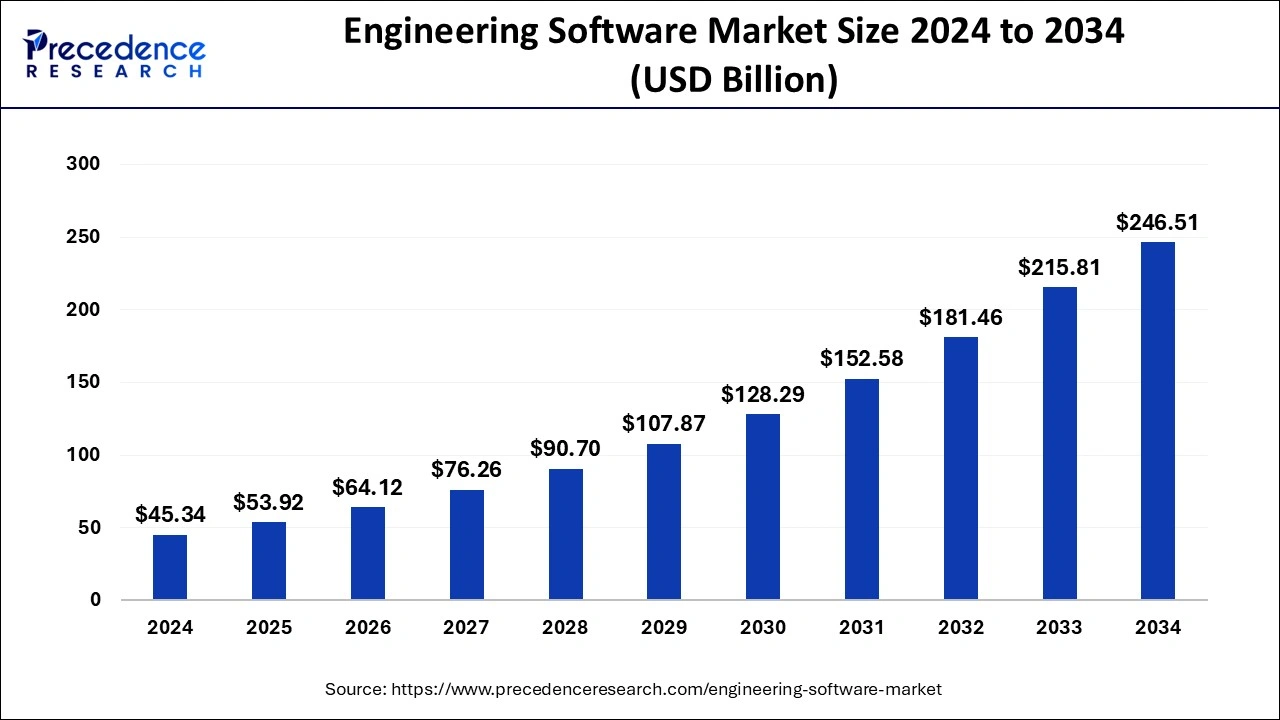

The global engineering software market size reached USD 38.12 billion in 2023 and is projected to hit around USD 215.81 billion by 2033, expanding at a CAGR of 18.93% from 2024 to 2033.

Key Points

- North America has contributed the largest market share of 35% in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR of 19.4% between 2024 and 2033.

- By component, the software segment has held the largest market share of 71% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 19.44% between 2024 and 2033.

- By deployment, the on-premises segment has generated over 54% of market share in 2023.

- By deployment, the cloud segment is expected to grow at the remarkable CAGR of 20.15% over the projected period.

- By application, the product design & testing segment has generated over 32% of market share in 2023.

- By application, the drafting & 3D modeling segment is expected to expand at the fastest CAGR over the projected period.

The engineering software market has experienced remarkable growth in recent years, driven by technological advancements, increasing demand for automation, and the growing complexity of engineering projects across various industries. Engineering software refers to specialized applications designed to assist engineers in designing, analyzing, and simulating products and systems. These software tools encompass a wide range of functionalities, including computer-aided design (CAD), computer-aided engineering (CAE), product lifecycle management (PLM), and computer-aided manufacturing (CAM). The market for engineering software is diverse, catering to the needs of industries such as automotive, aerospace, electronics, construction, and healthcare, among others. As companies continue to emphasize innovation, efficiency, and sustainability in their operations, the adoption of engineering software is expected to further accelerate, driving market growth.

Get a Sample: https://www.precedenceresearch.com/sample/4000

Growth Factors

Several key factors are driving the growth of the engineering software market. Firstly, the increasing complexity of engineering projects necessitates advanced software solutions to streamline design processes, improve accuracy, and reduce time-to-market. With the rise of smart manufacturing and Industry 4.0 initiatives, there is a growing emphasis on digital transformation, driving the adoption of engineering software for optimizing production processes and enhancing product quality. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies into engineering software is unlocking new capabilities, such as predictive modeling, optimization, and autonomous design generation, thereby fueling market growth. Additionally, the proliferation of cloud-based engineering software solutions offers scalability, flexibility, and accessibility, enabling remote collaboration and data sharing among geographically dispersed teams, which is particularly crucial in today’s globalized business landscape.

