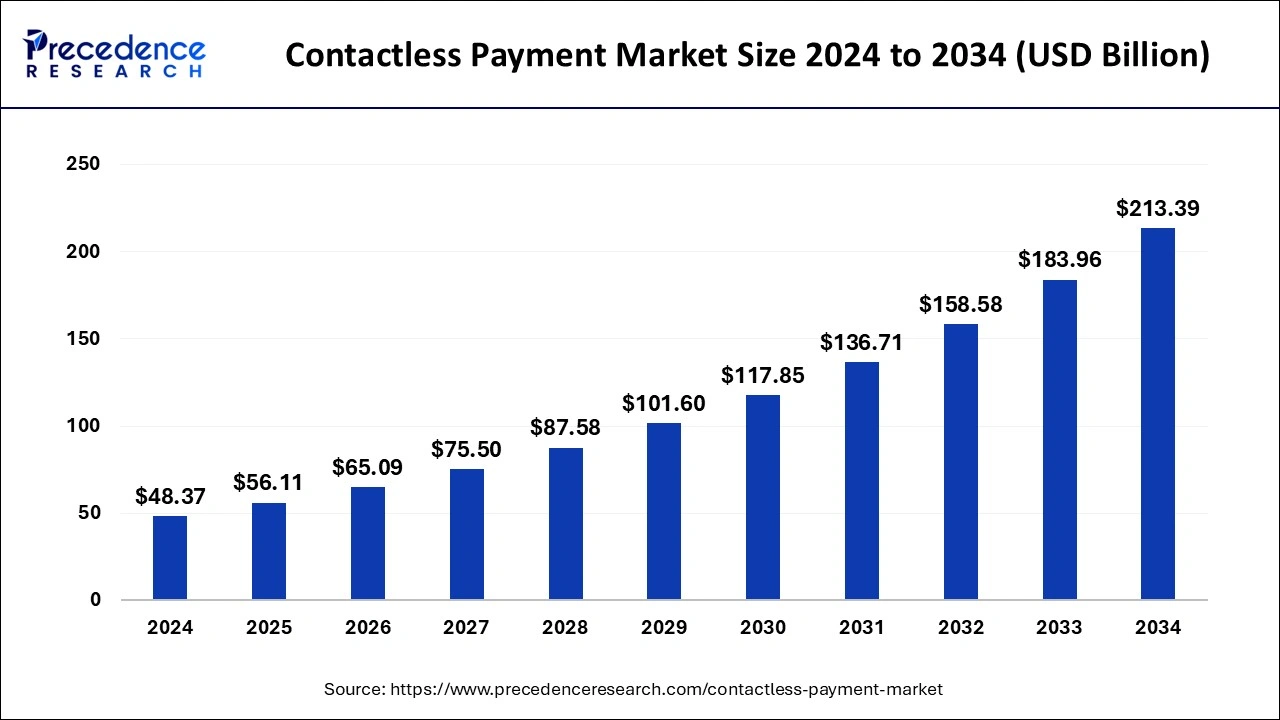

The contactless payment market size was estimated at USD 48.37 billion in 2024 and is expected to cross around USD 213.39 billion by 2034 with a CAGR of 16%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1044

Key Takeaways

- North America led the global market in 2024 with the highest share.

- The payment terminal solution segment made up more than 40% of the total revenue.

- The retail sector captured over 60% of the revenue share by application.

- The smartphones and wearables segment accounted for more than 60% of the revenue share by device.

The Role of AI in Advancing Contactless Payments

- AI-powered security systems reduce fraud risks through biometric authentication and anomaly detection.

- Predictive analytics enable financial institutions to anticipate trends and enhance payment processing.

- Chatbots and virtual assistants streamline customer support in digital payment services.

Contactless Payment Market Overview

The contactless payment market is expanding rapidly, transforming the way consumers and businesses conduct transactions. The increasing demand for convenience and security in payments has led to widespread adoption of contactless cards, mobile wallets, and wearable payment devices. The push for digitalization in banking and retail, combined with technological advancements such as biometric authentication and tokenization, has made contactless payments more secure and efficient. Businesses across various industries are integrating these solutions to enhance customer experience and streamline operations.

Market Dynamics

Market Drivers

The rise of digital wallets and mobile-based payment solutions is a key driver of market growth. Consumers are increasingly opting for contactless transactions due to their speed and ease of use. The growing awareness of hygienic payment methods, especially post-pandemic, has further accelerated adoption. Government initiatives aimed at promoting financial inclusion and reducing dependency on cash are supporting market expansion. Additionally, the adoption of NFC-enabled devices and the integration of blockchain technology in payment security are enhancing trust in digital transactions.

Opportunities

The increasing integration of contactless payment solutions in public transportation and smart retail solutions offers new growth avenues. Emerging economies with growing digital infrastructure present significant market opportunities. The rise of super apps that combine multiple payment functionalities, along with the adoption of biometric authentication, is expected to drive future innovations. Fintech firms collaborating with traditional banking institutions are likely to introduce more user-friendly and secure payment solutions.

Challenges

Challenges such as regulatory compliance, security concerns, and interoperability issues hinder market expansion. The risk of fraudulent transactions and data breaches remains a major concern for consumers and financial institutions. Some developing regions still lack the necessary technological infrastructure to support widespread adoption of contactless payments. Additionally, merchant adoption remains a challenge in certain markets due to high costs associated with upgrading payment terminals.

Regional Insights

North America and Europe continue to dominate the market, with widespread adoption of contactless cards and digital wallets. The Asia-Pacific region is experiencing rapid growth, driven by increasing smartphone penetration and government-backed initiatives promoting digital payments. Latin America and Africa are emerging markets with untapped potential, where ongoing investments in fintech and digital payment infrastructure are expected to accelerate adoption.

Contactless Payment Market Companies

- Verifone

- Ingenico Group SA

- Gemalto

- Visa Inc.

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Thales Group

- Wirecard AG

- On Track Innovations Ltd.

- IDEMIA

Recent Developments:

- In August 2024, Mastercard collaborated with boAt, India’s leading wearables brand, to enable contactless payments on boAt’s payment-enabled smartwatches. This collaboration enables Mastercard cardholders to make convenient and secure transactions using the boat’s wearable devices by offering key features such as Tap-and-Pay functionality and enhanced security.

- In September 2024, NMI, a global leader in embedded payments, partnered with INIT, a leading supplier of public transit ticketing solutions, to implement a cutting-edge payment processing solution for the San Diego Metropolitan Transit System (MTS). This collaboration showcases a new “Tap-on/Tap-off” model that enhances both convenience and security for daily commuters on MTS buses and trolleys.

- In January 2025, Mollie, a leading provider of financial services in Europe, introduced Apple’s Tap to Pay on iPhone for its customers in Austria, Italy, and the U.K. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need for additional hardware.

Segments Covered in the Report

By Solution

- Security and Fraud Management

- Payment Terminal Solution

- Transaction Management

- Hosted Point-of-Sales

- Analytics

By Application

- Government

- Healthcare

- Retail

- Transportation

- Hospitality

By Device

- Point-of-Sales Terminals

- Smartphones & Wearables

- Smart Cards

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/