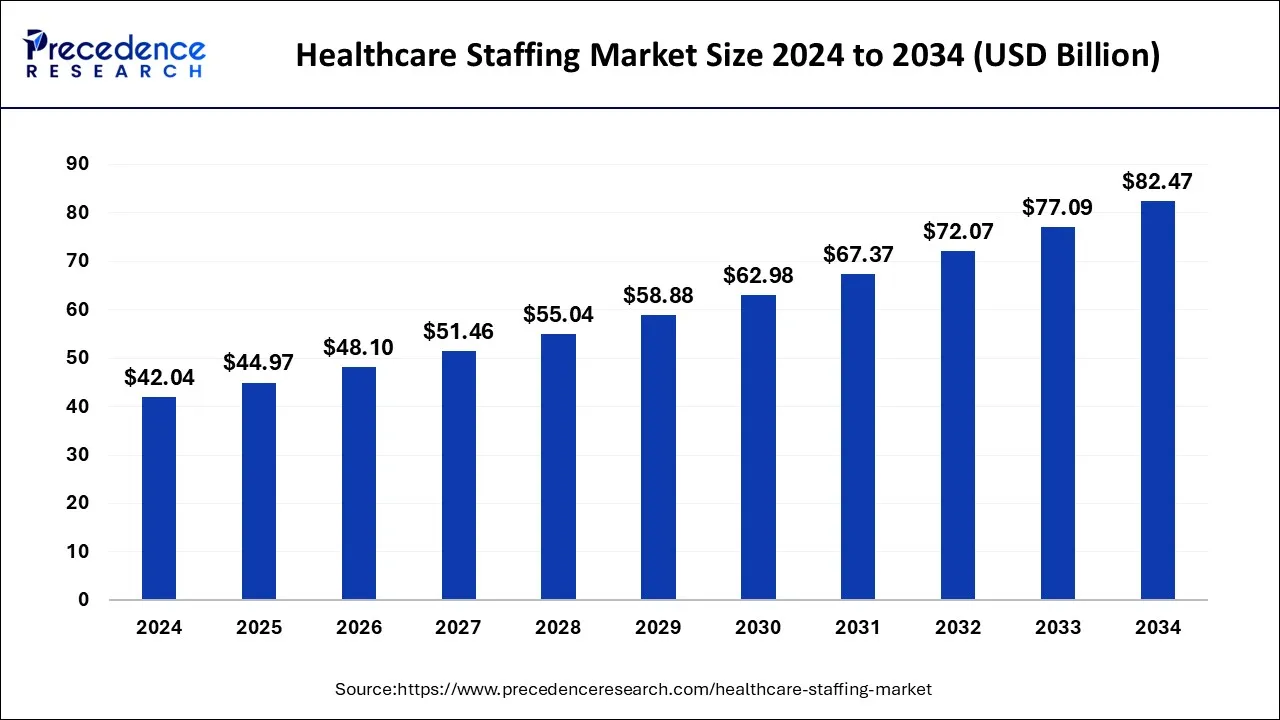

The global healthcare staffing market size was calculated at USD 42.04 billion in 2024 and is projected to attain around USD 82.47 billion by 2034 with a CAGR of 5.39%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1013

Market Key Takeaway

- In 2024, North America held the largest share of the healthcare staffing market at 57.90%.

- The Asia Pacific region is anticipated to expand at a CAGR of 7.8% throughout the forecast period.

- The travel nurse service segment had the highest market share by service type in 2024.

- The locum tenens service segment is forecasted to experience the fastest growth rate in the coming years.

- Hospitals remained the dominant end-user segment, securing the largest global market share in 2024.

Market Overview

The healthcare staffing market is experiencing steady growth due to the rising demand for healthcare professionals in hospitals, clinics, and other medical facilities. Factors such as an aging population, increasing patient admissions, and workforce shortages are driving the need for flexible staffing solutions. Various staffing services, including travel nursing, locum tenens, and allied healthcare staffing, are helping healthcare providers meet patient care demands efficiently. The market is expected to expand further as hospitals and medical institutions seek adaptable staffing models.

Market Drivers

Several factors are driving the growth of the healthcare staffing market. The shortage of healthcare professionals is one of the biggest challenges in the industry, leading to increased demand for temporary staffing solutions.

Rising healthcare expenditures and growing patient volumes are also contributing to market expansion. Government initiatives aimed at improving healthcare access have further fueled demand for staffing services. Additionally, advancements in recruitment technologies, such as AI-driven hiring platforms, have made it easier for healthcare facilities to connect with skilled professionals.

Market Opportunities

The healthcare staffing market presents various opportunities for growth. The increasing use of telehealth and remote patient care has created a demand for specialized healthcare professionals, particularly in virtual healthcare services.

Emerging markets are also experiencing a surge in demand for medical staffing as healthcare infrastructure continues to expand. Investments in digital recruitment platforms and partnerships between staffing agencies and healthcare providers are expected to enhance the efficiency of workforce management and improve patient care services.

Market Challenges

Despite strong growth, the healthcare staffing market faces multiple challenges. The shortage of skilled professionals remains a major concern, resulting in high competition for talent and rising labor costs. Regulatory and compliance requirements add complexity to hiring and recruitment processes.

Additionally, concerns about job satisfaction, burnout among healthcare workers, and fluctuating demand for temporary staffing can create instability in the market. Addressing these issues requires better workforce planning, government support, and improved job conditions for medical professionals.

Regional Insights

North America leads the healthcare staffing market, driven by a high demand for medical professionals and a well-developed healthcare system. The United States, in particular, relies heavily on travel nurses and locum tenens physicians to address staffing shortages.

Europe is also witnessing steady market growth due to aging populations and healthcare expansion initiatives. The Asia Pacific region is expected to grow at a rapid pace, supported by rising investments in healthcare infrastructure and staffing services. Meanwhile, emerging markets in Latin America and the Middle East are gradually adopting medical staffing solutions to strengthen their healthcare systems.

Healthcare Staffing Market Companies

- CHG Management, Inc.

- AMN Healthcare

- Almost Family

- Envision Healthcare Corporation

- inVentiv Health

- TeamHealth

- Maxim Healthcare Services, Inc.

- Cross Country Healthcare, Inc.

Segments Covered in the Report

By Service Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Allied Healthcare Staffing

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Private Sector

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/