Region Insights:

The engineering software market exhibits significant regional variations in terms of adoption, market dynamics, and competitive landscape. North America, particularly the United States, dominates the market owing to the presence of a robust technology infrastructure, a large base of engineering companies, and ongoing investments in research and development. The region benefits from early adopters of emerging technologies and a strong ecosystem of software vendors offering innovative solutions tailored to various industries. Europe follows closely, driven by the strong manufacturing base, stringent regulatory standards, and increasing focus on sustainable practices. Meanwhile, Asia Pacific is witnessing rapid growth, fueled by industrialization, urbanization, and investments in infrastructure projects across countries like China, India, and Japan. The region presents immense opportunities for engineering software vendors, given the burgeoning demand from sectors such as automotive, electronics, and construction.

Engineering Software Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.93% |

| Global Market Size in 2023 | USD 38.12 Billion |

| Global Market Size by 2033 | USD 215.81 Billion |

| U.S. Market Size in 2023 | USD 9.34 Billion |

| U.S. Market Size by 2033 | USD 53.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Deployment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Engineering Software Market Dynamics

Drivers:

Several factors are driving the adoption of engineering software across industries. Firstly, the need for efficiency and productivity gains is compelling organizations to invest in software tools that streamline design and engineering processes, reduce errors, and accelerate time-to-market. Engineering software enables iterative design optimization, simulation-driven product development, and virtual prototyping, allowing companies to minimize costs and maximize performance. Moreover, the increasing emphasis on sustainability and environmental stewardship is driving the adoption of software solutions that facilitate energy-efficient design, waste reduction, and lifecycle assessment. Additionally, the integration of interdisciplinary design and collaboration features in engineering software enables seamless coordination among multidisciplinary teams, leading to better-informed decision-making and superior outcomes.

Opportunities:

The engineering software market is ripe with opportunities for innovation and expansion. One significant opportunity lies in the development of industry-specific solutions tailored to the unique requirements and challenges of various sectors, such as automotive, aerospace, healthcare, and energy. By addressing industry-specific pain points and compliance requirements, software vendors can unlock new revenue streams and gain a competitive edge. Furthermore, the advent of disruptive technologies like additive manufacturing, digital twins, and generative design presents immense opportunities for software vendors to develop cutting-edge solutions that harness the full potential of these technologies. Moreover, the increasing adoption of subscription-based pricing models and cloud-based delivery platforms opens up new avenues for reaching a broader customer base, including small and medium-sized enterprises (SMEs) that may have limited IT infrastructure and resources.

Challenges:

Despite the promising growth prospects, the engineering software market faces several challenges that need to be addressed. One of the primary challenges is interoperability and data compatibility issues, particularly in environments where multiple software tools are used across different stages of the product lifecycle. Ensuring seamless integration and data exchange between disparate systems remains a persistent challenge for engineers and IT professionals. Moreover, the rapid pace of technological advancements necessitates continuous upskilling and training of engineering teams to leverage the full capabilities of sophisticated software tools. Additionally, concerns related to data security, privacy, and intellectual property protection pose challenges, especially as companies increasingly rely on cloud-based solutions and collaborative platforms for engineering work. Furthermore, the high upfront costs associated with acquiring and implementing engineering software solutions may act as a barrier to adoption for some organizations, particularly SMEs with limited budgets and resources.

Read Also: Artificial Intelligence (AI) in Semiconductor Market Size, Share, Report 2033

Recent Developments

- In February 2022, Dassault Systèmes and Cadence Design Systems, Inc. revealed a partnership, integrating Dassault Systèmes’ 3DEXPERIENCE platform with the Cadence Allegro platform.

- In November 2022, IBM introduced new tools designed to help companies eliminate data silos and incorporate analytics for making data-driven decisions and swiftly managing unforeseen disruptions. IBM’s Organization Analytics Enterprise provides users with a holistic view of their business’s data sources through features including business intelligence planning, budgeting, reporting, forecasting, and dashboard capabilities.

- Also in November 2022, Bentley Systems launched Bentley Infrastructure Cloud, a suite of business solutions covering the entire infrastructure value chain and lifecycle. Bentley Infrastructure Cloud’s comprehensive and continually updated digital twins enable the creation, delivery, and maintenance of superior infrastructure.

Engineering Software Market Companies

- Autodesk, Inc.

- Siemens Digital Industries Software

- Dassault Systèmes

- ANSYS, Inc.

- Bentley Systems, Incorporated

- Trimble Inc.

- PTC Inc.

- Hexagon AB

- Altair Engineering, Inc.

- MSC Software Corporation

- Synopsys, Inc.

- AVEVA Group plc

- Cadence Design Systems, Inc.

- MathWorks, Inc.

- Aspen Technology, Inc.

Segments Covered in the Report

By Component

- Software

- Computer-Aided Design (CAD) Software

- Computer-Aided Manufacturing (CAM) Software

- Computer-Aided Engineering (CAE) Software

- Others

- Services

- Development Service

- Training, Support & Maintenance

By Deployment

- Cloud

- On-premises

By Application

- Design Automation

- Product Design & Testing

- Plant Design

- Drafting & 3D Modeling

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/