

While the cellular health screening market shows strong growth potential, it also faces several challenges:

- Regulatory Hurdles: The development and approval of new diagnostic tests may face regulatory challenges that can slow down the adoption of new technologies.

- High Costs: The initial cost of some advanced cellular health screening technologies may be prohibitive for some consumers and healthcare providers.

- Lack of Standardization: The lack of standardized testing methods and interpretation of results can lead to inconsistencies in screening outcomes.

- Privacy and Data Security: With the rise of digital health platforms, ensuring the privacy and security of patient data is a significant concern.

- Limited Awareness: Despite increasing awareness, many individuals and healthcare providers may not be fully informed about the benefits of cellular health screening.

Read Also: Airport 4.0 Market Size, Share, Share, Report by 2033

Recent Developments

- In July 2023, Regenerus Labs launched the TruAge Complete test, a sophisticated epigenetic test that provides an accurate, complete, and actionable study of a patient’s biological aging and health insights.

- In April 2023, Virtua Health introduced a mobile health and cancer screening unit to increase accessibility to crucial cancer diagnostics.

- In January 2023, Atomo Diagnostics, an Australian diagnostic company, established a long-term partnership with NG Biotech SAS to produce and distribute rapid blood-based pregnancy tests for both home and professional usage in prominent markets.

- In May 2022, QIAGEN NV unveiled the QIAstat Dx Rise and enhanced panels, which feature a closed system for hands-off sample preparation and processing, offering improved convenience for users.

Cellular Health Screening Market Companies

- Life Length

- SpectraCell Laboratories, Inc.

- RepeatDx

- Cell Science Systems

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- OPKO Health, Inc.

- Genova Diagnostics (GDX)

- Immundiagnostik AG

- DNA Labs India

Segments Covered in the Report

By Test Type

- Single Test Panels

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metals Tests

- Multi-test Panels

By Sample Type

- Blood

- Saliva

- Serum

- Urine

By Collection Site

- Home

- Office

- Hospital

- Diagnostic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/