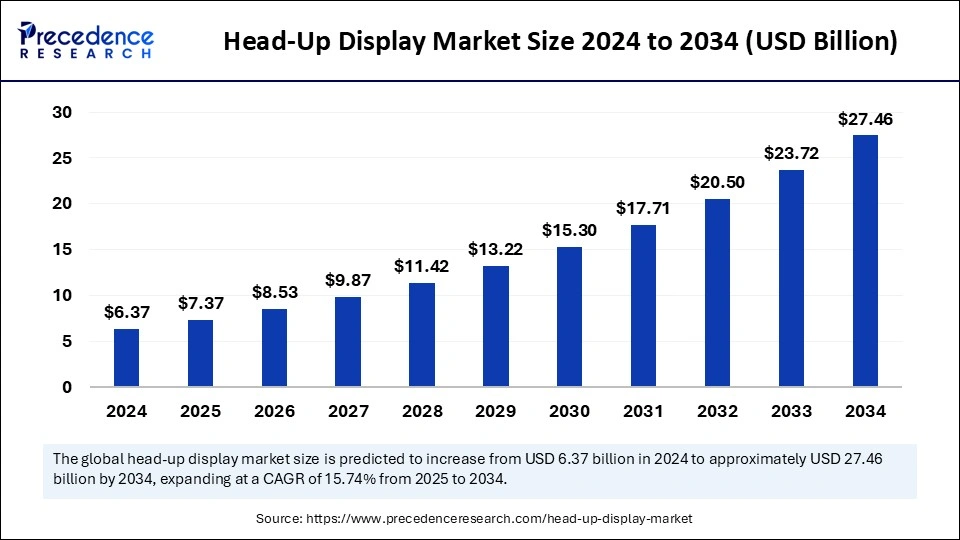

The global head-up display market size was valued at USD 6.37 billion in 2024 and is expected to cross around USD 27.46 billion by 2034, growing at a CAGR of 15.74% from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5765

Head-Up Display Market Key Points

-

In 2024, North America accounted for 35% of the global head-up display market, maintaining its leadership.

-

The Asia Pacific region is estimated to experience rapid expansion with a CAGR of 17.6% during the forecast period.

-

Europe is expected to showcase notable growth in the coming years.

-

Helmet-mounted displays remained the dominant type in 2024.

-

The fixed-mounted segment is projected to be the fastest-growing type throughout the forecast period.

-

The projector unit segment held the largest share among components.

-

The automotive sector was the top application area in 2024.

-

The wearable segment is set to grow at the highest CAGR in the forecast years.

-

The aviation sector is anticipated to experience steady and significant expansion.

Artificial Intelligence (AI) Impact on the Head-Up Display Market

1. Enhancing Display Performance and User Experience

AI-powered head-up displays (HUDs) significantly improve visual clarity, responsiveness, and adaptability. By utilizing real-time data analysis, AI enables HUDs to adjust brightness, contrast, and projection angles dynamically based on ambient lighting conditions and user preferences. This results in a more seamless and personalized viewing experience, enhancing driver or pilot situational awareness.

2. Advanced Augmented Reality (AR) Integration

AI-driven HUDs are increasingly integrating augmented reality (AR) elements to provide real-time, context-aware information. In automotive applications, AI-powered AR HUDs overlay navigation instructions, hazard warnings, and traffic updates directly onto the windshield. In aviation, AI-enhanced HUDs provide pilots with crucial flight data, reducing cockpit workload and improving decision-making efficiency.

3. AI-Powered Predictive Analytics and Safety Features

AI-driven HUDs are transforming safety by incorporating predictive analytics. These systems can detect obstacles, pedestrians, and other vehicles using AI-based object recognition and warn users proactively. AI also enables adaptive driving assistance features such as lane departure warnings, collision alerts, and speed limit recognition, reducing accident risks and enhancing driver assistance systems.

