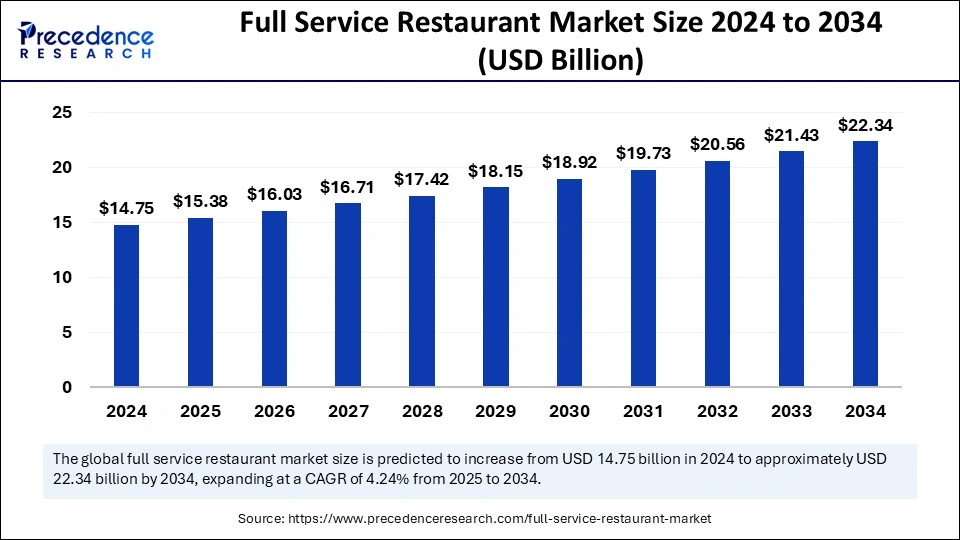

The global full service restaurant market size was valued at USD 14.75 billion in 2024 and is expected to exceed around USD 22.34 billion by 2034, growing at a CAGR of 4.24%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5818

Full Service Restaurant Market Key Takeaways

-

n 2024, North America topped the global market with a 31% share.

-

Asia Pacific is likely to emerge as the fastest-growing region throughout the forecast years.

-

Casual dining was the leading restaurant type in 2024.

-

Family dining is predicted to see consistent CAGR growth in the upcoming years.

-

Among menu types, ethnic cuisine was the most dominant in 2024.

-

Italian cuisine is set to grow rapidly in the coming years.

-

Table service held a significant market share based on service type in 2024.

-

Delivery services are projected to experience notable expansion during the forecast period.

The AI-Powered Evolution of Full-Service Restaurants

The role of AI in the full-service restaurant market is becoming increasingly significant as technology continues to enhance customer experience, streamline operations, and drive efficiency. AI applications are revolutionizing various aspects of the industry, from improving service delivery to optimizing inventory management and marketing strategies.

AI-powered chatbots and virtual assistants are transforming customer service by handling reservations, order placements, and customer inquiries. These systems enhance guest experiences by providing quick, personalized interactions, which helps reduce wait times and improve satisfaction. Furthermore, AI algorithms are used to analyze customer preferences, enabling restaurants to offer tailored menus and promotions that cater to individual tastes, increasing customer retention and sales.

In kitchen operations, AI-driven tools assist with inventory management, predictive analytics, and even recipe optimization. AI can forecast demand based on historical data, weather conditions, and local events, helping restaurants reduce food waste and manage stock more efficiently. Additionally, AI-based systems can suggest ingredient substitutions or improve cooking processes, ensuring consistency and quality in food preparation.

AI is also being applied in the backend for operational improvements, such as staff scheduling, energy management, and supply chain optimization. With real-time data analytics, restaurants can better allocate resources, manage energy consumption, and ensure a smoother flow of operations. AI-driven marketing strategies further enable restaurants to target the right audience with personalized offers, boosting customer engagement and brand loyalty.

Full Service Restaurant Market Growth Factors

The full-service restaurant market is experiencing robust growth driven by several key factors. Increasing disposable incomes and rapid urbanization are encouraging more people to dine out, while evolving consumer preferences for experiential and personalized dining are boosting demand for full-service establishments. Technological innovations such as digital menus, online reservations, and contactless payments are also enhancing customer experiences and streamlining operations.

In addition, the market is benefitting from trends toward health-conscious eating and sustainable practices, with many restaurants adapting menus and sourcing methods to meet these demands. The growth of tourism and expansion of delivery and takeout services have further widened customer reach, allowing full-service restaurants to cater to both on-site diners and those seeking convenient, high-quality meals at home.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 22.34 Billion |

| Market Size in 2025 | USD 15.38 Billion |

| Market Size in 2024 | USD 14.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Yeareny | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Restaurant Type, Menu Type, Service Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Full-service restaurants represent a vital segment of the foodservice industry, offering sit-down meals, customized services, and curated dining experiences. These establishments attract customers looking for a complete meal combined with attentive service and atmosphere, making them a preferred choice for family gatherings, celebrations, and business meetings.

Market Driver

The market is fueled by rising consumer expectations, a growing appetite for global cuisines, and the increasing popularity of dining as a lifestyle activity. Digital transformation, including online booking systems and customer feedback integration, is also helping businesses enhance service efficiency and user experience.

Opportunities

Restaurants can benefit from growing demand for healthy and specialized diet offerings like vegan, gluten-free, and keto options. Franchising and investment in smart kitchen technologies offer scalable growth paths. The rise in mobile ordering and loyalty apps also provides ways to retain and attract a wider customer base.

Challenges

Labor shortages and high employee turnover remain pressing issues, alongside stiff competition and high dependency on local foot traffic. Rising food and utility costs can squeeze margins, and disruptions in supply chains pose a risk to consistent service delivery.

Regional Insights

North America continues to dominate due to its mature market structure and consumer familiarity with full-service formats. The Asia Pacific region is emerging as a growth hub, with countries like India and China showing increased restaurant visits driven by young demographics and rising incomes. In Europe, culinary tourism and heritage dining experiences support the market’s steady performance

Full Service Restaurant Market Companies

- Taco Bell Corp

- Yum! Brands, Inc.

- The McDonald’s Corporation

- Domino’s Pizza, Inc.

- Dunkin’ Brands Group, Inc.

- Panera Bread Company

- Darden Restaurants, Inc.

- Restaurant Brands International Inc.

- Chipotle Mexican Grill, Inc.

- Starbucks Corporation

- Wendy’s Company

- Subway Restaurants, LLc

- Texas Roadhouse, Inc.

- Outback Steakhouse, Inc.

Recent Developments

- In March 2025, the New Museum in New York, U.S., is undergoing renovation. A full-service restaurant is set to be opened inside the museum for the first time. This restaurant will integrate sustainable materials and practices in its menu and design.

- In January 2025, Slim Chickens officially opened its first full-service restaurant in Ann Arbor, Michigan.

- In November 2024, a ‘metroburb’ Bell Works in New Jersey got its first full-service restaurant. This restaurant, named Mabel, will serve European bar food.

- In October 2024, Punta Gorda Airport in Florida, U.S., announced that it is demanding dialects for a public full-service restaurant, bar, and even catering operation at the PGD Air Center. The authorities take this step to accommodate rising demand from employees, aviators, and local residents.

Segments Covered in the Report

By Restaurant Type

- Casual Dining

- Fine Dining

- Family Dining

- Quick Service Restaurants (QSRs)

By Menu Type

- Ethnic Cuisine

- American Cuisine

- Italian Cuisine

- Asian Cuisine

By Service Type

- Table Service

- Counter Service

- Buffet Service

- Delivery Service

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

Also Read: Customer Self-service Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/