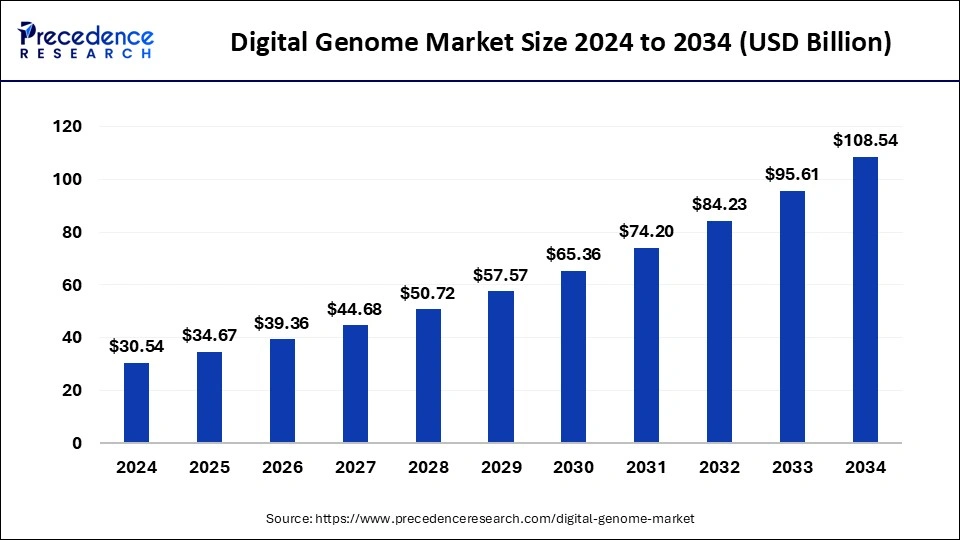

The global digital genome market size reached USD 42.23 billion in 2023 and is projected to attain around USD 109.74 billion by 2033, growing at a CAGR of 10.20% from 2024 to 2033.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the sequencing and analyzer instruments segment dominated the market in 2023.

- By product, the DNA/RNA analysis kits segment is observed to witness the fastest rate of expansion during the forecast period.

- By application, the microbiology segment accounted for the largest market share in 2023.

- By end-user, the academic research institutes segment dominated the market in 2023.

The Digital Genome Market refers to the global industry involved in the analysis, storage, and interpretation of genomic data using digital technologies. This market encompasses various segments such as sequencing platforms, bioinformatics software, and data analysis services, all aimed at decoding and understanding the genetic information of living organisms. With the advent of high-throughput sequencing technologies and advancements in bioinformatics, the digital genome market has witnessed significant growth in recent years. The ability to sequence and analyze genomes at a faster pace and lower cost has led to widespread applications across various fields including healthcare, agriculture, pharmaceuticals, and research.

Get a Sample: https://www.precedenceresearch.com/sample/3963

Growth Factors:

Several key factors are driving the growth of the digital genome market. Firstly, the declining cost of genome sequencing has made it more accessible to researchers, clinicians, and consumers, thereby expanding the market’s reach. Additionally, advancements in next-generation sequencing (NGS) technologies have enabled faster and more accurate sequencing of DNA, RNA, and other genetic materials, fueling demand for sequencing platforms and related services. Moreover, the growing focus on personalized medicine and precision healthcare has created opportunities for leveraging genomic data to tailor medical treatments and interventions according to an individual’s genetic makeup, further driving market growth.

Region Insights:

The digital genome market exhibits a global presence, with significant activity observed across various regions. North America, particularly the United States, dominates the market due to the presence of a robust healthcare infrastructure, extensive research and development (R&D) activities, and favorable government initiatives promoting genomic research. Europe also holds a significant share of the market, driven by increasing investments in genomics research, collaborations between academic institutions and industry players, and supportive regulatory frameworks. Meanwhile, the Asia-Pacific region is experiencing rapid growth, attributed to rising healthcare expenditure, expanding genomics research initiatives, and increasing awareness about the potential applications of genomic technologies.