4. AI in Gesture and Voice-Controlled Interfaces

AI is enabling more intuitive interaction with HUDs through gesture and voice recognition. Instead of physical controls, users can interact with HUD systems using natural hand gestures or voice commands, minimizing distractions and improving ease of use. This AI integration enhances accessibility and usability in both automotive and aviation applications.

5. AI-Optimized Navigation and Real-Time Data Processing

AI enhances HUD navigation systems by optimizing routes based on real-time traffic data, weather conditions, and road hazards. By continuously analyzing data from GPS, sensors, and cloud-based services, AI-powered HUDs provide more accurate and efficient navigation assistance. This is particularly beneficial for autonomous vehicles and aviation applications where precision is crucial.

6. AI-Powered Personalization and Adaptive Learning

AI allows HUDs to learn user preferences and driving behaviors over time. These intelligent systems can adjust interface layouts, suggest preferred routes, and even provide real-time driver fatigue detection alerts. AI-based adaptive learning makes HUDs more intuitive and tailored to individual users, improving overall engagement and satisfaction.

7. AI-Driven Efficiency and Energy Management

AI contributes to energy efficiency in HUDs by optimizing power consumption. AI-powered systems adjust display settings based on environmental factors, ensuring optimal performance while reducing energy use. In electric vehicles, AI-driven HUDs can provide real-time energy efficiency insights, helping users maximize battery life and driving range.

8. AI in Military and Aerospace Applications

In defense and aerospace, AI-powered HUDs are revolutionizing pilot assistance by integrating battlefield intelligence, drone coordination, and automated target recognition. These systems improve situational awareness by processing vast amounts of data in real time, giving military personnel a tactical advantage.

Head-Up Display (HUD) Market Overview

The head-up display (HUD) market is witnessing significant growth due to the increasing adoption of advanced display technologies across various industries. HUDs project crucial information directly into the user’s line of sight, improving situational awareness and reducing distractions. Originally developed for military aviation, HUDs are now widely used in automotive, aerospace, and wearable applications. The rising demand for augmented reality (AR)-based HUDs and the integration of artificial intelligence (AI) are further driving market expansion.

Head-Up Display Market Growth Factors

The growth of the head-up display (HUD) market is primarily driven by the rising adoption of advanced driver assistance systems (ADAS) in the automotive industry. As vehicle safety regulations become stricter worldwide, automakers are integrating HUD technology to provide real-time navigation, speed, and hazard alerts, reducing driver distractions.

The increasing consumer demand for luxury and electric vehicles further boosts market expansion, as premium automakers incorporate HUDs to enhance the driving experience. Additionally, advancements in augmented reality (AR) and artificial intelligence (AI) are improving HUD functionalities, making them more interactive and informative.

Beyond automotive applications, the aerospace and defense sectors are contributing to market growth, with HUDs being widely adopted in military and commercial aircraft for improved pilot situational awareness. The growing interest in smart wearable devices and AR-powered glasses is opening new opportunities in healthcare, industrial, and consumer applications.

Emerging economies in Asia-Pacific, particularly China and India, are witnessing increased demand for HUDs due to rapid urbanization and smart transportation initiatives. However, challenges such as high costs and technical limitations in bright environments remain, necessitating ongoing innovations to enhance affordability and usability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.46 Billion |

| Market Size in 2025 | USD 7.37 Billion |

| Market Size in 2024 | USD 6.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.74% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Drivers

-

Growing Demand for Advanced Driver Assistance Systems (ADAS)

-

Automotive manufacturers are integrating HUDs into vehicles to enhance safety and driver convenience. Features like real-time navigation, speed display, lane departure warnings, and collision alerts make HUDs an essential part of ADAS.

-

-

Rising Adoption in Aerospace and Defense

-

Military and commercial aviation sectors are increasingly adopting HUDs for enhanced cockpit display systems. Pilots benefit from real-time flight data, terrain awareness, and navigation assistance without looking away from their primary view.

