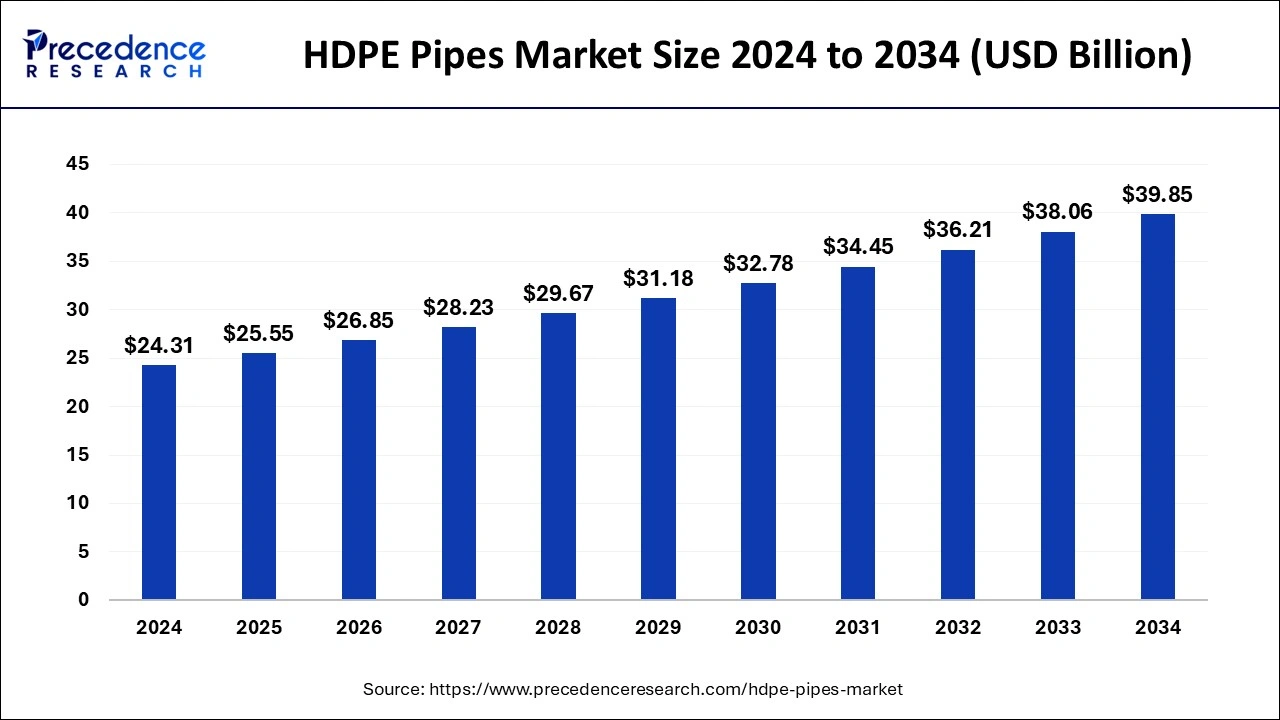

The global HDPE pipes market size reached USD 23.12 billion in 2023 and is predicted to reach around USD 38.06 billion by 2033, growing at a CAGR of 5.11% from 2024 to 2033.

Key Points

- Asia-Pacific dominated the global market in 2023.

- Europe shows a significant growth in the market during the forecast period.

- By type, the HDPE 100 segment dominated the HDPE pipes market in 2023.

- By type, the HDPE 80 segment is observed to be the fastest growing market during the forecast period.

- By application, the sewage system pipe segment dominated the HDPE pipes market in 2023.

- By application, the oil and gas pipe segment are observed to be the fastest growing market during the forecast period.

High-Density Polyethylene (HDPE) pipes are widely used in various industries for their strength, durability, and resistance to corrosion and chemicals. These pipes are made from a thermoplastic polymer known for its high tensile strength and flexibility. HDPE pipes are utilized in water supply, gas distribution, sewage systems, irrigation, and industrial applications. The market for HDPE pipes has been growing due to their cost-effectiveness, long lifespan, and environmental benefits.