Digital Genome Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.20% |

| Global Market Size in 2023 | USD 42.23 Billion |

| Global Market Size by 2033 | USD 109.74 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Genome Market Dynamics

Drivers:

Several drivers are propelling the growth of the digital genome market. Technological advancements such as the development of novel sequencing platforms, improved bioinformatics algorithms, and automation of data analysis processes are driving innovation and expanding the capabilities of genomic research. Furthermore, the rising prevalence of genetic disorders and chronic diseases has heightened the demand for genomic testing and personalized medicine, fostering market growth. Additionally, increasing adoption of genomic technologies in agricultural biotechnology, environmental conservation, and forensic science is driving market expansion across diverse applications.

Opportunities:

The digital genome market is ripe with opportunities for innovation and expansion. One significant opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) algorithms into genomic data analysis, enabling more precise interpretation of complex genetic information and facilitating the discovery of novel biomarkers and therapeutic targets. Furthermore, the burgeoning field of synthetic biology presents opportunities for leveraging genomic data to engineer biological systems for various industrial, medical, and environmental applications. Additionally, the growing trend towards direct-to-consumer (DTC) genetic testing offers opportunities for companies to tap into the consumer genomics market by providing personalized health insights and ancestry information.

Challenges:

Despite its promising growth prospects, the digital genome market faces several challenges that could impede its advancement. Data privacy and security concerns surrounding genomic data pose significant challenges, particularly with regards to safeguarding sensitive genetic information from unauthorized access or misuse. Moreover, the interpretation of genomic data remains complex and requires specialized expertise in bioinformatics and genomics, highlighting the need for ongoing education and training initiatives to bridge the skills gap in this field. Additionally, regulatory hurdles and ethical considerations surrounding genomic research and clinical applications necessitate clear guidelines and frameworks to ensure responsible use and dissemination of genomic data.

Read Also: Glucose Biosensors Market Size to Reach USD 50.19 Bn by 2033

Recent Developments

- In February 2024, the government of Telangana announced the Rs 2000 crore investment for the expansion of the Genome Valley Project in Hyderabad. The Chief Minister of Telangana Revanth Reddy announced the government is promoting the 300-acre second phase for the project expansion stated in the inauguration of the BioAsia 2024 meet in Hyderabad.

- In February 2024, Bio-Rad Laboratories, Inc. a leading player in clinical diagnostic products, and life science research announced the launch of the Vericheck ddPCR Replication Competent AAV Kit and Vericheck ddPCR™ Replication Competent Lentivirus Kit. The launch is the cost-effective solution of replication-competent adeno-associated virus (RCAAV), and replication-competent lentivirus (RCL), supports the safer production of gene therapies and cells.

- In February 2024, Veracyte, Inc. a leading player in cancer diagnostics announced the completion of a partnership with C2i Genomics, Inc., with the addition of whole-genome minimal residual disease (MRD) capabilities in its diagnostic platform and increasing the company’s ability to serve patients in the cancer care continuum.

Digital Genome Market Companies

- Illumina, Inc.

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc.

- Thermo Fisher Scientific Inc.

- Oxford Nanopore Technologies Limited

- Nanostring Technologies, Inc.

- IBM Corporation

- Google LLC

- Amazon.com, Inc.

- Desktop Genetics Ltd.

- Ancestry.com LLC.

Segments Covered in the Report

By Product

- Sequencing And Analyzer Instruments

- DNA/RNA Analysis Kits

- Sequencing Chips

- Sequencing and Analyzing Software

- Sample Preparation Instruments

By Application

- Microbiology

- Biological

- Clinical

- Industrial

- Reproductive and Genetic Transplantation

- Livestock and Agriculture

- Forensic Research and Development

By End-user

- Academic Research Institutes

- Diagnostics and Forensic Labs

- Hospitals

- Bio-pharmaceutical Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/