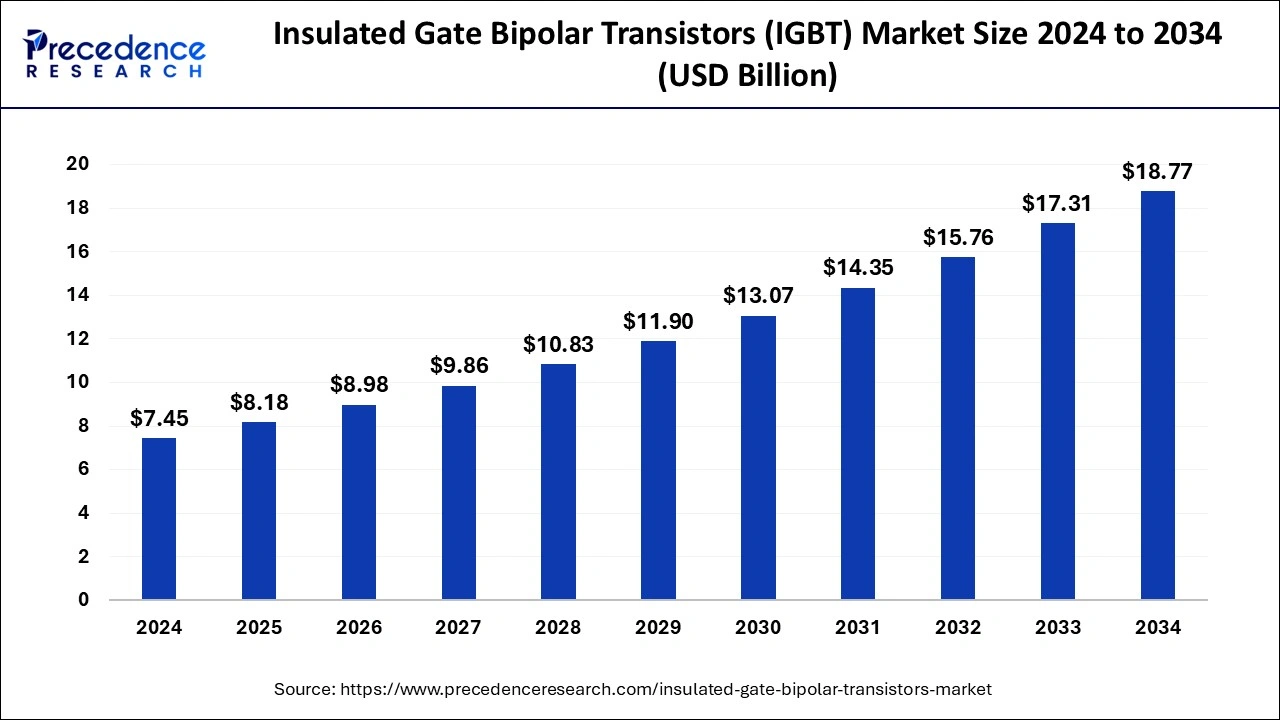

The global insulated gate bipolar transistors (IGBT) market size reached USD 6.78 billion in 2023 and is projected to hit around USD 17.31 billion by 2033, expanding at a CAGR of 9.83% from 2024 to 2033.

Key Points

- Asia-Pacific has contributed more than 44% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2023 and 2033.

- By voltage, the high voltage segment held the highest market share in 2023.

- By voltage, the medium voltage segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By application, the industrial manufacturing segment has held the major market share in 2023.

- By application, the automotive segment is anticipated to witness fastest growth over the projected period.

The Insulated Gate Bipolar Transistors (IGBT) market is a crucial segment within the semiconductor industry, playing a pivotal role in power electronics applications. IGBTs are semiconductor devices that combine the characteristics of both the insulated gate field-effect transistor (IGFET) and the bipolar junction transistor (BJT). These devices are extensively used in various applications such as industrial drives, renewable energy systems, consumer electronics, and automotive sectors. The market for IGBTs has witnessed significant growth owing to the increasing demand for efficient power management solutions, rising adoption of electric vehicles (EVs), and the rapid expansion of renewable energy generation.

Get a Sample: https://www.precedenceresearch.com/sample/4053

Insulated Gate Bipolar Transistors (IGBT) Market Data and Statistics

- Owing to favorable policies and declining prices, a recent International Energy Agency report forecasts that by 2030, there will be approximately 125 million electric cars globally, driving increased demand for IGBTs to fulfill the requirements of EVs.

- Renesas Electronics introduced a new series of high-voltage IGBTs in August 2022, aiming to enhance the power electronics essential for electric vehicles (EVs). These devices, part of the AE5 series, boast current ratings of up to 300 A and voltage tolerance of up to 1,200 V. By leveraging these IGBTs, automakers can optimize battery usage and extend the range of EVs through power conservation efforts.

Growth Factors:

Several factors contribute to the growth of the IGBT market. One of the primary drivers is the escalating demand for energy-efficient devices across various industries. IGBTs offer superior switching capabilities and low conduction losses, making them ideal for high-power applications. Moreover, the proliferation of electric vehicles (EVs) has surged the demand for IGBTs in automotive powertrain systems, as these transistors are essential components in motor control units and battery management systems. Furthermore, the increasing deployment of renewable energy sources such as solar and wind power has fueled the demand for IGBTs in inverters and converters used in power generation and distribution systems.