Get a Sample: https://www.precedenceresearch.com/sample/4361

Growth Factors

The growth of the HDPE pipes market is driven by several factors. Increasing infrastructure development, particularly in emerging economies, is a significant driver. The need for modern water supply systems and efficient waste management has led to a surge in demand for HDPE pipes. Additionally, the growing emphasis on sustainable and eco-friendly solutions in construction and industrial sectors has boosted the adoption of HDPE pipes, which are recyclable and have a lower environmental impact compared to traditional materials like steel and concrete.

Regional Insights

Regionally, the HDPE pipes market exhibits varying growth patterns. North America and Europe have mature markets with steady growth, driven by the replacement of aging infrastructure and stringent environmental regulations. Asia-Pacific, particularly countries like China and India, shows robust growth due to rapid urbanization, industrialization, and government initiatives to improve water and sanitation infrastructure. The Middle East and Africa also present significant opportunities due to ongoing infrastructure projects and increasing investment in oil and gas exploration.

HDPE Pipes Market Scope

| Report Coverage | Details |

| HDPE Pipes Market Size in 2023 | USD 23.12 Billion |

| HDPE Pipes Market Size in 2024 | USD 24.31 Billion |

| HDPE Pipes Market Size by 2033 | USD 38.06 Billion |

| HDPE Pipes Market Growth Rate | CAGR of 5.11% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

HDPE Pipes Market Dynamics

Drivers

Key drivers for the HDPE pipes market include the increasing need for efficient water management systems, rising investments in infrastructure development, and the advantages of HDPE pipes over traditional materials. Their lightweight nature, ease of installation, and resistance to chemicals and UV radiation make them an attractive choice for various applications. Moreover, technological advancements in manufacturing processes have improved the quality and performance of HDPE pipes, further fueling their adoption.

Opportunities

The HDPE pipes market offers several growth opportunities. The increasing focus on renewable energy sources such as geothermal and solar energy creates a demand for HDPE pipes in associated applications. The trend towards smart cities and sustainable urban development also provides a significant market opportunity, as HDPE pipes are integral to modern infrastructure. Additionally, innovations in material science and the development of advanced composite HDPE pipes can open new application areas and enhance market growth.

Challenges

Despite the positive outlook, the HDPE pipes market faces challenges. The fluctuating prices of raw materials, particularly polyethylene, can impact the profitability of manufacturers. Competition from alternative materials such as PVC and PEX pipes poses a threat to market growth. Additionally, issues related to the proper installation and maintenance of HDPE pipes can affect their performance and longevity. Addressing these challenges requires continuous innovation, effective supply chain management, and stringent quality control measures.

Read Also: Payment Security Market Size to Reach USD 95.35 Billion by 2033

HDPE Pipes Market Recent Developments

- In April 2024, based in Sequin, Texas, AmeriTex Pipe & items LLC is constructing a new Conroe, Texas factory to extrude corrugated pipe from virgin high-density polyethylene and polypropylene, meeting the state’s demand for infrastructure items.

- In December 2023, announcing the acquisition of Infinity Plastics, a manufacturer of manufactured high-density polyethylene (HDPE) piping products, was ISCO Industries.

- In November 2023, a definitive agreement was reached to acquire nearly all of the assets of Lee Supply Company Inc. (Lee Supply), the ability to rent HDPE fusion equipment and perform custom fabrication. Core & Main Inc. is a leader in advancing dependable infrastructure with local service across the country.

HDPE Pipes Market Companies

- Lane Enterprises, Inc

- POLY PLASTIC Group

- RADIUS System

- SCG Chemicals Public Company Limited

- JM EAGLE, INC.

- United Poly Systems

- Vectus

- Prinsco, Inc.

- WL Plastics

- Blue Diamond Industries

Segments Covered in the Report

By Type

- HDPE 63

- HDPE 80

- HDPE 100

By Application

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/