-

-

Technological Advancements in AR and AI

-

The introduction of AI-powered and AR-enhanced HUDs enables real-time data analysis, smart object recognition, and immersive visualization. These advancements are improving the accuracy and usability of HUDs in various applications.

-

-

Increasing Consumer Demand for Enhanced Vehicle Experience

-

With the rise of luxury and electric vehicles, there is a growing demand for advanced in-car technology. Automakers are integrating HUDs into premium vehicles to enhance driving experiences and ensure safety.

-

-

Government Regulations for Automotive Safety

-

Regulatory bodies are encouraging the adoption of HUDs as part of broader road safety initiatives. Countries implementing stringent safety regulations are pushing automakers to integrate HUD technology into their vehicles.

-

Market Opportunities

-

Expansion in Electric and Autonomous Vehicles

-

As electric and autonomous vehicles gain traction, HUDs will play a crucial role in providing real-time data visualization for drivers and passengers.

-

-

Development of Wearable and Smart Glasses-Based HUDs

-

HUDs are expanding beyond automotive and aviation, finding applications in smart glasses for healthcare, industrial use, and military operations.

-

-

Emerging Markets and Smart Cities Initiatives

-

Rapid urbanization and smart city projects are creating opportunities for HUD technology in connected vehicles and smart transportation infrastructure.

-

Market Challenges

-

High Cost of HUD Technology

-

The integration of HUDs into vehicles and aircraft remains expensive, limiting adoption in mid-range and budget-friendly models.

-

-

Technical Limitations in Bright Environments

-

HUDs face visibility issues in direct sunlight or high-glare conditions, impacting their effectiveness. Advanced display technologies are being developed to overcome this challenge.

-

-

Limited Awareness and Adoption in Emerging Economies

-

While developed markets are adopting HUDs at a fast pace, awareness and affordability remain barriers in emerging markets.

-

Regional Outlook

-

North America: Leading the global HUD market, driven by advanced automotive and aerospace industries, along with strong adoption of ADAS technologies.

-

Asia-Pacific: Expected to grow at the highest CAGR, fueled by rising vehicle production, increasing adoption of smart technologies, and government support for safer transportation.

-

Europe: A significant market due to strong automotive manufacturing, regulatory support for road safety, and increasing demand for luxury vehicles.

Head-Up Display Market Companies

- BAE Systems

- Continental AG

- DENSO CORPORATION

- Elbit Systems Ltd.

- Visteon Corporation

- YAZAKI Corporation

- Robert Bosch LLC

- Collins Aerospace

- Thales

Latest Announcement by Industry Leaders

- In November 2024, DENSO, a leading worldwide player in automotive technology from Japan, announced the collaboration with T-Hub, a leading startup incubator in India under the Telangana Government. The partnership helps in implementing the expertise of DENSO in the vibrant startup ecosystem in Telangana, aiming to enhance advanced automotive solutions.

Recent Developments

- In August 2024, Jio Platform Limited’s subsidiary MediaTek and JioThings Limited launched the “Made in India” smart module and smart cluster for the two-wheeler (2W) market.

- In May 2023, Google introduced the Android Auto and Android Automotive OS. With these updates, Google added WebEx, Microsoft Teams, and Zoom by Cisco, which will offer the convenience of attending meetings in cars.

- In June 2023, Continental AG, a leading multinational German automotive parts manufacturer, launched the ‘Smart Cockpit High-Performance Computer’ for OEMs. The smart cockpit combines multiple functionalities, such as infotainments, instrumentations, and others.

Segments Covered in the Report

By Type

- Fixed Mounted

- Helmet Mounted

By Component

- Combiner

- Video Generator

- Projector Unit

- Display Unit

By Application

- Automotive

- Premium/Luxury Cars

- Sports Cars

- Basic & Mid-segment Cars

- Aviation

- Wearables

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Also Read: Electronic Testing Services Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/