Region Insights:

The global IGBT market is geographically segmented into regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share in the market, driven by the presence of major semiconductor manufacturers and the burgeoning demand for consumer electronics and industrial automation in countries like China, Japan, and South Korea. Moreover, the rapid expansion of renewable energy projects in countries such as India and China further boosts the demand for IGBTs in the region. North America and Europe also contribute significantly to the market growth due to the widespread adoption of electric vehicles and the increasing emphasis on renewable energy integration into the power grid.

Insulated Gate Bipolar Transistors (IGBT) Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.83% |

| Global Market Size in 2023 | USD 6.78 Billion |

| Global Market Size in 2024 | USD 7.45 Billion |

| Global Market Size by 2033 | USD 17.31 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Voltage and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Insulated Gate Bipolar Transistors (IGBT) Market Dynamics

Drivers:

Several factors are driving the growth of the IGBT market. One of the key drivers is the increasing adoption of electric vehicles (EVs) worldwide. IGBTs play a crucial role in EV powertrain systems, contributing to improved efficiency and performance. Additionally, the growing focus on energy conservation and the need for sustainable power solutions have propelled the demand for IGBTs in various applications such as industrial drives, renewable energy systems, and consumer electronics. Furthermore, advancements in semiconductor technology, such as the development of insulated gate bipolar transistor modules with higher power density and efficiency, are driving the market growth.

Opportunities:

The IGBT market presents numerous opportunities for manufacturers and stakeholders. With the rapid expansion of renewable energy projects globally, there is a growing demand for IGBTs in inverters and converters used in solar and wind power systems. Moreover, the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) offers significant opportunities for IGBT manufacturers to supply power electronics components for vehicle electrification. Furthermore, the emergence of new applications such as smart grids, energy storage systems, and power electronics for aerospace and defense sectors presents untapped opportunities for market players to diversify their product offerings and expand their market presence.

Challenges:

Despite the promising growth prospects, the IGBT market faces several challenges that could hinder its growth trajectory. One of the key challenges is the intense competition among market players, leading to pricing pressures and margin erosion. Moreover, the cyclical nature of the semiconductor industry and fluctuations in demand from key end-user sectors pose challenges for manufacturers in terms of demand forecasting and inventory management. Additionally, issues related to product reliability, such as thermal management and lifetime degradation, remain significant challenges for IGBT manufacturers, particularly in high-power applications where reliability is critical. Furthermore, geopolitical tensions, trade disputes, and regulatory uncertainties could impact the supply chain and disrupt market dynamics, posing additional challenges for industry participants.

Read Also: Space Technology Market Size to Reach USD 916.85 Bn by 2033

Recent Developments

- In November 2022, NXP Semiconductor unveiled the new S32K39 series of automotive microcontrollers (MCUs) optimized for electric vehicle (EV) control applications. These modern S32K39 MCUs are designed to propel electrification into the future, offering high-speed and high-resolution control to enhance power efficiency, extend driving range, and deliver a smoother EV driving experience.

- In April 2022, Bhel announced plans to supply six electric locomotives for material handling operations. These locomotives will be manufactured at the company’s facility in the Jhansi Area of Uttar Pradesh. Traction motors for the locomotives will be supplied from the Bhopal plants, while IGBT-based transistors will come from its Bangalore unit. The company has experienced a significant rise in its stock business. The 6000 HP electric locomotives mark a milestone as the first-ever in India and represent a significant advancement in the nation’s thermal power projects. This development aligns with global efforts to reduce carbon emissions.

- In February 2021, Infineon Technologies AG introduced the 650 V CoolSiC Hybrid IGBT range. This advanced transistor features a 650 V blocking voltage and combines the benefits of technologies such as Schottky barrier CoolSiC diodes and 650 V TRENCHSTOP 5 IGBT.

- In October 2020, Microchip Technology Inc. revealed the acquisition of Tekron International Limited, a global leader specializing in high-precision GPS and atomic clock time-keeping technologies and solutions for smart grid and industrial applications.

- In September 2020, Infineon Technologies introduced its latest IGBT module technology, known as the TRENCHSTOP™ IGBT7. Engineered to deliver higher efficiency and power density, this technology caters to various applications such as renewable energy, industrial drives, traction, power factor correction, photovoltaic systems, and uninterruptible power supplies.

Insulated Gate Bipolar Transistors (IGBT) Market Companies

- Infineon Technologies AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Toshiba Corporation (Japan)

- ON Semiconductor (United States)

- ABB Ltd (Switzerland)

- STMicroelectronics (Switzerland)

- Renesas Electronics Corporation (Japan)

- Semikron International GmbH (Germany)

- Texas Instruments Incorporated (United States)

- Vishay Intertechnology, Inc. (United States)

- Fairchild Semiconductor (United States)

- IXYS Corporation (United States)

- Hitachi, Ltd. (Japan)

- ROHM Co., Ltd. (Japan)

Segments Covered in the Report

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Consumer

- Electronics Industrial

- Manufacturing

- Automotive (EV/HEV)

- Inverters/UPS

- Railways

- Renewables

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/